Chapter 3 Legal Framework for Financing Education

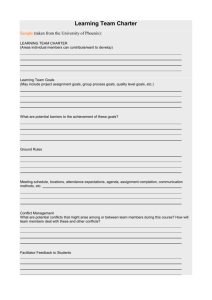

advertisement

Chapter 3 Legal Framework for Financing Public Education Federal Role in Education • The federal government has a long precedent of providing education programs, funds, & initiatives to the states • Without federal intervention, many initiatives may not have been started, and many injustices would have continued longer Federal Role in Education, cont. • Brown v. Board of Education of Topeka • • • • • • (ended desegregation) Brown II (ended more desegregation) Serrano v. Priest (finance equity) The Kentucky Education Reform Act (more finance equity) Title IX (ended gender discrimination), Title VII (Civil Rights Act) Public Law 94-142 (Special ed. rights) Limited Federal Role in Education • The Tenth Amendment to the United States Constitution says that the powers not delegated to the federal government by the Constitution or are not prohibited by it are reserved for the states • Since the first ten Amendments do not mention education, it became a state function by default The Tension Continues Today • The 10th Amendment compromise balanced interests of those who wanted a strong federal government and those who wanted to preserve states’ rights • The states are not willing to surrender control of education and the federal government can’t afford to pay its promised share 10th Amendment Compromise: Plenary Power • Each state is responsible for setting up an educational system and may pass laws it considers desirable towards that end as long as those laws are not in conflict with its own State Constitution or Federal Constitution • The courts, however, can only intervene if there is a challenge based on a legitimate controversy brought by a party with legal standing concerning the state’s practice and the State or Federal Constitution or its application 10th Amendment Compromise: Plenary Power, cont. Over the past decades, the federal powers have somewhat reduced the plenary nature of the states’ control of education. State Control of Education • Each state’s constitution has language that forms the legal framework for the organization of the state’s education function • All states except Hawaii (and the District of Columbia) delegate much of the authority for education to local school boards to be coordinated through the State Department of Education – also known as the State Education Agency (SEA) State Control of Education, cont. • • The state constitution & the state’s department of education regulations control the parameters under which each local school district operates School Finance & The Law • Finance is perhaps the most critical issue facing states as it affects the federal role in education • Increasingly, federal courts are ruling against states in cases involving state’s education funding formulae, challenging equity and adequacy School Finance & The Law, cont. • • • • • • A Historical & Legal perspective and Guiding principles regarding Taxation Equal protection State & Federal Constitutional language Adequacy Vouchers and charter schools Tuition tax credits Taxing to Fund Schools • The federal level has a long history of taxing & spending to pay for education services • The first public school laws involved taxation in the Massachusetts Bay Colony to raise the necessary funds for education services – the 1647 Ye Olde Deluder Satan laws Taxing to Fund Schools, cont. • Section 8, Article 1 of the U.S. Constitution gives the Congress the right to tax and spend • The article, in part, reads, “The Congress shall have Power to lay and collect Taxes, Duties, and Imports and Excises, to pay the Debts and provide for the common Defense and General Welfare of the United States…” “General Welfare” Clause • Originally controversial, the “General Welfare” clause conferred on Congress broad powers to tax and spend for the general welfare of the United States.[1] • [1] United States v. Butler, 297 U.S. 1, 56 S. Ct. 312 (1936). Taxing to Fund Schools • At the state level, the Supreme Court has ruled that states have taxing power “ to resort to all reasonable forms of taxation in order to defray the government expenses”. • Further, the court said, “Unless restrained by provisions of the Federal Constitution, the power of the state as to the mode, form, and extent of taxation is unlimited” . • Shaffer v. Carter, 252 U.s. 37 (1970). Federal Involvement in Education ONLY When • (1) States agree in accepting federal grants that are provided under the authority given the Congress by the General Welfare Clause • (2) Standards or regulations that the Congress has authorized within the Commerce clause • (3) Court actions that constrain states by enforcing federal constitutional provisions protecting individual rights and freedoms Federal Involvement in Education ONLY When… 1. When the state has accepted a federal grant (NCLB, Drug Free Schools, etc.) and grant provisions require the state to comply with certain federal guidelines. If states and localities do not comply, the