Life Insurance Licensing Study Guide for New Associates

Team

LAVINATION

Study Guide for New Associate

Chapter Guide that follows “UcanPass” to get You Licensed Now!

Congratulations! You’re here to start an exciting new journey that has the potential to change your family’s future!

You took the first step when you joined Primerica. Now, you’re here to take the next step: becoming life licensed. Your life license is real, tangible evidence of your desire to make a difference. Having this license gives you a shot at not only creating financial freedom for your family, but it also gives you the chance to change a lot of lives.

As you’re going through pre-licensing, I encourage you to think about why you’re doing this. Maybe you’re here because you want some extra money each month to pay down debt or to boost your savings. Maybe you want to be able to give your kids the things you never had as a child. Maybe you want to make sure no family is left unprotected in the event of the death of a breadwinner.

Whatever your reason for starting this journey, let that be your motivation for passing the exam. Remember, in this business YOU are in control of your future. I believe if you put your mind to it, put in the work and take advantage of the incredible support your upline, Licensing Specialist, and POL provide, you

CAN pass your exam.

Don’t worry if it’s been a while since you’ve been studying. We’re going to teach you exactly what you’ll need in order to get your license and to start making your dreams happen. The rest is up to you.

I believe you’ve got this! Let’s get started!

Glenn Williams

CEO, Primerica

Chapter 1: Completing the Application, Underwriting, and Delivering the Policy

Application Process Company Underwriting Delivering the Policy

1. Field Underwriter – the agent who solicits the sale, meets with the client and completes the application

2. Disclosure at point of sale – every applicant must be given a written disclosure statement providing basic information about the cost and coverage of the insurance being solicited; must be given at the time the application is signed

3. Application white-out

– the basic source of information used in the risk selection process

Part I: General Info.

Part II: Medical Info.

Part III: Agent’s Report

4. Required Signatures

Agent = field underwriter

Proposed Insured = applicant

Policyowner = if different from the proposed insured (third-party ownership)

5. Changes in Application insurance application are

- Made by applicant only and initialed or new application completed; never erase or use

6. Consequences of incomplete

Applications - m ay delay processing of application; insurer may return the application for completion.

Incomplete applications -insurer waives right to information if policy issued with incomplete information

7. Warranties and

Representations – a warranty is an absolutely true statement; a representation is a statement that is believed to be true to the best of one’s knowledge. Answers on an considered to be representations

1. Underwriting – risk selection and classification process

2. Insurable Interest – possibility of financial loss; your own life, family members, business partners, key employees, financial obligations/lender. Must exist at the time of application but not at death

1. Coverage Begins - when policy is delivered unless premium is prepaid

2. Conditional Receipt

– coverage begins day of application or day of medical exam, whichever is later, IF insured is insurable at the risk category applied for

3. Reports Used by Underwriters

Consumer Report – general report on finances, character, work, hobbies, and habits done by independent firm/reporting agency.

Investigative Consumer Reports are similar but include interviews with friends and associates

Medical Information - Attending

Physician’s Statement (APS) done by client’s physician; Paramedical report – done by paramedic or registered nurse

Medical Information Bureau

(MIB) – nonprofit trade organizations funded by member companies that collect adverse medical information from insurers.

Protects against fraud and holds down insurance costs

Medical Examinations and Lab

Tests including HIV applicant

- if a medical examination is needed, it is at the insurer’s expense; insurer must disclose the use of HIV testing and obtain written consent from the

Fair Credit Reporting Act federal law that establishes

– procedures for reporting agencies to ensure that information is confidential, relevant, and properly used; protects consumers against the circulation of inaccurate or obsolete information; also gives the consumer the right to know what was in a consumer report

4. Risk Classifications

Preferred – better than average, lower premium

Standard – average

Substandard – poorer than average risk, rated premiums

3. Statement of Good Health – may be required if premium is not collected until policy delivery

4. Agent Responsibilities policy delivery

5. STOLI (Stranger-Originated

Life Insurance) and IOLI

(Investor Originated Life

Insurance) – polices that are purchased with the intent of selling them to make a profit; insurable interest does not exist

: at

- explain the policy and its provisions, riders and exclusions; explain any ratings and, answer questions

6. Replacement - terminating or allowing an existing policy to lapse and obtaining a new one; producers and insurers must take special steps to help policyowners make informed decisions about replacement

7. USA Patriot Act – in response to the 9/11/01 terrorist attacks, the

Patriot act was passed to fight and prevent terrorist activities; requires banks and financial institutions

(including insurers) to establish anti-money laundering standards and report any suspicious activity

Suspicious Activity Report

(SARS) – procedures and plans must be in place to deal with any suspicious activity such as money laundering or terrorism financing; deposits involving $5,000 or more must be reported to if the activity is suspicious

Annually Renewable

Term

Renewable

(Option to renew)

Convertible

(Option to convert)

Limited Pay

Single-Premium

Adjustable Life

Chapter 2: Types of Life Policies and Annuities

Life Insurance Policies

Term Life

Level Term

Decreasing Term

Return of Premium Term

Increasing Term

Whole Life

Ordinary (Straight) Life

Description

Pure protection, lasts for a specific term, most insurance for the least premium

Coverage stays the same for the specified period

It pays a benefit only if the insured dies during the term

Coverage gradually decreases at predetermined times

Best used when the need for protection declines from year to year, ex.

Mortgage and Credit Insurance

Insurer returns premiums paid at end of term if no death benefit has been paid

May not return premium in the first few years of the policy

Beneficiaries may receive death benefit only

The most basic form of life insurance

Policy renews each year without proof of insurability

Premiums increase yearly due to attained age

Usually limited to a certain number of renewals or to a certain age

The death benefit increases at specific times

It is usually purchased as an increasing term rider

Special Features of Term Life

Guaranteed renewable before the policy terminates without evidence of insurability

Premiums increase at renewal based on attained age

Can be renewed for a limited number of times or to a certain age, usually 65

The option to convert from a term life policy to a whole life policy without evidence of insurability

Conversion must usually be done within a certain time or by a specific age

Everything is guaranteed (face amount, premium, and cash value) until death or age 100

Cash value is dependent upon the face amount, amount of premiums and how long the policy has been in force

Basic policy, level death benefit

The insured pays premiums for life or until age 100

Premiums are paid until a certain age or time (Ex, 20 Pay Life, Life paid up at 65)

Although premiums are paid up, coverage remains to age 100

Premiums paid in one lump sum and coverage continues to age 100

Three parts that are all adjustable (flexible); coverage, premium, and type of plan

The Insured chooses two and the insurer one

Flexibility in plan type means, for example, the insured may have term to age

65 then change to whole life as needs change

Universal Life

Variable Whole Life

Variable Universal Life

Interest-Sensitive Whole

Life

Equity-indexed Life

Joint Life (First-to-die)

Survivorship Life

(Second-to-die)

