Financial Management Grant

Financial Management Grant

Select Committee on Finance

National Treasury

TV Pillay

FMG

• The purpose of the FMG is to promote and support municipal financial management reforms and assist municipalities with the implementation of the MFMA

– 2001 : pilot programme targeted at selected municipalities –

• Cat A (Jhb/Tshwane), B (Msunduzi/Sol Plaatje),

• Cat C (OR Tambo, Amatole)

– 2003 : phased implementation of the MFMA

– 2004 : countrywide support for reforms

– 2005 : Grant extended to 194 municipalities

– 2006 and medium term to all municipalities

2

Background to the MFMA

– MFM reform commenced in 1998

– Testing with pilot municipalities commenced in 2000

– MFMA took effect 1 July 2004, with some sections delayed or exempted for lower capacity municipalities

– Financial and technical assistance provided via

FMG & MFMTAP

– Prime responsibility for financial management rests with EACH municipality

3

FMG

Aims

– Catalyst for MFMA implementation

– Strengthening of municipal financial management capacity

– Broaden skills base for financial management

4

FMG

Conditions

– Appointment of an appropriately skilled municipal manager and CFO

– Appointment of at least two interns for purposes of building future financial management capacity

– Council Resolution committing council to reforms

– Submission of primary bank account details

– Development of an action plan for implementation

– Monthly reporting on performance

5

FMG

Focus of reforms

– Build awareness and undertake training on MFMA reforms

– Create and implement credible multi-year budgets

– Linking plans and Budgets

– Improve consultation with communities

– In-year reports to council and external parties

– Prepare quality and timely AFS and Annual Reports

– Improve processes, procedures and quality of financial information

– Prepare and present SDBIP’s

6

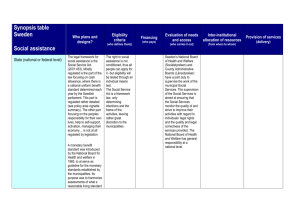

FMG Allocations

Distribution of Finance Management Grant per Category of Municipality 2000/01 to 2008/09

National Financial Years (R'000)

Medium-term estimates

Category 2001/02 2001/02 2002/03 2003/04 2004/05 2005/06 2006/07 2007/08 2008/09 Total

A

B

C

TOTAL

15 000

27 500

7 500

50 000

Municipalities 20

15 500

28 500

16 000

60 000

31

21 500

66 000

23 500

111 000

39

21 000

138 330

51 500

210 830

149

20 000

85 000

33 000

138 000

195

20 000

81 000

31 500

132 500

194

3 500

117500

24250

283

3 500

117500

24250

283

4500

117000

28500

145 250 145 250 150 000 1 142 830

283

123 000

782 630

237 200

-

Source: Division of Revenue Acts 2000 to 2006

7

Restructuring Grant

Aim

– Support large municipalities with restructuring

Conditions

– Municipality develop own restructuring plans

– Contractual obligations on plans

– Adopt resolution committing to implementing plans

– Show progress in quarterly reports

8

Restructuring Grant

Some indicators

– Institutional

• Staffing and skills levels

• Structured meetings and frequency

• Alternative service delivery mechanism

• Service centre

– Economic Development

• Innovative programmes

• Job creation activities

– Financial

• Credit ratings

• Debt ratios

• Revenue collection ratios

• Infrastructure spending levels

9

Restructuring Grant Allocations

Municipalities

Allocations prior to 2004

R’m

Nelson Mandela

Cacadu 48

Buffalo City

Mangaung

Mathebeng

City of Jo'burg

City of Tshwane

Emfuleni eThekwini

Msunduzi uMhlathuze

Polokwane

Sol Plaatje

City of Cape Town

15

550

134

20

10

20

Total 797

Allocation

2005/06

R’m

50

35

10

25

65

35

65

65

350

Amounts withheld

2005/06

R’m

20

Allocation

2006/07

R’m

10

35

55

35

75

35

75

Allocation

2007/08

R’m

50

100

100

Total since inception

R’m

108

48

103

120

15

575

155

60

155

134

20

10

20

30 75 100 125

95 350 350 1,942

10

Municipal Capacity Categorisation per Province

Province

Eastern Cape

Free State

Gauteng

Kwazulu-Natal

Limpopo

Mpumalanga

Northern Cape

North West

Western Cape

Total

Conclusion

Medium Low

45 6 16 23

25

14

61

5

6

9

10

7

16

10

1

36

30

21

32

25

30

283

3

6

1

6

8

50

Source: Local Government Datab ase

8

6

18

8

18

107

11

19

9

13

11

4

126

MFMA - Priorities

1. Preparing an implementation plan

2. Allocate responsibilities to AO=MM

3. Establish senior management team

4. Bank account and cash controls

5. Meeting financial commitments

6. Budgets

7. Supply Chain Management policy

12

MFMA - Priorities (cont.)

