Trends and Emerging Business Models

advertisement

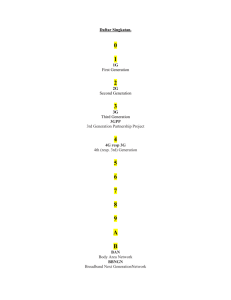

The future of wireless technology and its impact on e-business Presentation to Loyola University GSB Dr. Linda Salchenberger April, 2000 Anna Hillers 400 N. McClurg Ct. 1912 Chicago, IL 60611 Evolution of wireless technology Wireless meets Internet Everything – everywhere - always Best-in-Class Segment Players Trends and Emerging Business Models Anna Hillers 1 Evolution of wireless technology Wireless meets Internet Everything – everywhere - always Best-in-Class Segment Players Trends and Emerging Business Models Anna Hillers 2 GSM Global System for Mobile Communications With 200 million subscribers world wide and international coverage, GSM is the most successful digital mobile telephone standard Conversion: Analog/Digital Encoding/ Compression BTS = Base (Transceiver) Station MSC= Mobile Switching Center BTS = Base Station Mobile Phone: Data, Voice Global System for Mobile Communications (GSM) Features: • SIM (Subscriber identity module) allows for identification independent from phone • International Roaming (worldwide) • Voice and Data Service (SMS, 2 way messaging -> 14.4 Kbit/sec) • Call forwarding, Caller ID, Wait/Hold, Voicemail Anna Hillers 3 Upcoming Standards HSCSD, GPRS, EDGE, UMTS HSCSD, GPRS, EDGE are GSM-based standard, which enhance data transmission through enhanced software. UMTS, the European version of 3G will reach up to 2Mbit/sec through higher bandwidth. HSCSD: High Speed Circuit Switched data GPRS: General Packet Radio Service EDGE: Enhanced Data Rates for the GSM Evolution 3G: Third Generation (UMTS) • Circuit Switching: • Allows for ISDN speed: 56.7Kbit/sec • Introduced 1999 by some GSM carriers • TCP/IP protocol (Internet protocol), supports a wide range of bandwidth • Allows for up to 115 Kbit/sec • Will be introduced by the end of 2000 • Allows for up to 384 Kbit/sec • Will be introduced by 2001 • Increase of bandwidth • Allows for 2 Mbit/sec • Will be introduced by 2002 Anna Hillers 4 UMTS Total mobility Integrating other systems, UMTS will offer total mobility with a trade off between mobility and capability, leading to different levels of service International Roaming Next country 2.4-9.6 kbit (rest of world) Major roads: <384 kBit City: 2 MBit Suburbs: >384 kbit <115 kbit (GSM) Anna Hillers 5 UMTS Technical features compared with GSM UMTS is downward compatible to GSM technology but will be capable to offer advanced features beyond existing GSM systems UMTS • Up to 2 Mbit mobile packet data • Up to 384 Kbit mobile video GSM • 9.6 Kbit/s data, up to 112 Kbit/s with GPRS • Fixed/mobile convergence of protocols • Up to 64 Kbit/s mobile video with HSCSD • Switching platform based on GSM II+ • Services similar to ISDN • Wide range of terminals: voice, data only, multimedia • GSM switching platform • Downward compatible to GSM networks • Coverage limited but roaming available • Primarily voice terminals, first organiser announced • No compatibility to other networks • Full coverage, worldwide roaming Anna Hillers 6 UMTS Development path The present differences in coverage and service between GSM and UMTS will disappear in future as GSM evolves, while UMTS expands coverage Service/Capacity Speed UMTS • UMTS will initially only be available in urban areas, relying on GSM outside covered areas • Early UMTS terminals will only offer limited service (speed data <64Kbit), later developing towards high speed 2Mbit/s services UMTS GSM GSM • GSM is the standard with highest mobility (coverage footprint) worldwide Coverage • GSM will develop data up to 384 Kbit via GPRS Anna Hillers 7 UMTS Time schedule for introduction of UMTS The EU requirement will force UMTS licensing in most EU countries during year 2000 but Japan and UK will take the lead Licensing Preparation Mid 1999 UMTS auction in UK Licensing of UMTS I Year 2000 in UMTS licensing period License condition in D, DK, F, S (others) published Service development Licensing of UMTS II EU allows max. 12 month licensing delay March 2001, DoCoMo plans to launch UMTS in Japan Jan 2002, UMTS to be launched in Europe The three major stakeholders are 1. Customers, which demand service 2. Telecommunications operators, which want to stay ahead of the competition 3. Governments, which strive for the highest price Anna Hillers 8 UMTS Example for UMTS licensing in the UK Not only telecom companies might apply for UMTS licenses but also nontelecommunication firms such as IT-companies and equipment suppliers Non-telecom companies Telecom companies Industry Groups • Virgin IT-companies Microsoft Distributor • European telecom 3-5 UMTS licenses are currently auctioned Service provider • debitel • Mobilcom • Talkline • Airtel Regional players • Cellnet • Vodafone • Orange • Hutchison Eurpean players • Vodafone-Airtouch • Telia • Deutsche Telecom Fixed network operators • Internet SP • Energis • NTL License includes • 4 licenses with 2x15Mhz + 5Mhz unpaired each • Service requirement: 80% population coverage =70% area by the end of 2007 • License limitation for 20 years • No mandatory roaming, but roaming expected by government Anna Hillers 9 Evolution of wireless technology Wireless meets Internet Everything – everywhere - always Best-in-Class Segment Players Trends and Emerging Business Models Anna Hillers 10 Wireless meets Internet Middleware/Critical Services WAP The wireless application protocol (WAP) is the standard for bringing content, commerce, and other value-added services to wireless networks and mobile devices. Client WAP Gateway Encoded Request Origin Server Request Encoders and Decoders User Agent Encoded Response CGI Scripts etc. Response (Content) Content WAP Programming Model Benefits • Globally open standard that has already reached critical mass (80% of the industry) • Enables easy, secure access to relevant Internet/Intranet information and other services through mobile phones, pagers or other wireless devices • Provides the technology to develop, deploy and support wireless application, namely e-commerce Anna Hillers 11 Wireless meets Internet Middleware/Critical Services Bluetooth The Bluetooth phenomenon will likely have a powerful impact on this industry in the near future. Description Applications • An evolving specification of shortrange radio frequency being developed with most wireless vendors and some PC manufacturers • • Enables networking between devices within a range of 10 meters (30 feet through a radio frequency link in the unlicensed 2.4 gHz band) • Wireless access to peripherals – Connection of PCs with printers, faxes, other peripherals (e.g., PDAs) • Ad hoc conferencing – Facilitate ad hoc meetings (e.g., airports, hotels) that include data-sharing • Integration of digital cameras with mobile digital devices – Can send pictures directly from a Bluetooth-equipped camera to a PDA, notebook, or printer; or it could transmit to a wireless network • Will be embedded in most cellular phones and laptop devices by the end of 2000 and cost between $5 and $15 per module Device-independent mobile data – User could use Bluetooth to receive an e-Mail on a PDA from a notebook without having to power on the notebook – User could access the Internet via cell phone while receiving Web pages on a laptop or PDA • Will be capable of speeds approaching 1 Mbps • Backed by an alliance between Intel, Nokia, Ericcson, Toshiba, and IBM Implications • Reduces burden of creating single, complicated, small devices • Improves connectivity between devices Anna Hillers 12 Evolution of wireless technology Wireless meets Internet Everything – everywhere - always Best-in-Class Segment Players Trends and Emerging Business Models Anna Hillers 13 Current Industry Dynamics The Global Field At this early stage of development, the market for mobile data over cellular services will be more developed in Europe and Asia than in the United States. Current Situation • Thanks to the consistent GSM Europe and Asia are ahead of the fragmented U.S. market . • The U.S. have seen higher growth in part of the value chain, which is closer to the Internet (middleware, value-added services, content, commerce). • Wireless “smart” phones dominate in Europe and Asia, while PDA-based wireless units are more prevalent in the United States. 16 • Migration toward 3G will fuel more uniform growth globally. • Mass market will fuel need for high capacity data transmission Europe U.S. Asia/Pacific 1998 1999 2000 2001 2002 2003 Cellular Data Users by Region (millions of subscribers) Europe 12 U.S. 8 4 Asia/Pacific 0 1998 Future Trends • Multinational cross-border partnerships will blur geographic distinctions. SMS Users by Region (millions of subscribers) 50 40 30 20 10 0 1999 2000 2001 2002 2003 Worldwide Smart Handheld Device Shipments (millions of units) 1998–2003 CAGR 12 10 U.S. 32% Japan 42% Western Europe Rest of World 8 6 38% 67% 4 2 0 1998 1999 2000 2001 2002 2003 Anna Hillers 14 Current Industry Dynamics Wireline Versus Wireless Networks Growth of Data Traffic We have seen explosive growth of data traffic over wireline networks in the past 10 years. In the next five to seven years, an analogous explosion will occur over wireless networks. Migration to Data in Wireline and Wireless Networks Market Growth Forecasts 100 100% Incumbents Evolving to IP-Based Networks IP Data Wireline Incumbents Revectoring Evolution to IP-Based