federal government can force the state to comply. Federal Involvement in Education ONLY When… 2. A state action impacts the Commerce Clause (as in the case of United States v. Lopez). In this case, the U.S. Congress made it a crime to have a gun within a school zone. A student brought a loaded pistol to school and was sent to jail under the Gun Free School Zone. • United States v. Lopez, 131 L.Ed.2d 626, 115 S. Ct. 1624 (1995). Federal Involvement in Education ONLY When… 3. U.S. Constitutional rights are involved (as in Tinker v. Des Moines Independent Community School District). The school suspended students for wearing black arm bands to protest the Vietnam war. The Supreme Court ruled that a school policy cannot outweigh freedom of expression (speech) without reasonable knowledge that such an act of expression would have foreseeably substantially disrupted the school process. Federal $$$ to Schools • In 2003, the total federal contribution to national education expenditures was approximately 10% Federal $$$ to Schools Includes • Department of Health and Human Services' Head Start program • Department of Agriculture's School Lunch program • Department of Education pays only 6% of total education spending Federal $$$ to Schools The US Department of Education’s annual $63.2 billion appropriation is only 2.9 % of the Federal Government's nearly $2.2 trillion budget in fiscal year 2003. The remaining dollars are divided almost equally between state and local revenues. Federal Education Funds Over Time State Prerogatives • States may tax what they wish as long as it does not conflict with federal provisions or with the state’s constitution State Prerogatives, cont. • Taxing authority is not considered to be inherent in school districts unless the state constitution language permits such taxing authority State Prerogatives, cont. • There is strong legal precedent for state constitution language to be strong and clear regarding authority for school boards to tax • In Marion and McPherson Railway Co. v. Alexander, 64 P. 978 (Kan. 1901), the Kansas Supreme Court ruled that the authority to levy taxes is …extraordinary... and should never be left to implication • Contested again: Florida Department of Education v. Glasser, 622 So.2d 944 (Florida, 1993) State Prerogatives, cont. • This has been contested again in 1993 • The Florida Supreme Court ruled that the School Board of Sarasota County required authorization of law by the state legislature to levy taxes for schools. Absent the specific authorization, the school board could not direct the County tax collector to collect and remit school taxes • Florida Department of Education v. Glasser, 622 So.2d 944 (Florida, 1993) State Prerogatives, cont. • Some school districts have the legal authority to levy taxes for schools • Others must wait for a governing body to approve a school budget as one part of a city or county budget. That governing body must then set the tax rate • In spite of the states’ prerogative in taxing, virtually all states rely on one primary revenue source to finance public schools – property taxes Property Taxes • Property taxes date back to ancient Greece • In Athens, land and houses were taxed • Later, in Rome, people and property were taxed • In Europe, land, homes, and livestock were taxed Property Taxes in the th 19 Century • Taxing property became the accepted means for funding schools • Land was taxed at different rates if it were cleared, uncleared, or cultivated • Later, livestock and equipment was seen as a source of taxable property Property Taxes in the th 19 Century, cont. • Taxing property & equipment at different rates became increasingly complex for localities Property Taxes in the th 19 Century, cont. • States developed a uniform general property tax based on a percentage of the value (or millage) of the land • If Farmer Brown’s land were worth more than Farmer Jones’ land, Farmer Brown would pay more in property taxes • The tax rate, however, would be uniform throughout the state or locality “Equal Protection” & Taxation The Fourteenth Amendment, ratified in 1868: • Once states establish a revenue source, they must decide how to distribute that revenue to school districts • No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws. “Equal Protection” & Taxation, cont. • The Civil War had ended three years earlier and the country was trying to decide how to treat the newly-freed slaves • The 14th Amendment was clearly an attempt to legislate civil rights after the war “Equal Protection” & Taxation, cont. • Supreme Court took a role in defining “equal protection” of state taxation • The court determined that the equal protection clause established a minimum standard of uniformity to which that state legislation must adhere “Test” of States’ Taxation Constitutionality, 1890 Equal protection does not require identical treatment. It only requires: 1. The classification rest on real & not feigned differences 2. The distinction have relevance to the purpose for which the classification is made 3. The