notes 3 (2013)

LAWS3113

Law of Trusts A

LAWS3113 Summary 1

TABLE OF CONTENTS

1. INTRODUCTION ........................................................................................................ 6

D EVELOPMENT OF THE C OURT OF E QUITY ............................................................................. 6

Earl of Oxford’s Case [1615] ............................................................................................... 6

Chancellery = court of conscience .................................................................................... 6

D

IFFERENCE BETWEEN

CL

AND EQUITABLE REMEDIES

: ....................................................... 6

F

USION

? ...................................................................................................................................... 6

I

NTRODUCTION TO TRUSTS

: ...................................................................................................... 6

2. EQUITABLE MAXIMS ............................................................................................... 7

E

QUITY WILL NOT SUFFER A WRONG TO BE WITH A REMEDY

................................................ 7

E QUITY FOLLOWS THE LAW ...................................................................................................... 7

E QUITY WILL NOT ASSIST A VOLUNTEER ................................................................................. 7

H E OR SHE WHO SEEKS EQUITY MUST DO EQUITY ................................................................... 7

H E OR SHE WHO COMES TO EQUITY MUST COME WITH CLEAN HANDS .................................. 8

E

QUITY ACTS IN PERSONAM

...................................................................................................... 8

E

QUITY LOOK TO INTENT RATHER THAN THE FORM

,

SUBSTANCE AND NOT THE FORM

...... 8

E

QUITY LOOKS UPON THAT AS DONE WHAT OUGHT TO BE DONE

.......................................... 8

D

ELAY DEFEATS EQUITY

............................................................................................................ 8

E

QUITY IS EQUALITY

.................................................................................................................. 8

3. EQUITABLE INTERESTS IN PROPERTY ............................................................. 9

W

HAT IS AN EQUITABLE INTEREST IN PROPERTY

? ................................................................. 9

C LASSIFICATION OF EQUITABLE INTERESTS ............................................................................ 9

Equitable proprietary interest .......................................................................................... 9

Mere Equity ............................................................................................................................... 9

Latec Investments v Hotel Terrigal ................................................................................. 9

Personal equity ..................................................................................................................... 10

C

REATION OF EQUITABLE INTERESTS

................................................................................... 10

E

QUITABLE INTEREST OF PURCHASER

.................................................................................. 10

P

RIORITY BETWEEN INTERESTS

............................................................................................ 11

4. ASSIGNMENTS OF PROPERTY ........................................................................... 11

D EFINITION OF ASSIGNMENT : ................................................................................................ 11

Norman v FCT ....................................................................................................................... 11

Shepherd v FCT ..................................................................................................................... 11

Williams v Commis of Inland Revenue ........................................................................ 12

L

EGAL ASSIGNMENT

................................................................................................................ 12

Elements of legal assignment: ........................................................................................ 12

Advantages and Disadvantages of legal assignment ........................................... 12

E

QUITABLE ASSIGNMENT

....................................................................................................... 12

Elements of assignment in equity ................................................................................. 12

Milroy v Lord.......................................................................................................................... 12

Anning v Anning ................................................................................................................... 13

Corin v Patton........................................................................................................................ 13

S200 PLA – voluntary assignment ................................................................................ 13

Expectancies .......................................................................................................................... 13

Rights assignable in equity .............................................................................................. 13

Notice of equitable assignment ..................................................................................... 13

LAWS3113 Summary 2

Advantages and disadvantages of equitable assignment .................................. 13

Priority between successive equitable assignments: ............................................ 13

5. NATURE/CLASSIFICATION OF TRUSTS ......................................................... 14

W

HEN DOES A TRUST COME INTO EXISTENCE

? .................................................................... 14

D

EFINITION OF TRUST

............................................................................................................ 14

3 parties to trust: ................................................................................................................. 14

Equitable personal obligation ........................................................................................ 14

C LASSIFICATION OF TRUSTS : .................................................................................................. 14

Express trust .......................................................................................................................... 14

Resulting trust ....................................................................................................................... 15

Constructive trust ................................................................................................................ 15

O

THER TYPES OF TRUSTS

: ...................................................................................................... 15

P

OWERS OF APPOINTMENT

.................................................................................................... 15

6. THE 3 CERTAINTIES ............................................................................................. 16

2

WAYS OF CREATING AN EXPRESS TRUST

: ........................................................................... 16

R EQUIREMENTS FOR CREATION : ........................................................................................... 16

3 CERTAINTIES – K NIGHT V K NIGHT , P ASCOE V B OENSCH ................................................ 16

Certainty of intention ......................................................................................................... 16

Certainty of subject matter.............................................................................................. 17

7. BENEFICIARIES OF TRUSTS ............................................................................... 17

C

ERTAINTY OF OBJECTS

.......................................................................................................... 17

T

RUST POWER

......................................................................................................................... 18

M

ERE POWER

.......................................................................................................................... 18

H

OW DOES COURT WORK OUT WHETHER MERE OR TRUST POWER

? ................................. 18

D ISCRETIONARY TRUSTS ........................................................................................................ 18

P URPOSE T RUSTS .................................................................................................................... 19

G IFTS TO UNINCORPORATED ORGANISATIONS ..................................................................... 19

Leahy v A-G (NSW) .............................................................................................................. 19

Bacon v Piantai ..................................................................................................................... 20

S33Q Succession Act ........................................................................................................... 20

8. CHARITABLE TRUSTS .......................................................................................... 20

N

ATURE OF A CHARITABLE TRUST

......................................................................................... 20

Differences with express private trust ........................................................................ 20

Relevance of characterization as charitable trust? .............................................. 20

T EST FOR BEING CHARITABLE : .............................................................................................. 21

Income Tax Commissioner v Pemsel ............................................................................ 21

Central Bayside GP Assoc ................................................................................................. 21

AidWatch v Commis for Tax ............................................................................................ 21

Relief of poverty .................................................................................................................... 21

“Aged” ....................................................................................................................................... 21

“Sickness”................................................................................................................................. 22

“Education” ............................................................................................................................ 22

Advancement of religion ................................................................................................... 22

Public Benefit ......................................................................................................................... 22

Other benevolent purposes .............................................................................................. 23

M IXED CHARITABLE AND NON CHARITABLE PURPOSES ...................................................... 23

F AILURE OF CHARITABLE PURPOSE ....................................................................................... 23

LAWS3113 Summary 3

R

EGULATORY DEVELOPMENTS

.............................................................................................. 24

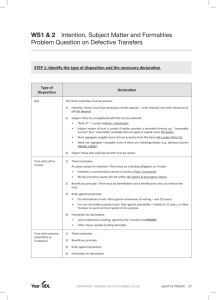

9. FORMALITIES IN THE CREATION OF TRUSTS ............................................. 24

R

EQUIREMENT OF FORM

........................................................................................................ 24

R

EQUIREMENT OF STATUTE

................................................................................................... 24

E

XEMPTIONS FROM WRITING REQUIREMENT

....................................................................... 25

R ESULTING TRUSTS ................................................................................................................. 25

Automatic resulting trusts ............................................................................................... 25

Presumed resulting trusts ................................................................................................ 25

R EBUTTAL OF PRESUMPTION OF RESULTING TRUST ........................................................... 26

T

RUSTS OF LAND

..................................................................................................................... 26

