US REAL PROPERTY INTEREST (USRPI)

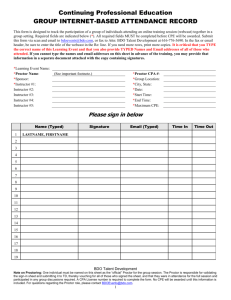

advertisement

U.S. INBOUND INVESTMENT February 2015 To ensure compliance with Treasury Department regulations, we wish to inform you that any tax advice that may be contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or applicable state or local tax law provisions or (ii) promoting, marketing or recommending to another party any tax-related matters addressed herein. ABOUT BDO 100-Year history in the United States BDO USA, LLP Statistics (Financial highlights are as of and for the year ended 6-30-14; location statistics as of 1-1-15.) Revenues: $833 million Business Line Breakdown: Accounting & Auditing Tax Consulting, Corp. Fin., Other 58% 32% 10% Total Partners: 346 Culture built around a hands-on accessible service team with significant partner and manager involvement BDO performs audits and/or EBP audits for 10 Fortune 1000 clients BDO Organization Structure Streamlined, accessible organizational structure Direct access to national technical resources Excellent staff-to-partner ratio Total Professional Personnel: 2,968 Foundation of core values Total Personnel: 4,041 Number of Offices: 58 BDO USA offices More than 400 independent Alliance firm locations nationwide. BDO USA, LLP, a Delaware limited liability partnership, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. BDO is the brand name for the BDO network and for each of the BDO Member Firms. Source: BDO USA, LLP Page 2 Honesty & Integrity, Competence, Dedication, Professionalism, Responsibility & Accountability Member firm of BDO International Limited Fifth largest accounting & consulting network in the world U.S. LOCATIONS Page 3 BDO INTERNATIONAL LIMITED Fifth largest assurance and tax consulting network in the world BDO GLOBAL NETWORK Worldwide Statistics (as of and for the year ended September 30, 2014) Revenues: $7.02 billion Business Line Breakdown: Accounting & Auditing Tax Advisory (Consulting, Corp. Fin., Other) 57.5% 20.6% 21.9% Total Partners: 5,037 Total Professional Personnel: 45,940 Total Personnel: 59,428 Number of Offices: 1,328 in 152 countries Service provision within the international BDO network of independent member firms (‘the BDO network’) is coordinated by Brussels Worldwide Services BVBA, a limited liability company incorporated in Belgium with its statutory seat in Brussels. Each of BDO International Limited (the governing entity of the BDO network), Brussels Worldwide Services BVBA and the member firms is a separate legal entity and has no liability for another such entity’s acts or omissions. Nothing in the arrangements or rules of the BDO network shall constitute or imply an agency relationship or a partnership between BDO International Limited, Brussels Worldwide Services BVBA and/or the member firms of the BDO network. BDO is the brand name for the BDO network and for each of the BDO member firms. Source: Brussels Worldwide Services BVBA Page 4 Seamless, cohesive global network Over 25,000 clients in the U.S. alone 1,328 BDO offices located in 152 countries Advancing compliance with national regulations and legal requirements in proximity to our clients and in the local language BDO WORLDWIDE LOCATIONS Page 5 U.S. TRADE OR BUSINESS A nonresident alien individual or foreign corporation generally pays U.S. income tax at the regular U.S. rates on the income (including certain foreign-source income) that is effectively connected with a U.S. trade or business. Threshold for what constitutes a U.S. trade or business is low. No statutory definition; reliance on case law and IRS rulings. Determination of what income is effectively connected with the conduct of a U.S. trade or business. Page 6 PERMANENT ESTABLISHMENT Most income tax treaties exempt the business profits of a resident of a treaty country from U.S. tax unless those profits are attributable to a taxpayer's U.S. “permanent establishment” (“PE”). These treaties allow foreign persons to conduct limited commercial activities in the U.S. without being subject to U.S. tax (PE threshold higher than “U.S. Trade or Business”). In general, a PE is a “fixed place of business” through which the business of an enterprise is carried on in whole or in part. Activities of a dependent agent may also create a PE. Page 7 EFFECTIVELY CONNECTED INCOME (“ECI”) Nonresident alien individuals and foreign corporations are taxed on a net basis ECI less allowable deductions allocable to that income. This net business income is subject to income tax at regular rates. Income or gains from foreign sources will not be treated as effectively connected with U.S trade or business unless the nonresident alien or foreign corporation maintains a U.S. office/other fixed place of business in the U.S. In which case, following foreign sourced income can be treated as effectively connected with U.S. trade or business. - Rents and royalties derived from use of intangible property; - Income from sale of inventory or personal property held for sale in normal course of business through U.S. office. Page 8 BRANCH PROFIT TAX 30% tax on a foreign corporation’s “dividend equivalent amount”. Essentially, profits that are not