Word - Personal Pages Index

advertisement

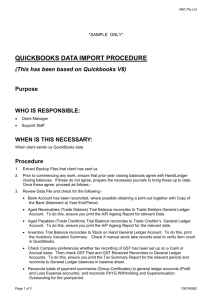

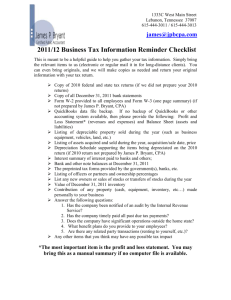

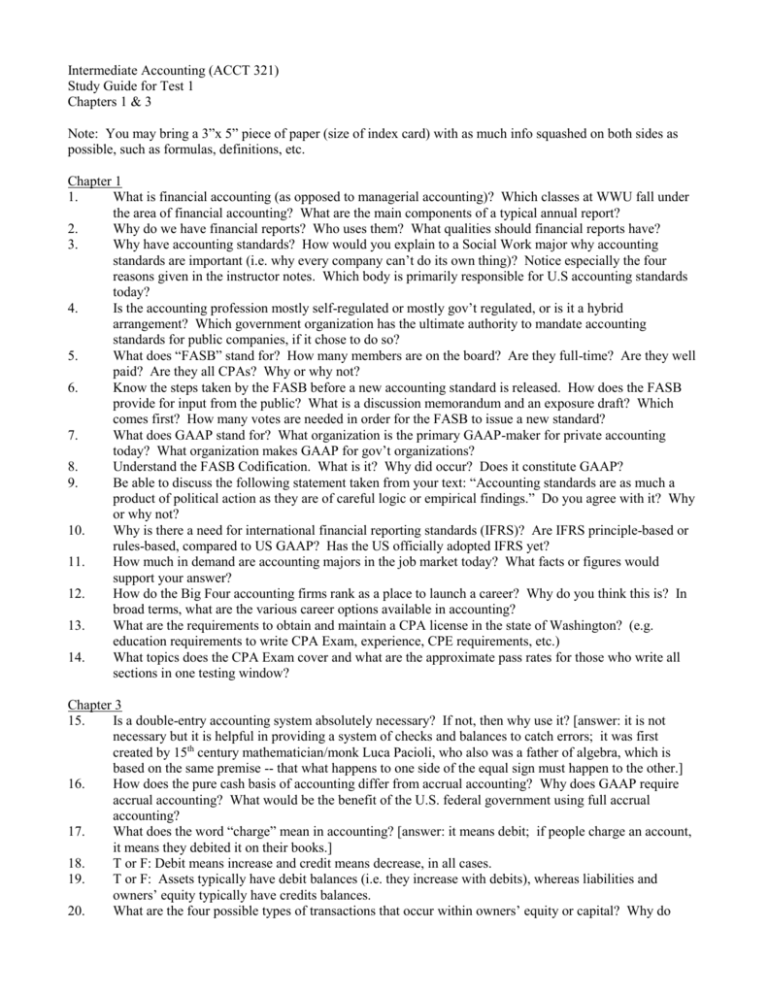

Intermediate Accounting (ACCT 321) Study Guide for Test 1 Chapters 1 & 3 Note: You may bring a 3”x 5” piece of paper (size of index card) with as much info squashed on both sides as possible, such as formulas, definitions, etc. Chapter 1 1. What is financial accounting (as opposed to managerial accounting)? Which classes at WWU fall under the area of financial accounting? What are the main components of a typical annual report? 2. Why do we have financial reports? Who uses them? What qualities should financial reports have? 3. Why have accounting standards? How would you explain to a Social Work major why accounting standards are important (i.e. why every company can’t do its own thing)? Notice especially the four reasons given in the instructor notes. Which body is primarily responsible for U.S accounting standards today? 4. Is the accounting profession mostly self-regulated or mostly gov’t regulated, or is it a hybrid arrangement? Which government organization has the ultimate authority to mandate accounting standards for public companies, if it chose to do so? 5. What does “FASB” stand for? How many members are on the board? Are they full-time? Are they well paid? Are they all CPAs? Why or why not? 6. Know the steps taken by the FASB before a new accounting standard is released. How does the FASB provide for input from the public? What is a discussion memorandum and an exposure draft? Which comes first? How many votes are needed in order for the FASB to issue a new standard? 7. What does GAAP stand for? What organization is the primary GAAP-maker for private accounting today? What organization makes GAAP for gov’t organizations? 8. Understand the FASB Codification. What is it? Why did occur? Does it constitute GAAP? 9. Be able to discuss the following statement taken from your text: “Accounting standards are as much a product of political action as they are of careful logic or empirical findings.” Do you agree with it? Why or why not? 10. Why is there a need for international financial reporting standards (IFRS)? Are IFRS principle-based or rules-based, compared to US GAAP? Has the US officially adopted IFRS yet? 11. How much in demand are accounting majors in the job market today? What facts or figures would support your answer? 12. How do the Big Four accounting firms rank as a place to launch a career? Why do you think this is? In broad terms, what are the various career options available in accounting? 13. What are the requirements to obtain and maintain a CPA license in the state of Washington? (e.g. education requirements to write CPA Exam, experience, CPE requirements, etc.) 14. What topics does the CPA Exam cover and what are the approximate pass rates for those who write all sections in one testing window? Chapter 3 15. Is a double-entry accounting system absolutely necessary? If not, then why use it? [answer: it is not necessary but it is helpful in providing a system of checks and balances to catch errors; it was first created by 15th century mathematician/monk Luca Pacioli, who also was a father of algebra, which is based on the same premise -- that what happens to one side of the equal sign must happen to the other.] 16. How does the pure cash basis of accounting differ from accrual accounting? Why does GAAP require accrual accounting? What would be the benefit of the U.S. federal government using full accrual accounting? 17. What does the word “charge” mean in accounting? [answer: it means debit; if people charge an account, it means they debited it on their books.] 18. T or F: Debit means increase and credit means decrease, in all cases. 19. T or F: Assets typically have debit balances (i.e. they increase with debits), whereas liabilities and owners’ equity typically have credits balances. 20. What are the four possible types of transactions that occur within owners’ equity or capital? Why do 21. 22. 23. 24. 25. 26. 27. 28. 29. expenses have debit balances? Why do revenues have credit balances? Why do withdrawals have debit balances? Review the accounting cycle carefully. Note the order of the steps and which steps are optional. What is another name for a journal? [answer: book of original entry]. What are five common types of journals? Why have special journals? Are they optional? Know which journals would typically be used to record various types of transactions, both in traditional systems, and in QuickBooks. How often is posting typically done to the general ledger? [answer: depends on the system; if batchprocessing, then posting might be done monthly; if real-time processing, it is done immediately.] What is the purpose of subsidiary ledgers? [answer: to provide details in a separate ledger so the general ledger is not cluttered.] What are common types of subsidiary ledgers? [answer: accounts receivable, accounts payable, payroll, fixed assets, etc.] What is the account in the general ledger called that contains the total of a subsidiary ledger detail? [answer: control