Homework 5

advertisement

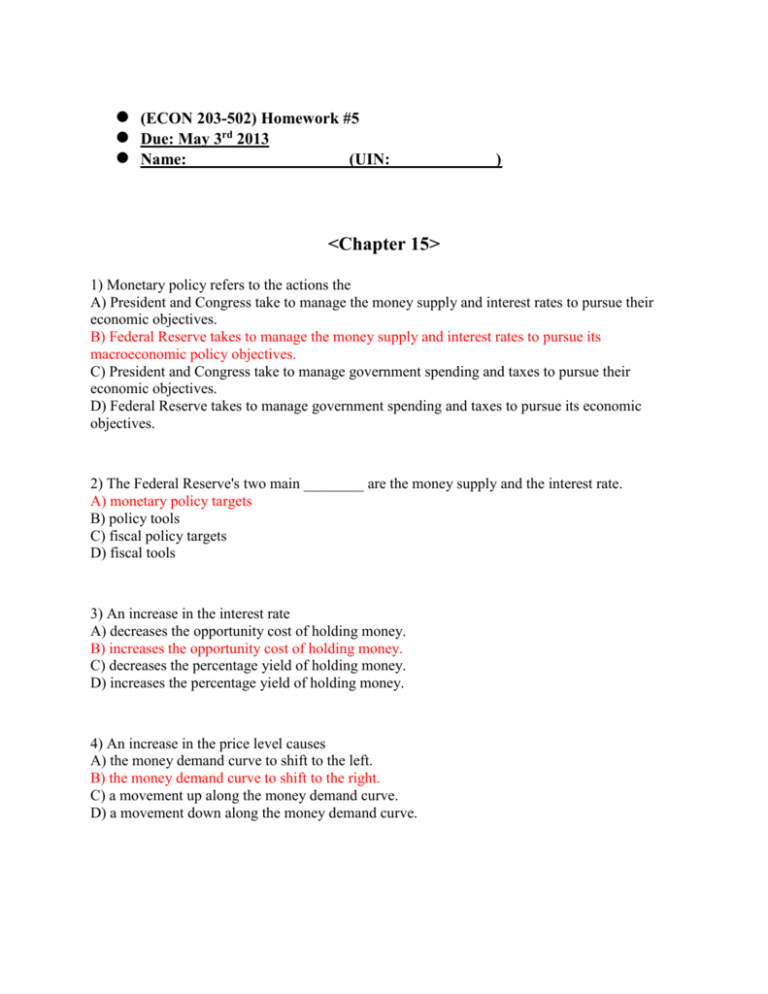

(ECON 203-502) Homework #5 Due: May 3rd 2013 Name: (UIN: ) <Chapter 15> 1) Monetary policy refers to the actions the A) President and Congress take to manage the money supply and interest rates to pursue their economic objectives. B) Federal Reserve takes to manage the money supply and interest rates to pursue its macroeconomic policy objectives. C) President and Congress take to manage government spending and taxes to pursue their economic objectives. D) Federal Reserve takes to manage government spending and taxes to pursue its economic objectives. 2) The Federal Reserve's two main ________ are the money supply and the interest rate. A) monetary policy targets B) policy tools C) fiscal policy targets D) fiscal tools 3) An increase in the interest rate A) decreases the opportunity cost of holding money. B) increases the opportunity cost of holding money. C) decreases the percentage yield of holding money. D) increases the percentage yield of holding money. 4) An increase in the price level causes A) the money demand curve to shift to the left. B) the money demand curve to shift to the right. C) a movement up along the money demand curve. D) a movement down along the money demand curve. Figure 1 5) Refer to Figure 1. In the figure, the money demand curve would move from MD1 to MD2 if A) real GDP increased. B) the price level decreased. C) the interest rate increased. D) the Federal Reserve sold Treasury securities. 6) Which of the following will lead to a decrease in the equilibrium interest rate in the economy? A) an increase in the price level B) a sale of government securities by the Fed C) a decrease in GDP D) an increase in the discount rate E) an increase in the reserve requirement 7) When the Federal Reserve decreases the money supply, at the previous equilibrium interest rate households and firms will now want to A) buy Treasury bills. B) sell Treasury bills. C) neither buy nor sell Treasury bills. D) hold less money. 8) Which of the following is true? A) The money market model is essentially a model that determines the short-term nominal rate of interest. B) The money market model is essentially a model that determines the short-term real rate of interest. C) The loanable funds model is essentially a model that determines the short-term real rate of interest. D) The loanable funds model is essentially a model that determines the long-term nominal rate of interest. Figure 2 9) Refer to Figure 2. In the figure above, when the money supply shifts from MS1 to MS2, at the interest rate of 3 percent households and firms will A) buy Treasury bills. B) sell Treasury bills. C) neither buy nor sell Treasury bills. D) want to hold more money. 10) The interest rate that banks charge other banks for overnight loans is the A) prime rate. B) discount rate. C) federal funds rate. D) Treasury bill rate. 11) A decrease in interest rates can ________ the demand for stocks as stocks become relatively ________ attractive investments as compared to bonds. A) increase; more B) decrease; less C) decrease; more D) increase; less E) increase; similar 12) From an initial long-run macroeconomic equilibrium, if the Federal Reserve anticipated that next year aggregate demand would grow significantly slower than long-run aggregate supply, then the Federal Reserve would most likely A) decrease interest rates. B) increase interest rates. C) decrease income tax rates. D) increase income tax rates. 13) Expansionary monetary policy refers to the ________ to increase real GDP. A) government's increasing spending and lowering taxes B) government's decreasing spending and raising taxes C) Federal Reserve's increasing the money supply and decreasing interest rates D) Federal Reserve's decreasing the money supply and increasing interest rates Figure 3 14) Refer to Figure 3. Suppose the economy is in a recession and the Fed pursues an expansionary monetary policy. Using the static AD-AS model in the figure above, this would be depicted as a movement from A) A to B. B) B to C. C) C to B. D) A to E. E) C to D. 15) Refer to Figure 3. Suppose the Fed lowers its target for the federal funds rate. Using the static AD-AS model in the figure above, this situation would be depicted as a movement from A) A to B. B) B to A. C) C to B. D) E to A. E) C to D. 16) Contractionary monetary policy on the part of the Fed results in A) an increase in the money supply, an increase in interest rates, and an increase in GDP. B) a decrease in the money supply, an increase in interest rates, and a decrease in GDP. C) an increase in the money supply, a decrease in interest rates, and an increase in GDP. D) a decrease in the money supply, a decrease in interest rates, and a decrease in GDP. 17) Which of the following would most likely induce the Federal Reserve to conduct expansionary monetary policy? A significant decrease in A) oil prices. B) business taxes. C) income tax rates. D) investment spending. 18) If the Federal Reserve raises or lowers interest rates too late, it could result in a ________ policy that destabilizes the economy. A) fiscal B) budgetary C) procyclical D) countercyclical