different treatment be not so disparate, relative to the difference in classification, as to be wholly arbitrary Civil Rights Act of 1964 Contained groundbreaking language regarding race and discrimination under the language of equal protection. This time the equal protection clause was linked to federal spending. Civil Rights Act of 1965 • Education was a constitutionallyprotected right of all citizens and that right should be provided to all citizens on equal terms • Any state that provided fewer dollars for poor school districts denied those children equal protection under the law Since the Supreme Court had already ruled that classifying people on the basis of poverty, occupation, homesite, or the like was unreasonable, it held that the quality of education could not be based on a state or local taxing system where the level of education is determined by the locality’s wealth. Two Court Cases Litigated Under Equal Protection Clause • Both cases cited that large disparities in ability to fund education within their respective states (Illinois & Virginia) resulted in wealthy school districts spending more to meet student needs than in poorer districts where educational needs may be much greater Two Court Cases Litigated Under Equal Protection Clause • The Supreme Court affirmed the lower courts’ rulings against the parents and for the existing funding practice in Illinois and Virginia, saying that equal expenditures were not required under the Fourteenth Amendment Two Court Cases Litigated Under Equal Protection Clause • Plaintiffs could not define a court-requested reasonable standard to assess and measure educational need • Since the ideas could not then be addressed with research or consensus, the Court refused to declare the finance systems unconstitutional 1977 California Supreme Court Case • Challenged The Court determined: the California funding formula – Serrano v. Priest (1971) 1. Education was a fundamental interest 2. The basic state aid did tend to equalize among the disparate school districts 1977 California Supreme Court Case, cont. The Court determined: 3. The state funding model generated state & local funds that created substantial disparities in revenue to school revenue – proportional to the wealth of the individual school 4. Declared: Unconstitutional 1973 Rodriguez Case • A group of Mexican-American parents from the Edgewood Independent School District sued the Texas system of education funding • The plaintiffs argued that education funding model in Texas makes the quality of education a function of the local property tax base and that the state funding is insufficient to correct the inherent inequalities 1973 Rodriguez Case, cont. • A Texas three-judge panel stated that since education is a state function, the quality of education should not be determined by the locality’s wealth, but by the state’s overall wealth • On appeal, the United States Supreme Court heard the arguments & decided that the wide disparities in the Texas funding formula do not violate the equal protection clause of the 14th Amendment Litigating Equal Protection & School Finance After Rodriguez, for all intents and purposes, litigation for school finance reform under the umbrella of the equal protection clause ended. Standards of Equal Protection The courts use 3 tests to decide if government actions that treat individuals differently for any reason violates the equal protection clause: 1. Rational relationship test 2. Intermediate test 3. Strict scrutiny test Test 1: The Rational Relationship Test • Does the government have a rational reason for the differential treatment of individuals that does not violate the Constitution? • The court is not looking for scientific data to substantiate the claim -- only for a rational relationship Test 2: The Intermediate Test • Instead of asking that there be a reasonable basis for the treatment based on a rational relationship, the court will ask for evidence of some substantial government interest Test 2: The Intermediate Test, cont. • This test has generally been applied to sex discrimination cases and many policies that treated women differently than men were overturned using this test Test 2: The Intermediate Test, cont. • The intermediate test examines the state’s action more closely than in the rational relationship test • For the state’s action to be upheld requires a greater level of government interest in the outcome Test 3: Strict Scrutiny • At this level, the government bears the greatest burden for treating individuals differently • At this highest level of reasoning, the government must show a compelling or overriding state interest in the differential treatment of individuals, and no less discriminatory manner exists for the government in accomplishing this overriding interest Test 3: Strict Scrutiny, cont. • Only two circumstances where courts invoke strict scrutiny: • (a) When a fundamental right is affected • (b) When the action taken by the government creates a suspect classification of individuals Test 3: Strict Scrutiny, cont. • In