Interest/Market Sensitive Life Policies

2 things flexible: Premiums & Face Amount

2 Rates of return on cash value o Guaranteed Minimum Rate OR o Current Rate (set by insurer)

2 Death benefits o Option 1

– death benefit = cash value plus decreasing term; has a corridor to protect policy from becoming a MEC o Option 2 – death benefit = the face amount plus the cash value

Cash Value invested in the separate account and are NOT guaranteed

Policyowner assumes the risk of the investment

Requires 2 licenses to sell / dually licensed & regulated o State Life Insurance License / regulated by State DFS o FINRA License / regulated by SEC

Chance to keep pace with inflation

Level Premium but Face Amount can vary based on performance

Blending of Universal and Variable life

Premium flexibility

Cash value investment control

Death benefit flexibility

Also known as current assumption whole life

Premiums may vary based on the insurer’s experience with investment and death benefits

Cash value may also vary

Face amount increases based on the performance of an equity index, such as the S&P 500 with a guaranteed minimum interest rate and fixed premiums

Combination Plans and Variations

2 or more insureds on the same policy

The policy pays the death benefit when the FIRST insured dies

Less expense than individual policies since the ages are averaged

2 or more insureds on the same policy.

The policy pays the death benefit when the LAST insured dies.

Annuities

Annuity Characteristics

Designed to provide income for a number of years

Not life insurance, but sold by life insurance companies

A method to liquidate an estate or a large sum of money

Use mortality tables that reflect a longer life expectancy than life insurance

Parties

Owne r – purchaser of the annuity who has all rights to the annuity

Annuitant – person who receives the benefit payments from the annuity and on whose life expectancy the annuity is written; may or may not be same as the owner

Beneficiary – person who receives the benefits if the owner dies during the accumulation phase

(either amount paid in or cash value, whichever is greater)

Accumulation vs. Annuitization Period

Accumulation period o liquidation period

Pay-in period o Interest earned on a tax-deferred basis

Annuitization, Annuitization period or o Pay-out period o Payments to the annuitant

How are premiums invested?

Fixed Annuities

Interest rates guaranteed

Invest in general account

Level benefit payment amount

Risk (insurance company assumes)

Do not keep up with inflation

Variable Annuities

Premiums invested in separate account

Interest rate is not guaranteed

Premiums purchase accumulation units (like shares in the separate account) which become a set number of annuity units at annuitization; the value of each unit fluctuates based on the investments

Two licenses (insurance & securities)

Regulated by FINRA/SEC

Indexed Annuities (also called Equity Indexed

Annuities)

Fixed annuity invested on a more aggressive basis to aim for higher returns

Guaranteed minimum interest rate with a current interest rate tied to a familiar equity index such as the S&P 500

Less risky than a variable annuity but expected to earn a higher interest rate than a fixed annuity

How can premiums be paid?

Single Premium - one lump sum

Periodic Premium - same payment frequency; accumulate funds for retirement o Level Premium – fixed payment amount o Flexible Premium

– amount and frequency of installments varies

When do benefits begin?

Immediate vs. deferred annuities

Immediate Annuity - payment begins within 12 months

Deferred Annuity - payment begins after 12 months

Single Premium Immediate Annuity (SPIA)

Single premium payment only

Deferred annuities

Single premium (SPDA) or flexible premiums

(FPDA)

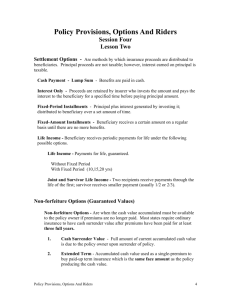

Chapter 3: Policy Provisions, Riders, Options, and Exclusions

Provisions Options Riders

Rights and obligations Choices regarding a policy

Provisions

Entire Contract

Insuring Clause

Consideration

Payment of Premium

Grace Period

Reinstatement

Incontestability

Misstatement of Age and

Nonforfeiture Options

R

E

C educed Paid-up xtended Term ash Surrender

(REC)

Dividends and Dividend

Options

(CRAPPO)

Gender

Owner’s Rights

Assignment o o

Collateral

Absolute

Free Look

Exclusions

Suicide

Policy Loan o Automatic Premium Loan o Withdrawals or Partial

Surrenders

C ash

R eduction of Premium

A ccumulate at Interest

P aid-up Additions

Paid-up Insurance

O ne-year Term

Settlement Options (CLIFF)

Cash (Lump-sum)

Life Income

Interest Only

Fixed-Period Installments

Fixed-Amount Installments

Add or modify coverage

Riders

Waiver of Premium

Waiver of Premium with

Disability Income

Payor Benefit (juvenile insurance)

Accelerated (Living)

Benefits o Long Term Care

Other Insureds/ Term

Riders

Accidental Death and/or

Accidental Death and

Dismemberment

Guaranteed Insurability

Return of Premium Rider

16

Provisions

Entire Contract

Entire Contract = Policy + Copy of Application +

(riders)

No changes can be made to the policy unless the insurer and the policyowner agree and the change is affixed to the policy

Misstatement of Age and Gender

Insurer can adjust the amount of the benefit when a claim is made to the amount the premium would have purchased at the correct age or gender

Assignments

Transfer partial or complete policy ownership: o Collateral = temporary (secure a loan) o Absolute = permanent (sell policy)

Insuring Clause

Basic agreement between the insurer and the insured

Insurer’s promise to pay benefits

Located on the face page of the policy along with other vital information about the policy

Free Look

Days to look over policy and return

Full refund of premium paid

Starts when policyowner receives the policy

In FL, new policy - 14 days; replacement policy -

30 days

Consideration

Both parties must provide something of value, or consideration , for the contract to be valid

Policyowner/insured makes statements on the application and agrees to pay premium

Insurer promises to pay benefits specified in the contract

Exclusions

Risks the policy will not cover (or may charge a higher premium to cover); common exclusions are aviation, hazardous occupations or hobbies, and war or military service

Payment of Premium

When the premiums are due, how often they are to be paid, and to whom they are to be paid

Premiums must be paid in advance

Mode – frequency of premium payments; monthly, quarterly, semi-annual, or annual

Premiums are most often level , but can be flexible for policies like universal life

Grace Period

Time following the due date the policyowner has to pay premium before policy lapses

Usually 30-31 days

Required grace period in FL is 30 days

Reinstatement

3 years to do 4 things: o Payback all back due premium o Pay interest on all back due premiums o Payback any loans (if cash value policy) o Provide evidence of insurability

Suicide

Death benefit will not be paid if insured commits suicide with in the first 2 years after the policy is issued (will return premium paid); will pay benefit after 2 years

Policy Loan

Found only in policies that contain cash value

Face amount will be reduced by the outstanding loan amount at the time of death

Insurer must give 30 days written notice if a policy is about to lapse because a loan and the accrued interest exceeds the cash value

Insurers may defer policy loan requests for up to 6 months

Will be subtracted from death benefit if not repaid

The maximum Interest rate on a policy loan in FL is not more than 10% per year

Automatic Premium Loan

Insurer takes loan from cash value to pay premium when grace period ends without receiving payment

