FINANCE 394.4 - McCombs School of Business

advertisement

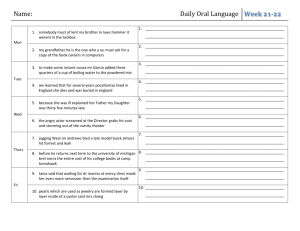

FINANCE 394.4 – Financial Management of the Small Firm Course Outline –Fall Semester, 2011 TTH 8:00-9:30; 9:30-11:00 – UTC 1.104 (Unique #03650, #03655) Office Hours: TTH 11:00 – 1:00 & by appointment TA – Office Hours – By Appointment Professor: Jim Nolen Office: GSB 4.126G Phone: 471-5798, Fax 471-5073 e-mail: james.nolen@mccombs.utexas.edu Course Material Posted on Blackboard Electronic Course Packet via Harvard Business Publishing Required Course Material The Finance 394.4 Small Business Finance course packet can be purchased at Speedway Printing in Dobie Mall at 21st and Guadalupe. Due to royalties for the cases, the course packet is expensive and the copy shop does not accept returns. Make sure you intend to stay in the class before you purchase the course packet. For those who prefer an electronic version of the course packet, you can go to Harvard’s website and pay to download the course material at http://cb.hbsp.harvard.edu/cb/access/9740657 Optional Reference Textbooks 1. Valuing A Business: The Analysis and Appraisal of Closely Held Companies by Shannon Pratt, 5th Edition, McGraw Hill 2. Your BA 385T core class textbook, such as Corporate Finance, 8th or 9th Edition by Ross, Westerfield, and Jaffe (McGraw-Hill Irwin); or Fundamentals of Corporate Finance or Principles of Corporate Finance by Brealey & Meyers. 3. Adelman, Philip J. and Marks, Alan M., Entrepreneurial Finance – Finance for Small Business, Second Edition, Prentice Hall. ENTREPRENEURSHIP CURRICULUM This course is part of the Entrepreneurship specialization that includes Opportunity Identification, Gathering Resources & Launch, Entrepreneurial Growth, Financial Management of the Small Firm (formerly called Entrepreneurial Finance, Harvest and Negotiations) and the capstone course, Entrepreneurial Management. This class is quite quantitative and a solid finance/accounting background is helpful. Fin 286 Valuation is a prerequisite to the course. If you do not have a strong finance/accounting background, make sure you get in a study group with someone who does have this strong financial background. This course is very demanding from both the amount of reading required and the number of cases discussed during the semester. THE CASE METHOD In a case course, much of the learning occurs in preparing for the case, which often requires three to six hours of readings and preparation, including discussions within your study group. The case method is student-centered rather than instructor-centered. In the classroom, the students will drive a rigorous discussion of each case by identifying the problems and issues faced by the managers and formulating alternatives for solution backed by case facts and assumptions. In addition to preparing for cases, there are substantial reading assignments, especially in the early part of the course. GRADING The class will set its own standards through friendly competition. The student with the highest weighted average ranking will receive the highest grade and then the remaining students are ranked from this top position. A forced curve is used in this class with approximately: A AB+ B B- or below 20% 20% 20% 35% 5% (includes B-, C+, and C) C-‘s, D’s and F’s will be awarded where deserved. Natural breaks in the distribution will be used to determine the final grade distribution. No student is allowed to take the course on a pass/fail basis. 1. CLASS DISCUSSION (30%) Your T.A. will record the class discussion and you will be graded on the quantity and, more importantly, the quality of your discussion of each case. Cold calls will be used for openings, summaries (closings) and during the class discussion. Openings and summaries will have a disproportionate weight on your class participation grade. Since there are more students in the class than cases, not everyone will be able to open or close a case and therefore, it is incumbent on you to raise your hand and participate fully in each case. Study group members will be expected to be active in the discussion when a group member opens a