Challenges to Valuing an S Corporation in the Gross Environment

advertisement

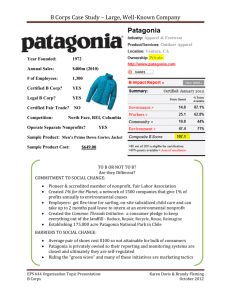

The Institute of Business Appraisers 2003 Annual Business Valuation Conference Challenges of Valuing an S Corporation in the Gross Environment 6/02/03 Dennis Bingham Robert Strachota Scot Torkelson William Herber 1 Here is a Group of Appraisers Trying to Value an S Corporation 2 Introduction / Background Shenehon was hired to help resolve a significant additional tax imposed by the IRS on a manufacturing company that gifted a 25% minority interest to a GRAT The original valuation was done by another firm using traditional methods to value the S Corp Although we were able to reduce the tax and interest by half at the agent level based upon our Continuum Model, that reduction was still not reasonable and the case is now going to Appeals 3 Introduction / Background The IRS position is very strong in application of what we call the Gross Formula The IRS in determining the additional tax and interest valued the company without tax affecting the earnings - the Gross Formula The report in this instance was submitted before the Gross Case was decided but was under audit when the case was decided and is now being held to the Gross Formula 4 Introduction / Background The Shenehon Continuum is a Model which measures the benefits of the S Corp election over a C Corp election Our model is a way to measure the premium of the Corporate S election It is only applicable when an analysis is first made of the company as if it were a C Corporation, ie. Taxes at the corporate level have been deducted (tax affected) 5 What is all the Fuss About?? The Gross Case conclusion results in an S Corp value which is 69% greater than an otherwise identical C Corporation Why?? S Corporations pay only one level of tax at the personal level. While a C Corporation pays taxes at the Corporate level and when dividends are paid at the personal level as well The issue is two levels of tax vs. one level of tax 6 Chart 2:0 7 Gross Court Quote “We disagree with the tax court’s characterization of the respective experts’ approaches to tax affecting as a mere difference in variables. There was no spectrum of tax percentages from which the court could have selected. Rather, the choice was either a corporate tax rate of 40% or a rate of 0%, the latter meaning no tax affect at all. But while the tax court’s analysis was rather cursory, we do not believe that further evaluation was necessary under the circumstances.” Gross 6th Circuit (emphasis added) 8 9 10 Chart 2:1 Establish Minority Value per Share of Subject as a C Corporation Value per Share Adjustments > for S Corp Premium > of Subject as an S Corporation 11 “‘Why won’t people become S Corporations and increase market cap by 60%?’ The answer is, well if they could, they should . . . if organizations choose their organizational form appropriately, you will not see this large value gap.” “S Corporations have a tax advantage than C Corporations. This tax advantage is a function of payout rate; it is a function of corporate versus personal marginal tax rates.” Bajaj, transcript 12 The fact is, in general, corporations that are organized as C Corporations reduce some of the potential value differential … because, given their investment and distribution policies, they expect not to make large distributions … which tend to favor C Corporations …. Bajaj 13 Chart 3:1A Polar Example: Family Farm S Corporation •No Operating Income •No Distributions •No Increase in the Market