Michelle Schlicker Professor Newsom English 1020 9 April 2012

advertisement

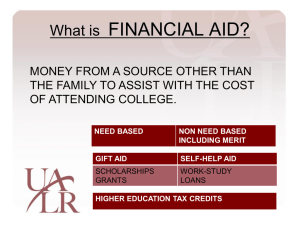

Michelle Schlicker Professor Newsom English 1020 9 April 2012 Evaluative Paper Most students would probably agree that the costs and fees of attending college are outrageously high. However, the colleges themselves don’t seem to get the hint, let alone care whether or not the students can afford to attend. As long as they get the money, they are happy. This is very wrong. American leaders are always talking about how they want more educated, successful people, but this is becoming almost impossible to achieve for many of its citizens. Colleges charge thousands of dollars in tuition and hundreds of dollars in parking passes, books and supplies, and other fees. This is for one semester (four-five months). In order to get a well-paid job, during the United States’ current economy, people must have at least a Bachelor’s degree in their respected study. A Bachelor’s degree requires four years worth of study, which most often means eight semesters. Eight semesters of college costs around $20,000-40,000. Very few people can afford this without any help from the government, the school itself, or a loan. I read an article called Higher education Academic inflation, in which it said, “Academic inflation makes most other kinds look modest by comparison. Students may not be getting a good deal in return….” The article goes on to say, “For decades, college fees have risen faster than Americans’ ability to pay them.” So, basically, even though students can barely pay the costs as it is, colleges are continuing to raise the prices. There are only three cost-free ways to get a college education: a grant from the government, a full-ride scholarship, or a combination of grants and scholarships. Unfortunately, there are only so many scholarships that a college can give out and there are even fewer grants. This means that the majority of the students are left to fight their own battle and figure out a way to get the money they need, by themselves. In New Payment Plan will Help COM Students Pay for College Fees, Cathy Summa-Wolfe wrote, “A record number of… students are applying for financial aid and scholarships to help pay for college costs.” Notice Summa-Wolfe she says “to help pay”, this backs up the fact that most students are not relying on scholarships or grants to pay for their education by themselves. This is probably because it is highly unlikely that a student would receive enough money through scholarships or grants by themselves. SummaWolfe selected a good quote, in New Payment Plan will Help COM Students Pay for College Fees, in which Bob Balestren said, “Students need more help than is available through financial aid alone…” So, if students aren’t able to get enough money to pay for college through scholarships and grants, they are forced to rely on loans and/or out of pocket money. However, most students don’t have out of pocket money in the form of thousands of dollars to spend on furthering their education. As the article, Student Loans, said, “For many students, the only way to pay for higher education is with the aid of federal and private student loans.” Student loans are one of the major things weighing on a college student’s mind. Questions like: how am I going to pay it back?, Do I have to graduate Work Cited "Higher education Academic inflation. " Economist.com / News Analysis 2 Sep. 2010: Research Library, ProQuest. Web. 9 Apr. 2012. "Student Loans." Opposing Viewpoints Online Collection. Gale, Cengage Learning, 2010. Gale Opposing Viewpoints In Context. Web. 9 Apr. 2012. Summa-Wolfe, Cathy "New Payment Plan will Help COM Students Pay for College Fees. " Targeted News Service 23 Nov. 2010,Research Library, ProQuest. Web. 9 Apr. 2012. "Text Alerts For College Fees Now Available. " US Fed News Service, Including US State News 27 Jan. 2012,Research Library, ProQuest. Web. 9 Apr. 2012.