Ch 2 NOL

advertisement

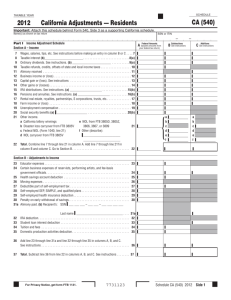

Net Operating Losses Chapter 2 pp. 39 - 70 2015 National Income Tax Workbook™ AMAZINGLY SIMPLE HOME REMEDIES (That Really Work!) 1. AVOID CUTTING YOURSELF WHEN SLICING VEGETABLES BY GETTING SOMEONE ELSE TO HOLD THE VEGETABLES WHILE YOU SLICE. 2. AVOID ARGUMENTS ABOUT LIFTING THE TOILET SEAT BY USING THE SINK. 3. FOR HIGH BLOOD PRESSURE SUFFERERS ~ REDUCE PRESSURE BY CUTTING YOURSELF AND BLEEDING. REMEMBER TO USE A TIMER. 4. A MOUSE TRAP PLACED ON TOP OF YOUR ALARM CLOCK WILL PREVENT YOU FROM GOING BACK TO SLEEP AFTER HITTING THE SNOOZE BUTTON. 5. IF YOU HAVE A BAD COUGH, TAKE LAXATIVES. THEN YOU'LL BE AFRAID TO COUGH. 6. YOU ONLY NEED TWO TOOLS IN LIFE. IF IT DOESN'T MOVE AND SHOULD, USE WD-40. IF IT SHOULDN'T MOVE AND DOES, USE DUCT TAPE. 7. IF YOU CAN'T FIX IT WITH A HAMMER, YOU'VE GOT AN ELECTRICAL PROBLEM. Net Operating Losses Chapter 2 pp. 39 - 70 2015 National Income Tax Workbook™ Net Operating Losses Page 39 Steps for NOL Deduction. NOL Carried between Joint and Separate returns Special issues in NOL calculations Making optimal use of an NOL deduction. Appendix–Helpful NOL Worksheets Net Operating Losses Why understand NOL Rules and Comps? There are decisions to be made that can impact the amount the client pays in taxes. ▪ Do we carryback or forward? ▪ Is it better to claim itemized deductions in loss year or delay payment to a CO year? What’s the difference? ▪ Is it better to try to move income into or out of the loss year to or from a CO year? 23 VAC 10-110-84 Net operating loss carrybacks and carryovers. Generally. For Virginia purposes a net operating loss deduction is allowed only to the extent that it is allowed in computing federal adjusted gross income. Therefore, it must be carried back or carried forward to the same year as for federal income tax purposes Where to file NOL in VA In the oval on the front of the return if the amended return is the result of a net operating loss (NOL) carryback. General instructions for computing the NOL can be obtained from the website at www.policylibrary.tax.virginia.gov/OTP/policy.nsf. Select 23VAC10-110-80 and 23VAC10-110-81 located in Chapter 110, Individual Income Tax, Virginia Tax Administrative Code. Net Operating Losses Page 39 NOL Deductions can allow carrybacks of 2, 3, 5,or 10 years and carryforwards up to 20 years. Idea simple but Calculations complex. IRC Section 172 removes some tax benefits before an NOL deduction is calculated. Income and deductions are modified in all affected years. Net Operating Losses Page 40 Deductions for the NOL year are modified to determine the NOL that can be carried to other years. Taxable income is modified in years to which the loss is carried to determine how much of the NOL is absorbed in each year. Net Operating Losses - Individual Taxpayers Page 40 Four Steps to Compute NOL Deductions for an Individual: 1. Determine eligibility 2. Compute the NOL 3. Distribute NOL to carryback & carryfoward years. 4. Re-Calculate taxes in carryback and carryforward years. Net Operating Losses - Individual Taxpayers Page 40 Step 1 - Determine Eligibility: Individuals and C Corporations claim their own NOLs Partnerships, S Corps and LLCs taxed as PS or S Corp: ▪ Cannot claim their NOL deduction. ▪ Partner, SH or member claim their share of the NOL deduction on their return. Net Operating Losses - Individual Taxpayers Page 40 Four steps to Compute NOL deductions for an Individual: 1. Determine eligibility 2. Compute the NOL 3. Distribute NOL to carryback & carryfoward years. 4. Calculate taxes in carryback and carryforward years. Net Operating Losses - Individual Taxpayers Pages 40 - 41 Step 2 – Compute the NOL: Negative taxable income is modified by removing deductions that are not allowed in computing the NOL. ▪ Generally, only business losses are in an NOL & carried to another year. ▪ Items with their own carryover rules are excluded from the NOL. (Ex.: Capital Losses) Net Operating Losses - Individual Taxpayers Page 41 Exclude from NOL / Add back to Negative Taxable Income: 1. 