case. Student comments which move the class forward and build on other comments will be rewarded while just citing case facts or being unprepared for the discussion will adversely affect your grade. A survey at the end of the semester will allow you to assess your study group’s effectiveness. Rarely is there a significant difference in how I rank your participation and how your classmates rank you. Classroom discussion counts toward 30% of your final grade. Preparation and Missed Class If you are not prepared to open a case and tell me before the class begins, I will give you a minus one (-1) for that class discussion. However, If you do not tell me before class, I will award you a minus three (-3) for that class discussion. If you miss class due to an excused absence, then you must turn in a written analysis of the missed case to your T.A. (or me) within one week of the missed class. Failure to turn in a written analysis will result in up to a letter grade deduction. Unexcused absences and excessive excused absences may result in your being dropped from the class, having your grade reduced or be given a failing grade in the course. Students with Disabilities Students with disabilities may request appropriate academic accommodations from the Division of Diversity and Community and Engagement, Services for Students with Disabilities at 471-6259. Cheating The McCombs Honor Code is in effect for all components of this course. Obtaining help on a case, either written or oral, from students who have discussed the case in this or other classes is considered cheating and you will receive an "F" for the course. Students should also not “surf the web” searching for the outcome or “the right answer”. Cases force you to put yourself in a managers/owner’s role, frame the problem, identify strategic alternatives and make a recommendations based on logic and fact-based analysis. Most cases are self contained and research on the web will not be required. Tardiness Being late to class is disruptive to the class discussion. If you are late to class, we will stop and find out why and you may get the pleasure of opening the case or being cold called multiple times. Laptop Policy - Students may use your laptop in the case discussions, including case notes and excel spreadsheets. In fact, you may be asked to display your models to the class with the LCD projector in the classroom. 2. MID-TERM AND FINAL EXAM CASES (50%) Midterm – All students will perform an individual analysis of a take-home, mid-term case (individual, no team analysis). The case will be handed out during the previous week’s class. Limit your analysis and spreadsheets to 10 pages total and put your name on the back of the last page of your analysis, as I grade the exams blindly. Please use double spacing on your word-processed analysis and use 12point font size on your text and spreadsheets. The mid-term represents 25% of your total grade. Final – You will be given an option for your final case. Option A – A written analysis of a comprehensive case similar to the mid-term. This take-home final exam case will be distributed to you on the final day of class and you will return the case, your written analysis and spreadsheet work at the scheduled time on the syllabus. The final represents 25% of your total grade. Option B – You may elect, during the first month of class, to form a team of 4 students in your section that will find a privately held company which will allow you to perform a financial analysis and valuation of their firm. In lieu of a written individual case final, the team members will work throughout the semester with their client company. Project teams will present their case study to the professor in his office during the last week of classes and will turn in their written PowerPoint analysis at the same time the Option A case finals are due. Your team will act as a financial consultant and generate a report targeted to the Board of Directors of the company that addresses, at a minimum: a SWOT analysis; an Industry/Competitor analysis; a financial analysis; and a valuation of the equity of the firm. This project will require you to