PowerPoint - CHILD SUPPORT DIRECTORS ASSOCIATION of California

advertisement

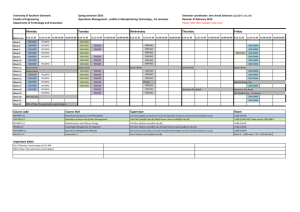

Employer Forum on Child Support Issues Brought to you by the Child Support Directors Association of California March 28, 2012 1 Today’s Agenda • Child Support Program - Overview • Income Withholding Orders (IWO) & National Medical Support Notice (NMSN) – Employer Responsibilities • Electronic Income Withholding Orders (e-IWO) • State Disbursement Unit - Overview • Employer Data Maintenance • Panel Q & A 2 Child Support Program – Created by Congress in 1975 – Designed to recover money from parents whose children received welfare – Evolved into a program serving the needs of parents paying support, those receiving, and the children – Working towards serving the needs of our partners – Today, serves more non-welfare families • 87% non-welfare Nationally • 76% non-welfare in California 3 Structure of the Program Federal Office of Child Support Enforcement (OCSE) California Department of Child Support Services (DCSS) 58 Counties with 51 Local Child Support Agencies (LCSAs) 4 Who Do I Contact? • State DCSS vs. Local Agencies (LCSA’s) • Closest agency or issuing agency? • Customer Connect • Interactive Voice Response (IVR) 5 What Services Do We Provide? • We promote family self sufficiency through – Establishing paternity for children conceived out of wedlock – Establishing and enforcing child support orders – Establishing and enforcing health insurance orders • Collections go to the families before the government • Reducing the number of families on aid 6 Collections • Nationally, 65.5% of all support is withheld from wages and salaries • California’s collections 2011 were $ 2.3 billion – $ 1.4 billion of that was withheld by employers • 62% of the money we are sending to families has come from you, the employers 7 Withholding Support and Providing Health Coverage 8 Child Support Guidelines • Income • Visitation • Hardship / Deductions – – – – – – – – Union Dues Mandatory Retirement Other minor children residing with parent Spousal/child support being paid for other relationships Catastrophic losses Work-related expenses Uninsured medical Other factors 9 Child Support Agency Responsibilities • Obtain an Income Withholding Order and health insurance coverage in every case • Serve employer within 15 days • Verify employee information with employer • Provide the custodial party with the health insurance information for the child 10 Employer Responsibilities • • • • • Provide copy of IWO to employee Withhold support Enroll health coverage Forward Support Complete the Wage and Insurance Verification Form • Notify LCSA if employment ends and provide new information • Refrain from negative action upon employee due to IWO or NMSN 11 Employers Should Not… • Accept Income Withholding Orders that are not payable to the State Disbursement Unit • Accept Income Withholding Orders received on an incorrect or old form – Form number is OMB0970-0154 or – FL-195/OMB0970-0154 Contact payee on existing IWO requesting updated order with corrected payee / corrected form 12 Priority of Orders and Liens 1. Child Support order 2. Bankruptcy order 3. Federal Administrative Garnishment 4. Federal Tax Levy* 5. Student Loan 6. State Tax Levy 7. Local Tax Levy 8. Creditor Garnishment 9. Employer deductions *Levy received prior to Child Support order has priority. 13 Applying Withholding 1. 2. 3. 4. 5. 6. Current Child/Family Support Medical Support, if on IWO Health Insurance Premium Current Spousal Support Child/Family Support Arrears Spousal Support Arrears Note: Current Child Support always takes priority over other deductions (with possible exception of IRS tax liens). 14 Determining Net Disposable Income (NDI) • Gross earnings less ONLY: – Mandatory deductions • State & federal tax, SDI – Mandatory union dues – Mandatory retirement (not 401k) 15 What are Earnings? • Earnings are defined by Family Code Section 5206 as: •Wages •Salary •Bonuses •Vacation Pay •Retirement •Commissions •Dividends •Royalties •Residuals •Payment for independent contractor services 16 How Do You Handle Employee Inquiries? • Why is the order so high? • How do you expect me to live on this check? • Can’t I work out a better payment plan? Employers should not be answering these questions…encourage your employee to contact the Department of Child Support Services that initiated the IWO 17 Medical Support • Court ordered coverage versus a specific monthly dollar amount • Within 20 business days of the date of the NMSN, you must forward a copy to the group health plan provider • Open enrollment requirements shall not apply • Health Insurance Includes – Medical – Dental – Vision 18 Medical Support Continued • Employee must maintain health insurance, if available, for the child at reasonable or no cost. – Reasonable if cost is not more than 5% of employee’s gross income • This percentage applied to the cost difference of the employee only plan versus the cost to add the child – Considered unreasonable if the employee is entitled to a low-income adjustment unless court orders otherwise – Accessibility of Health Insurance defined as “within 50 miles of the supported child’s residence” – California’s Healthy Families program meets the medical support obligation if the employee enrolls the child 19 Confidentiality • Case records are confidential • Employers can only be given information to comply with the IWO or NMSN • LCSA can only discuss case as it relates to the employer’s ability and/or obligation to process the IWO 20 Questions?? 