2. 3. 4. 5. 6. Dependents & personal exemptions. Nonbusiness deductions in excess of nonbusiness income Capital losses in excess of capital gains. 50% exclusion of gain from Sec 1202 stock. An NOL deduction carried from another year. IRC domestic Production activities deduction. If sum of the above exceed negative taxable income, there is no NOL for the year. Net Operating Losses - Individual Taxpayers Page 41 Paige’s taxable Income for 2009 is Nonbusiness deductions above nonbusiness income NOL Ex. 2.1 ($10,000) 6,000 ($4,000) If non-business income had equaled or exceeded $10,000 there would be no NOL. Business income & deductions arise from: ▪ A trade or business, wages and (an exception for) casualty & theft losses even if personal. Observation p. 41 For NOL purposes: Taxpayer prefers income and gain to be nonbusiness Taxpayer prefers deductions and losses to be business Net Operating Losses - Individual Taxpayers Pages 41 - 42 T.I. Bus Loss Ex 2.2 Add Back $(10,000) NOL $(10,000) Wage Inc 6,000 6,000 Invest Inc 500 500 AGI $( 3,500) $( 3,500) Pers Exe. ( 4,000) $ 4,000 Stand Ded ( 6,300) $ 5,800 Tax. Inc. = $(13,800) * Keeps $500 Of Stand Ded -0( 500)* $ 8,850 $( 4,000) = NOL attributable to Invest Inc Net Operating Losses – Other Ways to Look At It Page 42 Observation TI Bus Loss Add Back $(10,000) NOL $(10,000) $(10,000) Wage Inc 6,000 6,000 Invest Inc 500 500 AGI Or NOL $( 3,500) 6,000 -- $( 3,500) Pers Exe. ( 4,000) $ 4,000 Stand Ded ( 6,300) $ 5,800 Tax. Inc. = $(13,800) NOL = -0( 500) ________ $( 4,000) $( 4,000) Net Operating Losses - Individual Taxpayers Page 42 Farm & Fishing Income Averaging ▪ See pages 371 – 375 of the 2009 text. Suspended losses from passive activities, at-risk rules, basis limits, contributions: ▪ Do not impact NOL computation in years suspended because not deducted in these years. ▪ Do go into NOL computation in year they are allowed. Net Operating Losses - Individual Taxpayers Page 42 Form 1045 – Application for Tentative Refund Schedule A – A worksheet for computing NOL for Form 1045 or an amended return. Appendix to this Chapter, pages 65 – 70, include help to complete Form 1045 via 4 worksheets: ▪ #1 – Nonbusiness and business capital losses ▪ #2 – Nonbusiness and business capital gains ▪ #3 – Nonbusiness deductions ▪ #4 – Nonbusiness income Net Operating Losses - Individual Taxpayers Pages 42 - 43 Four steps to Compute NOL deductions for an Individual: 1. Determine eligibility 2. Compute the NOL 3. Distribute NOL to carryback & carryfoward years. 4. Calculate taxes in carryback and carryforward years. Net Operating Losses - Individual Taxpayers Pages 42 - 43 Step 3 -- Distribute the NOL Different carryback periods based on source of NOL. NOL absorbed in carryover year is modified taxable income NOT taxable income in carryover year. ▪ Thus do not get full benefit of the NOL carryover. Can elect to forgo carryback for a carryforward: ▪ Election on original return for NOL year or ▪ Amended return for NOL year filed within 6-months of original return due date. Net Operating Losses - Individual Taxpayers Pages 43 - 44 General Rule – Carryback 2 years and then forward for 20 years. ▪ Any loss not used up is lost. Exceptions – NOL from Casualty, Theft & Small Business Disaster Losses have 3-Year carryback and Farm losses have a 5-year carryback. Must allocate if have 2 and 3 year carryback losses – As though have two separate NOLs IRS does not provide rules on how to allocate between NOLs with different carrybacks but IRC 172(b)9(1)E(ii) does provide guidance. Net Operating Losses - Individual Taxpayers Page 44 EX. 2.3 Cherry had a $700 theft loss in 2015. She