Networks New Entrants Using IP-Based Networks Traffic Carried by Carrier Networks New Entrants/Lead Incumbents Evolve to IP-Based Wireless Mass Market ISP/e-Commerce 50 50% Client/Server Business (IT) Solutions Browser (Netscape) Technology Adoption Application Enablers Business/ Commercial Wireless Sub-$100 Devices MicroBrowsers Air Interface Improvements Network Improvements Lower $/MOU Incumbents Focused on Voice Voice “The compound annual growth rate (CAGR) for wireless data from 1996 through 2003 is projected to be 35%. The market is expected to reach close to $2.5 billion by the year 2002.” Source:Frost & Sullivan Market Research. “Two million wireless data subscribers existed in 1997. Over 40 percent average annual growth is expected through 2002.” Source:U.S. Mobile Data Marketplace. Mass Market Voice 100% 0 1990 1990 1991 1992 1993 1994 1995 1995 1996 1997 1998 1998 1999 2000 2001 2002 2002 2003 2004 2005 2005 Source: Nortel Networks and the Yankee Group. Key Messages • Wireless will follow wireline model. • Network evolves to an IP architecture as data traffic carried over the network increases (more than 50 percent). Anna Hillers 15 Current Industry Dynamics Technology meets customers Opportunities in the mobile data market are immense. Convergence Customers Convenience Simple Text Wireless Connectivity Corporate/ Institution e-Mail Business PC Usability and Power Internet Access Content Consumer The convergence of three strong and powerful industries is creating a flood of opportunity. Applications, once confined to large corporate infrastructure, are finally becoming available and affordable to the mass market. Commerce The true potential has yet to be realized. The evolution of advanced content and commerce will cause this market to explode. Anna Hillers 16 Current Industry Dynamics Technology and Market Barriers Several technology and market barriers exist to impede the rapid development of wireless data services. Technology Barriers Device Ergonomics (Form Factor) Market Barriers Lack of “Killer” Apps Data Security Cost of Access Data Throughput Cost of Handheld Devices Network Reliability Pricing Models Network and Technology Standards Integration of Various Components Perceived Value to Customer Anna Hillers 17 Current Industry Dynamics Technology Barriers Current Initiatives Trends indicate that most of these technology and market barriers are expected to be addressed in the next two years by several key enablers. Technology Trends Throughput GPRS, EDGE and UMTS will increase transmission speed Network coverage and infrastructure is improving (build-out) Device Ergonomics SIM Applications, WAP will improve the interface Data Security Equipment and middleware providers are addressing security Network and Technology Standards WAP is becoming a standard protocol, Migration paths to 3G are developed Lack of “Killer Apps” Cost of Access Intranet/extranet browsing is vital to mobile work force Increased Customer Value Network Reliability Integration of Various Components Market Trends Prices will fall similar to the wire line industry Cost of Handheld Devices Devices with serverbased micro-browsers cost considerably less than devices with built-in micro browsers Pricing Models Providers must develop new pricing schemes Bluetooth will improve connectivity Anna Hillers 18 Current Industry Dynamics Mobile Data Mass Market Applications Over time, as wireless technology and the Internet have evolved, mobile data services have finally begun to penetrate the mass end-user market. Type of Service Content e-Mail Services Drivers of Mass Market Adoption Internet Access Wireless Knowledge Intranet Access Improved Reliability and Speed of Wireless Networks Development of Data-Capable Information Devices News Text-Based Information Services Large-Scale Use of the Internet and Dependence on It Financial Travel Weather AccuWeather Sports Entertainment Content Aggregators and Distributors e-Commerce Anna Hillers 19 Evolution of wireless technology Wireless meets Internet Everything – everywhere - always Best-in-Class Segment Players Trends and Emerging Business Models Anna Hillers 20 The Wireless Value Chain To best capture the abundance of opportunities available in this growing market, we must understand the dynamics of each value chain segment. IT Telecom Infrastructure Create Technologies and wireless architectures Access Devices Phones Pagers PDAs etc. Carriers Provide wireless voice access or Internet access Middleware/ Critical Services Software that optimizes networks and Browser capabilities ValueAdded Services Large range of services: Synchronization, Commerce enabling applications, Document compatibility Content Create and