21 22 California State Disbursement Unit (SDU) Functions: • Collection Processing • Disbursement Processing • Electronic Help Desk State (DCSS) and County (LCSA) Functions: • Case Management • Fund Allocation • Non IV-D Customer Service We now have a centralized phone number (866) 901-3212. 23 • Remit all California income-withheld child support payments to the CA SDU • Include necessary employee identification information • Electronic payments are fast, efficient and the preferred way to streamline payment processing • Electronic payments are required by law for many employers • CA Family Code 17309.5 - Employers required to remit EDD or FTB payments electronically must also remit child support electronically 24 • ACH (Automated Clearing House) Credit • Push a payment from your account to the SDU account • ACH Debit • Pull a payment from your account to the SDU account • Check 25 • Benefits of electronic payment options • • • • • • Fewer errors No lost checks Saves time and money Reduces risk of the theft and fraud Faster SDU collection receipt and processing. It’s green 26 Contact SDU to Receive Guide and Enrollment Form Receive Guide and Form Complete and Return Form to SDU Create and Send Test File to SDU Receive Authorization from SDU to Remit Make a Payment ACH Credit Flows ACH Operator(s) SDU Bank Employer Bank $ $ Debit Employer $ Credit SDU 27 Contact SDU to Receive Guide and Enrollment Form Receive Guide and Form Complete and Return Form to SDU Create and Send Test File to SDU Receive Authorization from SDU to Remit Make a Payment There are two ways to register. • Employers can complete the enrollment information online at the SDU website at www.casdu.com • While there you can download or print the Employer Handbook. • Employers can initiate the process by contacting the SDU by phone at (866) 901-3212 or e-mail at: casdu-electronichelpdesk@dcss.ca.gov • The SDU can send the employer an Enrollment Form. 28 Contact SDU to Receive Guide and Enrollment Form Receive Guide and Form Complete and Return Form to SDU Create and Send Test File to SDU Receive Authorization from SDU to Remit Make a Payment • Once Employers receive the Enrollment Form they must complete the form and return it to the SDU by fax, e-mail or mail. • Fax: (888) 587-5471 • Email: casduelectronichelpdesk@dcss.ca.gov • Mail: P.O. Box 981326 West Sacramento, CA 95798-1326 29 Contact SDU to Receive Guide and Enrollment Form Receive Guide and Form Complete and Return Form to SDU Create and Send Test File to SDU Receive Authorization from SDU to Remit Make a Payment Employers working with their financial institution and technical department, create and send a test file to the SDU. 30 Contact SDU to Receive Guide and Enrollment Form Receive Guide and Form ACH File Structure Complete and Return Form to SDU CCD+ and CTX820 Record Layout Create and Send Test File to SDU Receive Authorization from SDU to Remit CCD+ and CTX820 File Format Make a Payment Testing Complete • File Header Record (1 Record) - Immediate Origin and Destination • Company Batch/Header Record (5 Record) – Identifies the Employer and briefly describes the purpose of the entry • Entry Detail Record (6 Record) – Debit/Credit Indicator (Transaction Code), Name, Account Number, Identification Number • Addenda Record (7 Record) – Used to supply additional payment information related to the Entry Detail Record • Company/Batch Control Record (8 Record) – Contains entry counts, totals and dollar amounts of the preceding Entry Detail Records • File Control Records (9 Record) – Contains accumulations of entry counts, totals and dollar amounts from the Company/Batch Control Records within the file 31 Contact SDU to Receive Guide and Enrollment Form Receive Guide and Form ACH File Structure Complete and Return Form to SDU CCD+ and CTX820 Record Layout Create and Send Test File to SDU Receive Authorization from SDU to Remit CCD+ and CTX820 File Format Make a Payment Testing Complete CCD+ CTX820 File Header Record Company/Batch Header Record Entry Detail Record Addenda Record (1 addenda with 80 byte Payment Related Information Field) Entry Detail Record Addenda Record (1 addenda with 80 byte Payment Related Information Field) Entry Detail Record Addenda Record (1 addenda with 80 byte Payment Related Information Field) Entry Detail Record Addenda Record (1 addenda with 80 byte Payment Related Information Field) Company/Batch Control