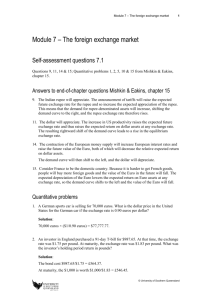

Homework Assignment 6

advertisement

Homework Assignment 6 Chapter 15 – Questions 1. When the Euro appreciates, are you more likely to drink California or French wine? 2. “A country is always worse off when its currency is weak (falls in value).” Is the statement true, false or uncertain? Explain your answer. 3. In a newspaper, chose one exchange rate from each of the regions listed in Following the Financial News box on p347. Which of these currencies have appreciated, and which have depreciated since June 23, 2010? 4. If the Japanese price level rises by 5% relative to the price level in the United States, what does the theory of purchasing power parity predict will happen to the value of the Japanese Yen in terms of US dollars? 5. If the demand for a country’s exports falls at the same time that tariffs on imports are raised, will the country’s currency tend to appreciate or depreciate in the long run? 6. In the mid-to-late 1970’s, the yen appreciated relative to the dollar even though Japan’s inflation rate was higher than America’s. How can this be explained by an improvement in the productivity of Japanese industry relative to American industry? Predicting the future 7. The president of the United States announces that he will reduce inflation with a new anti-inflation program. If the public believes him, predict what will happen to the exchange rate for the U.S. dollar vs. other currencies. 8. If the Bank of England prints money to reduce unemployment, what will happen to the value of the pound in the short run and the long run? 9. If the Indian government unexpectedly announces that it will be imposing higher tariffs on foreign goods one year from now, what will happen to the value of the Indian rupee today? 10. If nominal interest rates in the US rise but real interest rates fall, predict what will happen to the US exchange rate. 11. If American auto companies make a breakthrough in automobile technology and are able to produce a car that gets 60 miles to the gallon, what will happen to the US exchange rate? 12. If Mexicans go on a spending spree and buy twice as much French perfume, Japanese TVs, English sweaters, Swiss watches and Italian wine, what will happen to the value of the Mexican Peso. 13. If expected inflation drops in Europe so that interest rates fall there, predict what will happen to the exchange rate for the US dollar vs. the Euro. 14. If the European Central Bank decides to contract the money supply to fight inflation, what will happen to the value of the US dollar vs. the Euro? 15. If there is a strike in France, making it harder to buy French goods, what will happen to the value of the Euro? Chapter 15 – Quantitative Problems 1. A German sports car is selling for 70,000 euros. What is the dollar price in the United States for the German car if the exchange rate is 0.90 euros per dollar? 2. An investor in England purchased a 91-day T-bill for $987.65. At that time, the exchange rate was $1.75 per pound. At maturity, the exchange rate was $1.83 per pound. What was the investor’s holding period return in pounds? 3. An investor in Canada purchased 100 shares of IBM on January 1 at $93.00 per share. IBM paid an annual dividend of $0.72 on December 31st. The stock was sold that day as well for $100.25. The exchange rate was $0.68 per Canadian Dollar on January 1 and $0.71 per Canadian dollar on December 31. What is the investor’s total return in Canadian dollars? 4. The current exchange rate is 0.75 euro per dollar, but you believe that the dollar will decline to 0.67 euro per dollar in one years time. If a eurodenominated bond is yielding 2%, what return do you expect in US dollars? 5. The six-month forward rate between the British pound and the US dollar is $1.75 per pound. If six-month interest rates are 3% in the United States and 150 basis points higher in England, what is the current exchange rate? 6. If the Canadian dollar to the U.S. dollar exchange rate is 1.28 CAD/USD and the British Pound to US dollar exchange rate is 0.62 GBP/USD, what must the Canadian dollar to British Pound exchange rate be? 7. The NZ dollar to US dollar exchange rate is 1.36 NZD/USD, and the British Pound to US dollar exchange rate is 0.62 GBP/USD. If you find that the British Pound to New Zealand dollar exchange rate is 0.49 GBP/NZD, what would you do to earn a riskless profit? 8. In 1999, the Euro was trading at $0.90 per euro. If the euro is now trading at $1.16 per euro, what is the percentage change in the Euro’s value? Is this an appreciation or depreciation? 9. The Brazilian Real is trading at 0.375 real per US dollar. What is the US dollar per real exchange rate? 10. The Mexican peso is trading at 10 pesos per dollar. If the expected US inflation rate is 2% while the expected Mexican inflation rate is 23% over the next year, what is the expected exchange rate in one year? 11. The current exchange rate between the US and Britain is $1.825 per pound. The six-month forward rate between the British Pound and the US dollar is $1.79. If British interest rates are 2% then what are US interest rates? Assume interest rates are of the form (1 + 𝑟)𝑡 . 12. The current exchange rate between the Japanese yen and the US dollar is 120 yen per dollar. If the dollar is expected to depreciate by 10% relative to the yen, what is the new expected exchange rate? 13. If the price level recently increased by 20% in England while falling by 5% in the United States, how much must the exchange rate change if PPP holds? Assume that the current exchange rate is 0.55 pounds per dollar. 14. A one-year CD in Europe is currently paying 5%, and the exchange rate is 0.99 euros per dollar. If you believe that the exchange rate will be 1.04 euros per dollar one year from now, what is the expected return in terms of dollars? 15. One-year interest rates are 2% in Japan and 4% in the United States. The current exchange rate is 120 yen per dollar. If you can enter into a one forward exchange contract of 115 yen per dollar, how can you arbitrage the situation? 16. The interest rate in the United States is 4% and the Euro is trading at 1 euro per dollar. The euro is expected to depreciate to 1.1 euros per dollar in one years time. Calculate the interest rate in Europe. Chapter 15 – Additional Problems 1. Choose an exchange rate that you looked at in problem 3. Go back 3 months from today and find: a. The exchange rate that was valid for that date. b. The exchange rate valid for today. c. A measure of government 3-month interest rates in that country from 3 months ago. d. The relevant 3-month T-bill rate from 3 months ago. Given all of this information would you have expected that the foreign currency would have strengthened versus the dollar over the past three months or weakened? Explain your answer. What actually happened? 2. The spot rate for British Pounds (GBP) into Swiss Francs (CHF) is 1.4966 CHF/GBP. The 3-month forward point is quoted as -28. a. What is the 3-month forward rate? b. Are interest rates higher in the UK or Switzerland? c. If interest rates in the UK are 0.5% then what are interest rates in Switzerland? Assume rates are of the form (1 + 𝑟)𝑡 3. The spot rate for British Pound (GBP) into South African Rand (ZAR) is 14.06 ZAR/GBP. 6-month interest rates in the UK are 0.75% and 6-month interest rates in South Africa are 5.5%. Assume rates are of the form (1 + 𝑟)𝑡 a. Would you expect that the forward FX rate to be higher or lower than today? b. What is the 6-month forward FX rate? c. What is the quote for the 6-month forward point?