8. Entities, PPPs, long term contracts and borrowing reforms

9. Past financial statements

10. Present financial statements and annual report

11. Tender committees, boards, forbidden loans

12. Compliance with Division of Revenue Act

13

Internship Programme

• Commenced in 2004 - unemployed graduates in Public Finance, Economics,

Accounting and Auditing from disadvantaged communities

• Programme supported by municipalities, with international and local mentors guided by NT

• 490 interns currently employed in municipalities

• Over 60 appointed permanently in municipalities, state and private institutions

14

FMG Internship progress

Table 7.4 Recruitment and Movement of Interns 2004 to 2005 by Province

EC FS GP KZN LIM MP NW NC WC TOTAL

Interns 31 October 2004 43 26 25 49 25 24 24 22 49 287

New recruitment 2005

Subtotal

Interns leaving 2005

44

87

2

Interns 31 October 2005

Source: Local Government Database

85

34

60

5

55

16 45

41

9

94

4

32 90

33

58

3

55

26

50

11

39

21 23

45

4

45

3

41 42

30 272

79

24

559

65

55 494

15

Achievements

• All 6 Cat “A”, 40 cat “B”, and 15 Cat “C” municipalities now produce multi-year budgets

• Most high capacity municipalities are producing in-year reports on financial and non financial performance

• All municipalities have developed implementation plans

• New loan arrangements undertaken by large municipalities

• Internal processes drastically improved

• All municipalities have community consultation meetings on budget preparation

16

Capacity Building

• 2002/03 – hands-on technical assistance provided to

33 municipalities via international advisors

• 2004 - roving advisors appointed in 5 provinces (FS,

Limp, NW, Mpum, EC)

• 2004 - workshops on phase-in of MFMA undertaken countrywide with over 2500 attendees

• 2005 - SAQA accredited qualification approved :

NQF level 5 and 6

• 2005 – work plan part support for PC

• 2005 - technical sessions on budget reforms, in-year reporting, supply chain management undertaken with over 2100 attendees

17

Capacity Building – medium term

• 2006 and beyond

– new councillor training programme commenced with guides and booklets issued to all (copies in pack)

– MFMIP workshops for mentorship and service providers on workplace programmes and development of training material

– Conference with 1200 delegates (trainers and officials): Comprehensive approach to MFM

Capacity Building

– Further capacitation of Provincial Treasury staff

– Provincial legislature improved oversight over

MFMA implementation

– Multimedia self testing training programme

18

MFMA Credit Rating

Table 7.2 Credit Ratings of Metropolitan Municipalities

Metro

Ethekwini(Durban)

Ekurhuleni(East Rand)

Long-term zaAA zaAA-

Short-term zaA1+ zaA1+

Cape Town zaA+ zaA1

Tshwane(Pretoria)

Johannesburg

Nelson Mandela(Port Elizabeth) zaA+ zaA zaA zaA1 zaA1 zaA1

George zaA-

Sources: Global Credit Rating Co report October 2005 - Ethekwini.

CA-Ratings reports January and March 2006 - others.

zaA2

Ratings are based on SA national scales. The highest rating is zaAAA. Ratings scale down from zaAAA to zaA-. Within each of the levels a "+" or "-" sign indicates relative strength. An A indicates the relative strong and capacity to repay liabilities. Example: eThekwini has the best long-term rating.

19

• Progress in implementation for 2005/06

Budgets

Survey of 35 municipalities with NT Advisors

– 23 tabled on time (1 April 2005)

– 11 tabled one week late

– 1 outstanding

– 35 to approve before 30 June 2005

20

100

80

%

60

47

40

96

Budgets Tabled and Adopted on Time - 2005/06

100

97

92

100 100 100

79

41

58 57

20

16

20

44

97

70

0

Ea st ern

C ap e

Fre e

St at e

G au te ng

Kw az ul u-N at al

Li m po po

M pu m al an ga

N ort h

W es t

N ort he rn

C ap e

W es te rn

C ap e

Tabled On Time Adopted On Time

21

100

Budget Reforms

• Refer pack for detailed information on selected 22 municipalities

• Progress in 2006/07 budgets

– Spread across the country (Cat A, B and C)

– Tabling within timelines –February (9), March (12), April (1)