Record File Control Record File Header Record Company/Batch Header Record Entry Detail Record Addenda Record (up to 9,999 addenda with 80 byte Payment related Info Field) Addenda Record Addenda Record Addenda Record Addenda Record Entry Detail Record Addenda Record (up to 9,999 addenda with 80 byte Payment related Info Field) Addenda Record Addenda Record Addenda Record Addenda Record Company/Batch Control Record File Control Record 32 Contact SDU to Receive Guide and Enrollment Form Receive Guide and Form ACH File Structure Complete and Return Form to SDU CCD+ and CTX820 Record Layout CCD+ and CTX820 File Format Receive Authorization from SDU to Remit Make a Payment Testing Complete CTX820 CCD+ 101999999999955555555550612051000A094101BANK NAME COMPANY NAME 00000000 5200COMPANY NAME 1091000011229669 Create and Send Test File to SDU YOUR 1445556677CCDCHILD SUP 020301020301 6220730002227007002 0000018000BROK01 IOWA 091000011229670 STATE OF 705DED*CS*111111*020301*0000018000*999999999*W*JONSEYKEV*19000\ 00011229670 6220730002227007002 0000004476COMLO01 IOWA 1091000011229671 STATE OF 705DED*CS*222222*020301*0000004476*999999999*W*JOHNSONJOH*19000 \ 00011229671 6220730002227007002 0000002538COML01 IOWA 1091000011229672 STATE OF 705DED*CS*333333*020301*0000002538*999999999*W*NAMELASTFIR*1900 0\ 00011229672 8200000006000000000000000000000000000000000025014004465 091000010000000 101999999999955555555550612051000A094101BANK NAME YOUR COMPANY NAME 00000000 5220YOUR COMPANY NAME 9999999999CTXCS PAYMENT 061205 1999999990000001 622999999998555555555555555550000000001 CASDU 1000000000000000 705ISA*00* *00* *ZZ*11-1111111 *ZZ*CASDUSTATE DISB*061206*16500010000001 7051*U*00300*000000001*0*P*>\GS*RA*11-1111111 *CASDUSTATE DISB*061206*1651*00000020000001 70500011*X*003070\ST*820*9999\BPR*D*88.47*C*DXC*CTX*01*999999999*01*07 1004501**99-0003000001 7059999999*000000001*01*999999999*DA*BANKACCOUNTNUMBER*20061106*PCS\D ED*CS*12345604001 7059*061204*2500*111111111*Y*EMPLOYENAM*06305\DED*CS*CASENUMBR*061204 *6347*99990005001 7059*Y*EMPLOYENAM*06305\SE*5*9999\GE*1*000000011\IEA*1*000000001 00060000001 822000000200000000000000000000000000000000009999999999 9000001000001000000040000000000000000000000000000000002 9000001000001000000040000000000000000000000000000000002 33 Contact SDU to Receive Guide and Enrollment Form Receive Guide and Form Complete and Return Form to SDU Create and Send Test File to SDU Receive Authorization from SDU to Remit Make a Payment • Upon successful completion of the test file, the SDU sends employers an Authorization Letter that includes the bank routing and account number for transfer of funds • Employers can begin sending payments to the SDU by ACH Credit 34 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment • To make ACH Debit payments using the CA SDU website, employers must first register. • Once registered, employers can make payments by ACH Debit • • By phone (866) 901-3212 Online www.casdu.com • ACH Debit payment methods include: • Direct withdrawal from checking or savings account • • If your account has a Debit Block, contact your bank. VISA or MasterCard credit or debit card 35 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment Employer Registration • Access www.casdu.com • Click the Employers button to register to make payments electronically on behalf of employees • Click the Register Now button • Enroll to set up an electronic account 36 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment Employer Registration (continued) • Enter company details • Create a meaningful User ID • Username and FEIN are required for system access • Enter primary and secondary contact information • Click Submit • A Temporary Password will be sent to you via the Primary contact e-mail • The password is unique and can be changed by you 37 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment Employer Registration (continued) • Review the company details you entered • Click Done 38 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment Once you receive your password you may access www.casdu.com • Enter your Username and the Password you received via e-mail • Click the Submit button You will be prompted to change your password 39 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment From here you may make a payment or create a payment template Let’s make a payment. • Click the employer Make Payment button 40 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment • You have the choice to pay using your checking, savings, VISA, or MasterCard • Enter your checking or savings account information OR • Enter your VISA or MasterCard account information • Enter your employees’ information • Click Submit to make this payment 41 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment After account setup and payment profile entry is completed, employers have two system features available to make a payment by ACH Debit • Manual entry • Enter employees’ child support payment information manually • Bulk upload • Create and upload a file containing employees’ child support payment information We will go over the bulk upload process later. 