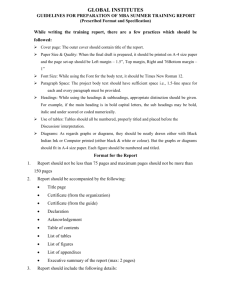

Optimal (Q,R)

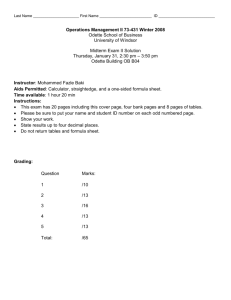

advertisement

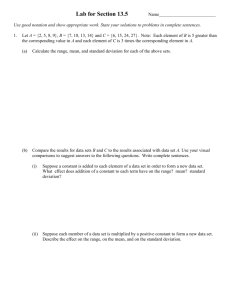

LESSON 18: INVENTORY MODELS (STOCHASTIC) Q,R SYSTEMS OPTIMIZATION WITHOUT SERVICE Outline • Multi-Period Models – Lot size-Reorder Point (Q, R) Systems • Optimization without service – Procedure – Example Procedure to find the Optimal (Q,R) Policy Without Any Service Constraint Goal: Given , , h, K , p find (Q,R) to minimize total cost Step 1: Take a trial value of Q = EOQ Step 2: Find a trial value of R = z where and are respectively mean and standard deviation of the lead-time demand and z is the normal distribution variate corresponding to the area on the right, 1-F(z) = Qh / p see Table A-4, pp. 835-841 Step 3: Find the expected number of stock-outs per cycle, n L(z ) where L(z ) is the standardized loss function available from Table A-4, pp. 835-841 Procedure to find the Optimal (Q,R) Policy Without Any Service Constraint Step 4: Find the modified 2 np K Q h Step 5: Find the modified value of R = z where z is the recomputed value of the normal distribution variate corresponding to the area on the right, 1-F(z) = Qh / p see Table A-4, pp. 835-841 Step 6: If any of modified Q and R is different from the previous value, go to Step 3. Else if none of Q and R is modified significantly, stop. Example - Optimal (Q,R) Policy Annual demand for number 2 pencils at the campus store is normally distributed with mean 2,000 and standard deviation 300. The store purchases the pencils for 10 cents and sells them for 35 cents each. There is a twomonth lead time from the initiation to the receipt of an order. The store accountant estimates that the cost in employee time for performing the necessary paper work to initiate and receive an order is $20, and recommends a 25 percent annual interest rate for determining holding cost. The cost of a stock-out is the cost of lost profit plus an additional 20 cents per pencil, which represents the cost of loss of goodwill. Find an optimal (Q,R) policy Example - Optimal (Q,R) Policy Fixed ordering cost, K Holding cost, h Ic Penalty cost, p Mean annual demand, Standard deviation of annual demand, y Lead time, Mean lead - time demand, Standard deviation of lead - time demand, y Example - Optimal (Q,R) Policy Iteration 1 Step 1: Q EOQ 2 K h Step 2: 1 F ( z) Qh p z (Table A-4) R z Example - Optimal (Q,R) Policy Step 3: L(z ) n L(z ) (Table A-4) Step 4: 2 np K Q h Question: What are the stopping criteria? Qh Step 5: 1 F ( z ) p z R z (Table A-4) Iteration 2 Example - Optimal (Q,R) Policy Step 3: L(z ) (Table A-4) n L(z ) Step 4: 2 np K Q h Question: Do the answers converge? Qh Step 5: 1 F ( z ) p z R z (Table A-4) Fixed cost (K ) Holding cost (h ) Penalty cost (p ) Mean annual demand () Lead time (in years Lead time demand parameters: Mean, Standard deviation, Step 1 Q = Step 2 Area on the right=1-F (z ) z= R= Step 3 L(z )= n= Step 4 Modified Q = Step 5 Area on the right=1-F (z ) z= Modified R = Note: K , h , and p are input data input input data <--- computed input data Iteration 1 Iteration 2 EO Q Q h / p Table A1/A4 z Table A4 L( z) 2 np K / h Q h / p Table A1/A4 z READING AND EXERCISES Lesson 18 Reading: Section 5.4, pp. 262-264 (4th Ed.), pp. 253-255 (5th Ed.) Exercise: 13a, p. 271 (4th Ed.), p. 261