Value of Farm Land 14 Chart 3:1B Polar Example: Family Farm S Corporation •No Operating Income •No Distributions •No Increase in the Market Value of Farm Land 15 Bajaj: “There are offsetting disadvantages of being an S Corporation and I addressed this question, as well in the Gross case and the example I used was that of Netscape. . . I testified that . . . it would be silly for Netscape Corporation to be an S Corporation.” --------------Why?? Because Netscape Made No Distributions There would be NO S Corporation Benefit/Premium 16 Chart 3:2A Polar Example: 100% Distribution S Corporation 17 Chart 3:2B Polar Example: 100%Distributing C Corporation 18 Chart 3:3 19 Step 4 “Shareholders of C Corporations directly or indirectly through the Corporation or through themselves pay two taxes, one at the level of Corporation and then at their own level, whereas holders of S Corporations pay only one layer of tax. “[The] level of distributions would affect relative values of S versus C corporation and that is absolutely correct …. The relative advantage of an S versus C Corporation is very much a function of level of payouts. Other things being equal, in general, the higher the payout ratio the more advantageous it would be to be an S Corporation.” Bajaj 20 Chat 4:1A 21 Chart 4:1B-1 Comparison of C Corp vs. S Corp Distributions S Corp Benefit Premium (S-C/C) 69.5% 22 Chart 4:1B-2 Comparison of C Corp vs. S Corp Distributions S Corp Benefit Premium (S-C/C) 18.9% 23 Model of S Corp Benefit Premium Calculation With Equivalent S Corp % Dividend Distributions C Corp Shareholder benefit Income Tax on income Net Income 100.00 (41.00) 59.00 100.00 (41.00) 59.00 100.00 (41.00) 59.00 100.00% 59.00 (27.14) 31.86 50.00% 29.50 (13.57) 15.93 0.00% 0.00 0.00 0.00 0.00 29.50 59.00 31.86 45.43 59.00 S Corp Shareholder benefit Income Retained By Corporation Dividend (Pretax income less amount retained in Corp) 100.00 0.00 100.00 100.00 (29.50) 70.50 100.00 (59.00) 41.00 Tax on income (46.00) (46.00) (46.00) 54.00 0.00 54.00 24.50 29.50 54.00 (5.00) 59.00 54.00 100.00% 70.50% 41.00% 69.49% 18.86% 0.00% C Corp Dividend % of Net Income Dividend Tax Retained by Shareholder Retained By Corporation (Net Income less Dividend) Total C Corp Shareholder Benefit Retained by Shareholder Retained by Corporation (Income less dividend) Total S Corp Shareholder Benefit S Corp Dividend % of Income S Corp Premium 24 4:1D Graph Calculation of S Corp Benefit 80% S Corp Benefit 70% 60% 50% 40% 30% 20% 10% 0% C Corp 0% S Corp 41.0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 46.9% 52.8% 58.7% 64.6% 70.5% 76.4% 82.3% 88.2% 94.1% 100.0% Market Distribution Percentages 25 Chart 4:2 Key of the Respective S Corp Benefits Relative to C Corp vs. S Corp Equivalent Distributions C Corp Dividend % of Net Income 100.00% 90.00% 80.00% 70.00% 60.00% S Corp Dividend % of Pre tax Income 100.00% 94.10% 88.20% 82.30% 76.40% 69.49% 56.19% 44.82% 34.99% 26.42% S Corp Premium C Corp Dividend % of Net Income 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% S Corp Dividend % of Pre tax Income 70.50% 64.60% 58.70% 52.80% 46.90% 41.00% S Corp Premium 18.86% 12.16% 6.18% 0.80% 0.00% 0.00% 26 Chart 5:1 In 1992, Gross was Distributing 100% of its Net Income to Shareholders Year 1988 1989 1990 1991 1992 Average Total Income 17,731,135 19,479,830 23,946,605 24,338,440 27,585,873 Total Distributions 17,778,483 19,458,148 24,032,657 24,126,041 28,188,889 % of Total Distributions to Total Income 100.27% 99.89% 100.36% 99.13% 102.19% 100.37% 27 Chart 5:2B Ye ar Coca