D

ISPOSITION OF EQUITABLE INTEREST

................................................................................. 26

Application of s11(1) .......................................................................................................... 27

E

QUITY WILL NOT PERMIT A STATUTE TO BE USED AS AN INSTRUMENT OF FRAUD

......... 27

C

OMMON INTENTION TRUST

.................................................................................................. 27

10. TESTAMENTARY TRUSTS ................................................................................ 28

F ORMAL REQUIREMENTS : ...................................................................................................... 28

Hensler v Padget .................................................................................................................. 28

Re Garris .................................................................................................................................. 28

R EVOCATION OF WILL ............................................................................................................. 28

P

ROPERTY THAT CAN BE DISPOSED OF BY WILL

................................................................... 28

N

ATURE OF TESTAMENTARY DISPOSITION

........................................................................... 29

N

EED FOR TESTAMENTARY CAPACITY

.................................................................................. 29

M

INORS

.................................................................................................................................... 29

T

ESTAMENTARY TRUST

.......................................................................................................... 29

D ELEGATION OF TESTAMENTARY POWER ............................................................................ 29

S ECRET T RUSTS ...................................................................................................................... 30

Elements of secret trusts ................................................................................................... 30

Blackwell v Blackwell......................................................................................................... 30

Voges v Monohan ................................................................................................................. 30

M

UTUAL TRUSTS

..................................................................................................................... 30

11. INVALIDATING FACTORS ................................................................................. 31

3

TYPES OF INVALIDATING FACTORS

: .................................................................................... 31

P

OLICY BEHIND RULE AGAINST PERPETUITIES

..................................................................... 31

R ULE AGAINST PERPETUITIES ................................................................................................ 31

P ROGRESSIVE EVOLUTION OF RULE ....................................................................................... 31

R ULE IS CONCERNED WITH THE VESTING OF PROPERTY ..................................................... 31

F

UTURE GIFTS

.......................................................................................................................... 31

E

XCEPTION TO RULE AGAINST PERPETUITIES

...................................................................... 32

P

ERPETUITY PERIOD

............................................................................................................... 32

L

IVES IN BEING

........................................................................................................................ 32

Re v Clarke .............................................................................................................................. 32

The rule in Andres v Partington .................................................................................... 32

D

ISPOSITION TO CLASS

........................................................................................................... 33

W IDOWER ................................................................................................................................ 33

R ULE IS CONCERNED WITH POSSIBILITIES AND NOT PROBABILITIES ................................. 33

P RESUMPTION AS TO FUTURE PARENTHOOD – PLA S 212 ................................................ 33

O THER REFORMS – S 212 PLA .............................................................................................. 33

“W

AIT AND

S

EE

” ..................................................................................................................... 33

LAWS3113 Summary 4

Example of ‘wait and see’ v CL ....................................................................................... 34

A

GE REDUCTION

...................................................................................................................... 34

C

LASS GIFTS

............................................................................................................................. 34

C

OMMON LAW

4

STEP PROCESS

:............................................................................................ 34

C

AN STATUTORY MODIFICATION SAVE THE GIFT

? ............................................................... 34

R ULE AGAINST PERPETUAL TRUSTS ...................................................................................... 35

P UBLIC POLICY ......................................................................................................................... 35

I LLEGALITY .............................................................................................................................. 35

12. VARIATION AND TERMINATION OF TRUSTS ............................................ 36

I

NHERENT POWER OF COURT

................................................................................................. 36

E

XPRESS POWER TO VARY TRUSTS

........................................................................................ 36

Variation of superannuation trusts ............................................................................. 37

Family law .............................................................................................................................. 38

T

ERMINATION OF TRUSTS

...................................................................................................... 38

13. COMPLETE CONSTITUTION OF TRUSTS ..................................................... 38

L EGAL TRANSFER OF TRUST PROPERTY ................................................................................ 38

N ECESSITY TO COMPLETELY CONSTITUTE TRUST ................................................................ 38

E NFORCEABILITY OF INCOMPLETELY CONSTITUTED TRUSTS ............................................. 39

M ARRIAGE CONSIDERATION .................................................................................................. 39

T

RUSTS OF BENEFIT OF COVENANT

....................................................................................... 40

LAWS3113 Summary 5

1. INTRODUCTION

Development of the Court of Equity

Henry VII transformed English Law – developed royal courts of justice – the Normans who made English law a national law

Chancellery emerged as a distinct court of equity

Earl of Oxford’s Case [1615]

King James ruled in favour of the Chancellery – meant that no one would challenge the chancellery again

Chancellery = court of conscience

Court applied a moral test – different from CL

Courts of equity to examine conduct and whether fair or reasonable

Decide whether moral impropriety

Discretion not relevant in Cl but relevant in equity

Equity to operate on the conscience of the owner of the legal interest, in the case of trust, the conscience of the legal owner requires him to carry out the purposes for which the property was vested in him

Difference between CL and equitable remedies:

Common Law: o Damages o Ejectment

Equity: o Compensation o SP o Injunction o Rectification o Account for profits o Declaration

Fusion?

Fusion fallacy – are common law and equity fused into a new component of law? o Murakamiv v Wiryedi – rejected the fusion fallacy approach o Modern approach – no fusion o S5(11) Judicature Act 1876 (Qld) – where conflict between law and equity, equity will prevail

Introduction to trusts:

Trusts defined in Trusts (Hague Convention) Act 1991 (Cth)

LAWS3113 Summary 6

o Article 2: “trust refers to the legal relationships create intervivos or on death – by a person, the settler when assets have been placed under the control of a trustee for the benefit of a beneficiary or for a specified purpose”

Characteristics of a trust: o Trust assets are separate funds and not part of trustee’s estate o If trustee becomes bankrupt, bankruptcy laws will not apply to trust’s assets o Trustee = legal owner of trust assets o Trustee has power to dispose of assets in accordance with terms of trust and special duties imposed on them by law

2. EQUITABLE MAXIMS

Equity will not suffer a wrong to be with a remedy

Chancellery originally intervened where no remedy at CL via injunction or

SP

Demonstrates flexible nature of the courts of equity

Warman International v Dwyer (1982) o Man worked for company and was privy to sales contract beween company and consumer o Decided to leave company and open up own business, took consumer with him o Company sued him for profits gained in breach of fiduciary relationship and exploitation of goodwill

Equity follows the law

Developed after Earl of Oxford’s Case to reconcile tensions between law and equity

Courts will recognise legal rights such as legal title

Doesn’t follow law blindly, where unconscionability – scope for intervention

Equity will not assist a volunteer

Volunteer = someone who ahs not provided consideration

Maxim not strictly applied – eg. where beneficiaries under express trust – volunteers but can still enforce rights

Generally applied where courts will not enforce gifts of property

He or she who seeks equity must do equity

Person seeking relief must be ready and willing to fulfill own legal and equitable obligations

King v Poggioli

LAWS3113 Summary 7

o Courts could not award SP or damages in equity as P was not shown to be ready and willing to perform

He or she who comes to equity must come with clean hands

P seeking equitable relief must not have engaged in improper conduct regarding the matter

However, sometimes where P has engaged in improper conduct court may be prepared to grant relief if Ps disgorge themselves from wrongful benefit