claimed a $6,300 Standard Deduction. Her Itemized Deductions were $4,500 (excluding the theft loss) She had a $10,000 business loss. Her only investment income was $500. What’s her NOL? Can she carryback her theft loss? Net Operating Losses - Individual Taxpayers Page 44 Bus Loss EX 2.3 ($10,000) Invest Inc 500 AGI ($ 9,500) Exemption ( 4,000) Stand. Ded. ( 6,300) Taxable Inc ($19,800) Add: Exem 4,000 Stand. Ded. 5,800 NOL ($10,000) ($10,000) = $6,300 SD – 500 Inv Inc ($10,000) No theft loss carryover since it did not affect her NOL and Carryover period is 2-years….NOT 3.. Net Operating Losses - Individual Taxpayers Pages 44 - 45 EX 2.4 Suppose Cherry’s theft loss had been $50,000 instead of $700? She would itemize because of that theft loss. Now what’s her NOL? Can she carryback her theft loss? How much of her NOL has a 2 yr CB? How much of her NOL has a 3 yr CB? Net Operating Losses - Individual Taxpayers Pages 44 - 45 Bus Loss Invest Inc AGI Exemption EX 2.4 ($10,000) 500 ($ 9,500) ( 4, 000) Stand. Ded. ( 6,300) Casualty $50,000-$10010% AGI Other Itemized Ded Taxable Inc ($19,800) Add: Exem 4,000 Stand. Ded. 6,300 Item Ded $4,500*- $500 NOL ($10,000) ($10,000) 500 ($ 9,500) ( 4,000) ( 49,900) ( 4,500)* ($67,900) 4,000 4,000 ($59,900) Net Operating Losses - Individual Taxpayers Pages 44 - 45 EX 2.4 Bus Inc ($10,000) Invest Income 500 AGI ($ 9,500) Personal Exemption ( 4,000) Deductible Casualty ( 49,900) $49,900* Other Itemized Deducts ( 4,500)* Taxable Income ($67,900) Add Back: Exemp 4,000 Item Deds – Invest Inc 4,000 NOL ($59,900) ( 59,900) NOL over Casualty – 2 year carryback = $10,000 $49,900* Casualty Loss NOL - 3 year carryback Net Operating Losses - Individual Taxpayers Page 45 Another Exception to 2 Year Carryback Small Business Disaster Losses – 3 Year Carryback These are losses from “Federally Declared Disasters”. Must allocate NOL between 2 year and 3 year CBs if have both types. Three possible methods of NOL allocation: ▪ Allocate to 3-year CB 1st ▪ Allocate to 2-year CB 1st ▪ Allocate based on pro rata basis Net Operating Losses - Individual Taxpayers Pages 45 - 46 Ex 2.5 Doug’s store destroyed by flood . Area declared a “Federal Disaster Area” Doug suffered a $70,000 loss from being closed Doug’s wife earned $20,000 teaching Doug’s wife suffered a $30,000 loss from her internet business How much of the NOLs can be carried back 2 years? How much of the NOLs can be carried back 3 years? Net Operating Losses - Individual Taxpayers Pages 45 - 46 Ex 2.5 Wages $20,000 Taxable interest 5,500 Doug’s store loss (70,000) 3-Year CB Wife’s business loss (30,000) 2-Year CB AGI $ ( 74,500) Standard Deduction ( 12,600) Personal exemption ( 8,000) Taxable income $ (95,100) Add back: Stand. Ded. 5,900 = 12,600 – 5,500 Inv Inc Pers. Exem. 8,000 NOL $ (80,000) 3 ways to allocate NOL between 2 and 3 year CB periods Net Operating Losses - Individual Taxpayers Pages 45 - 46 Ex 2.5 and Fig 2.5 $ 70,000 3-Year CB for Federal Disaster Area $ 30,000 2-Year CB from a regular business loss $100,000 total in losses But, due to adjustments NOL is only $80,000 Method 3-Year CB 1st allocate to $70,000 $70,000 1st allocate to $30,000 $50,000 Pro-rata allocation: 70,000 / 100,000 x 80,000 = $56,000 2-Year CB $10,000 $30,000 $24,000 Net Operating Losses - Individual Taxpayers Page 46 Ex 2.6 Priority of CBs and CFs -- 2-year CBs are used first If allocation Method # 1 were used: 2012 2013 1st 2nd 1st 2014 2015 2016 (70,000) (10,000) 2nd 1st 2nd 1st 3 Yr NOL CB 2 Yr NOL CB (70,000) (10,000) If elect to forgo CB the election to forego a CB applies to both CBs. Net Operating Losses - Individual Taxpayers Pages 46 - 47 Another Exception to 2 Year Carryback Farming Losses including nurseries, sod farms, etc – 5 Year Carryback & 20 Year Carryforward Farming Loss is defined as lesser of: ▪ NOL from income and deductions from farming ▪ Total NOL NOLs are 1st allocated to farming losses and then to other losses Net Operating Losses - Individual Taxpayers Page 47 EX 2.7, Fig. 2.6 Wages $20,000 Taxable interest 5,500 ($ 5,500) Farming bus. loss - 5-year CB ( 70,000) ($70,000) Truck bus. loss (Fed Disaster) ( 30,000) AGI ($ 74,500) Standard Deduction ( 12,600) 12,600 Personal Exemption ( 8,000) Taxable income ($ 95,100) Add Back: Excess Stand. Ded. $12,600 – 5,500 (non-bus inc) 7,100 $ 7,100 Pers. Exemp. 