Cola Bottling Discretionary D iv ide nds 88 - 90 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 100.0% 100.0% 100.0% 52.0% 66.0% 60.0% 57.0% 55.0% 56.0% 100.0% 100.0% 5 Year Avg - 88-92 100.0% 5 Year Avg - 93-97 58.0% 28 Chart 5:3 Gross Case as of Valuation Date 1992 and 1998 29 Chart 5:4 S Corp Premium 0.0% 0.0% .8% 6.2% 12.2% 18.9% 26.4% 35.0% 44.8% 56.2% 69.5% 30 Chart 6:1A Type of Industry E Commerce Restaurant Manufacturing Cosmetics/Household Railroad Publishing/Chemical Coal/Tobacco Natural Gas Petroleum Canadian Energy (Hydro) Gross C Corp Market S Corp Equiv. Distribution Distribution Percentage Percentage 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 41.0% 46.9% 52.8% 58.7% 64.6% 70.5% 76.4% 82.3% 88.2% 94.1% 100.0% S Corp Benefit 0.0% 0.0% 0.8% 6.2% 12.2% 18.9% 26.4% 35.0% 44.8% 56.2% 69.5% 31 Chart 6:1B Type of Industry E Commerce Restaurant Manufacturing Cosmetics/Household Railroad Publishing/Chemical Coal/Tobacco Natural Gas Petroleum Canadian Energy (Hydro) Gross C Corp Market S Corp Equiv. Distribution Distribution Percentage Percentage 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 41.0% 46.9% 52.8% 58.7% 64.6% 70.5% 76.4% 82.3% 88.2% 94.1% 100.0% S Corp Benefit 0.0% 0.0% 0.8% 6.2% 12.2% 18.9% 26.4% 35.0% 44.8% 56.2% 69.5% 32 Chart 6:2 Calculations of Dividend Distributions as a % of Net Income Metal Fabrication Industry Metal Fabrication P ublic C Corpora tions S Corp Equiv. 1995 1996 1997 1998 Avg. Amcast Industrial Corp. Fastenal 26.0% 3.0% 30.0% 2.0% 32.0% 2.0% 36.0% 1.0% 31.0% 2.0% Illinois Toolworks Kennmetal 19.0% 23.0% 18.0% 23.0% 18.0% 24.0% 19.0% 26.0% 18.5% 24.0% The Timken 25.0% 22.0% 23.0% 34.0% 26.0% 59.3% 42.2% 51.9% 55.2% 56.3% Median 23.0% 22.0% 23.0% 26.0% 24.0% 55.2% 21.0% 53.4% Value Line Average 33 Chart 653A Industry Average Comparison Metal Fabrication (Value Line) C Corp vs. S Corp from Industry Average Data S Corp Premium (S-C/C) 1.3% 34 Chart 6:5B Industry Average Comparison Comparable Analysis C Corp vs. S Corp from Industry Average Data S Corp Premium (S-C/C) 2.9% 35 Chart 6:5C Calculation of S Corp Benefit 80% S Corp Benefit 70% 60% 50% 40% 30% 20% Market Data 10% 0% C Corp 0% S Corp 41.0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 46.9% 52.8% 58.7% 64.6% 70.5% 76.4% 82.3% 88.2% 94.1% 100.0% Market Distribution Percentages 36 Quantifying the Tax Difference Between an S Corp and a C Corp Lets Set the Stage Facts •There are Tax Benefits to an S Corp relative to a C Corp at the time of a 100% Interest Sale •This again due to the issue of single vs. Double Taxation •When valuing a Minority Interest in a Company a Sale of the 100% Interest is NOT Triggered Questions •Whose Point of View? Buyer or Seller? •What Level of Value? Entity Level or Shareholder? •How do you Value the Tax Benefit? 37 Defining the Issues of Tax Differences Between C and S Corps • Capital Gains Taxes at the time of sale are different between a C Corp and S Corp • As with dividends, S Corp proceeds are taxed once while C Corp are taxed twice: – C Corps are taxed once at corporate rates at the time of the sale and again when distributed to the shareholder at capital gains rates – S Corps are not taxed at the time of sale at the corporate level. The S shareholders get a stepped up basis in the retained earnings (AAA) and the shareholder is taxed at capital gains rates. 