bundle Content for providers Provide Application tools Commerce Common Web Commerce services • What role does the segment play? Key Issues to Understand • Who are the leading participants? • What are the most significant trends in each segment? Anna Hillers 21 Value Chain From Content to Customer Today, multiple content distribution models exist – some models gain advantage of value chain disintegration, by providing more direct service Carrier Value Added Services Content Sources Wireless Device Wireless Device Wireless Customized and Packaged Data Services Value-Added Information Reseller • Infospace.com • Intelligent Information Incorporated WAPCompliant Device Carrier Network and Proxy Content in Server WML Format (Phone.com) Web Content in HTML Format • Online Anywhere software converts Yahoo! content to a wireless format in real time Selected Network of Content Providers • Reuters • CNN • The Weather Channel WWW • Converts HTML Web documents into WML, thus readable by WAP-compliant wireless devices Anna Hillers 22 Market Forces by Value Chain Segment Access Devices The wireless access device serves a critical function as the primary interface between the user and data applications. Wireless Handsets Qualcomm PDQ Phone • Europe/Asia will see first devices • Data entry methods will also need to improve PDAs Mobile Computers Modem Devices Others 3Com Palm VII Sharp Mobilon Tripad Sierra Wireless Aircard 300 Rocket eBook from NuvoMedia • An extremely large market will open up when throughput rates increase to 115 kbps and beyond • Market will flourish since it is a compelling alternative to purchasing wireless-ready devices • Wireless applications for nonstandard devices will begin to gain acceptance as the market continues to mature • Windows CEbased PDA will become an increasing threat to Palm dominance • Increased competition Anna Hillers 23 Best-In-Class Segment Players Access Device 3Com Palm Products (Palm VII) Palm computing has shot to the forefront of convenient, handheld Internet access products with the introduction of the Palm VII. Key Success Factors Maximize revenue streams from product sales, service, licensing and commission on commerce Increase customer base through shift from “organize” to “access” information Key Initiatives and Strategic Direction • Hundreds of content providers signed up for content provision • Wireless manufacturers are creating wireless attachments • Joint venture with Aether to form Open Sky – offer services nationwide over any standard Effectiveness • Connection speed is limited at 8 kbps • Pricing structure somewhat limited in usage. • Limited success for the Palm because of distribution only in New York. Technical, billing, customer support, and other issues need to be worked out as well. pdQ-800 pdQ-1900 Target Market and Services • Consumer and business markets. • Device offerings include the Qualcomm PDQ phone and the Palm VII. • Internet access and wireless services available through BellSouth’s Wireless Data network covering 260 U.S. regions Business Model • Revenue streams: product sales, recurring service revenues, licensing agreements and commissions on commerce transactions • Service provided is branded by Palm (Palm.net). Service revenue potential ranges from a cost of $120 to $300 per year, shared with Palm Strategic Positioning • First to market, solid reputation, brand name recognition • Palm VII has a slight change in target market: Goes from “people who want to organize their information” to “people who want to access information.” Anna Hillers 24 Market Forces by Value Chain Segment Carriers The growth of wireless subscribers, coupled with strong Internet growth, are the primary drivers for the service provider market and will lead to new relationships and increased competition between carriers Opportunities: Internet + Wireless = • An increase in Internet use results in increased air-time for service providers, and increased revenue per user. • Ability to provide Internet and e-Commerce-based services will increase “lock-in” and reduce churn. Equipment Manufacturer Network operator ISP • New relationships between network operators, IPS and wireless equipment manufacturers all aiming to provide wireless access and content • Incumbents and new entrants are racing to sign up content providers and establish relationships Anna Hillers 25 Best-In-Class Segment Players Carrier GoAmerica GoAmerica is a new breed of service provider that specifically targets the mobile data market. Key Success Factors “one-stop” shopping concept for nationwide wireless data services through strategic partnerships with equipment makers and content providers Focuses on building brand image Key