File

advertisement

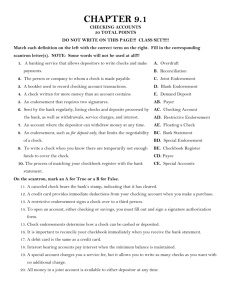

Cash Control Systems Chapter Five Terms Code of conduct Checking account Endorsement Blank endorsement Special endorsement Restrictive endorsement Postdated check Bank Statement Dishonored Check Electronic Funds Transfer Debit Card Petty Cash Petty Cash Slip Books - A - Million Customers use cash and credit cards to make purchases – What control problems may occur when employees except cash for sales? Where do you work – – What control systems do you have? Section 1: Checking Accounts Cash transactions occur more frequently than other types of transactions – more chances occur to make recording errors Cash can be transferred from one person to another without any questions about ownership Cash could also be lost from one place to another Safety Measures Cash in the bank All Cash receipts are placed in the bank – – Evidence to support accounting records Compare record of checks with bank statements Code of conduct: – Statement that guides the ethical behavior of a company and its employees. Example p. 118 Depositing Cash Business from ordering a bank to pay cash from a bank account is a check. Checking account – bank account from which payments can be ordered – Signature on card Deposit slip is prepared by a customer each time cash or checks are placed in an account. – – – Checks listed on slip by routing number Receipt given Record deposit on check stub page 119 DEPOSITING CASH DEPOSIT RECORDED ON A CHECK STUB page 119 Lets Talk About Endorsements! Endorsement – signature or stamp on the back of a check transferring ownership – Blank (just initial owners signature) – – If lost with this anyone can cash the check Special (indicates a new owner) Restrictive (restricts further transfer) Examples page 120 Blank Endorsement page 120 ENDORSEMENTS Special Endorsement Restrictive Endorsement Completing Check Stub & Check Example p. 121 Postdated check – most banks will not accept postdated checks because money cannot be drawn until that date. Check writing habits Recording a voided check page 121 COMPLETED CHECK STUB 1 2 3 4 6 1. Write the amount of the check. 2. Write the date of the check. 3. Write to whom the check is to be paid. 4. Record the purpose of the check. 5. Write the amount of the check. 5 6. Calculate the new checking account balance. page 121 COMPLETED CHECK 7. Write the date. 8. Write to whom the check is to be paid. 9. Write the amount in figures. 10. Write the amount in words. 11. Write the purpose of the check. 12. Sign the check. page 122 RECORDING A VOIDED CHECK 2 1 4 3 1. Record the date. 2. Write the word VOID in the Account Title column 3. Write the check number. 4. Place a check mark in the Post. Ref. column. 5. Place a dash in the Cash Credit column. 5 page 123 TERMS REVIEW code of conduct checking account endorsement blank endorsement special endorsement restrictive endorsement postdated check Practice Working Together On Your Own Review Quiz 1. 2. 3. 4. 5. 6. 7. 8. Why are cash control systems needed? What is an endorsement - hint what does it do? (not a signature on the back of a check) List the three types of endorsements? What is a postdated check and how do banks feel about them? What is all included on a check stub? What type of endorsement includes pay to the order of? What type of endorsement includes only an individuals name? What type of endorsement includes for deposit only? Section 5:2 Bank Reconciliation Bank statement – report of deposits, withdrawals, and bank balances sent to a depositor by a bank Bank records and depositor’s records may differ for several reasons: – – – – Service charge Outstanding deposits Outstanding checks Math errors Bank Reconciliation Verifying that the information on a bank statement agrees with the checkbook Reconciling immediately is very important in cash control Example – p. 125 Recording service charge on check stub Journalizing a bank service charge page 124 BANK STATEMENT 1. Date 2. Check Stub Balance BANK STATEMENT RECONCILIATION 3. Service Charge 4. Adjusted Check Stub Balance 3 5. Bank Statement Balance 6. Outstanding Deposits 7. Subtotal 8. Outstanding Checks 9. Adjusted Bank Balance 10. Compare Adjusted Balances page 125 1 2 5 6 7 4 8 9 10 RECORDING A BANK SERVICE CHARGE ON A CHECK STUB page 126 1. Write Service Charge $8.00 on the check stub under the heading “Other.” 1 2 3 2. Write the amount of the service charge in the amount column. 3. Calculate and record the new subtotal on the Subtotal line. JOURNALIZING A BANK SERVICE CHARGE August 31. Received bank statement showing August bank service charge, $8.00. Memorandum No. 3. page 127 4 1 2 1. Date. Write the date. 3 2. Debit. Write the title of the account to be debited. Record the amount debited. 4. Source document. Write 3. Credit. Record the amount the source document credited. number. page 128 TERM REVIEW bank statement Practice Working Together On Your Own Application Problems 1-2 Review Code of conduct Checking account Endorsement Blank Endorsement Special Endorsement Restrictive Endorsement Postdated check Preparing a check stub Preparing a check Purpose of bank reconciliation Reflection on Jig saw Section 5:3 – Dishonored Checks & Electronic Banking Check the bank refuses to pay – – – – – – Insufficient funds to pay the check Check appears to be altered Signature does not match Figures and words do not agree Postdated Person stopped payment Illegal/ credit Fee Section 5:3 Journalizing Dishonored Check, Electronic Funds Transfer, & Debit Card Transactions Make the book up to date See page 130 Working Together Electronic Funds Transfer – transfers funds without the use of checks – Password / cash control Debit Card Petty Cash Amount of cash left on hand – – – Used for making small payments Assets Normal balance = debit Petty cash slip – from showing the purpose and amount of payment – PROOF – Slip number, date, to whom, reason, amount, account and signature Replenishing Petty Cash Working Together Applications 3-5 Homework Challenge Problem