ACCOUNTING CHANGES answer key

advertisement

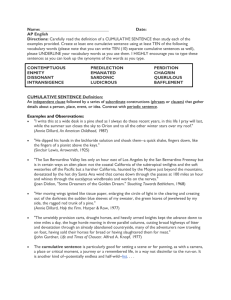

ACCOUNTING CHANGES MULTIPLE-CHOICE ANSWERS 1. c __ __ 6. c __ __ 11. a __ __ 16. d __ __ 21. b __ __ 2. b __ __ 7. c __ __ 12. d __ __ 17. c __ __ 22. d __ __ 3. c __ __ 8. d __ __ 13. c __ __ 18. a __ __ 23. c __ __ 4. c __ __ 9. a __ __ 14. b __ __ 19. a __ __ 5. b __ __ 10. d __ __ 15. a __ __ 20. c __ __ MULTIPLE-CHOICE ANSWER EXPLANATIONS C.1. Changes in Accounting Principles 1. (c) when a change in principle is made, generally the current or catch-up approach is used. The cumulative effect of the adjustment of prior years is reported in the current income statement, and the new method is used in the current year. Do not be misled by the statement in the question that says Bray changed retroactively. The term retroactive is being used in this question to refer to the way in which the catch-up or cumulative amount is computed, not the manner of reporting it. In comparative financial statements, no changes are made to the previously published financial statements for catch-up adjustments as an accounted for catch-up or cumulative type change. In this case the cumulative effect is 38,400 (86,400 double-declining balance accumulated depreciation – 48,000 straight-line accumulated depreciation). The journal entry to reflect this cumulative effect would be Accumulated depreciation 38,400 Retained Earnings 38,400 In 2010, depreciation expense would be computed using straight-line depreciation, computed as follows: Depreciation exp. is 24,000 (240,000 ÷ 10). Depreciation expense 24,000 Accumulated depreciation 24,000 2. (b) a change in principle is generally recorded using the current approach. The cumulative effect of the adjustment on prior years is reported in the current income statement net of the related tax effect. In this case, the accumulated depreciation account must be decreased by 120,000 [360,000 – (600,000 x 2/5)], the excess of accelerated depreciation over straight-line. The tax effect is 36,000 (30% x 120,000), so the cumulative effect reported is 84,000 (120,000 – 36,000). 3. (c) a change in principle is generally recorded using the current approach. The cumulative effect of the adjustment on prior years is reported in the current income statement net of the related tax effect. The cause of the tax effect is that while before the change, the tax basis and accounting book value of the asset were both 240,000, and after the change, the tax basis remains at 240,000 but the accounting book value is now 360,000 [600,000 – (2/5 x 600,000)]. When the book value of an asset is greater than its tax basis due to a temporary difference, the result is future taxable amounts for which a deferred tax liability must be recorded. The deferred tax liability is the future tax rate times the future taxable amounts [30% x (360,000 – 240,000) = 36,000] 4. (c) when a change in principle is made, generally, the current approach is used. The cumulative effect of the change on prior years, net of tax, is reported in the current income statement, and the new method is used in the current year. Depreciation recorded in the prior years (2008-09) using the straight-line method totaled 10,000 [(50,000 x 1/10) x 2]. If the units of production method had been used, depreciation would have been 12,000 [(50,000/50,000) x (8,500 + 3,500)]. Therefore, the cumulative effect on prior years before taxes is 2,000 (12,000 – 10,000), and the net-of-tax effect is 1,400 [2,000 – (30% x 2,000)]. Using the current approach, this amount is recorded as a cumulative effect in the income statement rather than as an adjustment to the beginning balance of retained earnings. 5. (b) The requirement is to determine which accounting change should be reported as the cumulative effect of a change in accounting principle. A change from straight-line depreciation to the double-declining balance method should be reported as a cumulative effect of a change in accounting principle after income from continuing operations. A change from the cash basis to the accrual basis of accounting is a change from non-GAAP to GAAP accounted for as the correction of an error. A change in reporting entity requires restatement of the financial statements of all prior periods presented in order to show financial information for the new reporting entity for all periods. A change in the method of accounting for long-term contracts qualifies as a “special” change, requiring restatement of prior periods as if the new method had been used. 6. (c) The requirement is to determine whether a change in depreciation method from straightline to double declining balance should be reported as a cumulative effect of a change in accounting principle and if the pro forma effects of retroactive application should also be reported. It requires the presentation of the cumulative effect of the change and the pro forma effects of retroactive application (for a change in accounting principle). Additionally, the pro forma effects of retroactive application are to be shown on the face of the income statement in a separate section, below earnings per share. 7. (c) The cumulative effect of a change in accounting principle is the cumulative effect on prior years’ income as if the new method had been used in those prior years. For the years prior to 2010, beginning inventory would be the same for both methods (0 inventory at the formation of the firm), and ending inventory would be 71,000 (FIFO) or 77,000 (WA). Therefore, the cumulative effect on prior years’ income, before taxes, would be 6,000 (77,000 – 71,000). Since it requires that a cumulative effect be recorded net of the related tax effect, Orca should report a cumulative effect of 4,200 [6,000 – (30% x 6,000)]. 