Guards against unintentional lapse

Payment of premium loan request are paid immediately

Incontestability

Prevents denial of a claim due to misleading statements made on the application after the policy has been in force for 2 years

Claim can be denied if misleading information is discovered within the first 2 years

Does not apply to statements about age, sex or identity

Owner’s Rights

Owner has all rights to the policy; naming and changing the beneficiary, receiving the living benefits, selecting a benefit payment option, and assigning the policy

Withdrawals or Partial Surrenders

Only allowed in universal life policies

May be a charge for withdrawals and a limit to the amount that can be withdrawn

May be subject to taxes

17

Beneficiaries

Beneficiaries can be

Individuals - most often used

Businesses – key employees, creditors

Trusts

– legal arrangement for ownership; trustee has fiduciary responsibility

Estates - if no beneficiary is designated, the estate becomes the beneficiary. The estate may be intentionally designated to help with federal estate taxes

Charities

– churches, educational institutions, hospitals, nonprofits, etc.

Minors – may present some legal problems in signing a valid receipt; a guardian may need to be appointed or a trust may need to be established and the benefits paid to the trustee.

Classes – policyowner designates a class or group of individuals as beneficiaries instead of by individual name (i.e., my children, business partners)

Beneficiary Designations

Primary

Contingent

First person(s) named to receive proceeds (death benefit)

All beneficiaries listed after primary

Secondary - next in line after primary

Tertiary - third in line after the secondary beneficiary

Will not receive death benefits unless the primary beneficiary has predeceased the insured

If no beneficiaries are alive upon the death of the insured, the benefit is paid to the insured’s estate

Revocable Policyowner can change beneficiary at any time

Irrevocable Policyowner cannot change beneficiary without written consent from the irrevocable beneficiary. (All owner’s rights require the consent of the beneficiary if the beneficiary is irrevocable)

Common Disaster Clause

(Provided under the Uniform Simultaneous Death Law)

If it cannot be determined who died first in a common accident, it is assumed that the primary beneficiary died first and the death benefit will either be paid to the contingent beneficiary, if one is named, or the insured’s estate

The primary beneficiary must die within 14-30 days of the insured for the benefit to be paid to the contingent beneficiary

18

Riders

Waiver of Premium

Waives premium if insured becomes totally disabled

90 – 180 day waiting period before benefit begins / expires at age 60 or 65

Waiver of Premium with Disability Income

Similar to waiver of premium

Pays a monthly income for the duration of the disability

Usually a small percentage of the face value

Has a waiting period before benefits begin

Payor Benefit (Juvenile Insurance)

If the payor (policyowner of a juvenile policy, usually a parent or guardian) becomes disabled or dies, the insurer will pay premiums until the child reaches a specified age, usually 21 or 25, and can convert the policy to an individual; policy

Accelerated (Living) Benefits

Allows for early payment of a portion of the death benefit

The insured must suffer from a terminal illness or condition that requires extensive medical intervention or treatment, or confinement in a long-term care facility

Usually pays a percentage of the face amount or a certain dollar limit

Will reduce the death benefit by the amount paid for the accelerated benefit

Long Term Care

Pays a monthly income to help cover the cost of health care while the insured is confined to a nursing home or convalescent home

Usually a small percentage of the face amount

Will reduce the death benefit if used

Can be either a rider or a separate policy

Other Insureds/Term Riders

Other insureds - Term insurance added to a base policy to cover a spouse, their children or any additional insured

Term Riders - Add additional temporary coverage at a reduced cost on the primary insured when added to a whole life or term policy

Accidental Death and/or Accidental Death and Dismemberment (AD&D)

Usually pays double or triple indemnity if death occurs due to an accident as defined in the policy

Death must usually occur within 90 days of the accident

The amount paid for accident death is called the principal amount (face amount)

AD&D pays a lump sum called the capital sum for the loss of a qualifying body part (a hand, eye, arm, or leg)

The capital sum is usually half the amount paid for accidental death

Guaranteed Insurability

Allows for purchase of additional insurance at specified future dates or events without evidence of insurability

Additional coverage is purchased at the insured’s attained age

Usually expires at age 40

Return of Premium

Increasing term added to a whole life policy that provides that if death occurs prior to a given age, not only is the death benefit payable to the beneficiary, but all premiums paid up until that time will be returned as well

Usually expires at a specified age, such as 60

19

Policy Options

Nonforfeiture Options (REC)

Cash value cannot be forfeited (lost)

Nonforfeiture guarantees are required by law to be included in the policy

Reduced Paid-up Insurance - use the cash value to buy a reduced face amount policy of the same type for the life of the policy (until death or maturity)

Extended Term - use the cash value to buy a policy that is the same face amount but term insurance (common automatic option); the term policy expires when the money runs out

Cash – surrender the policy for cash; if the cash value exceeds the premiums paid, the excess is taxable as ordinary income; a surrender charge may apply (decreases over time)

Settlement Options (CLIFF)

Methods to pay the death benefit to the beneficiary

Policyowner selects an option at application but can change it at any time

Beneficiary cannot change the option if one has been selected; if one has not been selected, then the beneficiary can select one

Cash Payment (Lump Sum)

Most common; not taxable to beneficiary

Life Income

Pays guaranteed installments as long as the recipient lives; payment amount is based on recipient’s life expectancy and amount of principal. Each payment is made up of principal and interest; interest is taxable. Any remaining principal is forfeited to the insurer upon death

Interest Only

Temporary option until proceeds are paid out; most flexible option. Interest rate is usually guaranteed; interest is taxable

Fixed-period Installments

Proceeds and interest paid in equal amounts over chosen period of time. Length of time determines the dollar amount of payments

Fixed-amount Installments

The dollar amount is chosen to be paid in equal portions until it runs out; the amount of each payment determines the length of time

Dividend Options (CRAPPO)

Mutual companies (participating policies)

Return of excess premiums

Not taxable

Not guaranteed

Cash - check

Reduction of Premium - use to reduce the next premium due

Accumulation at Interest - dividends are accumulated and invested by the insurer; the amount of interest earned is specified in the policy and the interest earned is taxable; the dividends can be withdrawn at any time

Paid-up Additions - dividends are used to buy single premium paid-up coverage to add to the policy (automatic option); increases the face amount of the policy which, in turn, accumulates cash value and pays dividends

Paid-up Insurance - dividends, and interest, are held and accumulated by the insurer and used to pay the policy up early; reduces the length of time premiums must be paid

One-year Term - dividend is used to buy one- year term to increase the face amount of policy; if the insured dies, the beneficiary would receive both the original face amount and the additional term death benefit

20

Chapter 4: Taxes, Retirement, and Other Insurance Concepts

Third-Party Ownership

Group Life Insurance

Conversion Privilege

Contributory vs.

