Nominal and Effective Interest Rates

advertisement

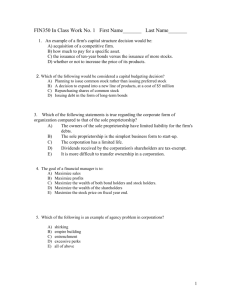

CE 533 - ECONOMIC DECISION ANALYSIS IN CONSTRUCTION Chapter III- Nominal and Effective Interest Rates By Assoc. Prof. Dr. Ahmet ÖZTAŞ GAZİANTEP University Department of Civil Engineering CHP 3- Nominal and Effective Interest Rates Contents Nominal and Effective interest rate staements Effective interest rate formulation Compounding and Payment Periods Equivalence Calculations - Single Amounts - Series: PP >= CP - Series: PP < CP Using spreatsheets CE 533 Economic Decision Analysis 2 / 54 3.1 Nominal & Effective Interest Rates In this chapter, we discuss nominal and effective interest rates, which have the same basic relationship. The difference here is that the concepts of nominal and effective are used when interest is compounded more than once each year. For example, if an interest rate is expressed as 1% per month, the terms nominal and effective interest rates must be considered. Every nominal interest rate must be converted into an effective rate before it can be used in formulas, factor tables, or spreadsheet functions because they are all derived using effective rates. CE 533 Economic Decision Analysis 3 / 54 3.1 Nominal & Effective Interest Rates Before discussing the conversion from nominal to effective rates, it is important to identify a stated rate as either nominal or effective. There are 3 general ways of expressing interest rates (See Table 3.1). Example: Interest is 12% per year Interest is 8% per year, compounded monthly Effctive Interest is 10% per year, compounded monthly CE 533 Economic Decision Analysis 4 / 54 3.1 Nominal & Effective Interest Rates These 3 statements in the top third of the table show that an interest rate can be stated over some designated time period without specifying the compounding period. Such interest rates are assumed to be effective rates with the compounding period (CP) same as that of the stated interest rate. CE 533 Economic Decision Analysis 5 / 54 3.1 Nominal & Effective Interest Rates The above interest statementsd prevail three conditions: (1) Compounding period is identified, (2) This compounding period is shorter than the time period over which the interest is stated, and (3) The interest rate is designated neither as nominal nor as effective. In such cases, the interest rate is assumed to be nominal and compounding period is equal to that which is stated. CE 533 Economic Decision Analysis 6 / 54 3.1 Nominal & Effective Interest Rates In above statements in Table 3.1, the word effective precedes or follows the specified, and the compounding period is also given. These interest rates are obviously effective rates over the respective time periods stated. CE 533 Economic Decision Analysis 7 / 54 3.1 Two Common Forms of Quotation Two types of interest quotation 1. Quotation using a Nominal Interest Rate 2. Quoting an Effective Periodic Interest Rate Nominal and Effective Interest rates are common in business, finance, and engineering economy Each type must be understood in order to solve various problems where interest is stated in various ways. CE 533 Economic Decision Analysis 8 / 54 3.2 Effective Interest Rate Formulation Understanding effective Interest rates requires a definition of a nominal interest rate r as the interest rate per period times the number of periods. A Nominal Interest Rate, r. Definition: A Nominal Interest Rate, r, is an interest Rate that does not include any consideration of compounding CE 533 Economic Decision Analysis 9 / 54 3.2 Effective Interest Rate Formulation The term “nominal” Nominal means, “in name only”, not the real rate in this case. CE 533 Economic Decision Analysis 10 / 54 3.2 Effective Interest Rate Formulation Mathematically we have