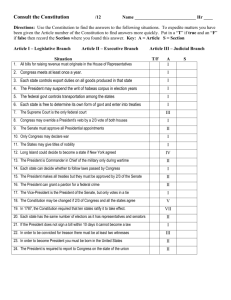

Authority for Judicial Review

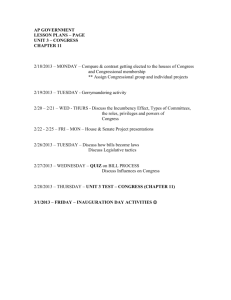

advertisement