Rhodes v Badenach o Ps refunded money that they were not entitled to so remedy was provided

Equity acts in personam

Originated in days where there were two actions: state or individual

Concerns with individual

Penn v Lord Baltimore o Equity maintains ability to make orders even if outside jurisdiction

Equity look to intent rather than the form, substance and not the form

Courts of equity are not concerned with unnecessary formalities

Milroy v Lord o However, court cannot look past transactional provisions – eg. production of transfer document and share certificate

Equity looks upon that as done what ought to be done

Some cases relief will be granted on assumption that legal or equitable obligation has been completed

Walsh v Lonsdale o D entered into lease and paid consideration o Lease required to comply with terms in Property Act to be enforceable at law o D didn’t pay rent and argued no leases as didn’t comply with terms o Equity held lease regarded as being notionally executed because tenant was in possession and had paid rent

Delay defeats equity

If party delays in seeking relief court will take this into account

Equity is equality

Maxim often applied where 2 or more people have intention to share property equally and equity will provided comp to ensure that this occurs

LAWS3113 Summary 8

3. EQUITABLE INTERESTS IN PROPERTY

What is an equitable interest in property?

Equitable interests are proprietary in nature

Ability of person to exclude others from the right of that thing and transfer it at will

Yanner v Eaton o Property is a description of a legal relationship between a thing and an individual

Will not always be both equitable and legal interest in property –

Commission of Stamp Duties v Livingston

Classification of equitable interests

3 types: o Equitable proprietary interest o Mere equity o Personal equity

Equitable proprietary interest

Interest recognised by court as having equitable jurisdiction

Eg. Interest of beneficiary under fixed trust o Trustee has legal title and beneficiary has some rights to that property

Has equitable remedies open to them

Mere Equity

Equitable interest less than a equitable estate but more than a personal right of action against a person

Right to seek equitable interest to acquire proprietary interest

Not regarded by court as having property as such, requires court proceedings to establish this

Can seek relief to set aside unconscionable transaction

Mere equity capable of being transferred to 3 rd party

Latec Investments v Hotel Terrigal

Facts: o HT had mortgaged property to Latec o HT couldn’t make payments o Latex seized property and sold in sham auction o Transferred property to Southern Hotels, a subsidiary of Latec – thus selling it to themselves at gross undervalue

This was in breach of their equitable obligation o SH charged property to MLC Insurance

LAWS3113 Summary 9

o SH liquidated

Ruling: o Agued sale of land of Latec to SH was nullity o Argued action of hotel was unconscionable because of sham auction o HT were given ‘equity in redemption’ subject to MLC’s interest as an innocent party

Personal equity

Right to seek equitable relief but cannot lead to acquisition of a proprietary right

Cannot be assigned

Creation of equitable interests

Equity will recognised interest in places where law doesn’t, for example, due to lack of form, such as an equitable lease

Walsh v Lonsdale o D entered into lease and paid consideration o Lease required to comply with terms in Property Act to be enforceable at law o D didn’t pay rent and argued no leases as didn’t comply with terms o Equity held lease regarded as being notionally executed because tenant was in possession and had paid rent

Can also arise due to implication o Eg. Vendor’s equitable lien implied where purchaser has taken transfer of estate but not paid whole purchase price – vendor has equitable lien to ensure payment of deposit even if contract is terminated – Hewett v Court

Person falling under class of objects of discretionary trust has no proprietary interest in assets of trust only mere expectancy or hope –

Kennon v Spry

Beneficiaries of unadministered estates do not have equitable interests – just right to compel due administration- Livingston v Commission of Stamp

Duties

Equitable interest of purchaser

Vendor holds property on constructive trust for purchaser who has paid consideration and where contract is capable of SP – gives purchaser equitable interest

Lysaght v Edwards o “Moment valid contract of sale, vendor becomes in equity, trustee for the purchaser of the estate sold”

KLDE Pty Ltd v Commission of Stamp Duties o Contract for sale – deposit of 10% Paid o Purchaser liquidated – assets distributed to shareholders

LAWS3113 Summary 10

o Court held beneficial ownership held by vendor until full amount paid

Priority between interests

Legal interest will yield to equitable interest where legal owner created equitable interest through fraud or negligence o Northern Counties Insurance Co v Whipp

Legal owner lost priority as negligent by not securing certificate of tite which led to rogue getting loan

Legal interest will yield to equitable interest where equitable interest was created first o UNLESS, person who acquires legal interest is a ‘bona fide purchaser for the value of the land without notice’ – Pilcher v

Rawlins

Where two equitable interests, the first in time will prevail o Will examine whether holder of prior interest has done anything or failed to do anything to create the later interest

Eg. Delay – Latec Investments

Eg. Parting with transfer docs – Heid v Relance

4. ASSIGNMENTS OF PROPERTY

Definition of assignment:

Norman v FCT: o “Immediate transfer of proprietary right from assignor to assignee”

Norman v FCT

Attempt to assign interest and dividend from shares to avoid tax

Dividends were held to be expectancies – property that may or may not arise in the future

Wife (receive or interest and dividend) was volunteer – equity does not assist a volunteer

Held: dividend couldn’t be assigned – merely expectancy

Shepherd v FCT

Inventor entitled to royalties

Tried to assign “right, title and interest” in 90% of royalties over 3 years

Assignment made under deed but beneficiaries did not provide consideration – volunteers

Tax commission argued beneficiaries = volunteers and royalties = expectancy

Held: Assignment was of contractual right not royalty

LAWS3113 Summary 11

Need to look at intention of parties

Williams v Commis of Inland Revenue

Attempted assignment of first $500 income from trust fund

Held: assignment = ineffective – no guaranteed income

Legal assignment

s199 PLA o Equuscorp v Haxton held that this section did not affect equitable assignments

Elements of legal assignment:

1.

Absolute assignment o Not revocable, not condition, not operate as a charge - Equuscorp

2.

Debt or other chose in action can be assigned o Eg. interest of beneficiary under trust can be assigned

3.

Writing signed by assignor o Oral assignment does not satisfy s199PLA

4.

Notice has to be given to debtor o Giving of notice amounts to receiving – Leveraged Equities v

Goodridge

Advantages and Disadvantages of legal assignment

Advantages o No requirement to be supported by consideration

Disadvantages o Cannot assign part of debt – must be whole – s 199 PLA o Identity of assignee not kept confidential

Equitable assignment

Elements of assignment in equity

1.

Clear intention to assign

2.

Subject matter must be declared with precision and certainty

Milroy v Lord

Purported voluntary assignment of 50 shares

At law: no transfer of shares – no transfer doc

Dividends had been paid under assignment

Held: Ps = volunteers, to make voluntary assignment effective assignor must have “done everything necessary to make assignment”

LAWS3113 Summary 12

Anning v Anning

Days before he died H made deed to W and children of all property inc bank acct

Held: not effective to transfer property, could not operate as will

Corin v Patton

Memo of transfer signed but not registered

Asignee = volunteer – invalid transfer

S200 PLA – voluntary assignment

Voluntary assignment is effective and complete as soon as everything possible done by assignor

Expectancies

Cannot be subject of assignment at law

But can be subject of contract to be performed in future

Tailby v Official Receiver o Can have assignment of expectancy in equity where valuable consideration has passed

Rights assignable in equity

Part of a debt (consideration not necessary) – Shepherd v FCT

Interest of beneficiary under a trust – Controller of Stamps

Notice of equitable assignment

Do not have to give notice of equitable assignment - Thomas v NAB

Do at law – s199 PLA

Advantages and disadvantages of equitable assignment

Advantages: o Part of debt can be assigned o Writing not required, provided supported by consideration o Not subject to PLA o Assignment can be made for security

Disadvantages o Need assignor to be party to any action o Assignment can be subject to any equities which arise after assignment but before the debtor has notice of assignment

Priority between successive equitable assignments:

Dearle v Hall o Priority can be postponed if fail to give notice

LAWS3113 Summary 13

5. NATURE/CLASSIFICATION OF TRUSTS

When does a trust come into existence?

