appendix 5

advertisement

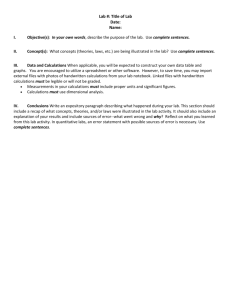

APPENDIX 5 Table A5 Characteristics of the signaling indicators of financial instability Indicator GDP growth ratio Dynamics of industrial output Current account balance Gold and foreign currency reserves Foreign state debt Terms of trade4 (oil prices on Brent Crude) Import and export Real effective exchange rate of ruble Net capital outflow6 Capital outflow Real exchange rate on the interbank credit market Spread between domestic interest rate and LIBOR Relation of credit rate to deposit rate Customer price index 1 Changes Periodicity Source of information Growth rate in real terms in relation to same period of previous year Rate of growth I relation to previous period Level Growth rate in relation to previous period % GDP Level on a quarterly basis MED1 on a monthly basis on a quarterly basis on a monthly basis on a quarterly basis on a monthly basis FSSS2 CB3 CB CB IFS5 Growth rate in relation to same period of previous year Growth rate in relation to previous period Level Level Level on a monthly basis on a monthly basis on a quarterly basis on a quarterly basis on a quarterly basis CB CB CB, calculations CB, calculations CB, FSSS, calculations Level on a monthly basis CB, IFS, calculations Level Growth rate in relation to the same period of previous year on a monthly basis on a monthly basis CB, calculations FSSS Ministry for Economic Development of the Russian Federation, www.economy.gov.ru. Preliminary estimate. Federal State Statistic Service of the Russian Federation, www.gks.ru. 3 The Central Bank of the Russian Federation, www.cbr.ru. 4 In original this indicator presents a relation of export prices to import prices. Such calculations are not possible because of the absence of export prices and import prices in the statistical data from the balance of payment of the Russian Federation. As similar variable I used the dynamics of oil prices of the Brent Crude. Because oil takes one of the main positions of the Russian export, then index of changes of its prices, assuming a relative invariability of the prices on imported good, might serves as a relatively reliable indicator of the terms of trade in the country. 5 International Financial Statistics database, www.imf.com 6 Net capital outflow is an account balance of capital flow for banks and non-financial entities, also net errors and omissions. Capital outflow is characterized by sum of trade credits and advances, not returned on time export revenues and net errors and omissions. Positive value of the variable means capital inflow, negative – capital outflow. 2 Domestic credit Monetary multiplier Deposits7 Relation of money supply to gold and foreign currency reserves Excessive money supply in real terms8 Speculative pressure index9 Growth rate in real terms in relation to the previous period Level Growth rate in real terms in relation to previous period Level on a monthly basis on a monthly basis on a monthly basis on a monthly basis CB CB, calculations CB, FSSS, calculations CB, calculations % GDP Index on a quarterly basis on a monthly basis CB, FSSS, calculation CB, calculations w1 E w2 ( R ) w3i . 3 Weights w1 , w2 , w3 are picked up so that dispersion of all three values were equals, in other words: D( w1 E ) D( w2 R ) D( w3i ) . Therefore, taking w1 1, I w2 7 8 D (E ) , w D (R ) 3 D (E ) . D ( i) It is an amount on deposits able to be withdrawn on demand, deposits with fixed period, saving deposits and deposits in foreign currency. Excessive money supply in real terms is a deviation of estimated money demand to observed money supply (expressed as a money supply share in GDP), i.e. as remains of the regression equation: where, Mt a0 a1Yt a 2 pt a3t t , GDPt M t – денежная масса М2; GDPt – nominal GDP; Yt – GDP volume (in real terms); рt – consumer price index; t – time. Remains t are interpreted as an indicator of excessive lending in economy. 9 Index presents a weighted-average of the three variables: E ; 2) Increase rate of gold and foreign currency reserves (reversed in sign), R ; 1) Increase rate of the exchange rate of the national currency per month, 3) Level of the interest rate (for Russia it is a weighted-average interest rate on the ruble credits to corporate entities in the lending institutions), i. Two last variables reflect fiscal and monetary policy of the governmental bodies on the exchange market in case of the speculative attack on the exchange rate of the national currency. It is assumed that at the fixed (regulated) exchange rate speculative attack on the exchange rate will appear as a decrease of the gold and foreign currency reserves. At the same time at any given regime of the exchange rate, for the protection of national currency central bank may raise interest rates. It is taken in account through including in the formula to calculate third variable. Thus, speculative pressure index is calculated in a following way: