Conclusion

advertisement

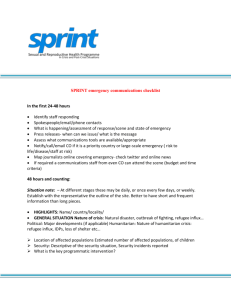

Sprint Group 5 Internal Factor Evaluation No Key Internal Factor(Strengths) Weight Rating Weighted score 1 high market share in long distance 15% 4 0.6 2 active pioneer 11% 4 0.44 3 wide portfolio expansion(service) 10% 4 0.4 4 strong brand 7% 4 0.28 5 great niche marketing 9% 3 0.27 Key Internal Factor(Weakness) 1 late deployment(4G LTE) 14% 1 0.14 2 high churn rate 10% 1 0.1 3 low ARPU 10% 1 0.1 4 poor network coverage 7% 2 0.14 5 large amount of debt 7% 2 0.14 Total weighted score 100% 2.61 A. Key Internal Factor (Strengths) 1. High market share in long distance: It means sprint has more power to manipulate the price. One of Sprint’s main business is long-distance telecom, so we rate it for 4. And Sprint is the main supplier of long-distance, so we weight it for 15%. 2. Active pioneer: Sprint was the pioneer of the wireless communication. Customer would win many market share by early offering service. In late 1994 and early 1995, Sprint acquired near nationwide 1900 MHz PCS spectrum, via Sprint Spectrum–APC (a joint venture between Sprint and several cable companies). Later in 1995, the company began to offer wireless service under the Sprint Spectrum brand in the Baltimore-Washington metropolitan area. This was the first commercial PCS network in the United States. Because of it, we rate it for 4 and weight it for 11%. 3. Wide portfolio expansion (service): Sprint offers more app service than other two company. Some customers shift to sprint for their wide service. We think it is an advantage of Sprint, so we rate for 4. But to be a reason for customers to shift from other telecoms to Sprint, it becomes a little weak that we weight it for 10%. 4. Strong brand: Sprint is the top 3 telecom company in USA. Many customers pay for Sprint by their strong brand name. From the p1, we can see Sprint is the second mentioned brand. The brand name is one of the most important reason for customers to choose the telecom, so we rate for 4. And because of its rank, we weight it for 7%. (P1) 5. Great niche marketing: Sprint has exclusive walkie-talkie features and patented ruggedness and look. Because we think this feature may not be so important to infect the choosing of customers, so we rate it for 3. And also because of it, we weight for 9%. B. Key Internal Factor (Weaknesses) 1. Late deployment (4G LTE): Compare with other telecom companies, Sprint was too late to start the 4G service due to their wrong development of WiMAX. On April 19, 2011, Sprint Nextel announced it agreed to pay at least $1 billion to Clearwire so it can operate on the 4G WiMAX network through 2012, a later agreement announced in December 2011 specified the terms allowing Sprint, its subsidiaries, and wholesale customers to continue having access to the Clearwire 4G WiMAX network through 2015. On July 15, 2012, Sprint Nextel commence operating the LTE network. In addition to the 5 markets originally announced, it launched in 10 additional markets, with more markets said to be covered by the end of the year. But for Verizon, it had been built the first big coverage of 4G LTE in US in 2010. Sprint has developed the 4G LTE too late, so we rate it for 1 and weight it for 14%. From the P2, we can see the coverage of 4G LTE of the 4 main telecom in US. (P2) 2. High churn rate: Compared to AT&T and Verizon, since Sprint didn’t have the special feature to attract the customers, their customer source got much unfixed. Churn rate is the influential factor to evaluate the customer royalty, so we rate it for 1. And compared with other telecoms, Sprint is too high for it, so we weight it for 10%. (P3) 3. Low ARPU: Because of the low data plan of Sprint, they had earned not too much from the customers only adopted them due to the price. From P4, we can see Sprint’s ARPU is not so high, and the ARPU is what one company measure its gain. So, we rate it for 1 and weight it for 10%. (P4) 4. Poor network coverage: From the coverage map of the Sprint, its service centers in the eastern U.S.A. Contrast with Verizon, its coverage is too poor. Compared to the other telecoms, Sprint’s coverage get poor, but contrast with the other factors, it seems not so important. So, we rate it for 2 and weight it for 7%. (P5) 5. Large amount of debt: Sprint was bought by Softbank because of the large debt, after mergers and acquisitions, though Sprint had gained some assets, it still had much debt unsolved. We think that Sprint might solve the problem of debt in the future if Softbank can manager Sprint well. That’s why we rate it for 2 and weight it for 7%. C. Conclusion Total weighted score significantly lower than the 2.5 of enterprise's signals that the internal situation is weak, while the score much higher than 2.5 of the enterprise's internal situation is strong. As we calculate, the total weighted score value is 2.61. It means the Sprint’s internal position is better. According to the IFE matrix, the greatest internal weaknesses Sprint must resolve are late deployment, poor network coverage, and large amount of debt. And we expect Sprint to solve all these questions. External Factor Evaluation No Key Factors (opportunities) Weight Rating Weighted Score 1 Increasing demand on mobile data Develop in ITS Global market Wireless technology Key Factors (Threats) 15% 3 0.45 10% 15% 10% Weight 2 1 2 Rating 0.20 0.15 0.20 Weighted Score US economy impacted by their debt Regulation of the government Saturation in the wireless market Stressed by other competitors 2% 2 0.04 16% 3 0.48 16% 2 0.32 16% 1 0.16 2 3 4 No 1 2 3 4 Total Score 100% 2.00 A. Key External Factor (Opportunities) 1. Increasing demand on mobile data: People may use more telecom service because it's trend. Creating new function and technique can improve our life quality, and makes people increase demand on mobile data. So we give this factor 15%. Sprint use its price strategy and try to achieve this factor. So we rate this factor 3. 2. Develop in ITS: More and more ITS system requires the wireless communication to support, so we give this factor 10%. Sprint can cooperate with the project developing wireless communication to capture the opportunity. But so far there is no obvious action, so we rate this factor 2. 3. Global market: Africa has huge numbers of populations, and it would create great business opportunity. The mobile network in Africa attracts many telecom suppliers in 78% growth speed. We give this factor 15%. However, if Sprint wants to enter this market, it has to invest huge assets. Thus, Sprint has difficult to catch this opportunity. We rate this factor 1. (P6) 4 Wireless technologies in hospital: Using wireless technology in a different way to improve security and reduce stress for patients and their families. Whenever a staff member enters a patient’s room, her photo, name and job function appears on the patient’s in-room screen. This allows the patient to easily and positively identify staff and it lets the patient’s family know who has visited the patient and when. Thus, we give this factor 10%. B. Key External Factor (Threats) 1. US economy impacted by their debt: US economy has shocked by their debts, it brings about stock market declined too. It would lower the purchasing power of customers; however, this factor would influence the telecom industries just a little bit, so we give this factor 2%. Because Sprint uses price strategy, we rate it 2. 2. Regulation of the government: The antitrust legislation made by the US government resists the probability of Sprint merging with T –mobile. This factor would influence the scale of Sprint, let Sprint grow hard. Thus, we give this factor 16%. However, Sprint keeps finding its cooperators actively, so we rate it 3. 3. Saturation in the wireless market: The saturation of the US wireless market may adversely affect the top line growth of telecom companies. Most telecom companies are relying on volumes to grow their wireless revenues as intense competition has negated any possibility of growing through higher prices. Thus, we give this factor 16%. We think Sprint doesn’t take the strategy to face this problem, so we rate it 2. 4. Stressed by other competitors: Sprint is mainly stressed by the advanced technology and brand of AT&T and Verizon, and T -mobile also gives pressure on Sprint because of its high growth rate. Thus, we give this factor 16%. Because so far Sprint can’t overcome this situation, we rate it 1. (P7) (P8) C. Conclusion The score of EFE is not so good. It shows Sprint didn’t react so well to this global environment. Sprint has to make more efforts to catch the opportunities and overcome the threats. Competitive Profile Matrix Sprint AT&T Verizon Weight rating score rating score rating score ARPU 0.2 4 0.8 4 0.8 3 0.6 Churn rate 0.2 2 0.4 4 0.8 4 0.8 Market share 0.16 2 0.32 3 0.48 4 0.64 Coverage 0.15 2 0.3 3 0.45 4 0.6 Financial position 0.15 1 0.15 4 0.60 3 0.45 Brand name 0.14 4 0.56 4 0.56 4 0.56 Total score 1.00 2.63 3.54 3.80 1. ARPU: ARPU is higher, the current value of the company's profits will be higher. Because the final goal of the company is to improve the earning, so we give ARPU 0.2 weights. In P9, AT&T’s ARPU is a little more than Sprint, and Sprint is more than Verizon. So we give Sprint rating 4, AT&T 4, Verizon 3. (P9) 2. Churn rate: Churn rate is the main indicators to determine the loss of customers that it directly reflects the current state of business and management. So we give churn rate 0.2 weights. In P10, we can see AT&T and Verizon’s churn rate is close, and Sprint is almost twice than them, so we give Sprint rating 2, AT&T 4, Verizon 4. (P10) 3. Market share: The main purpose of one company is to increase the market share that every business wants to let its company to have more influence in the market. But the market share may be affected by the time the companies have run, we give market share 0.16 weights. In P11, we can see in all subscribers AT&T occupies more than Verizon, but if we only see postpaid subscribers, Verizon is more than AT&T. Then we think postpaid subscriber has more ARPU , so we give Sprint rating 2, AT&T 3, Verizon 4. (P11) 4. Coverage: The coverage of the telecom corporation would affect the quality of signal. And it would influence the decision the customers choosing their telecom corporation a little bit. Thus, we give coverage 0.15 weights. IN P12 and P13, we can see Verizon’s 4G LTE coverage is bigger than AT&T’s, and AT&T’s is bigger than Sprint’s. Why we only compare with 4G LTE coverage, because in other area, like long-distance or 3G coverage, they are almost similar, so we give Sprint rating 2, AT&T 3 ,Verizon 4. (P12) (P13) 5. Financial position: The financial position is related to the operation of the corporation. A good financial condition makes the corporation have the space to invest and use money. It would influence the amount of the capital in corporation and the scale of the corporation. Thus, we give financial position 0.15 weights. In B1, we can see AT&T’s net income is more than Verizon, so we give Sprint rating 1 ,AT&T 4, Verizon 3. 2013 Net income EPS Sales Sprint -3018M($USD) -77.38$USD 3570M($USD) AT&T 18533 3.39 128752 Verizon 11497 38.71 120550 (B1) 6.Brand name: Customers will see the company’s brand name to identify which one is the best, so we give brand name 0.14 weights. These three company are top telecom company, so we give them all rating 4. Conclusion Sprint’s performance is bad in many area. Now they need to overcome two problems. 1. Low churn rate: Promote their service to meet the customers’ standard. 2. High debt: Improve their net income by increase their sales. Reference News http://www.ithome.com.tw/news/85465 http://www.ttia-tw.org/knowledge.php?id=36 http://www.itbusinessedge.com/slideshows/six-ways-wireless-technology-is-t ransforming-health-care-07.html http://www.104.com.tw/jb/area/media/article/detail/id/1671215733029164 56/cat/2 ARPU http://www.fiercewireless.com/....../how-verizon-att...... Churn rate http://marketrealist.com/....../prepaid-mobile....../ market share http://news.investors.com/....../101514-721877-vz-tmus...... coverage http://www.imore.com/att-vs-verizon-vs-t-mobile-vs......