Chapter 15

Options

Markets

McGraw-Hill/Irwin

Copyright © 2010 by The McGraw-Hill Companies, Inc. All rights reserved.

Option Terminology

1. What is a listed stock call option?

– A contract giving the holder the right to buy 100 shares of stock

at a preset price called the exercise or strike price.

– Expirations of 1,2,3,6,& 9 months and sometimes 1 year are

normal contract periods. Contracts expire on the third Saturday

of the expiration month.

– Contracts may be resold prior to maturity.

2.

What is a listed stock Put option?

- A contract giving the holder the right to sell 100 shares of stock at

a preset price

15-2

Option Characteristics

• If a call option holder wishes to purchase the stock, he or she will

exercise the option. The option holder must pay the exercise price to

the option writer.

• Exercise prices are adjusted for stock splits and stock dividends, but

not cash dividends.

• The cost of an option is called the premium and it is a small

percentage of the cost of the underlying asset. The option buyer

pays the cost; the option writer receives the cost at the time of sale of

the option.

• The underlying company is not involved in the option market.

• Options are a zero sum game.

15-3

American vs. European Options

American: the option can be exercised any time, but no

Later than the expiration date

European: the option can only be exercised at the

expiration date

15-4

Figure 15.1 Options on IBM

15-5

3. Uses of options:

a. To hedge changes in stock price.

b. Change your risk and return profile

• For example, buying a call is analogous to buying

stock on margin.

c. Short sale constraints can be avoided with

puts.

15-6

Option Clearing Corporation

(OCC)

• OCC is jointly owned by option exchanges

• OCC backs performance of both counterparties

– To limit OCC’s risk, option seller (or writer) must post margin.

Margin varies with option price and whether the option position is

covered or exposed.

• When an option is exercised an option seller is randomly

selected.

– If a call is exercised the selected call writer must deliver 100

shares of stock in exchange for receiving the strike price.

– If a put is exercised the selected put writer must purchase 100

shares of stock at the strike price.

15-7

4. Types of options

Listed Options vs OTC Options

o

o

o

o

o

Index Options

Options on Futures

Foreign Currency Options

Interest Rate Options

Exotic Options

15-8

15.2 Values of Options at

Expiration

15-9

5. Symbols & Valuation

Ct = Price paid for a call option at time t. t = 0 is today,

T = option's expiration date.

Pt = Price paid for a put option at time t.

St = Stock price at time t.

Xc, Xp= Exercise or Strike Price

> Xc.

A call is “in the money” if St ____

A call is “out of the money” if St ____ Xc.

A put is “in the money” if St ____ Xp.

A put is “out of the money” if St ____

> Xp.

>

>

15-10

6. The basics of option pricing

a) Price boundaries

o Ct ≥ 0,

Why?

o Ct ≥ St – X, Why?

o Pt 0

o Pt X - St

$5 $60 $50

– If Ct < St – X How could you take advantage of this?

o Thus Ct Max (0, St – X)

o Pt Max (0, X – St)

o Just before expiration at time T:

If ST < X then CT = 0

if ST > X then CT = ST – X

15-11

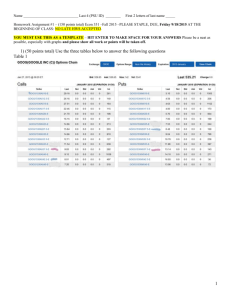

IBM Option Quotes

15-12

7. Option strategies and profits at expiration

BUYING A CALL

Profit Table

ST < X

ST > X

– C0

– C0

– C0

+CT

0

ST – X

= Profit

– C0

– C 0 + ST – X

Breakeven

ST = X + C 0

15-13

Profit

Call profit at expiration

ST = X + C 0

-$735

$100

$92.65

$0

$107.35

-C0 + ST – X

-C0

Stock

PriceT

Ex = $100

Bullish or bearish?

IBM Jul 100 call option

Stock Price = $96.14

Exercise = $100

Call premium = $735

Contract Size 100 shares

High or low volatility strategy?

15-14

Writing a naked call

WRITING A NAKED CALL

Profit Table

ST < X

ST > X

+C0

+C0

+C0

– CT

0

–(ST – X)

= Profit

+C0

+C0 – ST + X

Breakeven

ST = X + C 0

15-15

Writing a naked call

Profit

+C0 – ST + X

+C0

$0

X

S T = X + C0

Stock

PriceT

Bullish or bearish?