8,000 Total NOL $( 80,000) ($80,000) Remaining NOL – 3-year CB ($10,000) Net Operating Losses - Individual Taxpayers Page 47 EX 2.7 Q&A # 1: What is the NOL computed using only Sandy’s farm income? Q&A # 2: What is the NOL if Rocky’s wages were $35,000 instead of $20,000? Net Operating Losses - Individual Taxpayers Page 47 EX 2.7, Q1 Q&A # 1: Sandy’s NOL from farming only is $70,000 and has a 5-year CB since from farming. The $10,000 NOL from a small business disaster loss has a 3-year CB. Farming NOL = $70,000 Total NOL = $80,000 Remaining NOL = $10,000 5-year CB Farming 3-year CB Federal Disaster Area Net Operating Losses - Individual Taxpayers Page 47 EX 2.7, Q2 Wages changed to $35,000 Taxable interest 5,500 ($ 5,500) Farming business loss ( 70,000) Truck business loss (FDA) ( 30,000) AGI $( 59,500) Standard Deduction ( 12,600) 12,600 Personal Exemption ( 8,000) Taxable income $( 80,100) Add Back: Stand. Ded. 7,100 $ 7,100 Pers. Exemp. 8,000 Total NOL $( 65,000) Continued…….. ($70,000) ($65,000) Net Operating Losses - Individual Taxpayers Pages 47 - 48 EX 2.7, Q2 Farming NOL = $70,000 But limited to total NOL Total NOL = $65,000 5-year CB Farming Remaining NOL= $ -03-year CB Fed Disaster Area If waive 5-year farming CB it reverts to a 2-year CB Net Operating Losses - Individual Taxpayers Page 48 Other Exceptions to 2 Year Carryback Specified Liability Loss – 10-year CB ▪ NOL attributable to Product Liability loss or Reclamation of land Decommissioning of nuclear power plant Dismantling a drilling platform Remediation of environmental contamination Payment under worker compensation act Certain Disaster AREA losses – 5-year CB ▪ Qualified Disaster Loss – 2008 and 2009 ▪ Qualified GO Zone; Kansas Area; Midwestern Area If elect to waive 10-year CB the CB is 2-years. Net Operating Losses - Individual Taxpayers Page 48 Election to forgo any carryback requires attaching a statement to the original return for the loss year. Election must be made on: ▪ Original return including extensions or ▪ Amended return filed within 6-months of unextended due date. If no election is made the NOL is absorbed in the CB years even if no NOL is carried to those years….See Ex 2.9 Net Operating Losses - Individual Taxpayers Page 49 NOL Absorption -- NOL Minus Modified Taxable Income in each intervening year…..Use Schedule B, Form 1045 Modified taxable income = ▪ Taxable Income in the Intervening Year ▪ Less: • Capital Losses deducted in excess of capital gains • Partial exclusion on gain on qualified small business stock • Personal & dependent exemptions • Domestic production activities deduction Net Operating Losses - Individual Taxpayers Page 49 Adjustments to compute Modified Taxable Income change AGI which also affects: ▪ Special allowance for passive losses from rental property ▪ Taxable Social Security benefits ▪ IRA Deductions ▪ Excludible savings bond interest ▪ Exclusion amounts rec’d under employer adoption program ▪ Student loan interest ▪ Tuition and fees deduction ▪ Itemized Deductions impacted by a change in AGI. Enter these adjustments on Line 6, Schedule B Form 1045 Net Operating Losses - Individual Taxpayers Page 50 Four steps to Compute NOL deductions for an Individual: 1. Determine eligibility 2. Compute the NOL 3. Distribute NOL to carryback & carryfoward years. 