IRS Examinations

advertisement

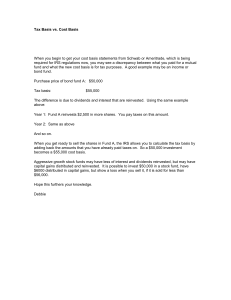

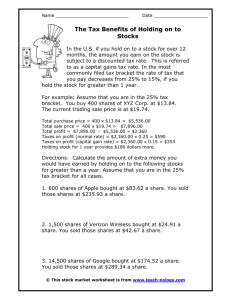

Investment Income Tom Tosuksri, Cleveland Housing Network 1 Investment Income • Investment income is non-earned income from a variety of sources. Depending on the source, this may be a basic or advanced return • BASIC Investment Income o Interest from bank accounts or savings bonds, Dividends o Schedule B • ADVANCED Investment Income o Capital Gains from the sale of Stocks, Bonds or Real Estate o Schedule D, Form 8949, Cap Gn Wkt • OUT OF SCOPE Investment Income o Rental Income o Schedule E 2 Basic Investment Income • Interest from bank accounts or savings bonds, Dividends • Schedule B has three parts: • I. Interest o 1a: Seller Financed Mortgages (not typical, for land contracts) o B-G: Other interest: Link from one of these lines to Interest Stmt • II. Ordinary Dividends o A-J: Link from one of these lines to Dividend Stmt • III. Foreign Accounts and Trusts o Not typical in our population 3 Capital Gains • IRS calculates and taxes based on the Gain of any transaction, not the proceeds • Negative Capital Gain is counted as a loss, can be used to offset other income up to $3,000, and can be carried over to a future year • Includes sales of Stocks, Bonds, Real Property • If Capital Gains exceeds $3,350, no longer eligible for Earned Income Credit • Short Term: Held for 1 year and under • Long Term: Held for over 1 year • System calculates using Purchase/Sale dates 4 Capital Gains • Capital Gain transactions are reported on form 1099-B, Sale or Disposition of Stocks, Bonds • Form will include: • Sales Date, Net Proceeds, Shares Sold, Price/Share o Commission should be deducted from the Sales price, ‘cost of sale’ • Purchase Date, Purchase Price, Shares bought, Price/Share o Commission should be added to the Purchase Price, ‘cost of buying’ • • • • Capital Gain = Net Proceeds –Cost Basis Net Proceeds = [(Shares Sold x Sales Price/Share) – Sales Commission] Cost Basis = Shares Sold x Original Cost/Share Original Cost/Share = [(Shares Bought x Purchase Price/Share) + Sales Commission] ÷ Shares Bought 5 Capital Gains • Example: • • Ted purchased 200 shares of ABC stock on October 15th, 2012 at $10 per share. His broker charged a $50 commission. On February 5th, 2014, he sold 100 shares of ABC stock at $15 per share. He paid his broker $25 in commissions for the sale. • What is Ted’s taxable gain? • Is it a Long Term or Short Term Capital Gain? 6 Capital Gains Example: 1. Ted sold 100 shares. His net proceeds at the sale: Net Proceeds = (100 shares x $15) - Commission $25 = $125 2. Since Ted purchased more than he sold, we will have to calculate his cost per share, including commission: Original Cost/Share = [(200 x $10) + $50] ÷ 200 = $10.25 3. Then, we calculate Cost Basis of the 100 shares sold: Cost Basis = 100 shares x $10.25 = $102.50 4. Finally we calculate Capital Gain: Capital Gain = $125 .00 - $102.50 = $17.50 Ted’s capital gain in this transaction is $17.50 7 Capital Gains • The cost basis of inherited property is the fair market value on the date of death, always long term. • What if there is no Cost Basis? o Sometimes, the brokerage firm does not have the cost basis. IRS will assume -0basis, which is not advantageous for our taxpayers o First, determine whether or not it will affect the tax liability: • • • Does adding it change the refund or amount due? Combined with other income, is it more or less than their Standard deduction and Exemptions? I.E., A taxpayer earning $2,500 in wages with a $2000 capital gain will not have a tax liability thus would not benefit from finding the cost basis. If his capital gains were $4000, though, he would benefit since he would be eligible for EIC. o Second, ask for the best estimate of the purchase date o Next, determine the Stock Symbol of the shares sold and look up the historical price using Google Finance or other historical database • https://www.google.com/finance/stockscreener o Finally, calculate an estimated cost basis, rounding down o The brokerage firm can also be contacted to see if they have any additional information regarding the history or transaction 8 Sale of Real Property • When real estate is sold, it must be reported to the IRS to determine whether it is a taxable event • Sales of a Main Home fall under a special exclusion: o o o o Gain of up to $250,000 ($500,000 if married) can be excluded Any losses cannot be included Must have owned the home for at least 2 years Must have been the primary home for 2 of the past 5 years • All others are treated as investment property, with gains and losses reported similar to stocks • Use Schedule D Wkt 2 to document sale of home in addition to Cap Gn Wkt and Form 8949 • Visit: http://fiscalofficer.cuyahogacounty.us for real estate information and past sales history 9