When established by settlor

Operation of law to resolve a property dispute

Recognition of proprietary rights of a person who has contributed to property

Prevent the legal owner of land from unconscionably denying the rights of holders of equitable interests in land

Definition of trust

Equitable obligation where trustee hold property on benefit for beneficiaries or for a charitable purpose

“Relationship where legal title vest in one person (trustee) and equitable title in another (beneficiary) – Hardoon v Belilos

3 parties to trust:

Settlor – creator of trust

Trustee – one who holds legal title

Beneficiary charitable purpose – equitable title holder – right to due administration but not regarded as proprietary interest – Kennon v Spry

Equitable personal obligation

Trustee has obligation to act in benefit of beneficiaries or charitable purpose

Fiduciary obligation – must be exercised in good faith

Duties normally stated in trust deed – if not can rely on statute

Classification of trusts:

Express trust

Settlor expresses intention,

Can be classified as either: o 1) Fixed or

Beneficiary is certain and has proprietary interest

Eg. “ To be held in trust for A and B in equal shares”

Also defined in statute o 2) Discretionary

Trustee has absolute discretion as to whether beneficiary will be allocated income/capital from the trust

LAWS3113 Summary 14

Resulting trust

Court implies intention

Failure to create express trust

Often where property held on trust for settlor and evident that they did not intend trustee to have beneficial ownership

Can be classified as either: o 1) Automatic resulting

Eg. A vests property in B for benefit of C and C dies, benefit goes back to A o 2) Presumed resulting

Eg. A provides B with funds to purchase property in both names but B purchases in their name, presumed B in trust for A – Calari v Green

Constructive trust

Often declared irrespective of intention of the parties

Often where decided that it would be unconscionable for person to hold property without recognising person’s beneficial interest – Dodds

Other types of trusts:

Inter vivos trust o Where settlor transfers property to someone to hold in trust for someone else o Eg. A gives $500 to B to hold on trust for C

Testamentary trust o Trust created under will

Superannuation trust o Superannuation Act 1933 (Cth)

Powers of appointment

Powers of appointment are powers vested in individuals to deal with or dispose of property that is not their own, acting on behalf of someone else

Eg. power of attorney

Difference to trusts: o Whilst trusts are imperative, powers are permissive

Classified: o General – power to appoint to anyone in the world including themselves o Special – power to appoint to 3 rd persons only o Hybrid – power to appoint to anyone bar a certain class or group

LAWS3113 Summary 15

6. THE 3 CERTAINTIES

2 ways of creating an express trust:

1.

Declaration of trust

2.

Transfer of property to trustee

Requirements for creation:

1.

3 certainties

2.

Trust is completely constituted

3.

Complies with statutory requirements

4.

No invalidating factors

3 certainties – Knight v Knight, Pascoe v Boensch

1.

Certainty of intention

2.

Certainty of subject matter

3.

Certainty of object

Certainty of intention

Bahr v Nicolay (No 2) o A had option to reacquire land at the end of the lease to B o Intervening event occurred before end of lease and B sold land to another C o C were aware of option o When A sought to exercise option, C refused o Held: A could recover property – clear intention to create trust

Re Adams and the Kensignton Vestry o T gave estate to wife “in full confidence that she will do what is right” o Court held no trust obligation o Words “in full confidence” were uncertain

Dean v Cole o Words “trusting to her that she will divide in my fair, just and equal shares between my children” - words of confidence and not obligation

Hoyes v National Heart Foundation o T left estate to daughter “on the understanding” that would give to charities o Held to be trust despite no use of the word

Barclays Bank o Company A provided Company B with money to pay dividends to shareholders o Agreement that this money would not become assets o Bank was given notice of this o Money not paid for dividends because Company B liquidated

LAWS3113 Summary 16

o Held: trust for payment of shareholders and secondary trust in favour of bank if dividends not paid

Aus Elizabethan Theatre Trust Co o Donations made to AETT with preference made to specific organisation o Held: gifts were unconditional and did not create trust – no certainty of intention – merely preferential

Re Kayford o Mail order company placed customer’s payments in trust account o On liq funds were held in trust for customers o Held: trust created – company manifested clear intent to create trust

Commissioner of Stamp Duties v Joliffe o H opened bank acct in name of wife to avoid stat provisions o Signed stat dec saying bona fide trustee for wife o Held: despite doc material, H did not intend to create trust – to avoid prohibition

Certainty of subject matter

Hunter v Moss o Trust declared for over 50 shares in company o No particular separation of shares o Held: valid trust – all of the same class

Re Golay o Made trust of ‘reasonable income/ o Held: valid gift – reasonableness implied question of fact – open to beneficiaries or could go to court to decide

Assoc Alloys o Retention of ownership clause in sale of goods – would remain with seller until payment was received o Proportion of proceeds received by buyer would be subject to trust o No req for money to be kept in separate bank acct o Held: property was ascertainable – proportion of proceeds received by buyer

7. BENEFICIARIES OF TRUSTS

Certainty of objects

Object = beneficiary or beneficial purpose

Identity must be clear

Morice v Bishop of Durham o Provided to bishop “for such objects of benevolence and liberality as he in his own discretion shall approve of” o In prev case law benevolence = charitable

LAWS3113 Summary 17

o Held: Court could not exercise control, therefore the objects we’re certain, lack of enforceability inhibits judicial control

Mere fact that do no know who beneficiaries are is no longer essential to trust

Sufficient that provisions of the trust ensure that upon date of distribution the beneficiaries can be ascertained with certainty

Trust power

Donee is required to exercise power by choosing which object from a class of beneficiaries should be benefitted

If Donee fails to exercise, court may do so

Beneficiaries do not have any right to property until power is exercised, but have right ot due admin of trust

Mere power

Donee does not have obligation to exercise power in favour of a member of the class

Presence of people who will take it if the discretion is not exercised in favour of the class members

If done fails to exercise, beneficial estate vests in settlor by way of resulting trust

How does court work out whether mere or trust power?

