1 - Deloitte

advertisement

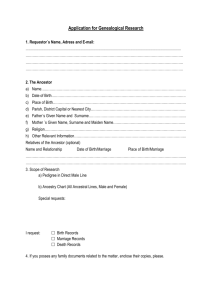

Instructions: This document and disclosures provided in it contain general information only and the application of this template in specific cases will depend on specific circumstances. Deloitte does not provide accounting, investment, legal, tax or other professional advice or services through this document. Deloitte accepts no responsibility for any losses sustained by any person as a result of placing reliance on the information presented in this document; This version is minimal and may need to be expanded by other relevant disclosures as and when required; This notes template includes only the most frequent types of information relevant for ordinary business entities. However, this template does not contain some of the less frequent types of information which are explicitly required by the Regulation. Please use the relevant checklist to review note disclosures for completeness; If the relevant disclosure section is not relevant for the Company, no comments need to be provided on this matter (eg, the Company has no pledged assets) and the relevant section can be deleted; Text in bold + italics represents instructions; Slashes represent multiple options; Dots in the text represent space for filling in information; Most of the tables are linked to financial statements, ie it is necessary to check whether data from the table agrees with the financial statements; It is necessary to modify the standard wording for a limited liability company, because the notes have been prepared primarily in respect of joint stock companies; If a table can be replaced with a note disclosure of the same informative value and the note disclosure is shorter, please delete the table and use the note disclosure; Comment on all material and non-recurring items; Remember to indicate the Company’s name in the footer and to update the table of contents; and If the Company used the profit and loss account structured by the function of expense/income method (‘ucelove cleneni’), then the notes always need to include the profit and loss account structured by the nature of expense/income method (‘druhove cleneni’). NOTES TO THE FINANCIAL STATEMENTS for the Year Ended 31 December 2015 Name of the Company: Registered Office: …………………………………. …………………………………. (State the place of business if it is different from the Company’s registered office.) Legal Status: ..................................................... Corporate ID: …………………......................... Notes to the Financial Statements for the Year Ended 31 December 2015 TABLE OF CONTENTS 1. GENERAL INFORMATION ........................................................................................................... 3 1.1. 1.2. 1.3. 1.4. 1.5. 2. INCORPORATION AND DESCRIPTION OF THE BUSINESS ......................................................................... 3 YEAR-ON-YEAR CHANGES AND AMENDMENTS TO THE REGISTER OF COMPANIES ............................... 3 ORGANISATIONAL STRUCTURE ............................................................................................................. 3 BOARD OF DIRECTORS AND SUPERVISORY BOARD AT THE BALANCE SHEET DATE.............................. 3 GROUP IDENTIFICATION........................................................................................................................ 3 ACCOUNTING PRINCIPLES AND POLICIES ........................................................................... 5 2.1. 2.2. 2.3. 2.4. 2.5. 2.6. 2.7. 2.8. 2.9. 2.10. 2.11. 2.12. 2.13. 2.14. 2.15. 3. TANGIBLE AND INTANGIBLE FIXED ASSETS .......................................................................................... 5 FINANCIAL ASSETS ............................................................................................................................... 5 DERIVATIVES ........................................................................................................................................ 6 INVENTORY........................................................................................................................................... 6 RECEIVABLES ....................................................................................................................................... 6 PAYABLES............................................................................................................................................. 6 LOANS .................................................................................................................................................. 7 RESERVES ............................................................................................................................................. 7 FOREIGN CURRENCY TRANSLATION ..................................................................................................... 7 FINANCE LEASES .................................................................................................................................. 7 BORROWING COSTS .............................................................................................................................. 7 REVENUE RECOGNITION ....................................................................................................................... 