SU14_2630_Assign3

advertisement

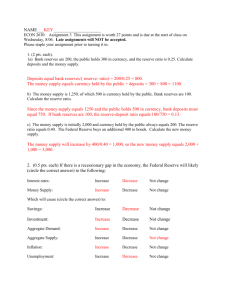

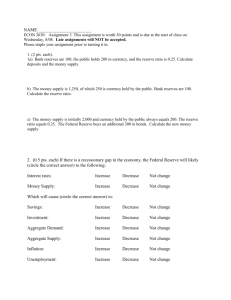

NAME________________________ ECON 2630: Assignment 3 This assignment is worth 27 points and is due at the start of class on Wednesday, 8/06. Late assignments will NOT be accepted. Please staple your assignment prior to turning it in. 1. (2 pts. each). 1a) Bank reserves are 200, the public holds 300 in currency, and the reserve ratio is 0.25. Calculate deposits and the money supply. b) The money supply is 1,250, of which 500 is currency held by the public. Bank reserves are 100. Calculate the reserve ratio. c) The money supply is initially 2,000 and currency held by the public always equals 200. The reserve ratio equals 0.40. The Federal Reserve buys an additional 400 in bonds. Calculate the new money supply. 2. (0.5 pts. each) If there is a recessionary gap in the economy, the Federal Reserve will likely (circle the correct answer) to the following: Interest rates: Increase Decrease Not change Money Supply: Increase Decrease Not change Which will cause (circle the correct answer) to: Savings: Increase Decrease Not change Investment: Increase Decrease Not change Aggregate Demand: Increase Decrease Not change Aggregate Supply: Increase Decrease Not change Inflation: Increase Decrease Not change Unemployment: Increase Decrease Not change 3. Go to the following website: http://www.federalreserve.gov/releases/h6/current/default.htm Use the seasonally adjusted numbers for M1 and M2 in Table 1 to answer the following questions. a. (1) What was the total amount in savings accounts in July 2012 and in June 2014. b. (1) Calculate the percentage change in M1 and M2 from July 2012 - June 2014. c. (2) From July 2012 – June 2014, average prices have increased by (inflation equals) approximately 3%. Using concepts discussed in class, briefly explain why inflation is much less than the changes in M1 and M2. d. (1) In which two months did M1 decline? 4a. (1) Suppose inflation is 3% and there is an expansionary gap of 2%. According to the Taylor rule, what should the Federal Funds rate equal? 4b. (1) Suppose inflation is 0% and there is a recessionary gap of 5%. According to the Taylor rule, what should the Federal Funds rate equal? 5. The San Francisco Federal Reserve Bank has a “Fed Chairman Game”, where you act as the Fed Chairman and choose the Federal Funds rate depending on inflation and unemployment. The game can be found at http://sffed-education.org/chairman/ Your assignment task is simply to play the game. When you are done (your term is up), you will either be reappointed or dismissed. If you are reappointed, you will receive 10 points. If you are dismissed, you will receive 0 points. To prove that you played the game, use the screen capture (Print Screen) function on your computer (PRTSC or PRTSCN on some keyboards). Paste the image of your completed game – which will state whether you were ‘reappointed’ or ‘dismissed’ - to a blank Microsoft Word document, and staple it to your completed assignment when you turn it in. Note that you can play the game as many times as you please, and you may work with others, but you have to turn in the results from your own game (the same game results cannot be printed out multiple times or copied). If it is found that you have the same exact game results (image) as someone else in the class, you both will receive a zero for the assignment.