4. Calculate taxes in carryback and carryforward years. Net Operating Losses - Individual Taxpayers Page 50 Step 4 – Calculate Taxes in CB and CF Years: An NOL carryback: ▪ Reduces AGI and Taxable Income which can affect itemized deductions and exemptions. ▪ Changes are reported on Form 1045 or an amended return. An NOL carryfoward: ▪ Shown as negative income on Line 21, Form 1040 (“Other Income”) Net Operating Losses - Individual Taxpayers Page 50 Deadline for Form 1045 ▪ Before end of tax year following year of NOL. ▪ Not before return for NOL year is filed. Example -- Form 1045 for 2015 can be filed after 2015 return is filed and before the end of 2016. Deadline for Form 1040X ▪ 3-years from due date of loss year return. Example -- Form 1040X for 2015 must be filed by 4/15/2019 unless there was an extension to file the 2015 return. Net Operating Losses - Individual Taxpayers Pages 50 - 51 Change in filing status requires allocations. Allocation of a Joint NOL: ▪ Allocate to each spouse their share of NOL as if a separate return had been filed. ▪ Computation = Each spouse’s NOL on a separate return divided by total of NOL’s both spouses would have had on separate returns is allocated to each spouse. ▪ If only one spouse had an NOL all of the joint return NOL is allocated to that spouse. Net Operating Losses - Individual Taxpayers Page 51 Ex 2.10 Joint NOL NOLs if filed Separate Total Joint NOL $10,000 Husband’s NOL $ 9,000 Wife’s NOL 3,000 Total NOL if filed separately $12,000 Allocation: Husband’s NOL = $10,000 x 9,000/12,000 = $ 7,500. Wife’s NOL = $10,000 x 3,000/12,000 = $ 2,500. Total of Allocated Joint NOL $10,000 Net Operating Losses - Individual Taxpayers Page 51 Ex 2.11 Joint NOL NOLs if filed Separate Total Joint NOL $10,000 Husband’s NOL $ 9,000 Wife’s NOL 3,000 Total NOL if filed separately $12,000 Allocation: Husband’s NOL = $10,000 x 9,000/12,000 = $ 7,500. Wife’s NOL = $10,000 x 3,000/12,000 = $ 2,500. Total of Allocated Joint NOL $10,000 But, now let’s suppose only one of the spouses filing a joint return had an NOL………. Net Operating Losses – Only One with NOL Page 51 Ex 2.11 Joint NOL NOLs if filed Separate Total Joint NOL $4,000 Husband’s NOL $ 7,000 Wife’s NOL -0Total NOL if filed separately $ 7,000 Allocation: Husband’s NOL = Wife’s NOL = Total of Allocated Joint NOL $ 4,000 -0$ 4,000 Net Operating Losses - Individual Taxpayers Pages 51 - 52 Allocation of Income and Deductions where there is a change in marital status / filing status ▪ See Figure 2.7 page 52 NOL Year Filing Status Single MFJ MFS Single Carryback /Carryforward Year MFJ MFS No Allocations Income & Deductions Allocated No Allocations NOL Allocated No Allocations NOL Allocated No Allocations No Allocations No Allocations Separate Returns May Reduce Tax Liability Page. 52 Ex 2.12 AGI for: Tom Mary Total 2015 ($19,000) 21,500 $ 2,500 2013 $30,000 40,000 $70,000 If file joint there is no NOL. If file separate Tom has an NOL that he can carryback to 2013 where their joint tax rate is higher. But must consider impact of MFS status. Net Operating Losses - Individual Taxpayers Page 53 Special Issues in NOL Computations Passive Activity Losses: ▪ Only currently deductible losses become part of the NOL. ▪ Suspended losses become part of computation in the year they come out of suspension. Net Operating Losses - Individual Taxpayers Page 53 Ex 2.13 Bridgett has a $30,000 rental loss in 2015. Can only deduct $25,000 in 2015. $5,000 suspended balance is carried to 2016 Uses $25,000 as a business loss in computing 2015 NOL. Uses the $5,000 as a business loss in computing 2016 NOL -- IF -- the $5,000 is deductible in 2016. Net Operating Losses - Individual Taxpayers Page 53 Special Issues in NOL Computations Sale of Assets Used in a Trade or Business: ▪ Gain or loss is from business for NOL comps S Corporations and Partnerships: ▪ NOLs NOT claimed by S Corp or PS ▪ Losses flow to SHs / Ps who use loss to compute possible NOL ▪ Business / Non-Business nature determined by SH / P status in the S Corp or PS. Net Operating Losses - Individual Taxpayers Page 54 Optimal Use of an NOL Some tax benefits may waste NOLs because: ▪ They may reduce the NOL in loss year even though they do not reduce taxable income in that year or any year. ▪ In carryback or carryfoward years other items may reduce the NOL but not reduce taxable income in that or another years. A CPA and I once wasted a lot of research, time and effort arguing over an issue that had zero dollar impact. Net Operating Losses - Individual Taxpayers Pages 54 - 58 Comprehensive Example- Refer to Text Four steps to Compute NOL deductions for an Individual: 1. 2. 3. 4. Determine eligibility Compute the NOL Distribute NOL to carryback & carryfoward years. Calculate taxes in carryback and carryforward years. NOL Planning: A Case Study Page 54 Barb and Guy file MFJ & have 2 children. Their 2013, 2014 & 2015 income & deductions are shown on page 55, Fig 2.9. Sch A Form 1045 shows an NOL of $22,500 in 2015. See page 56, Fig 2.10. They provided a projection of 2016 income & deductions. See page 58, Fig 2.11. What advice do you give them to best use their deductions? NOL Planning: A Case Study Page 54 Barb and Guy file MFJ & have 2 children. Their 2013, 2014 & 2015 income & deductions are shown on page 55, Fig 2.9. Sch A Form 1045 shows an NOL of $22,500 in 2015. See page 56, Fig 2.10. They provided a projection of 2016 income & deductions. See page 58, Fig 2.11. What advice do you give them to best use their deductions? Let’s look at the facts…. NOL Planning: A Case Study Pages 55, 56 & from Appendix Page 68 Barb and Guy’s 2015 income and deductions: Total Income ($ 20,823) Adjusts to Inc ( 1,100) AGI ($ 21,923) Itemized Deducts ( 16,077) Includes $3,500 in RE taxes Total ($ 38,000) Add back: Nonbus Cap Loss 900 Nonbus Deducts over Nonbus Income 13,600 $15,600 (page 8) - $2,000 Dom. Prod. Act. Ded. 1,000 NOL ($ 22,500) NOL Planning: A Case Study Pages 57 - 58 Fig 2.11 Barb and Guy’s 2016 income and deductions projection: Wages $10,000 Interest 9,000 Business Income or (Loss) 30,000 Business capital gain 6,000 Non-Business capital gain 2,000 Total income $57,000 DPAD (Domestic Production Activity Deduction) - 1,000 AGI $56,000 $56,000 Itemized Deductions: State inc. tax 3,000 Real estate 4,000 Mrtg. Interest 6,000 Total Itemized Deductions $13,000 ( 13,000) Pers. Exempt. ( 16,000) Taxable income $ 27,000 Net Operating Losses - Individual Taxpayers Page 58 Optimal Use of an NOL If Non-Business deductions exceed: ▪ Non-Business ordinary income ▪ + ▪ Non-Business capital gains over losses In an NOL year then…. The excess deductions will never provide a tax benefit. Try to shift Non-business deductions & capital losses to another year for a tax benefit. Or try to shift Non-business income & capital gains to the loss year so it is tax free. NOL Planning: A Case Study Page 58 So, you brilliantly tell Barb & Guy to delay paying their 2015 real estate taxes until 2016. The result is: Their NOL in 2015 does not change. They get an additional deduction in 2016. Let’s see that the 2015 NOL does not change... NOL Planning: A Case Study Page 58 Barb and Guy’s 2015 income and deductions: Total Income ($ 20,823) ($ 20,823) Adjusts to Inc ( 1,100) ( 1,100) AGI ($ 21,923) $ 21,923 Itemized Deducts ( 16,077) 3,500 ( 12,577) Inc. after Item. Ded. ($ 38,000) ($ 34,500) Loss Add back: Nonbus Cap Loss 900 900 Nonbus Deducts over Nonbus Income 13,600 (3,500) 10,100 Dom. Prod. Act. Ded. 1,000 1,000 NOL stay the same ($ 22,500) ($ 22,500) NOL Planning: A Case Study Compare Form 1045 on p. 56, Fig 2.10 to Form 1045 on p. 59, Fig 2.12 Since Barb and Guy delayed payment of $3,500 real estate tax until 2016, they reduce 2016 income without reducing 2015 NOL Schedule A, Form 1045 would reflect these differences: 2015 Before Line 1 Loss before exemptions ( 38,000) Line 9 Nonbus Deductions over Nonbus Income 13,600 Line 22 Non-Bus Capital loss 900 Line 23 DPAD 1,000 Line 25 NOL does not change ( 22,500) After ( 34,500) Differ. 