38 An Example of Tax Differences Between S Corps and C Corps - Stock Sale Sale Price $1MM $1MM C-Corp S-Corp Assets Cash FF&E Accumulated Depreciation Total Assets $250,000.00 $250,000.00 $1,250,000.00 $1,250,000.00 ($500,000.00) ($500,000.00) $1,000,000.00 $1,000,000.00 Equity Stock & Paid in Capital Retained Earnings/AAA Total Equity $200,000.00 $800,000.00 $1,000,000.00 Stock Sale Adjusted Basis in Stock Gain on Sale of Stock Federal Tax on Seller All Capital Gain Net Cash to Seller Sale Price $2MM $2MM C-Corp S-Corp $200,000.00 $800,000.00 $1,000,000.00 $1,000,000.00 $1,000,000.00 $2,000,000.00 $2,000,000.00 ($200,000.00) ($1,000,000.00) ($200,000.00) ($1,000,000.00) $800,000.00 $0.00 $1,800,000.00 $1,000,000.00 $160,000.00 $840,000.00 $0.00 $360,000.00 $1,000,000.00 $1,440,000.00 20% Increase $200,000.00 $1,800,000.00 24% Increase 39 An Example of Tax Differences Between S Corps and C Corps - Asset Sale Sale Price $1MM $1MM C-Corp S-Corp Assets Cash FF&E Accumulated Depreciation Total Assets $250,000.00 $250,000.00 $1,250,000.00 $1,250,000.00 ($500,000.00) ($500,000.00) $1,000,000.00 $1,000,000.00 Equity Stock & Paid in Capital Retained Earnings/AAA Total Equity $200,000.00 $800,000.00 $1,000,000.00 $200,000.00 $800,000.00 $1,000,000.00 $1,000,000.00 ____________ $1,000,000.00 $1,000,000.00 ___________ $1,000,000.00 Asset Sale Corporate Federal Tax Liquidation Proceeds Federal Tax on Seller Adjusted Basis Taxable Gain Distributed/ Allocated Individual Tax Effect - All Capital Gain Net Cash to Seller ($200,000.00) ($1,000,000.00) Sale Price $2MM $2MM C-Corp S-Corp $2,000,000.00 $2,000,000.00 ($328,250.00) $0.00 $1,671,750.00 $2,000,000.00 ($200,000.00) ($1,000,000.00) $800,000.00 $0.00 $1,471,750.00 $160,000.00 $840,000.00 $0.00 $294,350.00 $1,000,000.00 $1,377,400.00 20% Increase $1,000,000.00 $200,000.00 $1,800,000.00 30% Increase 40 Based on the Theoretical Example Theoretically, at the time of sale an S Corp owner/seller will receive at least 20% more in net proceeds than the same C Corp owner/seller 41 Tax Differences are Not as Simple or Clear-Cut in the Real World Buyers are willing to mitigate to some degree taxes paid by the seller if it does not affect what they are willing to pay for the assets Examples: • Non-compete agreements • Consulting agreements • Personal goodwill vs. corporate goodwill • Asset sale vs. stock sale • Negotiation of sales price Conclusion: Taxes Can be Mitigated at the Time of Sale 42 Minority Interest Capital Gain Tax Issues Between C and S Corps • Minority Interest Sales in an Operating Company do not trigger the sale of a Company nor payment of trapped in capital gains – If the company is never sold, the tax will never be incurred – If you assume a holding period for when the company is sold, at the very least this benefit will only be received sometime in the future • This is the reverse of the trapped in capital gain argument made for holding company’s in asset valuations • In most instances, the tax benefit of an S Corp over a C Corp would be small and very difficult to calculate 43 The Law is Clear That You Should Look at the Buyer’s Perspective Eisenburg, “the potential buyer whose only goal is to maximize his advantage … Courts may not permit the posting of transactions which are unlikely and plainly contrary to the interest of a hypothetical buyer.” 