mr. lipman's ap government powerpoint chapter 17

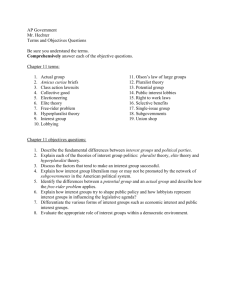

advertisement

MR. LIPMAN’S AP GOVERNMENT POWERPOINT CHAPTER 17 SOCIAL WELFARE POLICY • Social Welfare Policy is the intent of the government to improve the quality of life for its citizens. There are 4 different types of public policy theories: 1. Elite Theory (unequal distribution is normal) 2. Bureaucratic Theory (gov’t so big bureaucrats are the dominant power) 3. Interest Group Theory (gov’t is equilibrium between all competing groups at all levels) 4. Pluralist Theory (no single elite group) • Public Policy is determined in stages: –1. Problem recognition and definition –2. Agenda Setting –3. Policy Formation –4. Policy Adoption –5. Budgeting –6. Policy Implementation –7. Policy Evaluation The stages of public policy ______ theory assumes that no single group could ever gain monopoly control over any substantial area of policy. • • • • • pluralist elite bureaucratic interest group democratic ______ theory assumes that no single group could ever gain monopoly control over any substantial area of policy. • • • • • pluralist elite bureaucratic interest group democratic SOCIAL WELFARE POLICY • Panic of 1893 makes America 1st start to think gov”t has responsibility to help those in need. • Depression of 1930s greatly expanded upon this belief and led to the formation of the permanent welfare state in America. It’s highlighted by the Social Security Act of 1935. • SOCIAL SECURITY HAS THREE PARTS: – 1. Old Age Protection – 2. Aid for the blind, needy, injured, families w/kids – 3. Unemployment insurance/compensation Old Age Protection is a “pay as you go system” meaning you are paying now for others who are receiving it and that in the future others will pay for you when you are receiving it. (“good luck”) • Old Age Protection (con’t): – In 1940 maximum pension was $85 per month – In 2012 maximum pension was $2,513 per month In 2013 a social security tax is imposed upon the first $113k of an employees wages. The employer and the employee are normally each required to contribute 6.2% of the tax amount due. If self-employed you need to pay the entire 12.4% yourself. • Aid for Blind, Needy, Families with dependent children and disabled (SSI) – This is supplemental money provided by the federal government as a “safety net” to prevent disaster – In 2012 poverty line in America for a family of 4 was established at $22,350 up to $41, 348 Unemployment Insurance was initially set up by the federal government but it was “assumed” by the states. Employers pay 3% of a worker’s salary into an insurance fund. The amount received by each worker varies by state and there is a cap. EXPANSION OF GOVERNMENT’S ROLE IN SOCIETY • 1. Education (vouchers and charter schools) – Supreme Ct. has ruled that issue of inequality of spending on education is a state matter since education is NOT a fundamental right • 2. Health Insurance – Medicare (older citizens) – Medicaid (poorer citizens) • 3. Food Programs (ex: food stamps aka “snap”) • 4. Earned Income Credit (encourage work even if earning low wages) • Energy policy – By 1970s, U.S. dependent on foreign oil – Oil embargo crisis (OPEC) – Government set conservation and efficiency standards; creates DOE • Environmental policy – National Environmental Policy Act of 1970 – Clean Air Act of 1970 – Clean Water Act of 1970 – Safe Drinking Water Act of 1974 Where do U.S. oil imports come from? The Kyoto Protocol, which committed countries to reducing greenhouse gas emissions, was ratified by the U.S. in ________. • • • • • It was never ratified. 1997 1998 2000 2008 The Kyoto Protocol, which committed countries to reducing greenhouse gas emissions, was ratified by the U.S. in ________. • • • • • It was never ratified. 1997 1998 2000 2008 Today, most of the electricity in the United States is generated by A.wind farms. B.hydroelectric dams. C.nuclear power plants. D.natural gas. E. coal burning plants. Today, most of the electricity in the United States is generated by A.wind farms. B.hydroelectric dams. C.nuclear power plants. D.natural gas. E.coal burning plants. NCLB intends to promote all of the following EXCEPT • • • • • privatization of education school choice success educational methods flexible use of national funding results-oriented accountability NCLB intends to promote all of the following EXCEPT • • • • • privatization of education school choice success educational methods flexible use of national funding results-oriented accountability A National insurance was first seriously considered in ________. • • • • • the 1930s the Reagan administration the 1960s 1912 under President Wilson 2008 A National insurance was first seriously considered in ________. • • • • • the 1930s the Reagan administration the 1960s 1912 under President Wilson 2008 MEANS TEST = No aid given unless the recipient qualifies based on income. NON-MEANS TEST = A program which gives the aid regardless of the income of the recipient. ENTITLEMENT PROGRAM= If you meet the eligibility criteria you are to receive the benefit and spending on the program is mandatory RISING COST OF ENTITLEMENT PROGRAMS • Amounts Spent in Billions of Dollars: (FEDERAL) 2003 2005 2011(est.) S.S. 470 519 722 Defense 404 473 499 Means-Test 306 356 454 (entitlements)