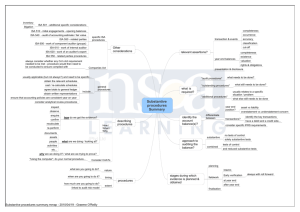

Revenue & Receipts Cycle

advertisement

SPECIFIC TYPES OF AUDIT EVIDENCE REFERENCES ISA 505 – External confirmations •“SAICA Handbook” or IFAC website ISA 540 – Auditing accounting estimates •“SAICA Handbook” or IFAC website ISA 520 – Analytical procedures •“SAICA Handbook” or IFAC website “ It is imperative for topics relating to ISA 540 & ISA 520 that the standards themselves are used for study purposes. 2 LEARNING OUTCOMES 1. Explain the auditor’s responsibility relating to: • external confirmations (ISA 505) • the audit of accounting estimates(ISA 540) • the performance of analytical procedures (ISA 520) in regard to account balances at the end of the financial year being audited. 2. Describe the audit procedures that the auditor should carry out to discharge his/her responsibility regarding: • the use of external confirmations(ISA505) • the estimates included in account balances(ISA540) • analytical procedures (ISA520) 3. Explain the reliability of external confirmations in a given scenario in terms of the appropriateness of audit evidence(ISA505) External Confirmations – ISA 505 1. INTRODUCTION – ISA505 para 2 Use of External Confirmations Bank information Investments Title Deeds matters Loan amounts/outstanding debt Documents held safeparties custody Accounts receivable Inventory (e.g. trade held debtor byinLegal third balances) to obtain Audit evidence and reliability: Source: external / internal; level of authority. Obtained direct or indirect/by inference. Form: documentary (paper/electronic) / verbal. For which assertions can audit evidence be obtained through external confirmations? (i.t.o. account balances) Existence, Rights / Obligations, Valuation and/or Completeness? 2. REQUIREMENTS – ISA505 para 7 2.1 When performing external confirmation; procedures: - Control over process - What Information? - Confirming party? - Design request - Send NB: obtain management permission to send beforehand 2. REQUIREMENTS – ISA505 para 8 0 2.2 If management refuses permission to confirm: Reason? Reasonable? Impact on risk assessment (RMM) /risk of fraud? Alternative procedures... Objective: must regardless, obtain sufficient appropriate audit evidence! What if can’t? 2. REQUIREMENTS – ISA505 para 9 2.3 Doubts as to reliability of audit evidence from external confirmation Impact on risk assessment (RMM)/risk of fraud? Alternative procedures Evidence , then impact on audit opinion 2. REQUIREMENTS – ISA505 para 06 2.4 TYPES OF EXTERNAL CONFIRMATION REQUESTS Positive confirmation request Respond if agree or disagree Negative confirmation request Respond only if disagree Which offers more reliable audit evidence? EXAMPLES Example of a bank confirmation (SAAPS 1100) Examples of alternative audit procedures •If cannot confirm a debtor’s balance? •If cannot confirm a creditor’s balance? Auditing Accounting Estimates – ISA 540 INTRODUCTION – ISA 540 para 6 Definition “An approximation of a monetary amount in the absence of a precise means of measurement.” Examples Auditor’s Responsibility/Objective Sufficient appropriate audit evidence about: (a) accounting estimates reasonable; (b) related disclosures in the financial statements are adequate. DEFINITIONS – ISA 540 para 7 Other Definitions “Auditor’s point estimate – The amount, or range of amounts, respectively, derived from audit evidence for use in evaluating management’s point estimate.” - ISA540 para7(b) “Estimation uncertainty – The susceptibility of an accounting estimate and related disclosures to an inherent lack of precision in its measurement.” - ISA540 para 7(c) “Management bias - A lack of neutrality by management in the preparation of information” - ISA540 para 7(d) “Management’s point estimate – The amount selected by management for recognition or disclosure in the financial statements as an accounting estimate.” ISA540 para 7(e) “Outcome of an accounting estimate – The actual monetary amount which results from the resolution of the underlying transaction(s), event(s) or condition(s) addressed by the accounting estimate.” - ISA540 para 7(f) NATURE OF ACCOUNTING ESTIMATES – ISA 540 para 2 Risk of material misstatement in accounting estimates varies: dependent on the level of estimation uncertainty of the estimate involved, in turn dependent on: • Complexity of the business activities of the entity; • Frequency at which the estimate is made (routine/non-routine transactions); • Availability (“Observability”) of data; • Ease at which the method of measurement is applied, as prescribed by IFRS; •“Model” used to measure the estimate. 