3,500 10,100 900 1,000 ( 22,500) (3,500) 0 0 0 NOL Planning: A Case Study Pages 58 - 60 And / Or you could brilliantly tell your clients to move non-business income or non-business capital gains from 2016 to the loss year 2015. The result is: Their NOL in 2015 does not change. They pay no tax on the income in 2016. Let’s see how that works if we can move $900 of the $9,000 in interest income from 2016 to 2015………. NOL Planning: A Case Study Pages 58 - 60 Barb and Guy’s 2015 income and deductions: Total Income ($ 20,823) Adjusts to Inc ( 1,100) AGI ($ 21,923) Itemized Deducts ( 16,077) Total ($ 38,000) Add back: Nonbus Cap Loss 900 Nonbus Deducts over Nonbus Income 13,600 Dom. Prod. Act. Ded. 1,000 NOL ($ 22,500) NOL Planning: A Case Study Pages 58 - 60 Barb and Guy’s 2016 income and deductions projection: Wages $10,000 Interest 9,000 Business 30,000 Business capital gain 8,000 Total income $57,000 DPAD (Domestic Production Activity Deduction) - 1,000 AGI $56,000 AGI State inc. tax Real estate Mrtg. Interest Total itemized Pers. Exempt. Taxable income $56,000 3,000 4,000 6,000 13,000 ( 13,000) ( 16,000) $ 27,000 NOL Planning: A Case Study Pages 58 - 60 Barb and Guy’s 2015 income and deductions: Total Income ($ 19,923) $ 900 ($ 20,823) Adjusts to Inc ( 1,100) ( 1,100) AGI ($ 21,023) ($ 21,923) Itemized Deducts ( 16,077) ( 16,077) Inc. after Item. Ded. ($ 37,100) ($ 38,000) Loss Add back: Nonbus Cap Loss 900 900 Nonbus Deducts over Nonbus Income 12,700 ($ 900) 12,700 Dom. Prod. Act. Ded. 1,000 1,000 NOL ($ 22,500) ($ 22,500) NOL Planning: A Case Study Compare Form 1045 on p. 56, Fig 2.10 to Form 1045 on p. 61, Fig 2.13 Since Barb and Guy moved non-business income from 2016 to 2015 they reduce 2016 income without reducing their 2015 NOL Schedule A, Form 1045 would reflect these differences: 2015 Before Line 1 Loss before exemptions ( 38,000) Line 9 Nonbus Deductions over Nonbus Income 13,600 Line 22 Non-Bus Capital loss 900 Line 23 DPAD 1,000 Line 25 NOL does not change ( 22,500) After ( 37,100) Differ. 900 12,700 900 1,000 ( 22,500) ( 900) 0 0 0 NOL Planning: A Case Study Page 60 And / Or you could brilliantly tell your clients to move non-business capital losses in excess of non-business capital gains from the 2015 loss year to 2016. The result is: Their NOL in 2015 does not change. They get a tax benefit from the non-business capital losses in 2016 and would get none in 2015. (But, we won’t go through the computations again) Just compare the Form 1045 on page 56, Fig 2.10 to Form 1045 on page 62, Fig 2.14 Net Operating Losses - Individual Taxpayers The Thing to Remember is on Page 58 Optimal Use of an NOL If Non-Business deductions exceed: ▪ Non-Business ordinary income ▪ + ▪ Non-Business capital gains over losses In an NOL year then…. The excess deductions will never provide a tax benefit. Try to shift Non-business deductions & capital losses to another year for a tax benefit. Or try to shift Non-business income & capital gains to the loss year so it is tax free. Net Operating Losses - Individual Taxpayers Page 60 Waiving Carryback may reduce tax liability – Use your “Crystal Ball” ▪ Are income & tax rates rising? ▪ Will credits be lost? ▪ Is income sufficient to use up a carryforward only? Net Operating Losses - Individual Taxpayers Pages 60 - 64 Present Value: To compare the impact of a CB to a CF you have to take into account the present value of money. ▪ Taxpayers receive immediate dollar benefit from a CB. ▪ Taxpayer dollar benefit from a CF takes place later in time. ▪ Will the taxpayer get immediate benefit by relief from making estimated tax payments or have to wait until later returns are filed? Net