44 We hold as a matter of law that the built-in gains tax liability of this particular business’ assets must be considered as a dollar-for-dollar reduction when calculating the asset-based value of the Corporation, just as, conversely, built-in gains tax liability would have no place in the calculation of the Corporation’s earnings based value. Dunn v. Commissioner 45 Questions You Should Ask Related to Potential Capital Gain Tax Benefits to S Corps • Have there been any sales of the subject’s assets, 10% or more, in the last five years? • Is management currently considering the liquidation of the subject? • Is there anything in the Articles of Incorporation, Shareholder Agreements, or other legal documents which could force a liquidation? • Is the industry currently experiencing consolidation? • Is the subject a viable takeover candidate? • Can the ownership being valued force the sale of the subject? 46 If the answer is “yes” to any of these questions, then consideration of a potential capital gain tax liability may be necessary. 47 Summary of Tax Benefits of S Corps vs. C Corps at the Time of Sale • S Corps have some tax benefits over C Corps, though the benefit is small • Minority Interest Sales do NOT Trigger release of Trapped In Capital Gains • In the Valuation of an Operating Company the Starting point is always the assumption that the assets will be retained and not disposed • Benefit from capital gain taxes to an S Corp must at the very least be calculated over an anticipated holding period 48 2 “S” Corporation Premium Studies Focus: Controlling Interest & Corporate Structure • Erickson-Wang – S Corp premium of 12 to 17% • Mattson, Shannon & Upton (Pratt’s Stats) – No S Corp premium ….However 49 Erickson Study Transactions Were Significantly Larger Than Pratt’s Stats MVIC Mean Median Revenue Mean Median C Corporation Erickson-Wang Pratt's Stats $ 46,240 $ 21,337 $ 22,600 $ 7,500 $ 62,280 $ 25,605 $ 34,460 $ 9,661 S Corporation Erickson-Wang Pratt's Stats $ 50,310 $ 12,233 $ 29,500 $ 2,700 $ 48,809 $ 16,989 $ 31,640 $ 2,836 ($000's) Source: Business Valuation Update 50 Are Both Studies Measuring The S Corp Premium But From Different Perspectives? Test Assumption • Analyze Publicly Traded Stocks by Exchange – Percent of companies paying dividends; and – Payout percent 51 OTC Median Revenue Is $26 Million: Less Than Than Erickson, Greater Than Pratt’s Stats NYSE NASDQ American Over the Counter Total Total 2,234 4,783 671 1,971 ($M) Revenue Median 1,391 $ 76 $ 51 $ 26 $ 9,659 52 26% of All Companies Pay Dividends However, OTC Percent Is Much Lower NYSE NASDQ American Over the Counter Total Paying Dividends 59.2% 18.8% 26.8% 5.6% 26.0% 53 Median Payout Percent Is Relative Constant at 32% NYSE NASDQ American Over the Counter Total Paying Dividends 59.2% 18.8% 26.8% 5.6% Payout Percent 31.9% 31.3% 33.2% 37.6% 26.0% 32.1% 54 Conclusion • Both studies are measuring S Corp premium but from a different perspective Size Matters The larger the company the more likely dividends are paid, which increases the likelihood of an S Corp Premium 55 Summary There is no Magic Chart you can go to for the Calculation of S Corp Premiums Appraisals are Dynamic. We are dealing with different appraisal dates, industries, company conditions. The FACTS and circumstances change over time and company to company The S Corp premium can be calculated for minority interests by looking at the dividend paying capacity of a company, and to a lesser extent the actual history of dividends 56 Summary Minority Interest Sales do NOT trigger the release of trapped in Capital Gains When Calculating a Premium for S Corps related to the Capital Gain Tax issue we must remember to conduct the analysis from the buyers point of view The Wang Study and the Pratt Study appear to be measuring different pieces of the spectrum of companies. We do not find the conclusions of these to studies contradictory with one another 57