Noncontributory

Qualified Plan

Characteristics

When the insurance policy is owned by someone other than the insured; usually for minors or business insurance

Group Life

Written for a group, usually employee-employer, but other groups may be eligible

Usually in the form of annually renewable term

Evidence of insurability is usually not required

Participants receive a certificate of insurance; the plan sponsor receives master policy contract

The cost of the coverage is based on the average age of the group and the ratio of men to women

31 days to convert from group to an individual policy without evidence of insurability

During the 31 day period the individual is still covered by the group plan

New individual policy face amount will be equal to group amount, but at a higher premium because of attained age

Can convert to any form of insurance offered by the insurer, except term

If death occurs during the 31 days period, group insurance will pay death benefit

Noncontributory – employer pays all the premiums; 100% of eligible employees must participate

Contributory – premiums are shared between employer and employee;

75% of eligible employees must participate

Retirement Plans

Qualified plans are approved by the IRS and include such benefits as deductible contributions and tax deferred growth. To receive tax advantaged IRS treatment, qualified plans must be:

For the exclusive benefit of the employees and their beneficiaries

Formally written and communicated to the employee

Does not discriminate in favor of highly paid employees

Not geared exclusively toward the prohibited group

Permanent

Approved by the IRS

Have a vesting requirement

10% penalty for monies withdrawn before age 59 ½ Withdrawals

Individual Retirement Plans

Individual Retirement

Account - IRA (Traditional

IRA)

Contributions must be in earned Income up to the IRS specified maximum and are tax deductible

Pretax contributions can be made up to age 70 ½

A married couple can contribute double the individual amount, even if only one spouse has earned income, but the money must be kept in 2 separate accounts

There is a 6% penalty for excess contributions

Participants age 50 and over can make catch up contributions

Distribution must begin by age 70

½

Contributions and earnings grow tax-deferred until withdrawn

10% penalty for monies withdrawn before age 59 ½

25

Roth IRA

Rollovers and Transfers

Plans for Employers

Self-employed Plans

Small Employer or Self- employed Plans

Employer Plans

Contributions are made with after-tax dollars

Contributions must be made with up to 100% of earned income up to the

IRS specified maximum

Contributions can continue past age 70 ½ and distributions do not have to begin by age 70 ½

There is also an excess contribution penalty of 6%

Money in the account grows tax deferred until withdrawn

Tax free distributions can begin once the owner reaches age 59 ½ and the account has been open for 5 years

10% penalty for monies withdrawn before age 59 ½

Rollovers

Distribution made payable and sent to the plan participant

20% withholding tax

Must be reinvested in a qualified plan within 60 days to avoid taxes.

Transfers

Distribution from one plan administrator to another plan administrator

No tax withheld

Keogh (HR10)

For Self-Employed Individuals or partners

Must work full or part-time and own at least 10% of the business

Contribution limits or 100% of earned income

Withdrawals must begin no later than age 70 ½

Simplified Employee Pension Plans (SEP)

Employee establishes and maintains an IRA to which the employer contributes

Employer contributions are not included in the employee’s gross income

SEP contributions can be much larger than IRA contributions (IRS established dollar limit or 25% of the employees compensation, whichever is less)

SIMPLE Plans (Savings Incentive Match Plan for Employees)

Plan for small businesses with no more than 100 employees

Participants must have received at least $5,000 in compensation the previous year

The employer must not have a qualified plan currently in place

Employees can defer a specific amount each year and the employer matches it, dollar for dollar, up to an amount equal to 3% of the employee’s annual compensation

Taxes are deferred on contributions and earnings until withdrawn

Profit Sharing Plan

Portion of company profits shared with employees

Contributions only in years of profit

Contributions must be systematic and substantial

401(k)

Contributions withheld from salaries on a pretax basis up to a certain dollar limit

Company can match on either a dollar for dollar or percentage basis

Participants age 50 and above can make catch up contributions

Employee can take a loan against their 401k due to hardship

26

Plans for Nonprofit

Organizations and Public

School Systems

Nonqualified Plans

Personal Insurance Needs

403(B) Tax Sheltered Annuities (TSA)

Qualified plan for certain nonprofit organizations [501(c)(3) organizations] and employees of public school systems

Contributions made by employer or employee through salary reduction

Same catch up and contributions limits as 401(k)’s

Do not have the tax advantages of qualified plans

No limit or requirement on contributions

Can discriminate in favor of voluble employees

Contributions are taken from after-tax money

Examples of nonqualified plans o Individual Annuity o Deferred Compensation Plans o Split dollar insurance agreement o Executive bonus plans

Life Insurance Needs and Analysis/Suitability

Survivor protection

Cash accumulation

Liquidity

Estate creation

Estate conservation

Business Insurance Needs Key person

Life insurance policy that guards against financial loss due to death of a key employee who has special knowledge, skills or business contacts

Business is the applicant, owner, and beneficiary of the policy

The death benefit can be used to keep the business going and replace the key employee

Premiums are not tax deductible, but death benefit is received tax free

The key employee must give permission for the coverage

General Rules

Individual Policy

Business Owned

Group Life

Surrenders

Life Insurance Tax Treatment

Premiums are not tax deductible

Death benefit is tax free if paid in a lump sum to a named beneficiary

If death benefit is paid in installments, the interest earned is taxable

Cash value grows tax deferred

Not subject to income tax even if it exceeds premium paid

Only interest earned is taxable

Tax deductible as a business expense

First $50,000 are not taxable to the employee

If the business is the named beneficiary of the policy, the premiums are not tax deductible

Cash value on a business owned policy or employer policy grows tax deferred and is taxed only on the interest earned when withdrawn

Death benefit is tax free if paid in a lump sum to a named beneficiary

Tax deductible as a business expense

Premium paid on the first $50,000 is not taxable to the employee

Death benefit is tax free if paid in a lump sum to a named beneficiary

If the policy is surrendered and the cash value received is more than the amount of premium paid, gain is taxed as ordinary income

Loans are never taxable Policy Loan

Accelerated Death Benefit a Not taxable

Estate Taxation May be included in insured’s estate and subject to federal estate taxes

Policy Dividends Not taxable; dividends on a participating policy are a return of premium

27

Modified Endowment

Contract (MEC)

Benefits Provided

Insured Status

Blackout Period

Any life insurance policy failing the seven-pay test (develops cash value faster than a seven-pay whole life policy)

MECs lose the tax advantages of a regular life policy

Once a policy becomes a MEC, it will always be a MEC

Surrenders come out Last In First Out (LIFO)

10% penalty for surrenders prior to age 59 ½

Social Security Benefits and Taxes

Disability

Survivor

Retirement

Fully insured – 40 quarters of coverage (10 years of work) entitled to receive Social Security retirement, Medicare, and survivor benefits

Currently insured (or partially insured) – 6 quarters of coverage during a

13-quarter period; only entitled to some benefits

The period of time between the time the youngest child turns 16 and the time the surviving spouse reaches retirement or turns 60 when there are no benefit payments

28

Chapter 5: Florida Statues, Rules and Regulations Common to All Lines

Transacting Insurance

Domestic Insurer

Foreign Insurer

Alien Insurer

Stock Insurers

Mutual Insurer

Fraternal Life Insurance

Organizations/Fraternal

Benefit Societies

Certificate of Authority

Admitted/Authorized

Insurer

Nonadmitted/

Unauthorized Insurer

Insurers

Solicitation or inducement to purchase insurance (presenting)

Preliminary negotiations toward the sale of insurance (take app)

Effectuation of a contract of insurance (issue & deliver policy)

Transaction of matters subsequent to effectuation of a contract of insurance or arising out of it (servicing the client after the sale)

Home Office is Domiciled (incorporated; chartered) in the same State where policies are being sold

Home Office is located in a different State than where policies are being sold.