Operating Losses - Individual Taxpayers Pages 60 - 64 To measure the Present Value of Carryfoward ▪ Use Figure 2.15 if tax savings are used to reduce the estimated tax payments. ▪ Use Figure 2.16 if tax savings are used to reduce the tax paid with the return or increase the refund claimed on a return. Remember - Present value is less than face amount of tax savings of a carryforward. Net Operating Losses - Individual Taxpayers Page 64 Ex 2.17, Fig 2.17 Taxpayers had a $55,000 NOL in 2015. Options are to the 2015 NOL: ▪ Carry the NOL back to 2013 or ▪ Carry the NOL forward to 2016 2013 & 2016 income and deductions are shown in Fig 2.17. CB = A $6,506 refund from 2013. CF = Reduces the $6,686 tax in 2016 to -0-. Do you recommend CB or CF? Net Operating Losses - Individual Taxpayers Page 64 Ex 2.17, Fig 2.17 ▪ If the tax savings will be from reducing estimated tax payments for 2016 the present value of the $6,686 2016 tax liability is $6,598. ▪ Thus, the present value of the CF is $6,598 ▪ The $6,598 is greater than the $6,506 refund that would be received from a CB to 2013. ▪ The taxpayer should therefore forgo the CB…….But…… Net Operating Losses - Individual Taxpayers Page 64 Ex 2.17, Fig 2.17 ▪ If the tax savings will not be realized until 2017 when the 2016 return is filed the present value of the $6,686 2016 tax liability is $6,429. ▪ Thus, the present value of the CF is $6,429 ▪ The $6,429 is less than the $6,506 refund that would be received from a CB to 2013. ▪ The taxpayer should therefore take the CB to 2013. Electing to Forgo an NOL CB Page 64, Fig 2.18 ▪ To forgo a CB in favor of a CF the taxpayer must make an election on their timely filed return (including extensions). ▪ See Fig 2.18 for a sample election which reads: Taxpayers elect to forgo the net operating loss carryback period under I.R.C. § 172(b)(3)(C) for the net operating loss shown on this return. Appendix Pages 65 - 70 ▪ These pages shows computations used in the Case Study and can be used aws worksheets to help in computing: • Business and Non-business capital gains and losses. • Nonbusiness income and deductions to complete Sch A, Form 1045. • Itemized deductions for intervening years. Net Operating Losses - Corporations Corporation v Individual NOLs Same steps as an individual Same 2-year CB and 20-year CF Same sequence with 2 or more NOLs Different from an NOL for individuals: ▪ Different deductions to compute NOL ▪ Different modifications in CB and CF years ▪ Different forms for claiming NOL deduction Net Operating Losses - Corporations Figuring the Corporate NOL: Start with Corporations Taxable Income ▪ No increase in current NOL for CBs or CFs ▪ Eliminate Domestic Production Activities Deduction ▪ Can take deduction for dividends received without regard to aggregate limits (70% or 80% of taxable income) ▪ Can figure deduction for certain dividends paid Net Operating Losses - Corporations Claiming the Corporate NOL ▪ Form 1139 or Form 1120X ▪ Can extend time for paying tax for year preceding NOL -- Use Form 1138 Figuring the NOL ▪ Computes Modified Taxable Income to determine how much of NOL will be used in a year and CO to other years Net Operating Losses - Corporations Modified Taxable Income: Use Taxable Income and ▪ Deduct NOLs only from prior years ▪ Compute charitable contribution deduction without considering NOL CBs. Modified Taxable Income cannot be less than zero Modified Taxable Income is not used to complete tax return or figure tax That’s All for NOLs Don't bite the hand that... looks dirty. If you lie down with dogs, you'll... stink in the morning. Love all, trust ... me. The pen is mightier than the... pigs. An idle mind is... the best way to relax. Where there's smoke there's... pollution. Happy the bride who... gets all the presents. A penny saved is... not much. A bird in the hand is... Is going to poop on you.