this test, unlike the rational relationship test, the courts will not defer to the ability or understanding of the legislative body writing the action Test 3: Strict Scrutiny, cont. • For example, the Court• could rule that hiring unlicensed minority teachers achieves a compelling state interest if licensing requirements can be shown to discriminate against minorities. In this case, the Court would examine the data and make an independent determination of the degree of relationship and the differential treatment that promotes the state’s compelling interest. Strict Scrutiny: “Fundamental Rights” • Fundamental rights are those rights identified in the U.S. Constitution and/or State Constitutions as guaranteed under the equal protection clause • These rights include those in the Bill of Rights, (i.e., freedom of speech, freedom of the press, the right to not only substantive & procedural due process) Strict Scrutiny: “Suspect Classification” • The Constitution prohibits unequal treatment of individuals under the law based on different classifications • One of these classifications, for example, is religion • The Constitution is silent on some other classifications Strict Scrutiny: “Suspect Classification”, cont. • For example, the 1954 U.S. Supreme Court decision involving Brown v. Board of Education of Topeka, Kansas, made race a suspect classification • The Brown ruling on school segregation – separate but equal – made race a suspect classification because the states had laws which denied a group of people equal protection under the law Strict Scrutiny: “Suspect Classification”, cont. • Unequal protection under the law based on race became illegal • The Civil Rights Act of 1964 added other classifications Strict Scrutiny & School Finance Cases Serrano v. Priest: 1. The state supreme court determined that education was a fundamental right based on language in the Brown v. Board of Education case from 1954 2. The California Supreme Court also decided that property wealth created a suspect classification of individuals Based on the strict scrutiny standard, the court found the finance model to be unconstitutional. Strict Scrutiny & School Finance Cases, cont. San Antonio Independent School District v. Rodriguez : The Texas Judges said that since education is a state function, the quality of education should not be determined by the locality’s wealth, but by the state’s overall wealth. The U.S. Supreme Court REVERSED this decision. Strict Scrutiny & School Finance Cases, cont. San Antonio Independent School District v. Rodriguez : Justice Powell, writing for the U.S. Supreme Court majority, maintained that education was not a fundamental right afforded by the Constitution under the equal protection clause. The US Supreme Court then reverted to a lower standard for examining the case – the rational relationship test instead of strict scrutiny. State and Federal Constitutional Language • Each state has language in its Constitution that frames how it will treat education • The state’s “education clause” • State education clauses have been the basis for many legal challenges to state finance models over the past 20 years Equity and Adequacy • Equity provides for what people need • Adequacy provides a sufficient quantity of what people need • People with equal needs should receive equal treatment, to be sure. Treating unequals equally, however, is a most unfair thing to do. Vouchers, Charter Schools, & Tuition Tax Credits • Interest in vouchers & charter schools reflect dissatisfaction with the current public school system and a desire to have the state pay for an alternative form of education • Dissatisfaction with the public schools’ and attempts to fund alternative schools is part of our history Vouchers, Charter Schools, & Tuition Tax Credits, cont. Basically, these issues involve the concept of increased parental choice in public schooling. Charter Schools • Alternative, generally specialty schools that operate with fewer state restrictions & restraints than regular public schools • The state constitution defines their operation • The state charter, or contract, stipulates how the school will operate and what accountability measures will gauge student achievement • If the charter’s measures are not kept, the state may revoke the charter Public Schools – Religious or Secular? “By 1750, …new secular interests began to take the place of religion as the chief topic of thought and conversation. Secular books began to dispute the earlier monopoly of the Bible…These changes manifested themselves …many ways in education. New textbooks, containing less of the gloomily religious than the New England Primer, and secular rather than religious matter, appeared and began to be used in the schools.” Battle for Free State Schools… By 1820, education had moved from private schools (run by individuals, churches, incorporated school societies) and state schools for the poor to a loosely organized public school system of secular interest. A conflict loomed: The Battle for Free State