42 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment Verify the information and click Submit 43 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment To save this information for your next payment click Save As Template Payment method information stored in the payment profile is safe and secure! 44 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment • Create a Template Name • You can add or remove employees even after you have created a template. • Click Add Employee or Remove Selected Employee and follow the instructions. • Type in employee information • Click Submit 45 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment • Verify your payment amount and the information • If you need to make changes click Modify. • If you are ready to make the payment click Submit • The system will show a confirmation page and a confirmation will be e-mailed to you. 46 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment • Once you click Submit you will see a confirmation page • For your convenience a confirmation will be e-mailed to you. 47 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment Bulk Upload • Create a Comma Separated Value (CSV) file and store it on your system. • Upload the file containing employees child support payment information. 48 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment Bulk Upload (continued) If you have already input your choice of payment, you may begin to process your bulk upload. If not, enter your checking or savings, VISA, or MasterCard account information. 49 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment Bulk Upload (continued) • To access your saved payment profile details, enter your Template Name and click Load Template. • If you did not save your payment information, enter your checking, savings, VISA, or MasterCard account information 50 Set Up Account and Register Receive Email with Password Log In to Account Enter Payment Profile Details Make a Payment Bulk Upload (continued) • For instructions on how to create and use the Bulk Upload click the View Instructions link 51 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment Bulk Upload (continued) • Detailed instructions as to how to create a comma separated value (CSV) file on your system are available. • Required payment information includes: • 13- or 15-digit Participant ID number • Social Security number • Case number (required if the payment is Non IV-D) • Payment amount • Payment date 52 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment Bulk Upload (continued) • Enter your CSV file name or click Browse to upload your CSV file from your system • Once you locate the file on your system click the Submit button 53 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment • Review payment verification • If any information is incorrect, click the Modify button and make your corrections • Once all information is correct click Submit 54 Set Up Account and Register Receive E-mail with Password Log In to Account Enter Payment Profile Details Make a Payment • Once you click Submit you will see a confirmation page • For your convenience a confirmation will be e-mailed to you. 55 • Payments sent directly to custodial parties must now be sent to the State Disbursement Unit (SDU) as per California Family Code Section 5235(e) • Do not send payments to the SDU until a case has been assigned by the SDU and you have received a CSE case number 56 The SDU recognizes and appreciates the integral role of employers in California’s child support program. • Remit all California wage-withheld child support payments to the SDU • Choose an electronic payment option that fits your needs • Paper payments can be sent to: PO Box 989067 West Sacramento, CA 95798-9067 Include: the employee name, social security number, CSE participant number, amount, date of withholding and CSE case number for Non IV-D payments. 57 • California Department of Child Support Services Web www.childsup.ca.gov • The SDU offers a dedicated team of professionals to support all aspects of employer child support payment processing • Contact us using any of the following methods – – – – Phone (866) 901-3212 E-mail casdu-electronichelpdesk@dcss.ca.gov Fax (888) 587 5471 Web www.casdu.com 58 Questions? 