7 USE OF ESTIMATES ............................................................................................................................... 7 YEAR-ON-YEAR CHANGES IN ACCOUNTING POLICIES .......................................................................... 8 CASH FLOW STATEMENT ...................................................................................................................... 8 ADDITIONAL INFORMATION ..................................................................................................... 9 3.1. 3.2. 3.3. 3.4. 3.5. 3.6. 3.7. 3.8. 3.9. 3.10. 3.11. 3.12. 3.13. 3.14. 3.15. 3.16. 3.17. 3.18. 3.19. 3.20. 3.21. 3.22. 3.23. 3.24. 3.25. 3.26. 3.27. INTANGIBLE FIXED ASSETS (INTANGIBLE FA) ...................................................................................... 9 TANGIBLE FIXED ASSETS (TANGIBLE FA) ............................................................................................ 9 NON-CURRENT FINANCIAL ASSETS .................................................................................................... 10 INVENTORY......................................................................................................................................... 10 LONG-TERM RECEIVABLES ................................................................................................................. 10 SHORT-TERM RECEIVABLES ............................................................................................................... 10 CURRENT FINANCIAL ASSETS ............................................................................................................. 11 DEFERRED EXPENSES AND ACCRUED INCOME.................................................................................... 11 EQUITY ............................................................................................................................................... 11 RESERVES ........................................................................................................................................... 11 LONG-TERM PAYABLES ...................................................................................................................... 12 SHORT-TERM PAYABLES .................................................................................................................... 12 BANK LOANS ...................................................................................................................................... 12 ACCRUED EXPENSES AND DEFERRED INCOME.................................................................................... 12 DERIVATIVE FINANCIAL INSTRUMENTS .............................................................................................. 12 DEFERRED INCOME TAX ..................................................................................................................... 13 DUE AMOUNTS ARISING FROM SOCIAL SECURITY AND HEALTH INSURANCE CONTRIBUTIONS AND TAX ARREARS .................................................................................................................................... 13 INCOME FROM ORDINARY ACTIVITIES ................................................................................................ 14 EMPLOYEES, MANAGEMENT AND STATUTORY BODIES ...................................................................... 14 OTHER OPERATING INCOME AND EXPENSES....................................................................................... 15 FINANCIAL INCOME AND EXPENSES.................................................................................................... 15 EXTRAORDINARY INCOME AND EXPENSES ......................................................................................... 15 RELATED PARTY TRANSACTIONS ....................................................................................................... 15 TOTAL FEE TO THE STATUTORY AUDITOR/AUDIT COMPANY ............................................................. 16 AGGREGATE RESEARCH AND DEVELOPMENT COSTS .......................................................................... 17 OFF BALANCE SHEET COMMITMENTS ................................................................................................ 17 POST BALANCE SHEET EVENTS .......................................................................................................... 17 Name of the Company pursuant to the Register of Companies 2 Notes to the Financial Statements for the Year Ended 31 December 2015 1. GENERAL INFORMATION 1.1. Incorporation and Description of the Business (Name of the company as indicated in the details held at the Register of Companies) (hereinafter the “Company”) was formed by a Deed of Association/Memorandum of Association/Founder’s Deed as a joint stock company/limited liability company on ................ and was incorporated following its registration in the Register of Companies held by the Court in ................. on ............... The principal activities of the Company include (Provide a list of principal activities.). The following table shows individuals and legal entities with an equity interest greater than 20 percent and the amount of their equity interest: Shareholder/owner Ownership percentage Other Total 100 % (Also give details, if any, about agreements put in place between the shareholders/owners that establish voting rights regardless of the share of the Company’s share capital - this relates to a shareholding in companies equal to or in excess of 20 percent.) 