Costs on Financial Statements

advertisement

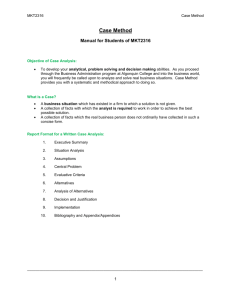

MODUL PERKULIAHAN Akuntansi Manajemen Basic Cost Management Concepts and Accounting for Mass Customization Operations Fakultas Program Studi Fakultas Ekonomi dan Bisnis S1 Manajemen 2013 1 Tatap Muka 02 Kode MK Disusun Oleh MK 84033 Suryadharma Sim, SE, M. Ak Abstract Kompetensi What Do We Mean by a Cost? Costs on Financial Statements. Manufacturing Cost Flows. Basic Cost Management Concepts: Different Costs for Different Purposes. Costs in the Service Industry. Mampu menjelaskan dan mengidentifikasi perbedaan akuntansi biaya konvensional dan kontemporer . Akuntansi Manajemen Suryadharma Sim, SE, M. Ak Pusat Bahan Ajar dan eLearning http://www.mercubuana.ac.id Product Costs, Period Costs, and Expenses An important issue in both managerial and financial accounting is the timing with which the costs of acquiring assets or services are recognized as expenses. An expense is defined as the cost incurred when an asset is used up or sold for the purpose of generating revenue. The terms product cost and period cost are used to describe the timing with which various expenses are recognized. A product cost is a cost assigned to goods that were either purchased or manufactured for resale. The product cost is used to value the inventory of manufactured goods or merchandise until the goods are sold. In the period of the sale, the product costs are recognized as an expense called cost of goods sold. The product cost of merchandise inventory acquired by a retailer or wholesaler for resale consists of the purchase cost of the inventory plus any shipping charges. The product cost of manufactured inventory includes all of the costs incurred in its manufacture. For example, the labour cost of a production employee at Comet Computer Company is included as a product cost of the computers manufactured. Exhibit 2–1 illustrates the relationship between product costs and cost-of-goods-sold expense. 2013 2 Akuntansi Manajemen Suryadharma Sim, SE, M. Ak Pusat Bahan Ajar dan eLearning http://www.mercubuana.ac.id Costs on Financial Statements The distinction between product costs and period costs is emphasized by examining financial statements from three different types of firms. Income Statement Exhibit 2–3 displays recent income statements, in highly summarized form, from Caterpillar, Inc. , Wal-Mart Stores, Inc. , and WestJet Airlines Ltd. These companies are from three different industries. Caterpillar is a heavy equipment manufacturer. Wal-Mart Stores is a large retail firm with 4,022 locations throughout the United States and 2,757 locations internationally, including 309 stores across Canada. Representing the service industry is WestJet Airlines, a major airline based in Western Canada. Selling and administrative costs are period costs on all three income statements shown in Exhibit 2–3. For example, Caterpillar lists $4.578 billion of selling, general, and administrative expenses. For Caterpillar, the costs of manufactured inventory are product costs. All costs incurred in manufacturing finished products are stored in inventory until the time period when the products are sold. Then the product costs of the inventory sold become cost of goods sold, an expense, on the income statement. Product costs for Wal-Mart include all costs of acquiring merchandise inventory for resale. These product costs are stored in inventory until the time period during which the merchandise is sold. Then these costs become cost of goods sold. There are no inventoried product costs at WestJet Airlines . Although this firm does engage in the production of air transportation services, its service output is consumed as soon as it is produced. Service industry firms, such as WestJet Airlines, TD Canada Trust , Fairmont Hotels & Resorts, Manulife Insurance, and Tim Hortons , generally refer to the costs of producing services as operating expenses. Operating expenses are treated as period costs and are expensed during the period in which they are incurred. WestJet Airlines includes costs such as flight operations, aircraft fuel, and aircraft maintenance in operating expenses for the period. 2013 3 Akuntansi Manajemen Suryadharma Sim, SE, M. Ak Pusat Bahan Ajar dan eLearning http://www.mercubuana.ac.id