– Multi year format (22)

– IDP/Budget alignment - capital (20) and operations (17)

– Service Delivery & Budget Implementation plan (10)

– Tabled budget on website (5)

• Other reforms

– Internal audit unit established (22)

– Audit committees established (22)

– Supply Chain Management Policy adopted (22)

22

National Treasury Support

– Implementation guidelines and manuals

– Pocket version of MFMA alignment with MSA

– Technical circulars, emails, F A Q

– Training seminars and workshops (budgets, internal audit, mentors, GRAP, DVD set)

– Validation Board to review materials established

– PPP desk established

– Website and MFMA help-line established

– Regular meetings with provincial officials instituted

23

24

Audited Financial Statements submitted to Auditor-General

2001/02, 2002/03, 2003/04

Western Cape

North West

Northern Cape

Mpumalanga

Limpopo

Kwazulu-Natal

Gauteng

Free State

Eastern Cape

Eastern Cape Free State Gauteng Kwazulu-Natal Limpopo Mpumalanga Northern Cape North West Western Cape no data 2

01/02, 2

01/02, 02/03 5

01/02, 02/03, 03/04 36

0

0

0

25

0

3

0

12

0

4

1

56

1

3

2

26

2

3

1

14

0

1

0

30

0

2

0

23

25

0

1

0

29

2004/2005 Annual Financial Statements Submitted to Auditor-General

Submitted by 31/12/2005 Outstanding at 31/12/2005

Western Cape

Northern Cape

North West

Mpumalanga

Limpopo

KwaZulu-Natal

Gauteng

Free State

Eastern Cape

0% 10% 20% 30% 40% 50% 60% 70% 80% 90%

26

100%

MFMA Urgent Priorities Score

Complying Fully With The Division Of Revenue Act

Complying With Provisions For Tender Committees, Boards Of Municipal Entities And In Relation To Forbidden Activities

Completing 2003/04 Financial Statements And Tabling Annual Report

Completing Past Financial Statements And Advising National Treasury - (For 2002/03 Financial Year And Before)

Implementing Reforms In Relation To Municipal Entities, Public-Private Partnerships, Long-Term Contracts And Municipal

Borrowings

Revising Policies For Supply Chain Mangement

Reporting Revenue And Expenditure

Meeting Of Financial Commitments

Implementing Appropriate Controls Over Municipal Bank Accounts And Cash Management

Establishing A Top (Senior) Management Team

Allocating Appropriate Responsibilities Under The Mfma To The Accounting Officer

Low [60/127 Respondents]

Medium [66/107 Respondents]

High [37/50 Respondents]

Preparing An Implementation Plan

0 10 20 30 40 50 60 70 80

27

90 100

Figure 7.1

MFMA Implementation Plans received as at 30 April 2006

100 100

Conclusion

100 100 100

100

98

96

94

92

90

88

86

84

82

E as te rn

C ap e

98

F re e

S ta te

G au te ng

K w aZ ul u-

N at al

89

Li m po po

M pu m al an ga

N o rt h

W es t

N o rt he rn

C a pe

W es te n

C ap e

28

100

Primary bank account details

• Municipalities were requested to submit their original primary bank account details to the National Treasury

• Initial request till 100% submission = 4 ½ months

• 34 submissions with errors, including noncompliant account names, etc

29

Original Primary Bank Account Details Submitted to NT as at 13 April 2006

Western Cape

Northern Cape

North West

Mpumalanga

Limpopo

KwaZulu-Natal

Gauteng

Free State

Eastern Cape

0% 20%

Compliant

40% 60%

Non-compliant

80%

Errors

30

100%

Regulations

– Investments (1 April 2005)

– Public Private Partnerships (1 April 2005)

– Supply Chain Management (1 July 2005)

– Budgets (schedule, format, resolution)

– Prescribed limits and frameworks in progress

– Competency levels

– General matters

31

Other support initiatives

– Disposal of assets

– Entities guide and regulations

– Councillor guide and training with SALGA

– Cash Management

– Borrowing guide and regulations

– Internal Audit guide

– New format Grap Statements

– Asset Management guide

– Establishment of MFRS

32

Provincial Support for MFMA

– PT to progressively assume MFMA delegation

– PT finalising support structures and strategies

– National MFMA Working Group established

• Regular meetings (SALGA, dplg, PT, PLG)

– Address resource and staff requirements

– Multi year allocations in Provincial budgets for all programmes to municipalities

– Alignment of Provincial and Municipal plans

– Further support and co-operative governance with other departments

33

Thank You

34