It is considered a foreign insurer in all States and Territories other than its home State

Home Office is chartered in any country other than the United

States

It is considered an alien insurer in ALL States & Territories

Owned and controlled by Stockholders

Stockholders have voting rights (elects Board of Directors)

Sell NonPar & Par Policies

Dividends are a share of profit and ARE taxable

Incorporated insurer without permanent capital stock

Owned and controlled by its policyowners

Policyowners have voting rights (elects Board of Directors)

Sell ONLY Participating Policies

Dividends are a return of premium and are NOT taxable

Operates as a Corporation, Society or Association

Is for the benefit of its members and beneficiaries

Not for Profit; Lodge System; Ritualistic; Elected form of

Government

Life Insurance is in the form of a Certificate of Membership instead of a policy (Group Insurance)

Issued by the Office of Insurance Regulation

Company is Authorized, Licensed, Admitted or certified

Unauthorized, Non-Admitted, Non-Certified or Unlicensed not allow to sell policies in the state (do not come under the jurisdiction of the state of Florida)

Licensed and authorized to transact business in Florida

Gets a Certificate of Authority

Does not come under the jurisdiction of the CFO & Office of

Insurance Regulation with regard to o examination of its financial soundness o examination and approval of types of coverages offered o advertising through the mail

If found guilty of aiding and abetting a nonadmitted insurer, 3 rd degree felony; Liability for all unpaid claims; suspension or revocation of all insurance licenses

Legal reserve requirement Insurers must maintain enough funds in the RESERVE account to cover future liabilities to policyowners; as promised in the insurance

29

Who administers

Insurance Laws in

Florida?

contract

Purpose of regulation

Who Administers the Insurance Laws of Florida?

Public Interest = Public Trust (Consumer Protection)

Financial importance of Insurance industry on the National

Economy

Technical character of insurance contracts requires expert control

The Chief Financial Officer (CFO), the Financial Services

Commission and the Office of Insurance Regulation

Chief Financial Officer

Duties

Department of Financial Services

Independently elected

Member of the Governor’s cabinet

Head of the Department of Financial Services

Member of the Financial Services Commission

Administers regulation of insurance agents, insurance fraud, and insurance consumer protection

Enforces the Insurance Code and carries out those duties set forth by the code

Financial Services Commission

Composed of

Duties

Governor, Chief Financial Officer (CFO), Attorney General,

Commissioner of Agriculture

Supervises the Office of Insurance Regulation and the Office of

Financial Regulation

Office of Insurance Regulation (OIR)

Appointed by the Financial Services Commission Commissioner of the

Office of Insurance

Regulation

Powers and Duties

Examination

Investigation

Insurance company regulation, including: licensing, rates, policy forms, market conduct, claims, certificates of authority and solvency.

The CFO and the OIR have the right to examine insurer’s books and records at least once every 5 years or as frequently as deemed appropriate

The cost of the examination is the responsibility of the insurer being examined

DFS and OIR may investigate any person who has violated or is violating the Insurance Code

The DFS can investigate the accounts, records and insurance affairs of any agent adjuster, insurance agency or other person subject to it’s jurisdiction

The OIR can investigate the accounts, records, and transactions of insurers and or any company that involved in doing business with a domestic insurer

Any individual who willfully obstructs an investigation is guilty of a misdemeanor

Office of Financial Regulation (OFR)

Head of the Office of Financial Regulation Commissioner of

Financial Regulations

Powers and Duties

Responsible for all activities of the Financial Services Commission

30

Investigation

Persons Required to be

Licensed

Scope of a License

License Types

Insurance Agencies

License Process

Financial related to regulation of banks, credit unions, other financial institutions, finance companies, and the securities industry

Includes a Bureau of Financial Investigation that investigates wrongdoing, and may refer suspicious violations of criminal law to state or federal law enforcement of prosecuting agencies

Has the power to conduct investigations concerning Florida financial institutions codes or rules adopted by the Commissioner

Failure to comply with a subpoena or order will result in a contempt of court and costs for the investigation are assessed against the person being investigated

Agent/Agency Licensing & Appointment

FL law requires any individual who solicits insurance to hold a valid license issued by the Department of Financial Services

A life agent’s license covers all classes of life insurance except limited credit

No agent shall transact business for any line for which they do not have a current license or appointment from an authorized insurer

Agent

– general lines agent, life agent, health agent, or title agent

Public Adjuster – any person who, for compensation, prepares, completes or files an insurance claim form for an insured or third- party claimant; may also be a compensated person who aids in negotiating or effecting the settlement of claims

All-lines Adjuster – a self-employed person who works for insurers or adjusting firms to ascertain and determine the amounts of claims, losses or damages payable under contracts and attempt to settle those claims

Agency – a business location at which an individual, firm, partnership corporation, association or other entity engages in any activity that by law can only be performed by a licensed insurance agent; does not include and insurer or adjuster

Unaffiliated agent – a licensed agent not appointed by any insurer, but is self-appointed; acts as an independent consultant for a fee that must be established through a written contract with the parties involved

Any business location at which an individual engages in any activity for which an agent’s license is required must be licensed

A licensed agent must be designated to be in full-time charge of each licensed agency location and is deemed the “Agent in

Charge”.