If language is imperative – likely to be held as trust power

If discretionary – like to be mere power

BUT language not always decisive

Court looks at doc as whol

Gift over clause – often indicates mere power

Discretionary trusts

Within discretionary trusts there are distinctions depending whether trust or mere power o Trust power – given to trustee who is obliged to exercise discretion o Mere power – trustee can choose whether or not to exercise discretion, if not exercised most often will take effect in ‘gft over clause’

Re Gulbrenkian o Settlor established trust for son or any person whose house his son was residing o Regarded as mere power, although had to be exercised as result of fiduciary obligation o “Mere power is valid if can say with certainty whether or not any given individual is a member of the class but do not have to ascertain every member of the class”

LAWS3113 Summary 18

o Held: not necessary for court to determine every member of class but just whether individual a member or not

McPhail v Doulton o Settlor wanted to establish trust for employees of company and their relative dependents o Was to be in amounts as trustee saw fit o Court held did not require full list of names for this to be possible and did not need to be equal

Purpose Trusts

Trusts for non-charitable purpose is not valid because no one has standing to enforce it,

However, exceptions: o Trusts for upkeep of specific animals

Re Dean o Trusts for erection of graves/monuments

Valid if kept within perpetuity period

Examples of invalidity:

Pooley o Trust for erection of monument dedicated to child in cemetery

Re Boning o Protecting property for 20yr after death o Trusts for purposes of unincorporated non-charitable associations o Miscellaneous cases

Gifts to unincorporated organisations

Unincorporated org is one where 2 or more persons bound for common purpose which generally has rules over its control

Not a separate legal entity and cannot hold property or be subject to legal rights

Eg. Club or society

Property cannot be left to unicorporated org

BUT can give gift if: o 1) Gift to indiv members o 2) Gift to members subject to the rules of the assoc o 3) Gift for continuing purposes of the assoc

Leahy v A-G (NSW)

Testator provided by will that property be held on trust for “nuns of

Catholic church or Christian brothers as executors and trustees shall elect” and residue of estate to build new convent or alter existing buildings

Held: gift was to selected order and not to members of order itself – held to be a trust – members spread all over world – not immediate beneficial gift

LAWS3113 Summary 19

Property was gift – could not be said to benefit all members

Bacon v Piantai

Gift to communist party not valid

“To communist party for sole use and benefit”

Could it be construed as gift to members? o “Gift to unicorp org prima facie construed as gift to member BUT if disposition amounts to a trust for benefit of both present and future or not for indiv but for some purpose gift will not be regarded as charitable”

Factors to look at: o Form of gift o Number/disposition of members o Subject matter of gift o Capacity for member to put end to assoc and distribute assets

Held: to be bequest to present and future members for purposes of party

– not construed as gift to indiv

Political purpose was not valid charitable purpose

S33Q Succession Act

Can save gift to unicorp org by classifying it as an augumentation of the funds of org

8. CHARITABLE TRUSTS

Nature of a charitable trust

Express trust created for charitable purpose

Eg. A transfers $1million to Uni of Bris to be used to create new scholarship

Differences with express private trust

Must be certainty of intention and subject matter

No need to stipulate which beneficiaries will benefit – just valid charitable purpose

Absence of named beneficiaries does not mean it will not be enforced – A-

G will enforce the trust

Relevance of characterization as charitable trust?

Tax concessions

Not subject to rule against perpetuities – could in theory last forever

LAWS3113 Summary 20

Test for being charitable:

For trust to be regarded as charitable it must come within ‘spirit and intent’ of Statute of Charitable Uses 1601 o Relief of aged, impotent and poor people o Maintenance of sick and maimed soldiers and mariners o Schools of learning, free schools and scholars in unis o Repair of bridges, ports, havens, causeways – public infrastructure o Education and preferment of orphans o Maintenacne of house of correction o Marriages of poor maids

Income Tax Commissioner v Pemsel

Redefined def. of charity: o 1) Trusts for relief of poverty o 2) Trusts for advancement of education o 3) Trusts for advancement of religion o 4) Other purpose beneficial to the community

Central Bayside GP Assoc

Non-profit company whose object was to improve health of community

Officers were largely funded by Cth

Lower courts held if link with gov could not be charity

HC rejected this saying that its key aim was improving care = charitable

AidWatch v Commis for Tax

Promotes advantageous relief of foreign aid

Engages in advocacy as to how funds should be allocated

FC said purpose was political – influence to change policy

Relief of poverty

Does not require destitution

Downing v Fed Commis for Tax o Trust for amelioration of condition of families of ex-servicemen = trust for relief of poverty

Re Gwyon o Reverend to provide clothing for boys in community not supported by charities o Held to be invalid as non indication that need was a feature

“Aged”

Hilder o House and land gifted to be used for nurses or elderly women

LAWS3113 Summary 21

o Held: accepted as valid trust, no need for extra element of poverty, need or adversity etc.

“Sickness”

Resch’s Will Trusts o Left residue of estate to hospital o Fact hospital charges fees did not deprive it of a charitable nature

– valid gift

“Education”

Not just confied to schools

Promotion of the arts = charitable o Perpetual Trustee v Gorth – gift of Archibald Prize o Re Municipal Orchestra – gift to orchestra – public benefit

Re Hopkins Will Trusts o Society behind working out where Shakespeares works came from o Held: pure research will be for education as long as published

Advancement of religion

Church of the New Faith v Commissioner of Pay-roll Tax o Religion requires:

1) Belief in supernatural being, thing or principle and

2) Acceptance of canons of conduct in order to give effect to that belief

Roman Catholic Archbishop of Melbourne v Lawlor o Trust must actually advance religion o Gift to Catholic daily newspaper was not confined to teaching catholic doctrine

Dunne v Byrne o Bequest to RC Archbishop of Brisbane o Possible for funds to be used for more than just the advancement of religion

Private religious ceremonies can be charitable – Crowther v Brophy

Public Benefit

Charitable trust must be for public benefit, presumed in some cases for relief of poverty, advancement of religion and education

Jensen & Ors v BCC o Religious fellowship – Brethren o Exclusivity of Brethren meant it was public worship/benefit

Re Comption o Trust to provide for education of children of 3 families o Not public benefit – only a small section of public

Oppenheim v Tobacco Industries o Trust provided for education of children of employees

LAWS3113 Summary 22

o > 11 000 employees o Not regarded as section of the public – beneficiaries must not be numerically determinable

Dingle v Turner o Trust for poor employees held to be charitable purpose

Other benevolent purposes

Incorporated Council of Law Reporting o Production of law reports = benefit to whole community

Bathurst CC o Public infrastructure = public benefit

Mixed charitable and non-charitable purposes

Trust for both charitable and non-charitable purposes used to be held to be non-charitable

If uses word charity courts will construe as charitable unless there is a contrary indication

Chicester Diocesan Fund v Simpson o Trust for ‘charitable or benevolent circumstances’ was not held to be a charitable purpose

Congregational Union v Thistlewaite o Trust for religious group which had objects of “the preservation of civil and religious liberty” and “maintenance of philanthropic agencies” o Objects were non-charitable but were construes as ancillary to religious objects of the union

Trusts Act 1973 s104 o Trust not invalid merely because its terms extend to both charitable and non-charitable purpose o Trust shall be construed as if no application of the trust property for a non-charitable purpose should be allowed

Roman Catholic Archbishop of Melbourne v Lawlor o Leg cannot be applied where charitable and non-charitable purpose cannot be separated

Failure of charitable purpose

If impossible or impractical to carry out charitable purpose trust may be saved under cy-pres doctrine

Doctrine is inherent chancellery doctrine now based on s105 Trusts Act

Re Anzac Cottage Trust o Purpose was to provide housing for homeless widows and dependents who died in WWI o Dominant purpose of trust was fulfilled – no longer able to advance purpose o Court held property could now be applied cy-pres

