Quantitative Easing and Inflation

advertisement

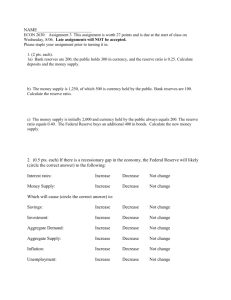

Quantitative Easing and Inflation Quantitative Easing In 2008, with the United States in economic free-fall, loosing upwards of hundreds of thousands of jobs a month, the Federal Reserve, the monetary policy maker of the United States economy, decided to take unprecedented actions to stimulate positive market responses and to halt the steep losses in jobs. Starting November 2008, the Federal Reserve engaged in a new transaction coined “quantitative easing:” the buying of financial assets from banks through open market operations, hoping to saturate banks with excess cash reserves. The hope would then be that the banks would lend out all this new money to restart a cycle of investment and consumption, stimulating the economy.1 Three different rounds of quantitative easing have taken place since 2008. As a result, the monetary base, the sum of currency in circulation and reserve balances, has drastically increased in the United States economy; for example, by itself, QE1 totaled approximately $1.25 Trillion dollars.23 That is, at least, $1.25 trillion new dollars that were artificially introduced into the economy that would have otherwise not taken place with a historically normal Graph 1- Monetary base expansion, in billions of dollars, 1980-2013 market. Thus, what are the results of such actions by the Federal Reserve? What have the short run implications been and what does 1 "What Is Quantitative Easing?" BBC News. BBC, 03 July 2013. Web. 15 Sept. 2013. "Current FAQsInforming the Public about the Federal Reserve." FRB: What Is the Money Supply? Is It Important? Federal Reserve, n.d. Web. 15 Sept. 2013 3 De Costa, Polyana. "QE1: Financial Crisis Timeline." QE1: Financial Crisis Timeline. N.p., n.d. Web. 15 Sept. 2013 2 the quantity theory of money tell us about possible long run implications? The quantity theory of money states that increases in the money supply of an economy will lead to a proportional unit increase in the price level; that is, money supply and inflation increase by proportional amounts.4 Because the monetary base has reached uncharted waters—it has more than doubled in less than 3 years—we should be experiencing equally uncharted levels of inflation. The Short run Nevertheless, three years after the first round of quantitative easing has been completed, increases in the price level have not been identical to the amount of money infused in the economy. In Graph 2- Quantity Theory of Money Theoretically, the Federal Reserve has helped shift the blue line to the right, decreasing the value of money, thus increasing the price level, or inflation. fact, the last 15 consecutive months have all seen core inflation at a level below two percent, a number relatively lower than the United Graph Source: Sparknotes States’ historical monthly average.5 In fact, 2009 saw deflation, or net decreases in the price level, despite the $1.25 trillion dollar QE that took place over that year.6 Thus, in the current short run, the quantity theory of money has not yet predicted out current economic situation. 4 See graph 2- quantity theory of money "USA Inflation Rate." USA Inflation Rate. Rate Inflation, n.d. Web. 15 Sept. 2013. 6 De Costa, Polyana. "QE1: Financial Crisis Timeline." QE1: Financial Crisis Timeline. N.p., n.d. Web. 15 Sept. 2013 5 Inflation Graph 3- Consumer Price Index: Core and Volatile Nevertheless, inflation, as measured by the Federal Reserve, reflects “core” price levels; namely, the market prices of items that are not volatile and subject to exogenous events. This is why items that have unstable prices, such as food and energy, are not included in the official calculus of the Federal Reserves’ definition of inflation. Thus, price levels are always more stable than they otherwise would be if all items were included in the calculation of inflation. Some economists believe that, while QE has not yet caused core inflation to take place, it is influencing overall inflation in the areas of food and energy. However, even with the volatile areas of food and energy included, overall inflation is currently not spiking, indicating that QE has not caused overall inflation.7 If QE had caused overall inflation, it would be rising at an exceptional rate. The long run However, the quantitative theory of money applies to the economic long run, a unit of time not bound by typical intervals. Instead, the economic long run applies to a point in the future where all inputs are not fixed and can be varied. It may so happen that we have currently not yet reached the economic long run. If the quantity theory of money proves to be correct we will not want the future to arrive either because unprecedented, run-away hyperinflation will wretch havoc on the United Sates economy. 7 See Graph 3- Consumer Price Index: Core and Volatile Conclusion Given the amount of new money helped created by the Federal Reserve and QE1, QE2, and QE3, it certainly is curious as to why we have not seen even a slight abnormal growth in inflation. Graph 1 truly shows that the United States economy has entered uncharted waters in respects to the monetary base. Perhaps banks unwillingness to lend all the new money safely stored in their excess reserves plays a part. Money cannot truly enter the money supply from banks unless it is loaned out. Or perhaps, the quantity theory of money is flawed in our current economic snapshot because of intricacies and complexities in the 21st century economy; it is unlikely but only time will tell.