Branch locations can have the same Agent in Charge providing they are present when activities requiring licensure are occurring

Branch Locations are not required to be licensed if they transact business under the name and the federal tax identification of the licensed agency (effective October 15, 2015)

File a written application, completed under oath and signed by the applicant; the application must include full name, age, social security number, residence address, business address, mailing address, contact phone numbers, and email address

31

Examination Process

Transferring a License

Continuing Education

30 days

Meet the required qualifications

Pay all application fees (non-refundable) in advance to the department

Provide proof of completion or in process of completing prelicensing, if required

If an applicant is denied a license based on the application, the applicant must wait 30 days from the date of denial before applying again

An exam application may be submitted either before or after submitting the license application to the department

An exam application must be accompanied by the exam fee

A notice containing the time and place of the examination will be emailed to the applicant

The exam will be held at a designated test site and will take place as soon as reasonably possible

Any applicant who fails to appear, fails to complete or fails the exam may repay the required fee and retake the exam

The department may require a licensee with a lapsed or suspended license to pay the exam fee and retake the exam before the license is renewed or reinstated

The license exam may not be taken by an applicant more than 5 times in a 12-month period

A license in good standing can be transferred from another state as long as it is in the same line of authority and has been active for at least one year prior to relocation

The agent must become a resident of Florida and submit an application and the appropriate fees within 90 days

Every 2 years each licensed agents in Florida must complete 24 hours of Continuing Education in order to renew their license and appointment

As part of the 24 hours of Continuing Education, each licensee must complete a 5 hour update course that is specific to the license held.(Additional: 3 hour Suitability in Annuities & Life)

This 5 hour course must also cover law updates, ethics, disciplinary needs, product suitability, and other related topics required by the Department

Agents who have been licensed for more than 6 years must complete 20 hours of Continuing Education every 2 years, including the 5 hour update course

Excess hours earned may be carried over to the next compliance period

The Department may grant a CE extension of up to 1 year if good cause is shown

A nonresident agent may use the hours earned in his home state to meet the Florida CE requirement if the home state has reciprocity with Florida

Reporting of Actions

Agents MUST notify Dept. of Financial Services of change of name, address, business address, telephone number or email

32

30 days

Appointment

Renewal and Termination of Appointments

Being found guilty, or pleading guilty, or nolo contendere (“no contest”) to a felony or a crime punishable by imprisonment of 1 year or more in any jurisdiction

Any administrative action taken by any government or other regulatory agency that relates to insurance, securities, or activities involving fraud, dishonesty, untrustworthiness, or breach of fiduciary duty

Appointments

The licensed individual must be properly appointed by an insurer to transact insurance

Appointment means the authority given by an insurer or employer to transact insurance or adjust claims on behalf of an insurer or employer

Agent has 4 years (48 months) to have a license appointed; if not appointed in that time, license terminates

An agent’s appointment remains in effect until revoked, suspended or terminated

The insurer is responsible for renewing the appointment and paying the fee

Late renewal requests must be accompanied by a late filing fee paid by the insurer, not the licensee

Insurers may require appointees to take training and education to be appointed, but these cannot be continuing education courses

Insurers cannot appoint or renew licenses that have not met the continuing education requirement

Activities by an agent

Suspension, Termination, Revocation of License

Unlawful Rebating which may result in the revocation or suspension of an agent’s license

Twisting

Misrepresentation of a policy, agent or insurer

Excessive Controlled Business

Fraud

Violating any ruling of the CFO

Violating any provision of Florida Insurance Law

Incompetence or untrustworthiness

Violating the Code of Ethics

Sale of an unregistered security

Representing an unauthorized insurer

Sliding

Felony conviction

Fiduciary Capacity

Agent Regulation

A fiduciary is someone in a position of trust; often in a position of

Commissions financial trust

Agents are legally obligated to treat applicants and insureds in an ethical manner

It is illegal for insurance producers to commingle premiums collected from applicants with their own personal funds

Agents are compensated by a commission which is a percentage of the initial (first year) and subsequent premiums

Commissions may only be shared with another Licensed and

33

Appointed Agent

Controlled Business Selling insurance only to yourself or people you know or persons they or their spouses are in business with

Cannot exceed 50% of the aggregate commissions and compensation received within a 12-month period

Record Keeping Agents are required to maintain records of transactions for three (3) years.

Rule 69B-215 F.A.C. Code of Ethics

– Life Underwriters (For AGENTS)

Code of Ethics

“Right & Wrong” /appropriate & inappropriate behavior by agents

Both NAIFA and HAHU issue their own

Incorporated into FL State Laws under Rule 69B-215

Violation of Ethic Laws can result in license suspension or

Scope

Twisting

Churning

Florida Life and Health

Guaranty Association revocation

Business of insurance is a public trust in which all agents have a common obligation to work together in serving the best interests of the insuring public

External replacement ; Illegally inducing any person to lapse, forfeit, surrender, convert an existing policy to replace it with another insurer’s policy *Fine can be up to $75,000 per violation

Replacing policies within the same company, often by the same producer in order to generate commissions. Also, using policy values in an existing policy to purchase another policy or contract with the same insurer. *Fine can be up to $75,000 per each willful violation

Insurance Guaranty Fund

Guaranty Associations protect policyowners, insureds, beneficiaries, and anyone entitled to payment under an insurance policy from the incompetency and insolvency of insurers

Payment limits are set by state law

The association is funded by its members through assessments

The aggregate liability of the FL Life and Health Guaranty

Association may not exceed the following o $100,000 in total net cash and cash withdrawal value for life insurance o $250,000 in net cash surrender and cash withdrawals for deferred annuities o $300,000 for all benefits including cash value, with respect to any one life

Misrepresentation

Unfair Marketing Practices

Untrue, deceptive or misleading information in regard to the terms of an insurance contract, insurance company, insurance agent including the financial standing of any insurer.

Omission of a material fact: o Innocent misrepresentation of a material fact is grounds to void a contract. Misrepresentations of immaterial facts makes contract voidable.

Examples of misrepresentation: Guaranteeing policy dividends;

Using inaccurate numbers on a Chart; false information about provisions or contract terms; Using the term “Vanishing

Premiums”, Implying “Flexible Premium” policies will fund

34

False Advertising

Rebating

Coercion

Sliding

Churning themselves after the Initial premium is paid

Any form of communication used to broadcast information that is untrue, deceptive or misleading that applies to the business of insurance or anyone connected with it

False advertising usually includes misrepresenting key facts and information about an insurer or a policy

Any inducement offered in the sale of an insurance product that is not specified in the policy

Both the offer and the acceptance of a rebate are illegal

In FL, rebates must be reflected on the rebate schedule and cannot be unfairly discriminatory

Agents are required to maintain a copy of all rebate schedules for the most recent 5 years

To impose ones will on another. To say to a client that they must buy one product in order to qualify for another. A prime example of coercion is a loan officer who claims you must buy mortgage life insurance in order to qualify for the loan.