the following definition: r= (interest rate per period)(No. of Periods) (3.1) Examples: 1) 1.5% per month for 24 months Same as: (1.5%)(24) = 36% per 24 months 2) 1.5% per month for 12 months Same as (1.5%)(12 months) = 18%/year CE 533 Economic Decision Analysis 11 / 54 3.2 Effective Interest Rate Formulation Equation for converting a nominal Interest rate into an effective Interest rate is: i per period = (1 + r/m)m – 1 (2) r = interest rate per period x number of periods, m = number of times interest is comounded İ = effective interst rate CE 533 Economic Decision Analysis 12 / 54 3.2 Example 1: Given: interest is 8% per year compounded quarterly”. What is the true annual interest rate? Calculate: i = (1 + 0.08/4)4 – 1 i = (1.02)4 – 1 = 0.0824 = 8.24%/year CE 533 Economic Decision Analysis 13 / 54 3.2 Example 2: Given: “18%/year, comp. monthly” What is the true, effective annual interest rate? r = 0.18/12 = 0.015 = 1.5% per month. 1.5% per month is an effective monthly rate. The effective annual rate is: (1 + 0.18/12)12 – 1 = 0.1956 = 19.56%/year CE 533 Economic Decision Analysis 14 / 54 3.2 Effective Interest Rate Formulation if we allow compounding to occur more and more frequently, the compounding period becomes shorter and shorter. Then m, the number of compounding periods increases. This situation occurs in businesses that have a very large number of CF every day. i = er – 1 Where “r” is the nominal rate of interest compounded continuously. This is the max. interest rate for any value of “r” compounded continuously. CE 533 Economic Decision Analysis 15 / 54 3.2 Effective Interest Rate Formulation Example: What is the true, effective annual interest rate if the nominal rate is given as: r = 18%, compounded continuously Or, r = 18% c.c. Solve e0.18 – 1 = 1.1972 – 1 = 19.72%/year The 19.72% represents the MAXIMUM i for 18% compounded anyway you choose! CE 533 Economic Decision Analysis 16 / 54 3.2 Effective Interest Rate Formulation To find the equivalent nominal rate given the i when interest is compounded continuously, apply: r ln(1 i ) CE 533 Economic Decision Analysis 17 / 54 3.2 Effective Interest Rate Formulation Example Given r = 18% per year, cc, find: A. the effective monthly rate B. the effective annual rate a. r/month = 0.18/12 = 1.5%/month Effective monthly rate is e0.015 – 1 = 1.511% b. The effective annual interest rate is e0.18 – 1 = 19.72% per year. CE 533 Economic Decision Analysis 18 / 54 3.2 Effective Interest Rate Formulation Example An investor requires an effective return of at least 15% per year. What is the minimum annual nominal rate that is acceptable if interest on his investment is compounded continuously? To start: er – 1 = 0.15 Solve for “r” ……… CE 533 Economic Decision Analysis 19 / 54 3.2 Effective Interest Rate Formulation Example - Solution er – 1 = 0.15 er = 1.15 ln(er) = ln(1.15) r = ln(1.15) = 0.1398 = 13.98% A rate of 13.98% per year, cc. generates the same as 15% true effective annual rate. CE 533 Economic Decision Analysis 20 / 54 3.3 Reconciling Compounding periods & Payment Periods (PP) The concepts of nominal and effective Interest rates are introduced, considering the compounding period. Now, let’s consider the frequency of the payments of receipts within the cash-flow time interval. For simplicity, the frequency of the payments or receipts is known as the payment period (PP). It is important to distinguish between the compounding period (CP) and the payment period because in many instances the two do not coincide. CE 533 Economic Decision Analysis 21 / 54 3.3 Reconciling Compounding periods & Payment Periods (PP) For example, if a company deposited money each month into an account that pays a nominal interest rate of 6% per year compounded semiannually, the payment