Schools. The Battle for Free State Schools, cont. • People who did not want to pay taxes to support public schools AND • Conservative Protestant ministers who argued that public schools would hurt religious schools’ attendance (& reduce their influence) VS. • Civic government & more progressive legislators The Battle for Free State Schools, cont. With conflict about the mission of the public schools, conflict about funding could be far behind. Massachusetts Act of 1827 • Declared that school committees should never require schools to buy any books which were calculated to favor the tenets of any particular Christian sect Massachusetts Act of 1827, cont. • As a result of this Act, for the first time in American public school history, the public schools were called “Godless schools” Massachusetts Act of 1827, cont. • The change in public school mission from religious to secular led to attacks on Massachusetts’ Secretary of Board of Education, Horace Mann, asserting that the “increase in intemperance, crime, and juvenile depravity in the State was due to the ‘Godless schools they were supporting” Massachusetts Act of 1827, cont. • In response to this initial school secularization, some said that if people did not agree with how the public schools were run, taxpayers should be allowed to have that portion of school taxes returned so those funds could be used to provide an education more closely resembling parents’ wishes Vouchers, Charter Schools, and Tuition Tax Credits Taking their stock of public funds and using the monies to establish schools more to their liking is essentially what today’s vouchers, charter schools, and tuition tax credits advocates try to do. Vouchers • “Vouchers” are receipts or documents issued by the state that can be used to pay tuition at a public or private school • Parents can use a voucher to pay the tuition to send their child to an alternative school that the child would attend Vouchers, cont. • In 2002, the U.S.Supreme Court ruled that vouchers could be used to pay tuition at private, religious schools Vouchers Are Not New • In 1869, Vermont adopted a tuition statute attempting to ensure that students in urban and rural school districts could receive a quality secondary education • In towns too small to support a school, the state paid the tuition to attend another public school or a private, non-sectarian school Vouchers Are Not New, cont. • This 1869 provision included vouchers for public schools outside Vermont • In 1961 the state legislature banned religious schools from this voucher provision What’s “Legal” Depends on the State Constitution’s Language • School finance cases – such as involving paying public monies to support private sectarian or parochial schools – often depend on the exact language the state’s constitution uses rather than judicial approval of the concept, itself Maine & Vouchers • In 1903, Maine legislation provided all students a high school education with the state paying tuition to any school of the parent’s choice, including paying tuition to schools outside of Maine • In 1980, however, the Maine Department of Education enacted provisions to end tuition payments to attend parochial schools in towns where public high schools exist Maine & Vouchers, cont. • In 1999, the Maine Supreme Court ruled in the Bagley v. Raymond case that the 1980 ban on religious schools receiving state monies is not unconstitutional • As written, Maine’s constitutional language did not prevent public monies from going to religious schools Maine & Vouchers, cont. • At the same time that the state court was hearing the Bagley case, Strout v. Albanese raised the same funding issue in federal court • Both courts delivered the same opinion – the state could ban religious schools from receiving voucher money BUT the constitutional language – not judicial approval of the concept – determined the outcome Wisconsin & Vouchers • In 1990, the Milwaukee, Wisconsin, enacted the Parental Choice program • This legislation provided for up to 1% of the economically-disadvantaged Milwaukee Public School students to obtain a voucher for the state’s share of public school costs to attend a participating non-sectarian private school Wisconsin & Vouchers, cont. • Five years later, the program expanded for Milwaukee students to include participating religious schools • Jackson v. Benton challenged this action • The Wisconsin Supreme Court did not allow the program’s expansion into religious schools, but allowed the program to include non-sectarian schools Wisconsin & Vouchers, cont. • In 1997, the Wisconsin legislature expanded the school choice voucher program to include religious schools. On remand, a district court ruled it unconstitutional • Appealed in 1998, the Wisconsin Supreme Court upheld publicly-funded vouchers used to fund students in private religious schools, stating it did not violate the Establishment Clause • On appeal, the U. S. Supreme Court declined to hear the case Ohio & Vouchers • In 1995, the Ohio state legislature enacted two educational assistance