Representing to an applicant that a specific ancillary coverage or product is either:

Required by law when it is not

Included in the policy at no charge when there is a charge

Charging without the applicants informed consent

Replacing policies within the same company, often by the same producer, in order to generate commissions. Also, using policy values in an existing policy to purchase another policy or contract with the same insurer. Churning is also called internal replacement and is prohibited unless the agent can prove it is in the best interest of the applicant

Twisting Misrepresentation by an agent to induce a policyowner to lapse an existing policy in order to switch insurers. Also called external replacement. Twisting is prohibited

Defamation False or maliciously critical statement of another person, product or business calculated to injure

Unfair Discrimination Knowingly making or permitting any unfair discrimination between individuals with regards to the business of insurance

Unfair Claims Settlements

Any form of misrepresentation of pertinent facts

Agent and insurer must acknowledge claim promptly

Insurer must process the claim in a timely manner

Insurer cannot delay the benefit payment

Insure must provide a reasonable explanation in writing if there is a reason for denial

Fraud

Knowingly making a false or fraudulent application for any license or violating any provision of the Insurance Code

Intentional deception (lie) that results in injury, for financial gain

Penalties and Fines

License Denial, Suspension, Revocation, Refusal and a fine of not less than $500 nor more than $3500, and/or imprisonment for not more than 6 months for each violation

In addition to a fine, CFO may assess an amount equal to the amount of commission the agent earned

35

Failure to answer a subpoena or order of the

CFO

Violating a Cease and

Desist Order

Aiding and Abetting an

Unauthorized Insurer

Acting as an Insurer without proper license

Twisting or Churning

Forging signatures on an application or policy- related document

Fraud against the Public

Fraudulent insurance claims and applications

Obstructing a DFS or OIR investigation

Contempt of court

$1,000 fine

Administrative penalty of up to $50,000

Suspension or revocation of the license or certificate of authority, and/or

Any other relief as provided in the Insurance Code

Conviction of a third-degree felony

Liability for all unpaid claims

Suspension or revocation of all insurance licenses

Conviction up to a third-degree felony

Liability for all unpaid claims

Suspension or revocation of all insurance licenses

First degree misdemeanor

Administrative fine of $5,000 each if non-willful

Aggregate fine $50,000 for non-willful violations

Administrative fine of $75,000 each if willful

Aggregate fine $$250,000 for all willful violations

Third-degree felony

$5,000 fine for each if non-willful violation

Aggregate fine $50,000 for non-willful violations

$75,000 if willful violation

Aggregate fine $$250,000 for all willful violations

CFO can turn the matter over to the Attorney General for prosecution

Third degree felony

Misdemeanor

36

Chapter 6: Florida Statues, Rules, and Regulations Pertinent to

Life Insurance Products

Specific regulations of which agents should be aware

Buyer’s Guide and Policy

Summary

Solicitation regulations

Annuity suitability

Senior Consumers

Prohibited practices for marketing of life insurance policies

Marketing Practices

Florida Life Insurance Solicitation Law – information and procedures required when proposing life insurance to a prospective buyer

Florida Replacement Rule – requirements and procedures to be followed when a prospective buyer will be replacing existing insurance with new insurance

Code of Ethics of the Florida Association of Insurance and

Financial Advisors – established an outline of appropriate and inappropriate business behavior for insurance agents; establishes the activities of agents as one of public trust

Disclosure

The Buyer’s Guide and Policy Summary must be given to the applicant no later than the time the application is signed o The Buyer’s Guide contains generic information about life insurance policies o The Policy Summary is a written statement that describes the elements of the policy, and includes the key features, conditions and restrictions of the policy

Life Insurance Solicitation

Provides buyers with information that will buyer’s select the most appropriate policy, understand the features of the policy, and evaluate the costs of comparable policies

Life insurance solicitation regulations does not apply to annuities, credit life, group life, variable life policies and life policies issued in connection with pension and welfare plans

Prohibited Practices

Using misleading terms such as financial planner, investment advisor, financial consultant or similar terms to imply that an agent is engaged in an advisory business in which compensation is not related to sales

False information and advertising

– insurers may not make, publish, circulate before the public any advertisement or statement with respect to the insurance business that is untrue, deceptive or misleading

Advertising gifts

– an insurer or its’ agents cannot give any item for the purpose of advertising that has a value of more than $25.

Free insurance – offering free life insurance for either the sale or purchase of personal property is prohibited

To ensure that annuity transaction are in the best interest of the consumer, producers must make a reasonable effort to obtain relevant information from the consumer and evaluate the following factors: age, annual income, financial and tax status, investment objectives, liquidity needs and liquid net worth, intended use of annuity, financial experience, and risk tolerance

A senior consumer is anyone age 65 or older

The insurer or agent has no obligation to the senior consumer if the

43

consumer refuses to provide relevant information as requested

Annuities sold to senior consumers may not contain a surrender or deferred sales charge for a withdrawal for more than 10% of the amount withdrawn

Agents and insurers must maintain records on recommendations and sales of products to senior consumers for 5 years after the transaction is completed

Replacement

Florida Replacement Rule Sets forth the requirements and procedures to be followed by insurers and agents when making a proposal for the replacement of a life insurance product

Definition of Replacement Any transaction in which an existing policy is

Lapsed

Surrendered

Converted to reduced paid-up or continued as extended term

Reissued with a reduction in Cash Value

Converted so that either the amount or coverage period is reduced

Used in a financed purchase

Replacing insurer

Existing insurer

Duties of Agents

Duties of Replacing

Insurers

The company that issues the new policy

The company whose policy is being replaced

Provide the applicant a “Notice Regarding Replacement” signed by both the agent and the applicant; leave a copy with the applicant

Obtain a list of all existing policies/annuities being replaced

Leave copies of Notice, all sales proposals or other sales material with the applicant

Submit a copy of the signed Notice to the replacing insurer along with the application

Notify existing insurer immediately of the receipt of an application for policy replacement and provide a copy of the Notice Regarding

Replacement and information on the replacing policy

If requested by the applicant, send a Comparative Information Form containing information about the proposed policy within 5 working

Products exempt from replacement rules days of receiving the application

Provide a buyer’s guide and policy summary prior to accepting the applicant’s initial premium unless the policy contains a free-look period of at least 10 days

Keep copies of replacement notices, statement, any sales material, and the application in the Producer’s file for that applicant for at least

3 years

Duties of existing insurers

Provide policyowner with a policy summary of the existing policy within 10 days of receiving the Notice and information that the existing policy is being replaced

Keep replacements notifications received for at least 3 years or until the next regular examination by the Insurance Department, whichever is later

Industrial insurance

Credit Life Insurance

Group Life Insurance

Variable Life and Variable Annuities

Every policy issued in

Florida must specify

Free Look

Grace Period

Secondary Addressee

Policy Loans

Nonforfeiture options

Spendthrift Clause

A contractual change is being made to an existing policy with the same insurer

Existing policy is nonconvertible term with 5 years or less left and the term cannot be renewed

Florida Specific Policy Clauses and Provisions

Names of the parties in the contract

Subject of the insurance

Risks insured against

Effective date and period of coverage

Premium

Conditions pertaining to the insurance

Form numbers and edition dates of all endorsements attached to the policy

Life insurance and annuities have a 14-day free look period in Florida

30 day grace period is required in Florida

Insurers may impose an interest charge of up to 8% for the number of days elapsing before the premium is paid

If insured dies during the grace period, the death benefit is paid out minus any premiums due plus up to 8% interest from the benefit

Protects elderly insureds

Coverage for those age 64 or older that has been in force for at least 1 year cannot lapse for nonpayment of premiums after the end of the grace period without notification to the policyowner and a secondary addressee (if provided by the policyowner) of the impending lapse

If the policy has a grace period of more than 51 days, the policyowner must be notified of the lase at least 21 days before the end of the grace period