Initiatives and Strategic Direction • Formed partnerships with Yahoo and Ericsson Wireless Solutions Target Market and Services • Offers services to corporations carriers, and mobile professionals. • Offers an interactive Web content service • Service is compatible with several popular devices. Effectiveness • Reached strong market penetration for its services • Teams up with best-in-class players to provide its services Business Model • Resells air time from AT&T. • Acts both as a content aggregator as well as a wireless service provider and provides content aggregation services on a wholesale basis. • Offers wireless services to traditional ISP Strategic Positioning • Positions itself as the leading nationwide wireless ISP • Partners with best-in-class service providers, content providers and device manufacturers such as AT&T, 3Com, BellSouth Wireless Data, and Wireless Knowledge Anna Hillers 26 Market Forces by Value Chain Segment Middleware/Critical Services The middleware segment includes a broad variety of software solutions, often consisting of a client/server architecture designed to optimize the mobile link. www-Protocol Stack Server-Level Middleware Network Protocol Client-Level Middleware Device Value-Added Services and Applications Device OS WAP Protocol Stack Other Server-Based Middleware GPRS SAMA+ IS95-B CDMA+ WAP Client Other Device-Based Middleware (Nettech’s InstantRF, Smart IP . . .) Micro Browser Windows CE e-Mail Fax Symbian’s EPOC 32 SMS Other Other Apple’s Newton Anna Hillers 27 Best-In-Class Segment Players Middleware/Critical Services Phone.com Phone.com’s positioning as the converter of mass market phones to wireless “companions” has been a huge success. Key Success Factors Positioning as the ubiquitous standard for wireless Internet applications (creator of WAP) Market leadership with strong penetration to all major carriers and manufactures worldwide. Key Initiatives and Strategic Direction Effectiveness • 75% of the wireless phone browser market under multi-year contracts to embed its product into new devices • 31 global carriers under multi-year contracts, some of which are prepaid licenses • Contracts with a lot of manufacturers to use technology in their next phone generation • Phone.com’s unique platform is the only integrating Internet and wireless system. • “push” data to its customers, increase customer loyalty (by reducing churn), and raise potential revenue per user (RPU) are strong incentives for carriers and phone subscribers to use Phone.com’s technology. Target Market and Services Business Model • Offers platforms for carriers and for device manufacturers, Content, and Network Management Systems • Software optimized for mass market wireless telephones, supports all wireless protocols, and is operating system and processorindependent. • 2 sources of income: Serves as a bridge between device manufacturers and carriers • Push Server technology allows for increased revenue potential • Network management and content applications cater to carrier and developer markets, respectively Strategic Positioning • First-to-market leader in wireless and Internet integration (Former Unwired Planet) • Set the standard for wireless data services through its leadership of the WAP forum. • Major competitive threats are Nokia, Ericsson, and Microsoft Anna Hillers 28 Market Forces by Value Chain Segment Value-Added Services Value-added software providers create applications to enhance the ease with which wireless/Internet devices function. Sample Value-Added Service Offerings Synchronization The segment is very young and highly fragmented. Many services, once considered value-added— such as e-Mail—are now essential. Conversion of Software Large device manufacturers are generally not as concerned with true interoperability as the consumer; therefore, the role these entrants play will be important. Information Management Some device manufacturers have shown strong, proactive interest in developing these services, as evidenced by Motorola’s involvement in Starfish. Access Software for Content and Applications Overall, this segment will continue to grow rapidly. Anna Hillers 29 Best-In-Class Segment Players Value-Added Software AvantGo With its product expertise in transforming “Web content” to “wireless data” and its capability to aggregate numerous content partnerships, AvantGo is positioning itself to become a true “wireless portal.” Key Success Factors Strives for industry leadership through high profile partnerships Bundles e-Commerce opportunities with content channels Key Initiatives and Strategic Direction Effectiveness • "wireless portal” for Palm OS and Windows CE devices, like AOL for desktop PCs • 40 