LAWS3113 Summary 23

o No indispensible requirement that money be used to provide for funds of the dependends of WWI o General charitable intention which can be fulfilled by providing for dependents of more recent conflicts

Is it impossible or impractical direction? Is it an indispensible part of the trust? o If yes then Cy pres can be applied

AG v Perpetual Trustee Co o T left farm to train ‘orphan lads’ o Farm was impractical for purpose o However use of farm was not ‘indispensible part of trust’

Re Lysaght o Money left to Royal College of Surgeons o Had discriminatory provision o College disclaimed gift rather than give effect to discrimination

Phillips v Roberts o Left property to improve biblical knowledge by establishing a new church o Held to be impractical to establish new church o Yet still expressed charitable intention o Applied in another way

Regulatory developments

Established ACNC – Australian Charities and Not for profit Commission

Charities use it for access to Cth tax concessions

This year draft was release a draft of leg to provide a statutory definition of charity

9. FORMALITIES IN THE CREATION OF TRUSTS

Requirement of form

Generally speaking, trust can be created in any form: o Deed o Will o Simple writing o Parol/word of mouth – Kennon v Spry

Requirement of statute

Rule has been modified by statute in relation to: o Trusts of land – PLA s11(1)(b)

Has to be in writing and signed o Assignments or dispositions of existing equitable interests – PLA s11(1)(c)

Signature and writing

LAWS3113 Summary 24

o Testamentary trusts – Succession Act 1981

Will must be in writing and signed by testator and executed in accordance with act

Exemptions from writing requirement

PLA s11(2) o Resulting trusts o Implied trusts o Constructive trusts

All trusts imposed by court and not express trusts

Resulting trusts

Implied by the courts

Resulting trusts classified as either: o Automatic resulting trusts o Presumed resulting trusts

Automatic resulting trusts

Where settlor has failed to dispose of beneficial interest

Pugh’s Will Trusts o P appointed solicitor as trustee and executor – not to take beneficial interest o Property left to trustee to dispose of at discretion o Held not to be trust – no instructions as to residuary estate o Failure of certainty of objects o Residual estate was held on resulting trusts for next of kin of testator

Re Trustess of Abbott Fund o Automatic resulting trusts are sometimes imposed hwere surplus assets in fund and where trustee has more than sufficient assets to satisfy express trust

Gillingham Bus Disaster Fund o Donations for memorial fund o Smaller donations made by unknown persons o Held: surplus was donors if could be identified as had given for particular purpose

Re West Sussex Constabulary Widows o Fund to be wound up o Rules said members couldn’t benefit, only widows o Money was held should go to donors

Presumed resulting trusts

Property purchased in ‘name of another’ – Calverley v Green o Equity adopts policy that if provided consideration prima facie you will be entitled to it

LAWS3113 Summary 25

o Often depends on intention of purchaser o Held: if no discernible intention then resulting trust in favour of purchaser o Man and woman lived together – man making payments – no presumption of advancement for de facto

This has since been changed by leg

Napier v Public trustee o Man purchased in name of de facto wife who died and left house to

3 rd party o Held: when property transferred in name of someone else without consideration there is presumption transferee will hold property on trust for transferor

Can be rebutted where ev idence of advancement – ie H puts in name of W

Rebuttal of presumption of resulting trust

Russell v Scott o Joint account between lady and nephew o Court had evidence of lady saying that on her death money would go to nephew o Prima Facie as lady had provided money should go to her estate o But evidence suggested nephew had interest

Re Bulankoff o Where gift made from parent to child – presumed to method of intended advancement

Nelson v Nelson o Woman obtained financial benefit from gov and made false declaration o Put house in name of children to get benefit o Aus recognised mother’s equitable interest and awarded relief on the basis that she must repay interest on loan

Trusts of land

PLA s11(1)(b) o 1) Declaration of trust – where one declares ptoperty will be held for someone else – Kenneth v Spry o 2) Land o 3) Proved by writing o 4) Who is entitled to that land

Disposition of equitable interest

PLA s11(1)(c) o 1) Disposition – defined in Sch 6

Note: dif definition to Succession Act o 2) Equitable interest o 3) Subsisting at time of disposition

LAWS3113 Summary 26

Application of s11(1)

Will apply where a beneficiary under trust assigns or transfers his/her interest in trust o ‘Disposition’ for purposes of s11

Qld requirement: needs to be proved by some writing and signed by person disposing of interest

Gray v IRC o Oral direction to trustees to hold on trusts for another was an attempted disposition and was void

Applies to both land and personalty

Vandervell v IRC o Transfer by bare trustee of entire legal and equitable estate to third party at direction of beneficial owner o Held: equitable interest had been transferred and leg didn’t apply as both legal and equitable estate had been transferred to 3 rd party

Equity will not permit a statute to be used as an instrument of fraud

Equitable intervention: o Doctine of part performance o Rochefoucald v Boustead o Doctrine of secret trusts

Part performance o Prevents fraud though admission of fabricated oral evidence

Rochefoucald v Boustead o Equity considers it to be a fraud on the part of the person to whom the land is conveyed as trustee to deny the trust o Beneficiary of oral declaration of trust may enforce the trust not withstanding the lack of written evidence

Common intention trust

As requirement of writing has been excluded from creation of constructive trusts, many former co-habitees have relied on constructive trust

Gissing v Gissing o No written declaration/agreement or direct provision by P of purchase price o Must establish common intent between parties and could give rise to beneficial ownership

No requirement that common intent should be limited to time when property was first acquired

Difficulties of advising on extent of beneficial interest in common intention trust

LAWS3113 Summary 27

10. TESTAMENTARY TRUSTS

Formal requirements:

Manner of execution of will – Succession Act s10 o Must be in wiritng and signed by testator o Must be witnessed – 2 or more at same time

S10(4) – changed law – witnesses do not have to be present at same time or know they are witnessing a will o (6) signatories can be on any part of will o s10 – must have intention of executing will o s10(9) - needs attestation clause – records how will was done o Testator must have signed doc with intent to make “last will and testament”

Hensler v Padget

Decided after amendments to the Succession Act in 2006

S18 confers power on court to dispense with execution requirements for will, alteration of revocation

Court will strive to save will if possible

If satisfied shows testamentary intention, courts will try save will even if other requirements are not met

Re Garris

Recognised s18 allows court to sanction making of will where some requirements haven’t been carried out - will admit evidence, even hearsay

(4) court not limited to what factors to take into account

(3) statements made by testator are admissible in court

If testamentary intention is clear then doc should act as will despite any lack of formalities

Revocation of will

Can be revoked by: o Another will revoking it o S14 – Marriage o S15 – Divorce

Property that can be disposed of by will

s8 – Property to which a person is entitled at time of death

Matrimonial home and superannuation may be governed by separate contract

LAWS3113 Summary 28

Nature of testamentary disposition

s5 – will includes codicil and other testamentary disposition – inc. gift, devise or bequest by will and creation or exercise of will by power of appointment

Nominations under super or pension schemes – Baird v Baird o Nominations are not testamentary dispositions as the interest of a member in the fund was not assignable o Don’t have to be executed in same manner as will