1.2. Year-on-Year Changes and Amendments to the Register of Companies (Describe changes and amendments to the Register of Companies.) 1.3. Organisational Structure (Describe the organisational structure and any significant changes in the structure made during the previous reporting period, and include a diagram thereof if available.) 1.4. Board of Directors and Supervisory Board at the Balance Sheet Date Board of Directors Supervisory Board Position Chairman Vice-Chairman Member Name Chairman Vice-Chairman Member 1.5. Group Identification (If the Company is included in a group, please provide detailed information about the Group). Name of the Company pursuant to the Register of Companies 3 Notes to the Financial Statements for the Year Ended 31 December 2015 (If the Company applies the exemption from the obligation to present consolidated financial statements, it shall disclose the business name and registered office of the consolidating entity or consolidating foreign entity that has presented the consolidated financial statements and information about the application of the exemption). Name of the Company pursuant to the Register of Companies 4 Notes to the Financial Statements for the Year Ended 31 December 2015 2. ACCOUNTING PRINCIPLES AND POLICIES The Company’s accounting books and records are maintained and the financial statements were prepared in accordance with Accounting Act 563/1991 Coll., as amended; Regulation 500/2002 Coll., which provides implementation guidance on certain provisions of the Accounting Act for reporting entities that are businesses maintaining double-entry accounting records, as amended; and the Czech Accounting Standards for Businesses, as amended. The accounting records are maintained in compliance with general accounting principles, specifically the historical cost valuation basis (unless stated otherwise), the accruals principle, the prudence concept, and the going concern assumption. The Company’s financial statements have been prepared as of the balance sheet date, ie 31 December 2015, for the year ended 31 December 2015 / for the fiscal year from DD Month 2014 to DD Month 2015. The financial statements were prepared on DD Month 2016. These financial statements are presented in thousands of Czech crowns (CZK ‘000), unless stated otherwise. 2.1. Tangible and Intangible Fixed Assets Fixed assets include assets with an estimated useful life greater than one year and an acquisition cost greater than CZK XXX thousand in respect of tangible assets, CZK XXX thousand in respect of start-up costs, and CZK XXX thousand in respect of other intangible assets, on an individual basis. Purchased tangible and intangible fixed assets are stated at cost less accumulated depreciation and provisions, if any. The cost of fixed asset improvements exceeding CZK XXX thousand for individual tangible assets for the taxation period, and CZK XXX thousand for individual intangible assets for the taxation period, increases the acquisition cost of the related fixed asset. Depreciation is charged so as to write off the cost of tangible and intangible fixed assets, other than land and assets under construction, over their estimated useful lives, using the straight line / accelerated / machine-hour-rate method, on the following basis: Type of assets Depreciation method (straight line, accelerated, machine-hour-rate) Number of years/% 2.2. Financial Assets Financial assets with maturity or intent to hold exceeding one year are reported as noncurrent; financial assets with maturity or intent to hold up to one year are considered current. Name of the Company pursuant to the Register of Companies 5 Notes to the Financial Statements for the Year Ended 31 December 2015 Valuation of Financial Assets upon Acquisition Upon acquisition, investments, securities and derivatives are stated at cost including the share premium and indirect acquisition costs. Valuation of Financial Assets at the Balance Sheet Date Securities held for trading, other securities available for sale, and derivatives are stated at fair value. If it is not possible to objectively determine the fair value, securities are stated at cost less provisions. Fixed yield securities held to maturity are stated at cost increased or decreased by interest income or expense. (If applicable) Equity investments in subsidiaries or associates are stated using the equity method of accounting (share of equity of the owned company). Other equity investments are stated at cost less provisions. 2.3. Derivatives Derivatives are stated at fair value. Fair value changes are recognised as financial expenses or income (for derivatives held for trading and derivatives hedging the fair value of the balance sheet asset or liability) or through equity accounts (for derivatives hedging the anticipated cash flows and derivatives hedging a net investment in foreign operations). 