programs for parents of children in the struggling Cleveland Public Schools – tuition scholarships and tuition assistance grants to pay tuition at eligible private schools in the Cleveland Public School District area or at participating public schools in adjacent districts • In 1999, the Ohio State Supreme Court overturned the program on a technicality Ohio & Vouchers, cont. • Appealed, the federal court ruled the Simmons-Harris v. Goff case unconstitutional • Appealed again, the Sixth Circuit Court of Appeals rejected the Ohio voucher plan as it violated the First Amendment’s separation of church and state provision • Appealed again, the U. S. Supreme Court, found the Cleveland voucher program was constitutional and did not infringe on the separation of church and state Vouchers & Religious Schools The 5-4 U.S. Supreme Court decision finally cleared a thick fog of legal opinion regarding vouchers to private religious schools. Public Funds & Private or Religious Schools The legal conflict between the Massachusetts parents who believed that the schools had failed by becoming more secular in curriculum & pedagogy & the more progressive legal and educational writers of the early to mid 1800s has been resolved. Public monies can fund private or parochial education. The philosophical discussion will continue. Tuition Tax Credits • Instead of receiving a “chit” for tuition at an alternative school, a tax credit is offered to parents who send their school-aged children to non-public schools, thereby reducing the parent’s tax liability • Tuition tax credits were first issued at the national level by Senators Moynihan (NY) and Packwood (OR) • The Reagan and first Bush presidential administrations advocated tuition tax credits repeatedly & unsuccessfully Minnesota & Tuition Tax Credits • In 1955, Minnesota passed a law (amended in 1976 and 1978) allowing state taxpayers to deduct certain expenses incurred in educating their children – regardless of the type of school attended • The deduction was limited to $500 per student in grades K through 6 and $700 per student in grades 7 through 12 Charter Schools • Gained popularity during the 1990s as example of school choice • The charter, or contract with the state, stipulates how the school will operate and the accountability measures that will be used to gauge student achievement • Operate with fewer state restrictions and constraints than regular public schools • If the charter’s measures are not kept, the state may revoke the charter Charter Schools & Mueller v. Allen, 1983 • The U.S. Supreme Court found that the loan of textbooks to parochial school students did not violate the First Amendment’s Establishment Clause, saying that parochial schools provided “acceptable” secular education Charter Schools & Mueller v. Allen, 1983, cont. • Local school boards were required to purchase textbooks and lend them without charge to students residing within that district who attended private schools in grades 7 through 12 that complied with compulsory attendance laws Charter Schools & Mueller v. Allen, 1983, cont. • Charter school advocates believed that it was easier to evade the constitutional proscription against the use of public funds to support religious education by suggesting that the secular aspects of parochial schools was so substantial that they justified receiving public funds Charter Schools in the 1990’s • Under the Clinton administration, the idea of charter schools changed dramatically • Proposed that charter schools should exist as public schools and not in private or parochial schools Redefined Charter Schools, 1990’s • Exempted from state & • Non-sectarian in local regulations that programs, inhibit flexible admissions, policies, management & employment • Operated under public practices supervision & • Not affiliated with a direction sectarian school or • Designed with specific religious institution educational objectives Redefined Charter Schools, 1990’s, cont. • Free of tuition or fees • In compliance with federal civil rights legislation • Students admitted by lottery • Operated in compliance with state law • In compliance with federal and state financial audit requirements • In compliance with federal, state, & local health & safety requirements Michigan Challenge to Charter Schools • Michigan adopted a Charter Schools Act that had provisions similar to the 1994 federal legislation • The Michigan State Supreme Court had to decide if the charter schools act were constitutional and if charter schools constituted parochial aid to religious schools • In 1994, the trial court determined that Michigan’s charter school act was unconstitutional Michigan Challenge to Charter Schools, cont. The State Supreme Court held that since the legislature declared the charter schools to be public schools, • Charter schools must comply with all applicable State Bd. Of Education laws • The State Board authorizes funding for some Charter Schools and not others • The Michigan Charter School Act did not constitute state aid to religious schools