2013 GRE Annual True-Up Meeting Presentation

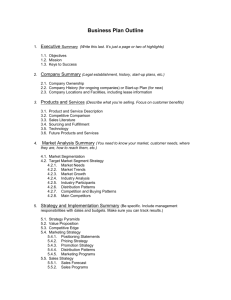

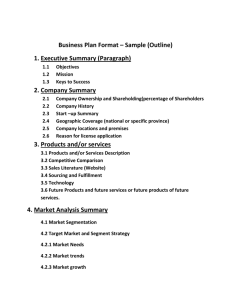

advertisement

Great River Energy 2013 Annual True-Up Meeting August 7, 2014 Agenda • • • • • Introduction Disclosure Meeting purpose Discuss the Regulatory Timeline Review the 2013 Annual True-Up results – actual to forecast comparison – discuss drivers • Discuss next steps • Question / Answer Disclosure All figures in this document are preliminary and subject to change. Per the revised Formula Rate Protocols, figures will be finalized after the Information Exchange, Challenge Procedures, and MISO’s review are complete1. 1 Awaiting FERC’s final decision on Docket ER13-2379 on FERC’s investigation into MISO Formula Rate Protocols Meeting Purpose • The revised Formula Rate Protocols require GRE to hold an Annual True-Up Meeting among Interested Parties between the Publication Date (June 1) and September 1 • Compare actual 2013 values against projections on which the 2013 rates were based • Review the Annual True-Up Adjustment calculation Formula Rate Protocol Timeline June 1 •Deadline for Annual True-Up •Info Exchange Period and Review Period begin June 1 – September 1 •Deadline For Annual True-Up Meeting September 1 – October 1 •Deadline to Post Projected Net Revenue Requirement September 1 – October 1 November 1 December 1 January 10 January 31 February 28 March 15 March 31 •Deadline for meeting on Projected Net Revenue Requirement •Deadline for joint meeting on regional cost-shared projects •Deadline for Interested Parties to submit information requests •Deadline for Transmission Owner to respond to information requests •Deadline for Interested Parties to submit Informal Challenges •Deadline for transmission owner to respond to Informal Challenges •Deadline to submit Informational Filing to the Commission •Deadline for Interested Parties to file Formal Challenge at the Commission 2013 True-Up Adjustment Overview Net Revenue Requirement Actual $99,203,840 Projected Difference $96,975,134 $2,228,705 (a) 2,012,415 2,023,751 Divisor True-Up Divisor 11,336 Projected Rate ($/kW/Yr) $47.919 True-Up (Divisor Difference x Projected Rate) $543,204 (b) Interest $79,442 (c) Total 2013 True-Up Adjustment (Under Recovery) $2,851,352 (a+b+c) 2013 ATTR Summary $99.2 $97.0 $73.0 $53.0 $33.0 Actual ATRR Projected ATRR $93.0 $2.2M Difference (2.3% ) $13.0 $0.96 $0.94 $(0.96) $(7.0) Return Operating Expenses $1.46 $(0.17) Attachment GG Adjustment Attachment MM Adjustment Revenue Credits Revenue Requirement Overview Projected 2013 Net Revenue Requirement $96,975,134 Actual to Projected Differences: Return $963,753 O&M Expense $(963,019) Attachment GG Adjustment $(165,196) Attachment MM Adjustment $935,421 Revenue Credits $1,457,747 Actual 2013 Net Revenue Requirement $99,203,840 Overall Difference $2,228,705 Return Overview Projected 2013 Rate Base $671,736,732 Actual to Projected Differences: Net Plant $(13,839,565) Construction Work In Progress $2,306,365 Adjustments to Rate Base * $333,388 Land Held for Future Use $0 Working Capital $389,971 Actual 2013 Rate Base $660,260,116 Overall Difference $(11,476,617) *offset to Rate Base Return Overview Actual Return % LTD Equity Return D/E Ratio Weighted 85.05% 4.77% (a) 14.95% 1.85% (b) 6.63% (a+b) Projected Return % LTD Equity Return Overall Difference = 0.2012% D/E Ratio Weighted 86.06% 4.70% (a) 13.94% 1.73% (b) 6.42% (a+b) Return Overview Rate Base Actual to Projected Difference Actual Return Rate $(11,476,617) 6.63% $(760,342) (a) Return Rate Projected Rate Base Actual to Projected Difference in Return % Overall Difference in Return $671,736,732 0.2012% $1,351,390 (b) $591,048 (a+b) Operating Expense Overview Projected 2013 Operating Expense $78,815,432 Actual to Projected Differences: O&M (includes A&G) $(755,842) Depreciation Expense $(332,354) Taxes Other Than Income Taxes $125,177 Income Taxes $0 Actual 2013 Operating Expense $77,852,413 Overall Difference $(963,019) Attachment GG & MM Overview Attachment GG Projected ATRR $17,872,720 Attachment MM Projected ATRR $5,998,423 Actual to Projected Differences: Actual to Projected Differences: Annual Expense Charge $64,038 Annual Expense Charge $(4,983) Annual Return Charge $199,605 Annual Return Charge $(429,469) Depreciation Expense $(98,447) Depreciation Expense $(500,970) Actual ATRR $18,037,916 Actual ATRR $5,063,002 Overall Difference $165,196 Overall Difference $(935,421) Revenue Credits Overview Projected 2013 Revenue Credits $4,338,375 Actual to Projected Differences: Account 454 (Rent From Electric Property) $(629,236) Account 456 (Other Electric Revenues) $(828,511) Actual 2013 Revenue Credits $2,880,628 Overall Difference $(1,457,747) Next Steps • Information Exchange Procedures* – Interested Parties have until December 1, 2014** to submit information requests – GRE shall make a good faith effort to respond within 15 business days of receipt of such request – Any information request should be submitted in writing to: • Todd Butkowski (tbutkowski@GREnergy.com) and • Seth Nelson (snelson@GREnergy.com) – All questions and answers will be distributed by e-mail to the Interested Party who asked the question(s) and will be posted on the MISO website and OASIS * Awaiting ** FERC’s final decision on Docket ER13-2379 on FERC’s investigation into MISO Formula Rate Protocols If December 1 falls on a weekend or a holiday recognized by FERC, the deadline for submitting the request will be extended to the next business day Questions?