2.4. Inventory Purchased inventory is valued at acquisition cost. Acquisition costs include the purchase cost and indirect acquisition costs such as customs fees, freight costs and storage fees, commissions, insurance charges and discounts. Internally developed inventory is stated at cost, including (Detail the method of valuation, eg if the valuation is established as equal to direct costs (direct material, direct labour costs, other direct expenses) OR as equal to internal production costs (direct costs and overhead production) OR as equal to the internal costs of output (internal production costs and administrative overheads, or supply overheads.) (Disclose the policy of provisioning against inventory if the provision is material.) 2.5. Receivables Upon origination, receivables are stated at their nominal value as subsequently reduced by appropriate provisions. (Disclose the policy of provisioning against receivables if the provision is material.) 2.6. Payables Payables are stated at their nominal value. Name of the Company pursuant to the Register of Companies 6 Notes to the Financial Statements for the Year Ended 31 December 2015 2.7. Loans Loans are stated at their nominal value. The portion of long-term loans maturing within one year from the balance sheet date is included in short-term loans. 2.8. Reserves Reserves are intended to cover future risks and expenditure the nature of which is clearly defined and which are either likely to be incurred or certain to be incurred but uncertain as to their amount or as to the date on which they will arise. (Indicate particular types of reserves and methods used in determining the level of reserves, eg a reserve for pensions and similar liabilities, a reserve for legal disputes, a reserve for restructuring costs, a reserve for anticipated warranty costs.) 2.9. Foreign Currency Translation Transactions denominated in foreign currencies during the year are translated using the exchange rate of the Czech National Bank / the fixed exchange rate prevailing on the date of the transaction. (If the Company uses a fixed exchange rate, indicate how and when it is determined and adjusted.) At the balance sheet date, the relevant assets and liabilities denominated in foreign currencies are translated at the Czech National Bank’s exchange rate prevailing as of that date. 2.10. Finance Leases Finance lease payments are recorded to expenses. The initial lump-sum payment related to assets acquired under finance leases is amortised and expensed over the lease period. 2.11. Borrowing Costs (If applicable) Borrowing costs arising from loans attributable to the acquisition, construction or production of fixed assets are added to the cost of those assets. All other borrowing costs are recognised in the profit and loss account in the period in which they are incurred. 2.12. Revenue Recognition Revenues from (include the principal types of revenues) are recognised on (specify the date of their recognition). 2.13. Use of Estimates The presentation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the balance sheet date and the reported amounts of revenues and expenses during the reporting period. Management of the Company has made these estimates and assumptions on the basis of all relevant information available to it. Nevertheless, pursuant to the nature of estimates, the actual results and outcome in the future may differ from these estimates. Name of the Company pursuant to the Register of Companies 7 Notes to the Financial Statements for the Year Ended 31 December 2015 2.14. Year-on-Year Changes in Accounting Policies As of 1 January 2015, the Company changed its accounting policy in respect of (describe the change). This change had the following impact on the assets, liabilities, and profit or loss: (CZK ‘000) Asset A Asset B Liability C Liability D Other profit or loss from prior years 2.15. Cash Flow Statement The cash flow statement is prepared using the indirect method. Cash equivalents include current liquid assets easily convertible into cash in an amount agreed in advance. Cash and cash equivalents can be analysed as follows: 31 Dec 2015 (CZK ‘000) 31 Dec 2014 Cash on hand and cash in transit Cash at bank Overdraft balances of current accounts included in current bank loans Cash equivalents included in current financial assets Total cash and cash equivalents Cash flows from operating, investment and financial activities presented in the cash flow statement are not offset. (If this is not the case, please change accordingly.) Name of the Company pursuant to the Register of Companies 8 Notes to the Financial Statements for the Year Ended 31 December 2015 3. ADDITIONAL INFORMATION (If the Company used the profit and loss account structured by the function of expense/income method (“ucelove cleneni”), then the additional information needs to include the profit and loss account structured by the nature of expense/income method (“druhove cleneni”.) (If the Company merged individual lines in the financial statements, it needs to present the merged lines in the notes separately.) 3.1. Intangible Fixed Assets (Intangible FA) Major additions to intangible FA include (stated at cost): Item/type of asset 2015 (CZK ‘000) 2014 Major disposals of intangible FA include (stated at net book value upon disposal): Item/type of asset 2015 (CZK ‘000) 2014 (If the Company accounts for a provision against an intangible FA, provide a schedule or a description of changes.) 