Need for testamentary capacity

Banks v Goodfellow o Test laid down – testator must understand the nature of act and it effects

Timbury v Coffee o Before will can be upheld must show testator had ‘sufficient mental capcity’ to understand nature of what doing and effects o Testator was drunk when made will – did not have testamentary capcity

Hensler v Paget o Had testamentary capacity but then was diagnosed with dementia o Was drafted with aid of solicitor o Held: valid testament

Minors

Minors can execute will if: o Married o Will in contemplation of marriage o Authorised by court order

Testamentary trust

Established under will

Takes effect of death of testator

Re Graham o “Give and bequeath… to my trustees upon trusts…” o Classic example of trust

Delegation of testamentary power

General presumption against delegation of testamentary power

Tatham v Huxtable o Person may not delegate testamentary power and is necessary, except in case of charitable trusts, for objects to be benefitted to be ascertainable o Will and power of executor to distribute estate to others not provided in will but who trustee thinks deserves benefit o Void due to uncertainty as class of beneficiary not defined

LAWS3113 Summary 29

Gregory v Hudson o Trustee had discretion to administer funds to world at large inc himself o Class of beneficiary not defined at all

S33r Succession Act o Power of trust, created by will to dispose of poerty is not void on ground that it is delegation of testator’s power to make will, if same power of trust would be valid if made by testator in lifetime

Secret Trusts

2 types: o Fully secret trust – eg. “I leave 50k” o Half secret trust – eg. “I leave 50 k on trusts which I have already told”

Elements of secret trusts

3 key elements: o Intention o Communication o Acceptance

Blackwell v Blackwell

Widow discovered after H’s death he had another child out of wedlock

Legatee bound to give effect to trust communicated to legatee and accepted by legatee

Voges v Monohan

Court enforced trust where evidence legatee was provided with money

Testator had 2 claims on etstae – servant and niece by marriage

Left whole estate to servant

Maj said trust was present

Voges was to provide for niece

Mutual trusts

Binding on both parties, provides reciprocal benefits

Prevents 3 rd party taking benefical interest

Bigg v Qld Trustees o H and W agreed to leave assets to each other and then equally to children from former marriages o H made investments in W’s name in accordance with agreement o W made will leaving assets to own children o Court held evidence of oral agreement and equity provided remedy

LAWS3113 Summary 30

11. INVALIDATING FACTORS

3 types of invalidating factors:

1.

Rule against perpetuities

2.

Public Policy

3.

Illegal purposes

Policy behind rule against perpetuities

Performs useful social function in limiting the power of members of generations past from tying up property in such a form as to prevent its being freely disposed of in the present or future

Re Clark o Necessary to prevent tying up property forever

Rule against perpetuities

Air Jamaica v Charlton o “No interest is valid unless it must vest with a certain period of time – the date of the gift plus 21 years”

Rule has been modified by courts over time

Progressive evolution of rule

Duke of Norfolk’s case o Property has to vest within a life in being

Stephens v Stephens o Extended to include length of time that child was under gestation

Cadell v Palmer o Extended to be within 21 years of life in being

Rule is concerned with the vesting of property

Gift must vest within perpetuity period

When interest to vest several matters must be known: o 1) Who is person entitled to interest o 2) Interest must be ready to take effect upon possession upon any prior interest o 3) Gift mustn’t be subject to contingents

Future gifts

Rule against perpetuities has general application to future gifts

Doesn’t apply where immediately given gift, only where someone is given it in future o Eg. Successive generations enjoying same property

LAWS3113 Summary 31

Exception to rule against perpetuities

Mt Gravatt Showgrounds Act 1988 s24 o Rule against perpetuities has been excluded – any gift to showgrounds can continue indefinitely

Gift from one charity to another – s219(2) PLA

Options contained in leases – sometimes leases will contain option to purchase property subject of lease – if option exercisable within one year following determination it is protected by s219(2) PLA

Options for renewal or right of preemption contained in will – s218 PLA

Exercise of trustee power – s220A(1)(a)-(c) PLA

Superannuation trusts – s220(1)(d)

Perpetuity period

Maximum period for which the vesting can be postponed o A) Period of life in being + 21 years o B) 21 years where there is no life in being o C) Period not exceeding 80 years which is specified in the instrument – PLA s209

When does perpetuity period commence? o As soon as disposition takes effect

A) Instrument inter vivos – immediately

B) Will – at death

C) Deed – when signed, sealed and delivered (may be exception)

Lives in being

a) Measuring life must be human

b) Person must be living at date when interest is created

c) If group of persons is used that group cannot be capable of increase – s210(5) PLA

d) Group must be ascertainable

Re v Clarke

Testator dies, one of provisions is trust for children of sons who attain the age of 25

Perpetuity period was 21 years after death of last life in being – which was children

If child did not obtain age of 25 in that 21 years they would be outside that vesting period

Thus, gift to grandchildren was held to be void

The rule in Andres v Partington

If, at the time the disposition takes effect, A has at least one grandchild who has attained the age of 21years, the class of beneficiaries is deemed to only include those already

LAWS3113 Summary 32

Disposition to class

s210(5) – In case of disposition to class, any person living at the date of disposition whose life is so expressed to be relevant for any member of the class may be reckoned as a life in being

Widower

Settlor provides that A has life in an estate, then to the widower of A for his life, and then for the children of A then living

PLA s214 deems the widower the life in being

Rule is concerned with possibilities and not probabilities

If possibility that gift may vest outside perpetuity period then gift is void gift – Air Jamaica

Re Dawson o Testator gave property to trustees to hold on trust for daughter for life with remainder to children that attain age of 21 o Gift was held void despite daughter > 60 and all children > 21 o Possibility that daughter could have more children who would be

21 outside perpetuity period o Assumption that males and females could reproduce at anytime

Presumption as to future parenthood – PLA s212

It is presumed that: o Male > 12 can have child o Woman > 12 can have child o Woman > 55 cannot have child o However, these presumptions may be rebutted with evidence to the contrary

Other reforms – s212 PLA

s212(1)(b) – in case of living person evidence may be shown not capable of having child – eg. vasectomy, STI

s212(2) – court may make order as it sees fit

s212(4) – with exception of s212(1)(b) extends age presumptions to case of having child by adoption, legitimation or other means

“Wait and See”

At CL validity of gift is assessed at start of perpetuity period

S210 PLA allows court to wait and see whether interest will vest outside perpetuity period

Parties may compromise on appropriate distribution of property if don’t want to wait

LAWS3113 Summary 33

Enables court to look at what actually occurs before expiration of perp period to see if there has been vesting – Nemesis Australia

Example of ‘wait and see’ v CL

“Inter vivos to my trstees on trust for first child of A to attain 21” A = 51, has 2 children. One grandchild aged 3 o Common law:

A’s children not lives in being because A may have more children

Child of A may have child after A’s death, which becomes first to reach 21

Disposition is void o ‘Wait and see’

Disposition not struck down immediately

If living grandchild survives to 21 (in 18yrs) vesting will have occurred within life of A or within 21 years of A’s death

Disposition will only be void if at end of perpetuity period the oldest living grandchild has not attained 21

Age reduction

Applies where disposition is limited by reference to person attaining age exceeding 18 years

Disposition void as stands byt would not have been had the age between

18 years

Aged reduced as far as necessary to save disposition (but no futher than

18 years) – s213 PLA

Class gifts

At CL for a gift to be valid, every member of the class must have satisfied the necessary requirements within the perpetuity period

Exclusion of class members: PLA s213(3)

Exclusion of some class members is now permitted to save the validity of an interest

Common law 4 step process:

1.