59 The California Department of Child Support Services (DCSS) Program Relationships Employers and DCSS March 28, 2012 60 DCSS Mission Statement Enhance the well-being of children and the self sufficiency of families by providing professional services to: • • • • Locate parents Establish paternity Establish/Enforce orders-financial support Establish/Enforce orders-medical support 61 Building Bridges •Employers •Employment Development Department (EDD) •Office of Child Support Enforcement (OCSE) •Department of Child Support Services (DCSS) •Child Support Enforcement System (CSE) •Employer Data 62 RELATIONSHIPS Employers, EDD, OCSE and the DCSS Mission LOCATE EMPLOYER DE 34 OCSE FPLS DE 6/9C EDD SDNH NDNH FCR ESTABLISH •Paternity •Support CSE ENFORCE •IWO •e-IWO •NMSN SDNH: STATE DIRECTORY OF NEW HIRES FPLS: FEDERAL PARENT LOCATOR SERVICE NDNH: NATIONAL DIRECTORY OF NEW HIRES FCR: FEDERAL CASE REGISTRY 63 Employer Information Request (EIR) http://www.childsup.ca.gov/Portals/0/employer/docs/E mployer_Information_Request_Form.pdf 64 Conflicting Information IWO NMSN 2.5 MILLION UNCONFIRMED RECORDS Verifications 65 Employer Information Request (EIR) 66 YOU Are A Critical Partner! • e-IWO •Increase accuracy and reliability of data •Single point of contact for e-IWO questions •Save time money and resources • State Services Portal – March 2012 • Debt Inquiry • Providing small insurance companies an avenue to report payments and settlements • Lump Sum • lumpsumresponseteam@dcss.ca.gov • 916-464-6640 • Employer Information Request form (EIR) • Improves delivery of support enforcement documents • http://www.childsup.ca.gov/Portals/0/employer/docs/Employer_Inform ation_Request_Form.pdf • DCSS Employer Portal • Improve delivery of services 67 Vision and Values of DCSS CHILDREN CAN RELY ON THEIR PARENTS FOR THE FINANCIAL AND MEDICAL SUPPORT THEY NEED TO BE HEALTHY AND SUCCESSFUL • • • • • • Commitment to Children and Families Fairness and Respect Quality Customer Service Cooperative Partnerships Integrity and Ethical Conduct Operational Excellence 68 • Employer Maintenance Customer Service • (888) 898 1743 • edmv@dcss.ca.gov – John Contreras • (916) 464 6595 • Internet: • http://www.childsup.ca.gov/Default.aspx • Email Updates: – http://www.childsup.ca.gov/Employer/Emai lSubscription.aspx Questions? 70 Employer Workshop The electronic Income Withholding Order project e-IWO Bill Stuart Federal Office of Child Support Enforcement 71 What is e-IWO? • • • • States electronically send IWOs Employers electronically acknowledge IWO The Portal - One “point of contact” Federal Employer Identification Number (FEIN) is key • Handles terminations, lump sum payments • Implementation Options – System to system – Fill-able PDF and Spreadsheet 72 Get Rid of the Crates! 73 e-IWO Process Flow 74 Portal Registration • Everyone must register • Complete a Profile form • Registration includes Agreement System to System Implementation • • • • Flat File or XML Schema offered Mapping IWOs received in file/batches Employer generates Acknowledgement • Error files returned • Manual processing minimized • 3-5 Month IT project eZ-IWO No Programming Options • Option 1 – PDF Income Withholding Order and – PDF Acknowledgment • Pretty Darn Fast • Option 2 – PDF Income Withholding Order and – XLS Acknowledgment • Xtreme Lightning Speed The PDF Acknowledgment Option • • • • • In production Sample – next slide Reduces the IT resources required Accept or reject the IWO Acknowledgment information provided to States • Handles termination and lump sums 79 The XLS Acknowledgment Option • • • • • In Production Sample Reduces the IT resources required Accept or reject IWO Acknowledgment information provided to states • Handles termination and lump sums States Using e-IWO Arizona California Colorado District of Columbia Idaho Illinois Indiana Massachusetts Michigan Missouri Nebraska New Jersey New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Texas Virginia Washington West Virginia 235+Employers on e-IWO – Comprising 2,350+ FEINs Accor of N.A. Adecco ADP Costco DOD Dollar General Dollar Tree Express Professionals Jack in the Box KBR Kelly Services Meijer Pepsi Peoplelink Quest Diagnostics Ruby Tuesday Target Tyson Foods UPS Time Warner Cable UPS USPS Verizon Yum! Brands 82 Improvements! • E-mail process and error notifications • Enhanced editing • e-IWO information on Web 83 Ready, Set, Go! Speed records will be broken with this process! What do I need? •Secure File Transfer Protocol (SFTP) Server or •FTP Server with a Virtual Private Network •We will help you get set up! 84 Ready, Set, Go! I want to do this! How do I get started? •No cost to the employer! •Fill out Profile, FEIN Spreadsheet •We establish connectivity with you •Conduct a test •Start receiving Acknowledgments!! 85 The Benefits • Adding additional employers (for states) or states (for employers) is straightforward • Increases collections • Saves time, money, and resources • Ensures uniform IWO data from all states • Increases accuracy and reliability of data • Acknowledgement provides timely feedback Resources • Software Interface Specification Document (SIS) http://www.acf.hhs.gov/programs/cse/ne whire/employer/publication/eiwo/sis/eiwo _sis_qc.htm • e-IWO Workgroup • 33 States; 65+ employers - monthly calls • e-IWO Workplace • Minutes of meetings, business rules, etc. • Contact Bill Stuart to register and access the Workplace In Summary DO THIS e-IWO NOT THAT Questions & Answers Contact Information Bill Stuart william.stuart@acf.hhs.gov 518-399-9241 89 Child Support Directors Association 916-446-6700 www.csdaca.org 90