find and meet with the business owner/manager and do original research including searching for comparable companies and industry benchmarking. I will give you access to databases such as BizComps and PrattStats, RMA Annual Financial Statement Surveys and Capital IQ/FactSet. Your final PowerPoint analysis will substitute for the same 25% of your final grade as the case final in Option A. All team members will receive the same starting grade based on the accuracy, quality and completeness of your team’s project and ranked relative to the other team’s projects. Adjustments to individual member’s project grade will be based on their team member’s evaluation of their contributions to the project. Samples of previous semester projects are posted on BlackBoard. 3. Written Assignments and Take-home Quizzes (20%) The remaining 20% of your grade is based on written exercises, turned-in case analyses, and two, take-home quizzes. For each case, your study team should print out a copy of your analysis and spreadsheet just in case I ask that you turn them in for grading. You may e-mail the files within 30 minutes of class if the files are on your notebook computer. Someone in your study group should have your spreadsheet work on their laptop or on an overhead slide in case I ask you to show your model to the class. Rules of Engagement for Class Discussion: 1) 2) 3) 4) 5) 6) 7) 8) Come prepared to participate and come on time. Take a stand and defend it. State your assumptions. Give evidence to support your claims but do not just repeat case facts. Speak concisely. Airtime is a scarce resource, do not ramble. LISTEN and build on previous student comments. Direct your comments to your classmates, not the professor. Respectfully challenge or support the arguments being made. OPENINGS While this course is about harvesting, exit strategies and valuation, do not overlook your traditional SWOT, FIT (PODC) and Industry/Competitor analysis frameworks in preparing your case. For your openings, take a stand and then defend it. Decide what the central issue of the case is and put yourself in the decision-maker's shoes. Outline your alternative solutions and the pros and cons of each option. Never just give “the answer”. List any assumptions such as: normalization of the cash flows, the discount rate used and why, the terminal value assumptions, which comparable company that was used and why, any unique risk of the company and any discounts for marketability, minority interest or other adjustments. Only after you have cited your assumptions should you give your conclusion of value. Some of the points that I will use to grade your opening and class discussion are: a. Was the problem or issue clearly defined? b. Did you take a firm stand and back it with evidence? c. Did you outline your assumptions? d. Did you use the frameworks, valuation models and notes discussed in class? e. Did you explore the pros and cons of the strategic alternatives? f. Did you perform both qualitative and quantitative analysis? g. Was a plan of action presented along with implementation steps, timing and costs? h. How did you respond to your peer’s questions about your solution? i. A good question can be worth as much as a good answer. Feel free to experiment with unorthodox solutions, which will be rewarded if you can defend them with logic and evidence. REVIEW OF READINGS and CLOSINGS At the beginning of the class I may ask someone (cold call) to summarize one of the notes assigned for that class. At the end of most cases I will ask someone (cold call) for the lessons learned in the case. You should be able to concisely summarize the key learning objectives derived from the readings, the case and/or the class discussion. USE OF EXCEL TEMPLATES Try to develop a valuation excel template that allows you to enter data regarding an asset/cost approach, comparable market value approach, and discounted cash flow approaches. I have posted a few examples on Blackboard under “Resources”. You can use this template for the mid-term and the final to assist you with your analysis of the case. VALUATION Finally, valuation is both art and science. If