14 REQUIREMENTS – ISA 540 para 8-11 1. Risk Assessment Procedures: ID and Assess RMM Auditor’s considerations when determining the risks associated with estimates: • The requirements of the financial reporting framework (e.g. IFRS)? • How management identifies indicators that give rise to the need for estimates? • How does management make the estimate? On what data is it based? The method used Relevant controls Whether an expert was used Underlying assumptions Changes in the method used from the prior period How management has assessed the effect of estimation uncertainty • What is the estimation uncertainty associated with the estimate? • Is there a significant risk associated with the estimate? REQUIREMENTS – ISA 540 para 12-14 2. Responses to the Assessed Risk of Material Misstatements Put risk assessment into action (i.e. respond to the information obtained as per the previous slide): Auditor determines whether: Requirements of the applicable financial reporting framework have been applied appropriately? Expert is needed in assisting with valuation? Controls were in place when management made estimate? Auditor tests whether: Methods used by management are appropriate and have been applied consistently; Assumptions used are reasonable; Management’s point estimate reasonable compared to auditor’s. 16 REQUIREMENTS – ISA 540 para 21-22 Indicators of Possible Management Bias Review the judgments/decisions made by management to identify whether there are indicators of possible management bias. Written Representations Obtain written representations from management whether they believe significant assumptions are reasonable. Analytical Procedures ISA 520 APPLICABILITY There are two ways to accumulate audit evidence. Test the controls and/or Perform substantive tests on the transactions and the balances Test of detail Analytical procedures ISA -520 APPLICABILITY ISA 520 para 1 and 3. When would we as auditors make use of ISA 520 ? 1. As a substantive procedure • During an audit • For relevant , reliable evidence, as to an assertion/s • Alone/in combination with other substantive tests of detail. 2. To corroborate conclusions formed at the end of the audit Suggestion of responsibility to perform in the final conclusion of the audit 3. Risk assessment ( but this is covered by ISA315) ANALYTICAL REVIEW DEFINED ISA 520 para 4. What is an analytical procedure? Comparison / Relationship Evaluation ANALYTICAL REVIEW DEFINED ISA 520 para 4. and A1. to A3. Comparison/Relationship of Current financial transactions/ balances • individually • aggregated • dissembled to other Financial ,non financial and operating data of • • • • • Prior periods Budgets Same/similar industry Auditors expectations etc. ANALYTICAL REVIEW DEFINED ISA 520 para 4. and A1. to A3 Comparison/Relationship This can take the form of : • Ratios • Percentages • Volumes • Averages • GP% • Payroll costs to number of employees etc. ANALYTICAL REVIEW DEFINED ISA 520 para 4. and 5 and A15. to A21. Evaluation The results must be evaluated against predetermined expectations The auditor would need to: • • • Get explanations from management as to why any results differ from the expected Corroborate these explanations Perform further substantive tests of detail if still not satisfied DESIGNING & PERFORMING PROCEDURES ISA 520 para. 5 and A12 to A16 In designing Analytical Procedures the auditor should consider: 1. Suitability of actual analytical procedure 2. Reliability of data 3. Predetermined expectations 4. Need to determine an amount of acceptable difference based on materiality and desired level of assurance DESIGNING & PERFORMING PROCEDURES ISA 520 para. 5 and A6. to A10. 1.Suitability? Degree of reliance Of procedure for purpose Predictable Assessed risk of material misstatement DESIGNING & PERFORMING PROCEDURES ISA 520 para. 5 and A12 2.Reliability? Independent Source Preparation Nature and relevance Comparability DESIGNING & PERFORMING PROCEDURES ISA 520 para. 5 and A15 3.Predetermined expectation! Detection of material misstatement Precision of results ? Dissembling of information EXAMPLE A typical , basic analytical procedure that one may perform for a dairy’s sales (Financial year end 31 December) o First : Dissemble the information e.g. • Ice cream sales • Milk sales • Cream sales etc. o Second: Determine expectations e.g. • Sales increased 8% on previous year, increase occurring on 1January 2013 (management’s documented price increase policy) • Higher sales in summer and the holiday seasons • Lower sales in winter EXAMPLES 800 Monthly Ice Cream sales of Delly Dairy (Pty)Ltd 700 Rands 600 500 400 300 2012 2013 200 100 0 Months EXAMPLE A typical , basic analytical procedure that one may perform for a dairy’s sales o Third: Accumulate data o Fourth: Analyse data e.g. ask management why • April and May are lower than last year ? • June through to July are lower than last year ? o Fifth: Corroborate management’s reasons • Perform additional tests if necessary DESIGNING & PERFORMING PROCEDURES SUMMARY Predetermined Expectation! Corroborate expectations if necessary Gather & dissemble data Ensure data agrees to the financial records Compare data to expectations Determine reasons for any differences Corroborate reasons END THANK YOU! BAIE DANKIE! ENKOSI KAKHULU!