Florida Law specifies that insurers can charge no more than 10% interest on policy loans

Adjustable loans interest rates may not exceed the higher of either the published monthly average for the month ending 2 months before the date the rate is determined, or the rate used to compute the cash surrender value on the policy plus 1% per year

The paid-up nonforfeiture benefit becomes effective if the premium has been in default for at least 1 year unless another option is selected within 60 days after the due date of the premium

If the policy is surrendered within 60 days of the premium due date

(after premiums have been paid for 3 years on ordinary insurance and 5 years in industrial policies), the insurer will pay the cash surrender value

If the policy is paid-up under the nonforfeiture benefit, the insurer will pay the cash surrender amount if surrendered within 30 days after the policy anniversary date

Insurers can defer the payment of cash surrender values for up to 6 months after demand with surrender of a policy

Protects beneficiaries from the claims of their creditors or the policyowners creditors

Protects proceeds still being held by the insurer that have not yet

Designation of

Beneficiaries

Policy Settlement

Characteristics

Competent Parties

Prohibited Provisions

Number of members required to form a group

Eligible Groups been paid to the beneficiary, such as in the case of fixed-amount or fixed-installment options

Does not apply to lump sum payments

Proceeds paid to an estate become part of that estate and are subject to creditors

If the former spouse of the policyowner is the designated beneficiary, the designation will be void at the time of divorce or declared invalid by court order if the designation was made prior to the divorce

Life agents cannot be designated as beneficiaries unless the agent is placing coverage on a family member (controlled business)

Settlement of the policy must be made upon the death of the insured and proof of receipt of death

If the settlement is a lump sum, the payment must include interest at an annual rate equal to or greater than the Moody’s Corporate Bond

Yield Average-Monthly Average Corporate as of the day the claim was received

The insurer has the power to hold policy proceeds as agreed in wiring between the insurer and the policyholder. The funds can be held in the insurer’s general account

Parties entering into an insurance contract must be of legal age, mentally competent to understand the contract, and not under the influence of drugs or alcohol

The minimum legal age for entering into a life insurance or annuity contract in Florida is 15

Insurers may not issue policies in groups according to age

Insurers may also not issue policies that contain annual endowments such as founder’s policies or coupon-bearing policies

The Certificate of Authority of any insurer who violates this provision will be revoked

Group Life

Sponsoring organization/employer holds the Master Contract

(policyholder)

Members receive a Certificate of Insurance

Individual coverage amounts must be determined according to nondiscriminatory rules

Group life is usually written as annually renewable term

Rates and coverage are based on group underwriting

Evidence of insurability is usually not required if participants enroll during the open enrollment period

Coverage amounts over $50,000 are taxable to the employee

Group must exist for a purpose other than to purchase insurance

Individual members of the group must have the right to convert to individual coverage without evidence of insurability should they leave the group

Florida law requires that a group plan must provide coverage to more than one person under one policy

Employee groups – offered to both active and retired employees

Debtor groups – to be eligible, the group must have at least 100 new persons a year

Florida Required

Provisions

Labor Union groups – must include all of the members of the union

Trustee Groups – the Trust is policyholder o 2 or more employers/unions join together to provide benefits to their employees

Association groups – must have at least 100 members o Must be in active existence for at least 2 years o Have regular meetings at least annually

Credit Union Groups – policy must be issued for the benefit of all eligible members of the credit union

Other groups receiving special approval from the Department

Grace period – 31 days

Incontestability period – 2 years

Entire Contract, Representations vs. Warranties – a copy of the application must be attached to the policy; statements on the application are representations and not warranties

Insurability – insurer reserves the right to require an applicant to provide evidence of insurability as a condition to coverage

Misstatement of age – premiums and/or benefits may be adjusted if the age of the insured has been misstated

Payment of benefits – death benefits must be paid to the beneficiary designated in the policy

Certificate of Insurance – the insurer issues the policyholder to provide each insured an individual certificate of insurance

Conversion on termination of eligibility – each individual has the right to convert to individual coverage without evidence of insurability within 31 days

Conversion on termination of policy – if the policy itself is terminated, every insured who has been covered for at least 5 years, and their covered dependents, is entitled to convert to individual coverage subject to the same conditions and limitations as the group policy

Death pending conversion – if the insured dies during the

Conversion Privilege conversion period before an individual policy becomes effective, the claim is payable under the group policy

Must convert within 31 days

Can convert to any type of individual coverage (except term)

Proof of insurability is not required

The face amount will be the same as the group coverage but the premium will be higher since the individual policy will be issued at the insured’s attained age

Coverage for dependents

Group coverage must be extended to include the employee’s spouse and dependent children

The amount of coverage for the dependent may not exceed the amount of coverage for the insured employee

Assignment of Proceeds

The individual covered under the group policy may make an assignment of all or part of incidents of ownership including, but not limited to, ownership, the conversion privilege, and the naming of beneficiaries

1)

Step 1) Simulate Your Exam:

After you have finished the Chapters and Quizzes, Simulate Your Exam. You must score at least 70% on the exam simulation. This is a combination of the quizzes, there are 100 questions. You have Two Hours to complete the exam. You will be provided the right answers once all questions are completed. Study this review** Take the simulator again until you pass with a 70%.

You Must Not use your notes during the Exam, you will sign an affidavit attesting that you did not use any notes during the exam.

In order to receive your Pre-Licensing Certificate from the state, you must complete the Certificate Exam with a 70%.

2) Immediately after passing the exam simulation, click "Get Certificate" on the main menu and follow the instructions. Be sure to verify your name, address and that all the information is correct. You will need to sign an affidavit attesting that you completed the course as directed. You will not get credit for

completing the course until you do this. If you do not complete this step within

16 days of passing the exam, then you will need to take the exam again.

3) Print your certificate of completion from the website .

Step 2) Guarantee Your Exam:

1) Take this test & pass with a 75% *10* days BEFORE taking your test

(this ensures that if perhaps you don’t pass on your first attempt, your second attempt will be paid for by the company).

Step 3) Schedule your state Exam:

1) Register online with Pearson Vue at www.pearsonvue.com

or call

(888)274-2020 and pay $42. Life exam fee. This will be refunded as soon as you take the exam.

2) Select: “Fla Dept. of Financial Services” then “New Users, create

an account.” The exam requested is: FLA LIFE and Annuity (incl

Variable Contracts) (0214) and exam code InsFL-Life01 for Life.

You’ll receive a confirmation number to take to the exam.

3) Schedule Live Scan Fingerprinting appointment: www.L1enrollment.com/FLinsurance . For Agency Name, choose

Insurance-Agent. Payment type, choose BILLING, then FLB00I009.

Print email confirmation and take with you to fingerprint appt.

4) You can get your fingerprints done either before or after the exam, bring the confirmation page when you take the exam,

5) Study before the test, use your Quiz4Life app as a refresher

…...and PASS YOUR EXAM!

Great job at achieving your state insurance License!