Gould & Pakter Associates, LLC

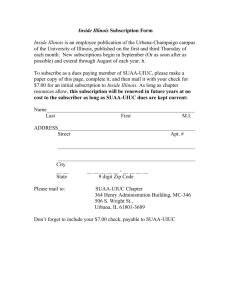

advertisement