3.2. Tangible Fixed Assets (Tangible FA) Major additions to tangible FA include (stated at cost): Item/type of asset 2015 (CZK ‘000) 2014 Major disposals of tangible FA include (stated at net book value upon disposal): Item/type of asset 2015 (CZK ‘000) 2014 (If the Company accounts for a provision against a tangible FA, provide a schedule or a description of changes.) (Comment on extraordinary write-offs, modification of depreciation plans, etc.) (Include a description and accounting value of the pledged assets or real estate with a lien.) (If deemed material, present own assets that are not reflected on the face of the balance sheet, such as low value assets and intangible assets.) Name of the Company pursuant to the Register of Companies 9 Notes to the Financial Statements for the Year Ended 31 December 2015 (If deemed material, present third party assets that are reflected on the face of the balance sheet, such as assets held under a contract to lease a business or a part thereof.) (If deemed material, present the aggregate lease value and the aggregate anticipated value of lease payments.) 3.3. Non-Current Financial Assets Equity Investments - subsidiary (controlled entity): Company’s business name Registered office Company’s equity* Company’s profit/loss* (CZK ‘000) Net book value Total * Figures from the unaudited financial statements for the year ended 31 December 2015 Equity Investments in Associates: Company’s business name Registered office Company’s equity* Company’s profit/loss* (CZK ‘000) Net book value Total * Figures from the unaudited financial statements for the year ended 31 December 2014 (Include the business entity or the name, registered office and legal status of each entity in which the Company acts as an owner with unlimited liability.) (State if controlling contracts or contracts for the transfer of profit have been concluded, and which obligations arise from such contracts). 3.4. Inventory (Comment on material balances or changes in inventory levels and provisioning against inventory.) (If applicable) The balances of inventory that has been pledged as collateral for current loans were CZK XXX thousand and CZK XXX thousand as of 31 December 2015 and 31 December 2014, respectively. 3.5. Long-Term Receivables (Comment on the nature and balances of major receivables, unless such information is apparent from the balance sheet.) (Disclose receivables that have maturity exceeding five years as of the balance sheet date.) 3.6. Short-Term Receivables (Comment on the nature and balances of major receivables, unless such information is apparent from the balance sheet.) Name of the Company pursuant to the Register of Companies 10 Notes to the Financial Statements for the Year Ended 31 December 2015 Receivables past their due dates amount to CZK XXX thousand and CZK XXX thousand as of 31 December 2015 and 31 December 2014, respectively. 3.7. Current Financial Assets (Disclose relevant information only if it provides other significant information that is not apparent from the balance sheet.) (Comment on significant balances or changes in the amounts of individual assets, such as term accounts and securities. Overdraft loans with a debit balance should be reported under “Loans”. Provide a detailed breakdown of the main components of equity and debt securities; provide fair values in respect of securities available for sale and held for trading. If certain debt securities are exchangeable or if financial assets comprise similar securities, disclose these securities and indicate their amount and the extent of rights they establish.) (Disclose current financial assets whose title is restricted, such as pledges, blocking for the benefit of a bank, etc.) 3.8. Deferred Expenses and Accrued Income (Comment on material assets or changes in balances, such as the quantification and nature of complex deferred expenses and accrued income.) 3.9. Equity (Comment on significant increases or decreases in individual equity components, unless such information is apparent from the statement of changes in equity.) Gains and losses from the revaluation of assets and liabilities are composed of: 31 Dec 2015 (CZK ‘000) 31 Dec 2014 Valuation of derivatives Change in the valuation of an equity investment accounted for using the equity method of accounting Change in the valuation of securities available for sale Total 3.10. Reserves (The structure of the table must be consistent with the relevant disclosure provided in Note 2 Accounting Principles and Policies; this is only a draft disclosure.) Reserves under special Reserve for pensions Income tax legislation and similar liabilities reserve Other reserves (CZK ‘000) Total reserves Balance at 31 Dec 2014 Charge for reserves Use of reserves Release of redundant reserves Balance at 31 Dec 2015 (Comment on material items or changes in the amount of individual items. Provide a specific disclosure for reserves under special legislation, and other reserves.) Name of the Company pursuant to the Register of Companies 11 Notes to the Financial Statements for the Year Ended 31 December 2015 3.11. Long-Term Payables Long-term payables predominantly include (Specify material items of long-term payables, unless such information is apparent from the balance sheet.) The aggregate balances of long-term payables whose maturity exceeded five years were CZK XXX thousand and CZK XXX thousand as of 31 December 2015 and 31 December 2014, respectively. 