8. (d) a change in accounting principle generally should be recognized by including in the net income of the period of change the cumulative effect, based on retroactive computation, of changing to the new accounting principle. The cumulative effect is to be reported as a special item after extraordinary items. Only retroactive-type accounting changes (not cumulative effecttype) and error corrections are reported as prior period adjustments. The cumulative effect is reported separately after income from continuing operations. Extraordinary items are a separate category distinct from cumulative effect of change in accounting principle, and are defined as unusual and infrequent nonrecurring events that have material effects. 9. (a) a change in inventory methods from LIFO is one of the exceptions requiring the use of the retroactive approach rather than the current approach. The cumulative effect at the beginning of the period of change is entered directly to retained earnings as a prior period adjustment, and the prior year statements are retroactively restated. The cumulative effect is recorded net of the related tax effect. In this case, the cumulative effect is 350,000 [500,000 – (30% x 500,000)]. The journal entry is Inventory 500,000 Retained earnings 350,000 Deferred tax liability 150,000 10. (d) “special” changes in accounting principle are reported by retroactively applying the new method in restatements of prior periods including reporting the cumulative effect of the change as an adjustment to the beginning balance of retained earnings. A change from the LIFO method of inventory pricing to another method is designated as such a change. In contrast, a change from FIFO to weighted-average should be accounted for by presenting the cumulative effect of the change in the income statement between the captions “extraordinary items” and “net income.” 11. (a) the amount shown in the income statement for the cumulative effect of changing to a new accounting principle is the difference between (a) the amount of retained earnings at the beginning of the period of a change and (b) the amount of retained earnings that would have been reported at that date if the new accounting principle had been applied retroactively for all prior periods which would have been affected and by recognizing only the direct effects of the change and related income tax effect. 12. (d) a change in accounting principle includes both accounting principles and practices and the methods of applying them. Such a change should be recognized by including the cumulative effect, based on retroactive computation, of changing to the new accounting principle in the net income of the period of the change. The effect of adopting the new accounting principle on income before extraordinary items (if any) and net income of the period of the change should be disclosed. The cumulative effect of the change is excluded from income from continuing operations due to the unique nature of this component of net income. Corrections of errors, not accounting changes, are treated as prior period adjustments. 13. (c) The requirement is to indicate how a change in accounting principle from the completedcontract method to the percentage-of-completion method should be reported. A change in the method of accounting for long-term contracts is one of the exceptions requiring the use of the retroactive, rather than the current, approach. The cumulative effect at the beginning of the period of change is entered directly to retained earnings as a prior period adjustment, and prior year statements are retroactively restated. The cumulative effect is recorded net of the related tax effect. In this case, the cumulative effect is 108,000 [(880,000 – 700,000) x (1 – .40)]. C.2. Change in Accounting Estimates 14. (b) This situation is a change in accounting estimate and should be accounted for currently and prospectively. From 1/1/2007 to 12/31/2009, patent amortization was recorded using a fifteen-year life. Yearly amortization was 47,600 (714,000 ÷ 15), accumulated amortization at 12/31/2009 was 142,800 (47,600 x 3), and the book value of the patent at 12/31/2009 was 571,200 (714,000 – 142,800). Beginning in 2010, this book value must be amortized over its remaining useful life of 7 years (10 years – 3 years). Therefore, 2010 amortization is 81,600 (571,200 ÷ 7) and the 12/31/2010 book value is 489,600 (571,200 – 81,600). 15. (a) From 1/1/2007 to 12/31/2009, depreciation was recorded using an eight-year life. Yearly depreciation was 66,000 (528,000 ÷ 8), and accumulated depreciation at 12/31/2009 was 198,000 (3 x 66,000). In 2010, the estimated useful life was changed to six years total with a salvage value of 48,000. Therefore, the 12/31/2009 book value (528,000 – 198,000 = 330,000) is depreciated down to the 48,000 salvage value over a remaining useful life of three years (six years total – three years already recorded). Depreciation expense for 2010 is 94,000 [(330,000 – 48,000) ÷ 3], increasing accumulated depreciation to 292,000 (198,000 + 94,000). 16. (a) A change in estimated warranty costs due to technological advances in production qualifies as a change in accounting estimate. Changes in estimate are treated prospectively; there is no retroactive restatement, and the new estimate is used in current and future years. Therefore, in 2010, Oak should use the new estimate of 1% and report warranty expense of 50,000 (5,000,000 x 1%). 17. (c) The cumulative effect is the net-of-tax difference in retained earnings between the new principle and the old principle as of the beginning of the fiscal year of the change. The cumulative effect will be computed as of January 1, 2010, for the change in accounting principle made during the 2010 fiscal year, regardless of when during the year the change in accounting principle is actually made. As of January 1, 2010, the amount of deferred demo costs were 500,000. Therefore, the net-of-tax cumulative effect in the 2010 income statement will be 350,000 (500,000 x .70 net of tax.)