High or low volatility strategy?

15-16

Buying a put option

BUYING A PUT

Profit Table

ST < X

ST > X

– P0

– P0

– P0

+PT

X – ST

0

= Profit

X – ST – P0

– P0

Breakeven

ST = X – P0

15-17

IBM Option Quotes

15-18

Profit

$8,834

$0

-$1,166

Buying a put option

IBM Dec 100 put option

Stock price = $96.14

Exercise = $100

Put premium = $1,166

Contract Size 100 shares

Short

position in

IBM

X – ST – P0

$100

$88.34

$111.66

– P0

B.E.: ST = X – P0

Ex = $100

Bullish or bearish?

Stock

Pricet

Put

Alternative Stock Strategy?

High or low volatility strategy?

15-19

Writing a put option

Writing A Put

Profit Table

ST < X

ST > X

+P0

+P0

+P0

– PT

–(X – ST )

0

= Profit

ST – X + P 0

+P0

Breakeven

ST = X – P0

15-20

Profit

Writing a put option

$1,166

ST – X + P0

$0

$88.34

$100

Long

Position

in

Xx IBM

= $100

- $8,834

Bullish or bearish?

$111.66

+P0

Stock

Pricet

IBM Jul 100 put option

Stock price = $96.14

Exercise = $100

Put premium = $1,166

Contract Size 100

shares

Alternative Stock Strategy?

High or low volatility strategy?

15-21

Buy stocks and at the money puts:

Profit

Protective Put

Long

position in

IBM

Hedged

Position

$0

Stock

Pricet

X

Put

Hedged profit equals sum of profits of put and stock

at each stock price.

15-22

Writing Covered Calls

Profit

Long

position in

IBM

Covered Call

Written call

$0

S0

ST = S0 - C0

Stock

Pricet

• Bullish or bearish?

• High or low volatility strategy?

15-23

Bullish Price Spread

Bull perpendicular or price spread with

calls; write (sell) the high exercise price

call and buy the low exercise price call. All

other option terms identical. L=low

exercise price, H=high exercise price

15-24

Bullish Price Spread

BULLISH PRICE SPREAD

Profit Table

ST < X L

XL < S T < X H

ST > X H

– C0L

– C0L

– C0L

– C0L

+C0H

+C0H

+C0H

+C0H

+CTL

0

ST – X L

ST – XL

– CTH

0

0

–(ST – XH )

= Profit

C0H – C0L

ST – XL – C0L +C0H

XH – XL – C0L + C0H

Breakeven

–

ST = XL + C0L – C0H

+

Profit

XH

XL

Stock

Pricet

• Bullish or bearish?

• High or low volatility strategy?

15-25

Long or Bull Straddle

Long or bull straddle: buy a put and a call

with the same T and X.

(For bear or short straddle, sell both put and

call and just flip the graph upside down.)

15-26

Long or Bull Straddle

BULL STRADDLE

Profit Table

ST < X

ST > X

– C0

– C0

– C0

– P0

– P0

– P0

+CT

0

ST – X

+PT

X – ST

0

= Profit

X – ST – C0 – P0

ST – X – C0 – P0

Breakeven

ST = X – C0 – P0

ST = X + C 0 + P 0

Profit

$0

X – C0 – P0

X

X + C0 + P0

Stock

Price t

• Bullish or bearish? _____________

Neutral

Max Loss: C0 + P0

• High or low volatility strategy?

15-27

Strips and Straps

•

Long or bull strap; buy two calls and one

put, more bullish than straddle.

•

Long or bull strip; buy two puts and one

call, more bearish than straddle.

Think about bear versions of each.

15-28

Short Strangle:

Sell out of the money

put and call

Short Strangle

Profit Table

ST < X L

XL < S T < X H

ST > X H

+ P0L

+ P0L

+ P0L

+ P0L

+C0H

+C0H

+C0H

+C0H

– PTL

– (XL – ST )

0

0

– CTH

0

0

–(ST – XH )

= Profit

ST – XL+ P0L + C0H

P0L + C0H

XH – ST + P0L + C0H

Breakeven

ST = XL– P0L– C0H

+

ST = XH + P0L + C0H

Profit

ST= XL–P0L–C0H

XL

XH

ST = XH + P0L + C0H

Stock

Pricet

15-29

8. Warnings about options

positions

o Options may have to move 10-15% or more in a short

time period before an investor recovers the price &

commission.

o Options are by definition short term instruments; an

investor can ride out bad times in spot markets but not in

options.

