tax - Iowa State University

advertisement

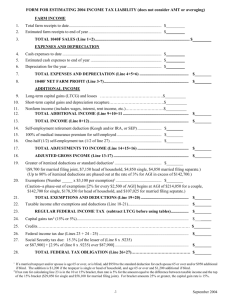

People debate how “big” government should be . . . . . . but everyone recognizes some legitimate role for government. (Public policies to correct market failure (provision of public goods, tradable pollution permits, etc.), income redistribution programs (welfare), etc.) Government activities require funds . . . . . . and raising funds requires taxes. But there are also costs of taxation. Our analysis of the effects of an excise tax can be interpreted more broadly. (Income tax is largely an “excise tax” on labor, for example.) ($/unit) tax wedge Supply tax revenue (green) deadweight loss (yellow) Demand (units/day) Deadweight loss is part of the cost of taxation. Another part of the cost of taxation: Administrative burden: cost of compliance with tax law. Taxpayers’ costs: time spent filling out forms, keeping records; costs of tax consultants, tax-form preparation software. Government’s costs: costs of enforcing tax law -IRS audits, for example. Efficiency of tax system: keeping deadweight loss and administrative burden to a minimum. Equity of the tax system: distributing the burden of taxes in a “fair” way. “Are the rich paying their ‘fair’ share?” Most of our attention will focus on: Federal individual income tax --- the single largest source of federal government revenue. Federal income tax code is extremely (!) complicated (2010 form 1040 Instruction booklet is 179 pages!) (http://www.irs.gov/pub/irs-pdf/i1040.pdf) . . . but here is a simplified overview (omitting lots of details): Taxpaying unit is the “family” (could be a single person, could be a married couple with children, etc.) Tax liability (amount of tax owed) is based on concept of “taxable income.” “taxable income” (line 43 on Form 1040, 2010 version) = income from (almost) all sources (wages, tips, interest, rent, pensions, etc.) - “adjustments” (IRA contributions, moving expenses, alimony paid, etc.) - “exemptions” ($3650 for each family member) - “deductions” (“standard”: $5700 - single, $11,400 married, filing jointly; or . . . “itemized”: mortgage interest payments, charitable contributions, state and local taxes, etc.) The result (“taxable income”) is the basis for a tax calculation (details in a moment). Tax actually owed may be further reduced by “credits”: credit for the elderly or disabled, adoption credit, child credit ($1000 for each child under 17), etc. Note: “Adjustments,” “exemptions,” and “deductions” reduce “taxable income” directly (and tax indirectly). “Credits” reduce tax directly. For a given taxable income, how is tax determined? Most taxpayers are required to use “Tax Tables” . . . . . . but you get the same answer (and a better understanding of structure) from “Tax Schedules.” Schedule Y-1 -- Use if your filing status is Married filing jointly. If your taxable income is: Over -$0 16,750 68,000 137,300 209,250 373,650 The tax is: But not over -$16,750 68,000 137,300 209,250 373,650 ---------- ---------- 10% $1,675 +15% 9,362.50 +25% 26,687.50 +28% 46,833.50 +33% 101,085.50 +35% of the amount over -$0 16,750 68,000 137,300 209,250 373,650 Tax tables and brackets for another filing status? See . . . http://www.irs.gov/pub/irs-pdf/i1040tt.pdf Marginal tax rate: the extra taxes paid on an additional dollar of income. Average tax rate: total taxes paid divided by total income. “tax bracket”: a taxable income range associated with a given marginal tax rate. A very common misconception: Getting “bumped” into a higher tax bracket can leave you with less after-tax income. Let’s use the tax schedule to graph tax liability as a function of total and taxable income. Some assumptions about our hypothetical taxpayers: Married filing jointly No “adjustments” 2 exemptions (husband, wife, no children) = $7,300 $12,700 in itemized deductions. Taxable income = total income - $20,000 (No tax credits.) Caution: Following analysis is a simple illustration only. (Some details of tax code ignored.) tax liability 46,833.50 (marginal tax rates) (28%) 26,687.50 (25%) total income (in thousands) (15%) 9362.50 (10%) 1,675 0 20 36.75 0 16.75 88.0 68.0 157.3 229.25 137.3 209.25 taxable income (in thousands) Progressive tax: a tax for which high-income taxpayers pay a larger fraction of income than low-income taxpayers. (Average tax rate increases with income.) Proportional tax: a tax for which high-income and lowincome taxpayers pay the same fraction of income. (Average tax rate independent of income.) Regressive tax: a tax for which high-income taxpayers pay a smaller fraction of income than low-income taxpayers. (Average tax rate decreases with income.) Calculating some average tax rates for our hypothetical taxpayers: Total income = $60,000 (taxable income = $40,000) tax = 1,675 + 0.15 (40,000 – 16,750) = $5,162.50 average tax rate = 5,162.50 ÷ 60,000 = 8.60% Total income = $120,000 (taxable income = $100,000) tax = 9,362.50 + 0.25 (100,000 - 68,000) = $17,362.50 average tax rate = 17,362.50 ÷ 120,000 = 14.47% Total income = $180,000 (taxable income = $160,000) tax = 26,687.50 + 0.28 (160,000 - 137,300) = $33,043.50 average tax rate = 33,043.50 ÷ 180,000 = 18.36% Federal individual income tax is progressive. Can see this in the graph. tax