period would be 1 month while the CP would be 6 months as shown in below Figure. CE 533 Economic Decision Analysis 22 / 54 3.3 Reconciling Compounding periods & Payment Periods (PP) So, to solve problems first step is to determine the relationship between the compounding period and the payment period. The next three sections deseribe procedures for determining the correct i and n values for use in formulas, factor tables, and spreadsheet functions. In general, there are three steps: 1. Compare the lengths of pp and CP. 2. Identify the CF series as involving only single amounts (P and F) or series amounts (A, G, or g). 3. Select the proper i and n values. CE 533 Economic Decision Analysis 23 / 54 3.4 Equivalence Calculations of Single Amount Factors There are many correct combinations of i and n that can be used when only single amount factors (F/P and P/F) are involved. This is because there are only two requirements: (1) An effective rate must be used for i, and (2) Time unit on n must be the same as that on i. In standard factor notation, the single-payment equations can be generalized. P= F(P/F, effective i per period, number of periods) F= P(F/P, effective i per period, number of periods) Thus, for a nominal interest rate of 12% per year compounded monthly, any of 24 / 54 CE 533 Economic Decision Analysis 3.4 Equivalence Calculations of Single Amount Factors Thus, for a nominal interest rate of 12% per year compounded monthly, any of the i and corresponding n values shown in Table 3.4 could be used in the factors. Example: if an effective quarterly interest rate is used for i, that is, (1.01)3 - 1 = 3.03%, then the n time unit is 4 quarters. Alternatively, it is always correct to determine the effective i per payment period using Equation [3.2] and to use standard factor equations to calculate P, F, or A. CE 533 Economic Decision Analysis 25 / 54 3.4 Equivalence Calculations of Single Amount Factors Example: Sherry expects to deposit $1000 now, $3000 4 years from now, and $1500 6 years from now and eaen at a rate of 12% per year compounded semiannually through a company-sponsored savings plan. What amount can she withdraw 10 years from now? Solution: Only single-amount P and F values are involved (See Figure below). CE 533 Economic Decision Analysis 26 / 54 3.4 Equivalence Calculations of Single Amount Factors Since only effective rates can be present in the factors, use an effective rate of 6% per semiannual compounding period and semiannual payment periods. The future worth is calculated as; CE 533 Economic Decision Analysis 27 / 54 3.4 Single Amounts: PP >= CP Example: “r” = 15%, c.m. (compounded monthly) Let P = $1500.00 Find F at t = 2 years. 15% c.m. = 0.15/12 = 0.0125 = 1.25%/month. n = 2 years OR 24 months Work in months or in years CE 533 Economic Decision Analysis 28 / 54 3.4 Single Amounts: PP >= CP Approach 1. (n relates to months) State: F24 = $1,500(F/P,0.15/12,24); i/month = 0.15/12 = 0.0125 (1.25%); F24 = $1,500(F/P,1.25%,24); F24 = $1,500(1.0125)24 = $1,500(1.3474); F24 = $2,021.03. CE 533 Economic Decision Analysis 29 / 54 3.4 Single Amounts: PP >= CP Approach 2. (n relates to years) State: F24 = $1,500(F/P,i%,2); Assume n = 2 (years) we need to apply an annual effective interest rate. i/month =0.0125 Effective I = (1.0125)12 – 1 = 0.1608 (16.08%) F2 = $1,500(F/P,16.08%,2) F2 = $1,500(1.1608)2 = $2,021.19 Slight roundoff compared to approach 1 CE 533 Economic Decision Analysis 30 / 54 3.4 Example 2. F 10 = ? Consider r = 12%/yr, c.s.a. 0 1 2 3 4 $1,000 5 6 7 8 9 10 $1,500 $3,000 Suggest you work this in 6- month time frames Count “n” in terms of “6-month” intervals CE 533 Economic Decision Analysis 31 / 54 3.4 Example 2. F 10 = ? Renumber the time line r = 12%/yr, c.s.a. 0 2 4 6 8 $1,000 10 12 14 16 18 20 $1,500 $3,000 i/6 months = 0.12/2 = 6%/6 months; n counts 6month time periods CE 533 Economic Decision Analysis 32 / 54 3.4 Example 2. F 20 = ? Compound Forward r = 12%/yr, c.s.a. 0 2 4 6 8 $1,000 10 12 14 16 18 20 $1,500 $3,000 F20 = $1,000(F/P,6%,20) + $3,000(F/P,6%,12) + $1,500(F/P,6%,8) = $11,634 CE 533 Economic Decision Analysis 33 / 54 3.4 Example 2. Let n count years…. F 10 = ? Compound Forward r = 12%/yr, c.s.a. 0 1 2 3 4 $1,000 5 6 7 8 9 10 $1,500 $3,000 IF n counts years, interest must be an annual rate. Eff. A = (1.06)2 - 1 = 12.36% Compute the FV where n is years and i = 12.36%! CE 533 Economic Decision Analysis 34 / 54 3.5 Equivalence Calculations Involving Series With PP >= CP When CF of the problem dictates the use of one or more of the uniform series or gradient factors, the relationship between CP and PP must be determined. The relationship will be one of the following three cases: Type 1. Payment period equals compounding period, PP = CP Type 2. Payment period is longer than compounding period, PP > CP. Type 3. Payment period is shorter than compounding period, PP < CP. The procedure for the first two CF types is the same. Type 3 problems are discussed in the following section. CE 533 Economic Decision Analysis 35 / 54 3.5 Equivalence Calculations Involving Series With PP >= CP When PP = CP or PP > CP, the following procedure always applies: Step 1. Count the number of payments and use that number as n. For example, if payments are made quarterly for 5 years, n is 20. Step 2. Find the effective interest rate over the same time period as n in step 1. For example, if n is expressed in quarters, then the effective interest rate per quarter must be used. CE 533 Economic Decision Analysis 36 / 54 3.5 Series Example F7 = ?? Consider: 0 1 2 3 4 5 6 7 A = $500 every 6 months Find F7 if “r” = 20%/yr, c.q. (PP > CP) We need i per 6-months – effective. i6-months = adjusting the nominal rate to fit. CE 533 Economic Decision Analysis 37 / 54 3.5 Series Example Adjusting the interest r = 20%, c.q. i/qtr. = 0.20/4 = 0.05 = 5%/qtr. 2-qtrs in a 6-month period. i6-months = (1.05)2 – 1 = 10.25%/6-months. Now, the interest matches the payments. Fyear 7 = Fperiod 14 = $500(F/A,10.25%,14) F = $500(28.4891) = $14,244.50 CE 533 Economic Decision Analysis 38 / 54 3.5 This Example: Observations Interest rate must match the frequency of the payments. In this example – we need effective interest per 6-months: Payments are every 6-months. The effective 6-month rate computed to equal 10.25% - un-tabulated rate. Calculate the F/A factor or interpolate. Or, use a spreadsheet that can quickly determine the correct factor! CE 533 Economic Decision Analysis 39 / 54 3.5 This Example: Observations Do not attempt to adjust the payments to fit the interest rate! This is Wrong! At best a gross approximation – do not do it! This type of problem almost always results in an un-tabulated interest rate You have to use your calculator to compute the factor or a spreadsheet model to achieve exact result. CE 533 Economic Decision Analysis 40 / 54 3.6 Equivalence Calculations Involving Series With PP < CP This situation is different than the last. Here, PP is less than the compounding period (CP). Raises questions? Issue of interperiod compounding An example follows. CE 533 Economic Decision Analysis 41 / 54 3.6 Equivalence Calculations Involving Series With PP < CP Consider a one-year cash flow situation. Payments are made at end of a given month. Interest rate is “r = 12%/yr, c.q.” $120 $90 $45 0 1 2 3 4 $75 $150 5 6 7 $100 8 9 10 11 12 $50 $200 CE 533 Economic Decision Analysis 42 / 54 3.6 Equivalence Calculations Involving Series With PP < CP r =12%/yr. c.q. $120 $90 $45 CP-1 0 1 CP-2 2 3 4 $75 $150 CP-3 5 6 7 $100 8 CP-4 9 10 11 12 $50 $200 Note where some of the cash flow amounts fall with respect to the compounding periods! CE 533 Economic Decision Analysis 43 / 54 3.6 Equivalence Calculations Involving Series With PP < CP Will any interest be earned/owed on the $120 $200 since interest is compounded at the end $90 of each quarter? $45 CP-1 0 1 2 $150 $200 3 The $200 is at the end of 4 5 6 7 8 10 11 month 2 and will 9it earn $50to go for one month $75interest $100 to the end of the first compounding period? 