– The limited loss feature makes options appear safer than they

are.

– You have to compare equal $ investments in stocks and options

to really see the higher risk of the option position.

o Options are traded in a highly competitive market.

15-30

8. Warnings about options positions

Profit

What’s wrong with selling options?

o Covered calls (writing calls against stock you own)

Stock

Pricet

$0

– The investor never gets the occasional

large stock price run up and suffers most of the

loss of a big price drop.

Eliminates any positive skewness of stock returns

– Wind up with portfolio of poorer performers

o Naked calls (writing calls when you do not own the

stock)

– Maximum gain is limited to call premium but

unlimited loss, poor strategy in volatile markets

Profit

$0

Stock

Pricet

15-31

Optionlike Securities

1. Callable bonds

– Issuing firm has the right to call in the bond

and pay call price.

– When will the firm want to exercise its call

option?

15-32

Figure 15.11 Values of Callable Bonds

Compared with Straight Bonds

15-33

2. Convertible Securities

• Security holder has the option to convert the

bond to a fixed number of shares of common

stock.

• Bond’s Conversion Value = Conversion Ratio x

Common Stock Price

• If a bond is convertible to 20 shares of stock, stock is

priced at $60 per share. The bond’s conversion value

= $1,200

15-34

Figure 15.12 Value of a Convertible

Bond as a Function of Stock Price

The option is issued deep out

the money, the ‘option cost’ is

a lower coupon.

15-35

Convertibles (cont.)

Theoretical value of a convertible bond =

Value straight debt + Value of conversion option

In reality there are three complicating factors:

1. The conversion price may increase over time effectively

increasing the option’s exercise price.

2. Stocks may pay dividends, this makes it harder to value the

option to convert

3. Virtually all convertible bonds are callable by the firm. The firm

may call to force conversion, this makes the maturity of the

bond and the option indeterminate.

15-36

3. Warrants

– Firm sometimes issue warrants with its bonds.

The warrants are call options to purchase new

stock at a fixed price.

– Detachable “sweetener” to help sell the bond

– Exercise of warrants (and convertibles) can

result in dilution of earnings per share

15-37

4. Collateralized loans

–

–

Suppose a borrower is obligated to pay back L dollars at

loan maturity (Time T) and has posted collateral worth St

dollars.

The borrower has an option to repay the loan at maturity if

L > ST, otherwise the borrower can default and give up the

value of L.

5. A similar logic applies to corporate equity if a firm

has debt.

–

Equity holders effectively have a call option on firm value

as they can choose to pay off the debt if firm value > value

of the debt or default otherwise.

15-38

Collateralized Loan Payoffs

15-39

Exotic Options

Asian Options

Barrier Options

Payoff depends on the average (rather than the

final) price of the underlying asset during a

portion of the life of the option.

Example “down-and-out” expires worthless if

the stock price drops below a specified barrier.

Lookback Options

Payoff depends on minimum or max price

during life of option.

15-40

Exotic Options

Currency Translated Options or Quantos

Allows a variable amount of foreign currency

based on the performance of an investment to

be translated to dollars at a fixed exchange rate.

Binary or Digital Options

Pays a fixed amount if the option is in the money at

expiration.

15-41

Problem 1

a.

Purchase a straddle, i.e., buy both a put and a call on

the stock.

The total cost of the straddle would be: $10 + $7 = $17

$17

b.

15-42

Problem 3

Joe’s Protective Put Strategy

Profit Table

ST < $1,200

ST > $1,200

ST – $1,200

ST – $1,200

ST – $1,200

– P0

– $60

– $60

+PT

$1,200 – ST

0

= Profit

– $60

ST – $1,260

ST = $1,260

Breakeven

Sally’s Protective Put Strategy

Profit Table

ST < $1,170

ST > $1,170

ST – $1,200

ST – $1,200

ST – $1,200

– P0

– $45

– $45

+PT

$1,170 – ST

0

= Profit

– $75

ST – $1,245

Breakeven

ST = $1,245

Sally’s

Joe’s

$1245

$1260

-$60

-$75

15-44