Fortune 500 companies use AvantGo to provide mobile information • Bundling agreements on devices from HP, Phillips, Casio, Palm Computing, IBM, and Symbol • Supports hundreds of thousands of registered users of both Palm OS and Windows CE handheld devices Target Market and Services • Enterprise product and a free consumer service. • Scalable solution for transferring data and applications onto handheld computers. • Personalized content offline or wirelessly in real time—anytime, anywhere Compatible with PalmOS/Windows CE platforms Business Model • Mobile enterprise solutions and Web-based application hosting to Fortune 1,000 companies • Partnerships with a variety of content providers • Free service as a promotion for business solutions Strategic Positioning • Spearheading the Mobile Link initiative, an open industry standard for connecting mobile devices to server-based applications • Microsoft and 3Com are investors. AvantGo serves as an independent software vendor (ISV) to both Anna Hillers 30 Market Forces by Value Chain Segment Content In today’s wireless data market, there are three main groups of companies that are providing content to all types of wireless devices. Information Suppliers Description Players Value-Added Information Resellers Web Portals • Media and news companies that author, publish, and syndicate content • Act as intermediaries by aggregating, customizing, and transforming Web content • Resell content and services primarily to carriers and/or end-users • No brand presence on the Web • Act as intermediaries by aggregating, customizing, and transforming Web content • Large brand presence and subscriber base on the Web • • • • • • • • • • • Yahoo! Mobile • MSN Mobile • AOL Anywhere CNN Reuters The Weather Channel Fidelity • Basic news, financial and weather information Features Intelligent Information Inc. (iii) AvantGo.com GoAmerica Infospace.com @Mobile Palm.net • Personalized content including news, financial information, and weather alerts • Limited content • e-Mail, calendar tools, and targeted e-Commerce • Personalized content including news, financial and entertainment information • Large breadth and depth of content • e-Mail, calendar tools, and eCommerce Anna Hillers 31 Best-In-Class Segment Players Content Yahoo! Yahoo! is positioning itself to be the leading content provider for wireless Internet users. Key Success Factors Continue to build strategic content distribution agreements with a number of wireless service providers. Increase revenue stream by incorporating more contentdriven commerce opportunities and value added services. Key Initiatives and Strategic Direction • Acquired Online Anywhere, a provider of Web delivery solutions for non-PC appliances, which tackles the non-PC market • Announced several wireless content distribution agreements: PageNet, Sprint PCS, Palm Computing Target Market and Services • Users of Palm and Microsoft CE computing platforms • Markets Yahoo mobile! Via Yahoo site • Targets Yahoo!’s existing 35 million subscribers and that of its wireless partners’ (Sprint PCS, PageNet) Effectiveness • Strong commitment and investment by Yahoo! • Difficult to assess since wireless Internet access and content distribution is in a very early stage Business Model Strategic Positioning • “Stickiness” shall generate revenues through Yahoo online storefront and auction site • First portal to align itself with a service provider to provide Web access • Fees for the distribution of personalized news and content alerts to pagers and PDAs • Personalized content and direct marketing • Wireless partners for access to Yahoo content “anytime and anywhere” • International expansion Anna Hillers 32 Market Forces by Value Chain Segment Commerce With WAP as a standard and mobile Internet access growing, wireless e-Commerce is set to explode. Online Banking Online Stock Trading • Discount brokerages already offer wireless stock trading • Fidelity has teamed up with Palm to offer brokerage services Players • Fidelity • e-Trade • Mydiscountbroker.com • Banks will push their services to wireless users Players • Wellsfargo.com • Paybox.com • Citibank Players • Amazon.com • Buy.com • Barnesandnoble.com • eBay and SkyTel have partnered to provide auctioning services to SkyTel’s two-way paging customers Players • eBay • onsale.com • Yahoo! auctions Entertainment Wireless User • Showtimes.com currently transmits showtimes to Yahoo! mobile users; next step is to sell tickets • Look for traditional ticket houses to sell tickets wirelessly Retail • Books and CDs represent low-cost impulse purchase opportunities for wireless users • Expect significant wireless e-Tailing Auctions Travel • Ability to purchase