you are looking for "the number" you will get frustrated. We are trying to "narrow the range of darkness" by using different valuation models and hope to get some convergent validity and triangulation from these models to give a valuation range. Ultimately, fair market value will be what a willing buyer and seller agree upon. Finance 394.4 - Financial Management of the Small Firm C: Course Packet B: Blackboard H: Handout T: Turn In Class # Date Topic Case Readings C: Syllabus Assignment C: Course Introduction C: The Case Method 1 Thurs. Aug. 25 Course Introduction C: Classroom Discussion C: Note to the Student: How to Study & Discuss Cases C: Note on Study Groups Browse the BlackBoard Class Site Module I - Starting or Buying a Small Business Work for Money or Money Work for You? 2 Tues. Aug.30 C: The Questions Every Entrepreneur Must Answer 1. Small vs. Large Business C: Small Company Finance: what the books don’t say T: Turn In Your Resume 2. Business Archetypes C: A Small Business Is Not Just A Little Big Business Form Study and Project Teams B: Overview of Small Business.PPT Prepare An Elevator Pitch Start, Buy, Franchise or Family Business? C: A Note on Franchising C: Entrepreneur: How to Buy a Business 3 Thurs. Sept. 1 1. Exploring ways to become selfemployed C: How Venture Capitalists Evaluate Potential venture opportunities B: entrepreneurship.ppt Review the Websites on the Assignment Sheet Discuss your “Perfect” Business Elevator Pitch Class # Date Topic Case Readings Assignment All In The Family Succession Planning C: Transferring Power in The Family Business 1. Family Businesses 4 Tues. Sept. 6 2. Succession Planning *ColeTek, Inc.* C: Definitions & Typologies of the Family Business B: Succession Planning.PPT Legal Forms of Organization 1. Sole Proprietorship 5 Thurs. Sept. 8 C: Organizing the Enterprise: Which Form is Best for You? 2. General & Limited Partnerships 3. Limited Liability Companies 4. S and C Corporations B: Legal Forms.PPT Founder Choices 1. Equity Splits 2. Roles & BOD 6 Tues. Sept. 13 3. Rich vs. King 4. Persistence vs. Exit Show Me the Money! Sources of Capital Sources of Capital 7 Thurs. Sept. 15 1. Debt 2. Equity 3. Government *Lather, Rinse, repeat: FeedBurner’s Serial Founding Team* C: Why Entrepreneurs Don’t Scale C; Bootstrap Finance: The Art of Startups C: Note on Angel Investing C: Note on Valuation of Venture Capital B: Term Deals Sheets.PPT C: Note on Private Equity Deal Structures B: Sources of Captial.PPT B: History of Private Equity.PPT Class # Date Topic A Big Piece of A Small Pie or A Small Piece of a Large Pie Case *Clarion Optical* 8 Tues. 1. Financing the Sept. 20 Company Readings Assignment C: Note on the Theory of Optimum Capital Structure C: Indifference Point Analysis 2. Capital Structure B: Capital Structure.PPT Module II - Financial Management of the Small Firm Measuring Performance 9 Thurs Sept. 22 C: Note on Unit Economics 1. Financial Statement Analysis C: Breakeven Analysis 2. DuPont Analysis C: Note on the Financial Perspective: What Every Entrepreneur Should Know 3. Breakeven Analysis Individual Assignment: Match the industry Analysis (due next class) B: Financial Statement Analysis.PPT B: Breakeven Analysis.PPT Financial Strategies C: Assessing the Firm’s Future Financial Health 10 Tues. Sept. 27 1. Financial Statement Analysis 2. Bench Marking *Match the Industry* (Individual Effort) C: measuring Business Performance B: Financial Statement Analysis.ppt T: Match the Industry analysis Class # Date Topic Case Readings Assignment Growth Can Kill Working Capital Mgt. *Butler Lumber* 1. Cash Conversion Cycle 11 Thurs. Sept. 29 C: Cash Management Practices in Small Companies C: Note of Managing the Growing Venture C: Five Stages of small Business Growth 2. Percent of Sales Method of Asset Forecasting H: Take Home Exam (Due Next Class - Tues. Oct. 4) B: Working Capital Management.PPT B: Asset Forecasting.PPT Module III - Valuation and Harvesting Strategies What's it Worth? Business Valuation Art & Science C: Note on Valuing Private Businesses 1. Precedent Transactions 12 Tues. Oct. 4 C: Corporate Valuation and Market Multiples T: turn in Take Home Exam 2. Guideline Public Comparables 3. DCF Models B: Business Valuation.PPT 4. LBO Models D-I-V-O-R-C-E What’s Your Bid 1. Estimating Cash Flows & Terminal Value 2. Discount Rates 3. Discounts for Lack *Carlton Polish* of Marketability & Control 13 Thurs. Oct. 6 C: Note on Cash Flow Valuation Methods: Comparison of WACC, FTE, CCF and APV Approaches C: Note on Valuing Control and Liquidity in Family & Closely Held Firms C: Quantitative Support for Discounts for Lack of Marketability B: Business Valuation.PPT H: Midterm Case Handout (Due Oct. 13th) Class # Date Topic Value Drivers & Deal Terms Case Readings Assignment 1. Five Value Drivers; profitability, Efficiency, Leverage, Risk and Growth 14 Tues. 3. Oct. 11 2. Stock vs. Asset Sales C: Accounting for Business Combinations: Purchase Method 3. Taxes & Liability B: St. Jude Medical Valuation Workbook 4. Sec 338 Tax Free Reorganization 5. Earnouts 6. Seller Notes 7. Non-Competes Exit Strategies: When & How To Harvest 1. Initial Public Offering C: A Note on the Initial Public Offering Process 2. Sale To Financial Buyer 15 C: A Managerial Primer on the U.S. Bankruptcy Code Thurs. Oct. 13 3. Sale to Strategic Buyer C: Note on Employee Stock Ownership Plans and Phantom Stock Plans 4. Bankruptcy Restructuring 5. ESOPS Greed vs. Fear Making the Hard Choice 16 Tues. Oct. 18 1. Sell 2. Raise Venture Capital 3. KOKO *Tickle* C: The Company Sale Process T: Turn In Midterm Case Class # Date Topic Just a Matter of Taxes Leveraged Buyouts 1. LBO Analysis 17 Case Readings C: Technical Note on LBO valuation (A) *Brazos Partners C: Technical Note on the Comark LBO* LBO Valuation (B) Thurs. 2. Majority Oct. 20 Recapitalization Is This A Bubble? Cross Border Valuation 18 Tues. Oct. 25 1. Cross Border Valuation Issues Political, Currency, & Repatriation Risks *Mandic BBS - An Entrepreneurial C: Valuing Cash Flows Harvesting in an International Decision* Context Divergence of Goals? Private Equity Exits 19 Thurs. Oct. 27 1. Sale vs. IPO 2. Private Equity Exits *Eller Media* C: A Note on Exits Rolling Rolling …. Roll-ups 20 Tues. Nov. 1 1. Rollups as an Exit Strategy 2. Buy & Build Strategy Assignment *Project DialTone* C: The Consolidation of Highly Fragmented Service Industries: Rollups Try Doing a Reverse Induction Method Class # Date Topic Changing of the Guard Management Buyout Case Readings Assignment *John M. Case Company* 1. Management Buyouts 21 C: A Note on Leveraged buyouts Thurs. Nov. 3 2. Financing & Deal Structure Stock as Currency M&A Using Stock *Automated Intelligence Corp* 22 Tues. Nov. 8 C: A Note on Mergers and Acquisitions and Valuation 1. Exchange Ratios 2. Accretion/Dilution C: Evaluating M&A Deals -Equity Consideration 3. Operating and Financial Synergy B: Mergers & Acquisitions.PPT Is the Whole Worth the Sum of the Parts? Breakup value 23 Thurs. Nov. 10 1. Sum of the Parts Valuation *Interco* C: Note on Sum-of-theParts Valuation H: Second Take Home Exam (Due Next Classnov. 15) Playing Hardball Ethics in Negotiations C: Ethics in Finance 24 1. Ethics In Finance Tues. 2. Moral, Ethical & Nov. 15 Legal *Devon Industries, Inc. (A) & (B)* C: Brinksmanship in Business Fill Out the *B* Case T: Turn In Second Take Home Exam Class # Date Topic Case Readings Assignment Riding the Wave *Star CableVision (A)* 1. Operating and Financial Synergy 25 Thurs. Nov 17 *Star CableVision (B)* C:Capital Market Myopia 2. Exchange Ratios 3. Accretion/Dilution The Perfect Storm *Star CableVision (C)* 26 Tues. Nov 22 Project Team Meetings With Nolen 1. Restructuring 2. Recapitalization Prep the “C” Case and Bring the “D” Case *Star CableVision (D)* Lessons Learned *Star CableVision (E)* Read both the “E” & “F” Cases for Class 1. Full Circle 27 Tues. Nov. 29 2. Lessons Learned *Star CableVision (F)* Project Team Meetings With Nolen Class Summary 28 Thurs. 1. Teacher Evaluation Dec. 1 2. Class Summary H: Final Case Exam (optional) Project Team Meetings With Nolen Class # Date Thurs. Dec. 8 Topic Final Deliverables Final Case and Consulting Projects Due in Finance Office CBA 6.222 by Noon. Case Readings Assignment T: Final Exam or Final Project