3.12. Short-Term Payables (Comment on the nature and balances of material payables unless such information is apparent from the balance sheet.) Payables past their due dates amounted to CZK XXX thousand and CZK XXX thousand as of 31 December 2015 and 2014, respectively. (Comment on the reason for the existence of material past due payables.) 3.13. Bank Loans Long-term bank loans include: Bank/ creditor Currency Balance at 31 Dec 2015 Balance at Interest rate – 31 Dec 2014 2015 (CZK ‘000) Form of collateral Total The portions of loans referred to above, which mature within one year from the balance sheet date, are reported under “Short-term bank loans” in the balance sheet. Short-term bank loans and financial borrowings include: Bank/ creditor Currency Balance at 31 Dec 2015 Balance at Interest rate – 31 Dec 2014 2015 (CZK ‘000) Form of collateral Total 3.14. Accrued Expenses and Deferred Income (Comment on material items of estimated payables or changes in the amount thereof.) 3.15. Derivative Financial Instruments (For each type of derivative, please disclose the extent and substance, including the principal conditions and circumstances that may affect the amount, timing and certainty of future cash flows.) Name of the Company pursuant to the Register of Companies 12 Notes to the Financial Statements for the Year Ended 31 December 2015 The positive and negative fair values of financial derivative instruments are reported under “Other receivables” and “Other payables”, respectively. Nominal value (CZK ‘000) Fair Changes in fair value Changes in fair value value recorded in profit or loss recorded in equity FRA transactions Options Total derivatives held for trading Derivatives designated as fair value hedges Derivatives designated as cash flow hedges Total hedging derivatives (If applicable) The Company has derivative financial instruments that serve as an effective hedging instrument pursuant to the Company’s risk management strategy but cannot be accounted for as hedging instruments under Czech Accounting Standards as they do not meet hedge accounting criteria. Therefore, such derivatives are presented as trading derivatives in the table above. 3.16. Deferred Income Tax The aggregate existing deferred tax asset/(liability) can be analysed as follows: Balance at 31 Dec 2015 (CZK ‘000) Balance at 31 Dec 2014 Accumulated depreciation and amortisation of fixed assets Provisions against fixed assets Revaluation of fixed assets Valuation difference on acquired assets Non-current financial assets Current financial assets Inventory Receivables Reserves Payables Derivatives Tax losses carried forward Total asset/(liability) (If applicable) The asset referred to above was accounted for only to the extent to which it can be anticipated to be recovered on the grounds of prudence: Balance at 31 Dec 2015 (CZK ‘000) Balance at 31 Dec 2014 Recognised asset Unrecognised asset Total assets 3.17. Due Amounts Arising from Social Security and Health Insurance Contributions and Tax Arrears (Only include past due amounts arising from social security and health insurance contributions.) The due amounts arising from social security contributions and contributions to the state employment policy were CZK XXX thousand and CZK XXX thousand as of 31 December 2015 and 31 December 2014, respectively. Name of the Company pursuant to the Register of Companies 13 Notes to the Financial Statements for the Year Ended 31 December 2015 The due amounts arising from public health insurance contributions were CZK XXX thousand and CZK XXX thousand as of 31 December 2015 and 31 December 2014, respectively. The Company reports tax arrears to the local taxation authorities in the amounts of CZK XXX thousand and CZK XXX thousand as of 31 December 2015 and 2014, respectively. 3.18. Income from Ordinary Activities (Present income from current operations by principal activities split between “In-country” and “Cross-border”. This table needs to be included when the types of services and geographical markets substantially differ. If the Company is an issuer of registered securities, this information should always be included.) Year ended 31 Dec 2015 InCrossTotal country border (CZK ‘000) Year ended 31 Dec 2014 InCrossTotal country border Goods O Goods P Etc Total sales of goods Sales of product A Sales of product B Etc Services X Services Y Etc Total sales of own products and services 3.19. Employees, Management and Statutory Bodies The following table summarises the total amount of staff costs and the number of the Company’s employees and managers: (CZK ‘000) 2014 Number Total staff costs 2015 Number Total staff costs Staff Managers Total The number of employees is based on the average recalculated headcount. The category of “Managers” includes Management/Directors/Deputy Directors/Branch Managers. The members of the Company’s Board of Directors, Supervisory Board and management received the following loans and bonuses in addition to their basic salaries: Year ended 31 December 2015 Board of Directors Supervisory Board (CZK ‘000) Managers Loans and borrowings provided (as of 31 Dec) Interest rate Guarantees provided (as of 31 Dec) Life and pension insurance contributions Bonuses Directors’ fees Use of services rendered by the Company Cars/other movable and immovable assets also available for personal use (amount by which the tax base of employees is increased) Other benefits Name of the Company pursuant to the Register of Companies 14 Notes to the Financial Statements for the Year Ended 31 December 2015 (Disclose the amount of contracted or incurred pension debts for the current or former members of the statutory, supervisory and management bodies. Also disclose other benefits, both in cash and in kind, provided to the shareholders, partners, members of a cooperative, and members of statutory, supervisory, and management bodies, including former members of such bodies, in aggregate, split separately by category.) 