airplane, train, and bus tickets and reserve car and hotel reservations Players • Travelocity • Expedia.com • Biztravel.com Players • Ticketmaster.com • Showtimes.com Anna Hillers 33 Best-In-Class Segment Players Content/Commerce Intelligent Information Incorporated Intelligent Information Incorporated is striving to make the user experience more personalized, a key success factor in this industry. Key Success Factors Increase number of content distribution partnerships with wireless service providers Expand content and services to meet the immediate and high value-added needs of users Key Initiatives and Strategic Direction • Partnered with AT&T Wireless to provide personal news service for its digital/PCS subscribers. • Customer base: 50% of the largest U.S. paging carriers and 8 PCS/digital cellular carriers Target Market and Services • Provides wireless personalized and customizable information and consumer e-Commerce services by creating a “wortal” • Markets content and services to wireless carriers and media enterprises Effectiveness • Ability to customize information leads to reduced churn and increased revenue per user through longer on-phone times and more outbound calls. Business Model • Revenue through the distribution of content to wireless service providers and new media enterprises. • Value-added services to wireless carriers: customer care and billing for news services Strategic Positioning • Cooperation with Nokia for activities focused on supporting WAP and the growing demand for mobility • Developing local/national content Anna Hillers 34 Evolution of wireless technology Wireless meets Internet Everything – everywhere - always Best-in-Class Segment Players Trends and Emerging Business Models Anna Hillers 35 Trends and Emerging Business Models Trends Partnership and alliances fuel the current evolution, however it is unclear how the customer can reached and who “owns” him or her How would wireless E-Commerce be marketed? What Type of e-Commerce Opportunities Should Be Delivered? Who Keeps the Transaction Revenues? User Anna Hillers 36 Emerging Business Models The Device-Centric Model The new Palm model is a compelling example of how a device manufacturer can capture value in this new industry. Access Devices Infrastructure Carriers Middleware/ Critical Services ValueAdded Services Content Commerce Palm.Net Customer Experience User logs on to Palm.net Customer purchases Palm VII device mySimon.com User compares prices and reads reviews through mySimon.com User auctions for product on eBay $$ $$ $$ Value Captured “Traditional” revenue stream $600 Retail price Additional potential recurring revenue stream $10–$25 per month mySimon and other content providers strike deals to embed software on Palm Palm earns commission on transaction Anna Hillers 37 Trends and Emerging Business Models The Carrier Owns All In a carrier-centric model, the carrier truly “owns all”—the service, the content, and most importantly, the customer experience. Infrastructure Access Devices Carriers Middleware/ Critical Services ValueAdded Services Content Commerce Select Content/Commerce Partnerships WWW Wireless Customer Pays for Network “Air Time” and Access to Content Revenue Flows Select Content and Commerce Partnerships • Customer pays carrier for network “air time” and access to content. • Models can vary: Subscription-based, pay-as-you-go, and “free device/charge for service.” • Carriers pay content aggregators and suppliers. Anna Hillers 38 Trends and Emerging Business Models The Wireless Portal: “Wortal” In the “wortal” business model, established Internet portals still provide free content, thus successfully owning the customer in the wireless world. Access Devices Infrastructure Carriers Middleware/ Critical Services ValueAdded Services Content Commerce Wireless WWW Pays for “Air Time” and Not Content Selected Content/Commerce/Applications Revenue Flows Other Companies Pay for Advertisements and Marketing Services • Customer pays carrier for network “air time” (i.e., flat monthly service fee or per-minute usage rate). • The “wortal” earns revenues from advertising and targeted marketing services for e-Merchants. • Content is free for end-user. Anna Hillers 39 Trends and Emerging Business Models Summary The success or failure of wireless Internet will depend on the capability of all participants to offer superior value to the customer Success? Wireless + Internet • Commitment of big players • Mobility is a customer need • 3G = ww success like GSM • 2 Mbit/sec will be needed Bubble? • Volatile stock markets • Fierce competition • 3G = 3rd generation or third failure • Inherent fixed infrastructure, 2Mbit/sec = overkill? Anna Hillers 40