account]. What purposes does a trial balance serve? [answer: it proves that debits = credits and it provides a listing of accounts]. Can a trial balance be taken any time an accountant gets the urge? [answer: yes, even in the middle of the night, if you get the urge]. What was the likely cause if the difference between total debits and total credits is evenly divisible by nine? [answer: trans-positional error, e.g. wrote 54 instead of 45]. Do both a balance sheet and a trial balance prove that debits equal credits? [answer: no, only the trial balance – the balance sheet proves that A = L + OE, and nothing more.] Why are adjusting entries necessary? What are the five types? Be able to match a particular adjusting entry with one of the five types. Are reversing entries optional? What is the purpose of reversing entries? Which adjusting entries can be reversed? When do reversing entries occur in the accounting cycle? In what order should the three financial statements be prepared (if done manually)? Why? [answer: net income must first be calculated so it can be used to determine ending owner’s equity, which is needed for the balance sheet.] Do owner’s withdrawals appear on the income statement? Why or why not? [answer: no, withdrawals are not an expense of the business.] What are other common names for owners’ equity? [answer: capital, net worth, book value, net assets, etc.] From a list of accounts, can you tell which are real (permanent) or nominal (temporary)? For example, what about prepaid expenses? Unearned revenue? What steps are required to close the temporary accounts? What is the purpose of an income summary account, and is it optional? On a post-closing trial balance, would any temporary accounts appear, such as wages expense or service income? Be able to prepare adjusting, reversing and closing entries. From an adjusted trial balance, be able to prepare a simple trial balance, income statement, statement of changes in owner’s equity and balance sheet. Practice Set 30. What is the difference between the cash basis and accrual basis of accounting? Why do most small businesses ignore GAAP (and accrual accounting) and rather use cash basis or tax basis of accounting? When might a small business need to follow GAAP? 31. Why would someone want to be a small business owner? What are the drawbacks? Can small business owners usually withdraw large amounts of cash for personal use during the first few years of operations? 32. Review again the requirements for getting a CPA license in the state of WA? [4-year degree and extra credits needed to make 225 quarter hours of college education (including 36 credits of accounting and 36 credits of other business subjects), pass 4-part CPA Exam with at least a 75% score, pass ethics exam, get one year of work experience under a CPA, get sufficient continuing education (avg of 40 hrs per year), apply for license and pay fee]. 33. What would be a range of hourly rates for accounting, tax and audit services in the WW Valley? [answer: generally, $40-$100 for bookkeeping, $80-$250 for tax, and $150-$350 for auditing; may differ from firm to firm depending on a variety of factors.] 34. Why do CPAs often end up being counselors, investment advisors, retirement advisors, business valuation specialists, computer consultants, legal advisors, and advisors in a multitude of other areas? [partial answer: surveys consistently show that CPAs are the most trusted financial advisors by the general public and small business owners, more than any other professional. It is natural for business owners to turn to their CPAs for all kinds of advice.] 35. 36. 37. 38. 39. 40. 41. 42. 43. In QuickBooks, know which windows are used for the following types of transactions: Purchase goods/services on credit Pay for goods/services on credit. Purchase goods/services with a check. Earn revenue/sales from customers. Receive payments from customers. Other deposits (e.g. owner contributions). Other transactions that don’t fit above (e.g. most adjusting entries). Know what accounts are automatically debited/credited in the following windows: enter bills, pay bills, write checks, invoices, receive payments, record deposits. With the computer software, is it necessary to prepare closing entries and record them in the general journal? Why or why not? With the computer software, is it necessary to prepare adjusting entries? Why or why not? Does the computer software prepare trial balances and financial statements automatically? On the computer, if the journal entries have been recorded properly, then will the rest of the accounting also be correct? In QuickBooks, what account is automatically debited with a customer’s invoice is prepared? What account is automatically credited with a vendor’s bill is entered? What account is automatically credited when a check is prepared? How much does QuickBooks Pro cost? Does QuickBooks have a majority of market share in small business accounting software? What are the advantages of QuickBooks Online and other “cloud-based” software? Good luck! . . . but regarding luck, remember the harder you work, the more you have of it.