liability 33,043.50 17,362.50 total income (in thousands) 5,162.50 0 20 36.75 60 88 0 16.75 40 68 157.3 180 229.25 120 137.3 160 209.25 100 taxable income (in thousands) One more word of caution: This simplified analysis exaggerates the actual degree of progressivity in federal income tax. Reason: Deductions usually grow with income. So our married couple with total income of $60,000 might have deductions < $12,700 and, therefore, taxable income > $40,000. Couple with total income of $180,000 would probably have deductions > $12,700 and taxable income < $160,000. Recall: One of the costs of taxation is deadweight loss. The deadweight loss of an income tax is determined by marginal tax rates. Workers’ labor supply decisions are influenced by the return (“take-home-pay”) from the marginal hour of work . . . . . . this is determined by the marginal tax rate. So it’s the marginal tax rate that measures how much the tax system discourages work . . . . . . or other income-generating activities. Higher marginal tax rates mean greater deadweight loss. Are current marginal rates too high? Some historical perspective: Highest current bracket subject to 35% rate. In 1990s – before Bush tax cuts, it was 39.6% In 1970s – before Reagan tax cuts (Remember Arthur Laffer?), it was 50% (on earned income) In 1950s, it was 90%! (on income over $400K) For history of top and bottom marginal rates: See (http://www.ntu.org/main/page.php?PageID=19) Current rates are the result of “Bush tax cuts” Passed in 2002 but with a “sunset” provision calling for expiration this year. In December 2010, Congress passed and President Obama signed a bill to extend Bush tax cuts. Many Democrats had wanted to allow tax cuts to expire for the wealthiest Americans. 2010 tax brackets (married, filing jointly) and marginal tax rates for 2010 and 2011 (given that the Bush tax cuts were extended). If the tax cuts had expired for all. 0 16,750 68,000 137,300 209,250 373,650 16,750 68,000 137,300 209,250 373,650 and up actual 10% 15% 25% 28% 33% 35% 15% 15% 28% 31% 36% 39.6% If the tax cuts had expired just for the rich. 10% 15% 25% 28% 36% 39.6% National Commission on Fiscal Responsibility and Reform (the “Deficit Commission”) (http://www.fiscal . . .) Co-chaired by: Alan Simpson (R., former Senator from WY) Erskine Bowles (D., former Clinton Adm. official) Make recommendations on: Health Policies Social Security Discretionary Spending Tax reform Report issued Dec. 1, 2010 (http://www.fiscal . . . report) The Commission’s recommendations on federal individual income tax: Substantially reduce marginal rates (reduce top rate to 23 – 29%). Increase or maintain progressivity. Broaden the income tax base (eliminate some current exemptions and deductions). All capital gains and dividends taxable as ordinary income. Will any of this become law? We’ll see. Sales tax A popular way for states to raise revenue. (All states except AK, DE, MT, NH, and OR.) (http://thestc.com/STRates.stm) In Iowa, state sales tax = 6%, but local options available. Iowa state-wide average sales tax (taking account of local options) = 6.85% Sales taxes have a tendency to be regressive . . . . . . because low-income households tend to spend a greater proportion of income than highincome households. Hypothetical example with a 5% sales tax: Household 1 Household 2 Total income 30,000 100,000 Expenditures on goods and services 20,000 50,000 Sales tax (assuming tax applies to all expenditures) 1,000 2,500 Average tax rate 3.33% 2.50% Lower average tax rate for higher income household means tax is regressive. To partially mitigate sales tax regressiveness, states generally exempt some “necessities”: food, medicine, clothing (exempted in MN, not IA), etc. Most states have both state income tax and sales tax. Not all: Washington (for example) has sales tax only. (The Associated Press, 01/08/2003) “A study by the Institute on Taxation and Economic Policy found that Washington’s tax structure puts a bigger tax burden on the poor than any other state. Because Washington has no income tax, state government leans heavily on the 6.5% sales tax. The other states at the top of the study’s list -- FL, TN, TX, and SD, have similar systems.” Mail order and Internet taxation. Federal law exempts Internet and mail order retailers from having to collect state and local sales tax. U.S. Supreme Court, Quill Corp. v. North Dakota, 1992: (http://www.law.cornell.edu/supct/html/91-0194.ZO.html) States cannot compel out-of-state companies to collect state sales tax. To do so would be unconstitutional interference with interstate commerce. Only (“brick-and-mortar”) retailers with a physical presence in the state can be compelled to collect tax. (http://www.youdebate.com/DEBATES/tax_internet_tax.HTM) Mail order and internet shopping involves a “tax break” compared to shopping in brick-and-mortar stores. Makes already regressive sales tax more regressive (only those with Internet access and/or credit cards can get the tax break). Supreme Court ruling: Congress can change policy. With most states experiencing budget problems, collecting internet sales tax is a growing priority. Recent Congressional efforts to force internet merchants to collect state sales taxes. (http://news.cnet.com . . .)