Does the rule apply to the interest?

2.

What is the date when an interest is created?

3.

Who are the lives in being?

4.

Can vesting occur outside the perpetuity period?

Can statutory modification save the gift?

1.

Power to specify perpetuity period – s212

2.

Presumptions and evidence of future parenthood – s212

LAWS3113 Summary 34

3.

Unborn husband and wife – s214

4.

Wait and See – s210

5.

Reduction of age - s213

6.

Exclusion of class members – s213(3)

These reforms take place after 1 April 1974

Rule against perpetual trusts

Trust will be void where, under terms of trust, capital will be kept in tact so that the income can be used for indefinite period

Public policy

Trusts which are contrary to public policy will not be enforced by the court

Trusts which undermine the sanctity of marriage will not be enforced

Ellaway v Lawson o Trust was made only if person divorced husband o Was allowed to stand as “no obligation” and “changing standards of society”

Attitude of courts as to public policy largely formed by reference to legislation – eg. Anti-Discrimination Act etc

Thus authority on such matters as cohabitation agreements and trusts for ex-nuptial children will no longer be authoritative

Illegality

Trusts may be unenforceable on the basis that enforcing the trust would assist party in carrying out illegal purpose

Nelson v Nelson o Defence service home loan o Mother put house in name of children to take advantage of benefit that she was not entitled to o Demonstrates that you can plead existence of a resulting trust even if must confess to illegal act

Robins v Robins o First homebuyers grant and stamp duty

Timsley v Milligan o Joint party purchased in P’s name so D could receive social security payments o Held: illegality did not defeat D’s claim of resulting trust

The situation in which trusts will not be effective to avoid creditors or to reduce or avoid tax liability is now largely governed by statute

LAWS3113 Summary 35

-

12. VARIATION AND TERMINATION OF TRUSTS

Inherent power of court

Originated with court of Chancellery – inherited by Sup Ct Qld – has equity jurisdiction

Chapman v Chapman o Recognised inherent jurisdiction to allow trustees to act in manner not authorised by the trust instrument o As matter of emergency, trustee would be allowed to do something not expressly allowed by trust instrument o For example:

Giving trustee powers to repair roof

May be inbenefit to allow breach where trustee had not provided for education advancement of beneficiary

Seettlor may have not anticipated situation which may arise in future which may need to give power to trustee to do something not authorised in deed

Re Duke of Norfolk’s Settlement Trusts o Wider jurisdiction re: administration of trust o Concerned provision of remuneration of trustee o Ordinary having trust is obligation and does not normally involve remuneration o Trustee need remuneration for administering trust as would reconsider position if not o Court gave power to trustees to claim remuneration under estate under inherent jurisdiction

Express power to vary trusts

s95 Trusts Act o Introduced following Chapman v Chapman o Leg intervened to allow court to grant authorization to vary trusts in certain cases o Section usually operates where beneficiaries are unable to give consent

Often concerning infants or children yet unborn where steps are being taken which may prejudice their interest

S94 – expediency provision which allows discretion in varying trust

Provision in trust deed o May allow trustee to amend deed

1) Often to allow for addition/deletion of beneficiaries

2) Often amended due to taxation law changes

3) Often necessary for powers of administration

Australian approach less restrictive than English approach

LAWS3113 Summary 36

o Re Ball’s Settlement Trusts (ENG) – courts regard any major change as not being within the intention of settlor or trust o Kearns v Hill (AUS) – variation clause given natural meaning

Graham Australia v Perpetual Trustees WA o Deed enabled unit holders to redeem units by giving notification to trustee who would have to pay them value of units as listed on exchange market o Unit holder allowed to redeem unit at price which prevailed 7 days before redemption form was lodged o Stockmarket crash led to many seeking redemption o Trustees refused to deal with these applications until meeting with all unit holders o This was fair because those that acted quicker than others would receive better benefit o Varied trust to mean that units would be redeemed at current rate o Court upheld this o Imposed 2 tier test:

1) Must be made in good faith

2) Made to benefit unit holders as a whole

Variation of superannuation trusts

Cases where injunctions have been sought against super trustees from exercising power of amendment

Surplus funds often sent back to employer who originally contributed them

Wilson v MGM o MGM restructuring business and winding up pension fund o Trust contained clause allowing trustee and owner of company to alter/amend deed but could not be prejudiced and had to be to benefit of members o Did not confer absolute discretion to deal with surplus funds o Amendment to trust deed to return surplus funds to company was contrary to what was intended o Fiduciary obligations – company had one to prevent using power of amendment to benefit itself

Lock v Westpac Banking Group o Questionable authority… o Defined benefit fund conferred right on members to get payment of percentage of final salary as pension o Rules specified amount of benefit, how paid, what contributitions had to be paid by member and bank o Board of bank had power to amend deed with consent of trustees – had to have consent of 75% of members o Court said courts take different approach to super and pension funds as do to ordinary trusts o Rejected submission that in defined benefits scheme that once benefits were provided company was precluded by fiduciary obligations from acting in own interest

LAWS3113 Summary 37

o Company must act in good faith but no fiduciary obligation o Trustees had not acted in breach of duty by consenting to amendment – entitled to consider whether amendment was in interest of members and bank as a whole

Family law

FLA 1975 s90AC – can make order which overrides terms of trust deed

Termination of trusts

Trust can be terminated by all beneficiaries acting together and giving direction to the trustee o Saunders v Vautier

When > 1 beneficiary can all combine to terminate trust provided that they are all entitled and unanimous

Trust can be terminated by distribution o Hawkesley v May

2 beneficiaries entitled to joint fund at 21

Trustees didn’t advise first beneficiary to come of age of their rights under the fund and sever joint tenancy

Trustees accumulated income from that share even after other beneficiary came of age

Trustees bound to pay income of that share to which eldest was entitled

Case for fixed trust – not the same for discretionary trust

In case of complete distribution trust wil be brought to end when no more property, but when partial distribution will continue

13. COMPLETE CONSTITUTION OF TRUSTS

Legal transfer of trust property

Distinction where: o Declaration of trust of property by settlor and o Inter vivos transfer

Necessity to completely constitute trust

Once trust is completely constituted court of equity will recognise the beneficial interest of the beneficiaries

Milroy v Lord o For trust to be effective settlor must have “done everything… which was necessary to be done in order to transfer the property and render the settlement binding”

For Inter vivos – settlor must lose all interest in property

LAWS3113 Summary 38

For declaration – settlor will retain legal title but beneficial interest will vest in beneficiaries o Facts:

A purported to assign 50 shares to Lord to be held on trust for Ps

Certain procedures needed to be carried out

No transfer ever made, lord never registered as owner

Dividends were paid to lord and passed onto Ps

After A’s death held no trust as property hadn’t actually been transferred to Lord

S200 PLA – for transfer to be effective in equity donor must have done everything necessary

Enforceability of incompletely constituted trusts

Where trust is not completely constituted, a beneficiary faces difficulties in obtaining relief