3.20. Other Operating Income and Expenses (Comment on significant items.) 3.21. Financial Income and Expenses (Comment on significant items.) 3.22. Extraordinary Income and Expenses (Comment on significant items.) 3.23. Related Party Transactions (Disclose the aggregate amounts of all related party transactions.) Income from related party transactions for the year ended 31 December 2015: Entity Relation to the Company Parent company Fellow subsidiary Goods Products Services Financial Other (CZK ‘000) Balance at 31 Dec 2015 Total Income from related party transactions for the year ended 31 December 2014: Entity Relation to the Company Parent company Fellow subsidiary Goods Products Services Financial Other (CZK ‘000) Balance at 31 Dec 2014 Total Expenses from related party transactions for the year ended 31 December 2015: Entity Relation to the Inventory Company Parent company Fellow subsidiary Fixed assets Services Financial Other (CZK ‘000) Balance at 31 Dec 2015 Total Expenses from related party transactions for the year ended 31 December 2014: Entity Relation to the Inventory Company Parent company Fellow subsidiary Fixed assets Services Financial Other (CZK ‘000) Balance at 31 Dec 2014 Total Name of the Company pursuant to the Register of Companies 15 Notes to the Financial Statements for the Year Ended 31 December 2015 Other significant related party transactions for the year ended 31 December 2015 (describe) Receivables from related parties as of 31 December 2015: Entity Relation to the Company Parent company Fellow subsidiary Short-term trade Other receivables short-term Loans Other (CZK ‘000) Balance at 31 Dec 2015 Longterm Loans Other (CZK ‘000) Balance at 31 Dec 2014 Longterm Loans Other (CZK ‘000) Balance at 31 Dec 2015 Longterm Loans Other (CZK ‘000) Balance at 31 Dec 2014 Longterm Total Receivables from related parties as of 31 December 2014: Entity Relation to the Company Parent company Fellow subsidiary Short-term trade Other receivables short-term Total Payables to related parties as of 31 December 2015: Entity Relation to the Company Parent company Fellow subsidiary Short-term trade Other payables short-term Total Payables to related parties as of 31 December 2014: Entity Relation to the Company Parent company Fellow subsidiary Short-term trade Other payables short-term Total (Comment on significant transactions or balances, unless such information is apparent from the financial statements or the tables above). 3.24. Total Fee to the Statutory Auditor/Audit Company (If applicable) The fee to the statutory auditor for the obligatory audit of the financial statements for the year ended 31 December 2015 amounted to CZK XXX thousand (CZK XXX thousand as of 31 December 2014). The statutory auditor did not provide the Company with any other services. (If the statutory auditor provided other services to the Company, please complete the following table.) Year ended 31 Dec 2015 (CZK ‘000) Year ended 31 Dec 2014 Obligatory audit of the financial statements Other assurance services Tax advisory Other non-audit services Total Name of the Company pursuant to the Register of Companies 16 Notes to the Financial Statements for the Year Ended 31 December 2015 (The Company is not obligated to disclose this information if it has been included in the consolidated financial statements pursuant to Part 5 of Regulation No. 500/2002 Coll., or if this information is disclosed in the notes to the consolidated financial statements.) 3.25. Aggregate Research and Development Costs Year ended 31 Dec 2015 (CZK ‘000) Year ended 31 Dec 2014 Research costs Development costs Other Total (Comment on the significant items or changes in the amounts thereof. Disclose if these costs have been capitalised or if the amount was recorded to expenses.) 3.26. Off Balance Sheet Commitments (State the amount of other significant off-balance sheet commitments, such as: Security bills and other guarantees provided; Irrevocable payables arising from concluded contracts; and Potential payables arising from legal disputes and similar demands.) 3.27. Post Balance Sheet Events (State significant post balance sheet events, such as an increase/decrease in share capital, material investments, new loans, acquisition of an enterprise, and natural disasters. Describe the nature of each material event and the financial impact of the event on the Company, or explain why an estimate of the financial consequences cannot be made.) (Or) No events occurred subsequent to the balance sheet date that would have a material impact on the financial statements. Name of the Company pursuant to the Register of Companies 17