12 The last month of the first compounding period. Is this an interest-earning period? CE 533 Economic Decision Analysis 44 / 54 3.6 Equivalence Calculations Involving Series With PP < CP The $200 occurs 1 month before the end of compounding period 1. Will interest be earned or charged on that $200 for the one month? If not then the revised cash flow diagram for all of the cash flows should look like….. CE 533 Economic Decision Analysis 45 / 54 3.6 Equivalence Calculations Involving Series With PP < CP $165 Revised CF Diagram $90 $90 $45 0 1 2 3 4 5 $75 $150 $200 $200 6 7 $100 8 9 10 11 12 $50 $50 $175 All negative CF’s move to the end of their respective quarters and all positive CF’s move to the beginning of their respective quarters. CE 533 Economic Decision Analysis 46 / 54 3.6 Equivalence Calculations Involving Series With PP < CP $165 Revised CF Diagram $90 0 1 2 3 4 5 6 7 8 9 10 11 12 $50 $150 $200 $175 Now, determine the future worth of this revised series using the F/P factor on each cash flow. CE 533 Economic Decision Analysis 47 / 54 3.6 Equivalence Calculations Involving Series With PP < CP With the revised CF compute the future worth. “r” = 12%/year, compounded quarterly “i” = 0.12/4 = 0.03 = 3% per quarter F12 = [-150(F/P,3%,4) – 200(F/P,3%,3) + (-175 +90)(F/P,3%,2) + 165(F/P,3%,1) – 50] = $-357.59 CE 533 Economic Decision Analysis 48 / 54 3.7 Using Excel for i Computations In Excel, two functions are used to convert between nominal and effective interest rates: the EFFECT or NOMINAL functions. Find effective rate: EFFECT(nominal-rate, compounding frequency) The nominal rate is r and must be expressed over the same time period as that of the effective rate requested. The compounding frequency is m, which must equal the number of times interest is compounded for the period of time used in the effective rate. CE 533 Economic Decision Analysis 49 / 54 3.7 Using Excel for i Computations Therefore, in the second example of Figure 3.6 where effective quarterly rate is requested, enter the nominal rate per quarter (3.75%) to get an effective rate per quarter, and enter m = 3, since monthly compounding occurs 3 times in a quarter. CE 533 Economic Decision Analysis 50 / 54 3.7 Using Excel for i calculations Find nominal: NOMINAL(effective rate, compounding frequency per year) This function always displays the annual nominal rate. Accordingly, the m entered must equal the number of times interest is compounded annually. if the nominal rate is needed for other than annually, use Equation [3.1] below to calculate it. r = (interest rate per period)(No. of Periods) This is why the result of the NOMINAL function in Example 4 of Figure 3.6 is divided by 2. CE 533 Economic Decision Analysis 51 / 54 3.7 Using Excel for i calculations Study Example 3.7: “Use EXCEL to find the semiannual cash flow requested in Example 3.5.” CE 533 Economic Decision Analysis 52 / 54 Chapter Summary Many applications use and apply nominal and effective compounding Given a nominal rate – must get the interest rate to match the frequency of the payments. Apply the effective interest rate per payment period. When comparing varying interest rates, must calculate the Effective “i” in order to compare. CE 533 Economic Decision Analysis 53 / 54 Chapter III End of the Chapter III