Tax Outline

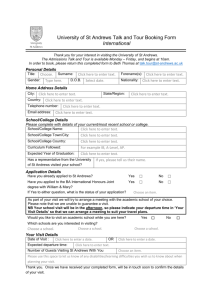

advertisement