reinvested (deemed repatriated) are subject to branch profits tax. BPT may be reduced under a tax treaty (typically to the same rate as dividend withholding tax). No BPT when branch is terminated. Page 9 BRANCH OR SUBSIDIARY Both are essentially subject to the same tax rates: up to 35% Federal corporate income tax plus State income tax plus dividend withholding tax (or branch profits tax) upon repatriation. A branch will require the foreign owner(s) to file US tax returns. Allocation between US and worldwide income and expenses adds to the complexity of a branch return (especially at the State and local tax level). Corporate form provides for income deferral in home country. “Check-the-box” elections and hybrid entities. Page 10 LIMITED LIABILITY COMPANY (LLC) Transparent for US tax purposes unless an election is made to treat the LLC as a corporation. Characterization may be difficult in the shareholder’s jurisdiction. Check-the-box regime allows for substantial flexibility and sometimes planning opportunities. Single-member LLC is disregarded for US tax purposes. Transactions between single-member LLC and its owner are therefore also disregarded for US tax purposes. Page 11 BASIC STRUCTURING ALTERNATIVES T1 T2 TR Co US Sub US Sub files US tax return Dividend withholding tax No exposure for TR Co, T1 and T2 Page 12 T1 T2 TR Co US LLC TR Co files US branch return Branch profits tax No exposure for T1 and T2 T1 T2 TR LP US LLC T1 and T2 file individual US tax returns TR LP files US partnership tax return No dividend withholding tax or BPT Individual income tax rates CONSOLIDATED RETURNS T1 T2 TR Co US Sub US Sub T1 T2 T1 TR Co T2 TR Co US Hold Co US LLC US Sub NO Page 13 US LLC US Sub YES YES NON-BUSINESS INCOME/WITHHOLDING Generally, there is a 30% U.S. withholding tax from certain types of (nonbusiness) income from U.S. sources paid to foreign persons. This applies to payments of fixed or determinable annual or periodical (“FDAP”) income from U.S. sources. FDAP income generally includes interest, dividends, rents, royalties and any other annual or periodical gain, profit or income. Income tax treaties between the U.S. and foreign countries may reduce or eliminate withholding tax on various types of FDAP income. Page 14 WITHHOLDING CERTIFICATES Determination by a U.S. withholding agent of the status of a payee (e.g., beneficial ownership, entitlement to reduced tax rates under a treaty) is made on the basis of a withholding certificate. Withholding certificate required from beneficial owner prior to payments being made. In absence of being provided with withholding certification, U.S. withholding agent must withhold at 30% (or, in some instances, assume that the payee is a U.S. person and apply “backup withholding”). No requirement to submit the withholding certificates to the IRS. Page 15 WITHHOLDING CERTIFICATES Form W-8BEN – for nonresident aliens and foreign corporations receiving FDAP income; Form W-8BEN-E – for foreign entities receiving FDAP income as beneficial owners; Form W8-ECI – for persons claiming that income received is effectively connected with U.S. business; Form W8-EXP – foreign governments, central banks of issue, international organizations, foreign private foundations claiming tax exempt status; Form W-8IMY- applies to payments made to intermediaries (e.g., partnerships, qualified intermediaries); Form W-9 – for U.S. citizens and residents; Form 8288-B- applies to transfers of U.S. real property interest; and Form 8233 – certain compensation for personal services. Page 16 TIPS FOR THE PRACTITIONER Compliance with withholding tax rules is a tier 1 exam issue. Completion of W-8 Forms has become more complex due to the Foreign Account Tax Compliance Act (FATCA) Withholding agent (e.g. US subsidiary) is liable for withholding tax. If US Co makes a payment to its foreign parent: always check parent’s eligibility for treaty benefits under the treaty’s “limitation on benefits” (LOB) clause Dividends can be fully exempt under some newer treaties (again: a complex LOB analysis may be necessary). Make sure you understand a foreign entity’s classification for U.S. tax purposes. Form W-8BEN and W-8BEN-E must generally include foreign person’s US taxpayer ID if treaty benefits are claimed (exception: dividends or interest from publicly traded US companies) Don’t automatically rely on foreign person’s claim not to be engaged in a U.S. trade or business; better file a protective return (best practice) Page 17 TREATY BASED RETURN POSITIONS A taxpayer who, with respect to any tax imposed, takes the position that a treaty of the U.S. overrules (or otherwise modifies U.S. tax law) is generally required to disclose such position on a U.S. tax return. If no tax return filing is otherwise required, disclosure is made by filing a return. Return need only include required disclosure, taxpayers name, address, and taxpayer identification number. The required disclosure is made on Form 8833, attached to the return. Exceptions from the Form 8833 reporting requirement include certain amounts that are reported on Form 1042-S (e.g. dividends) and that do not total more than $500,000 for the tax year. Page 18 FOREIGN INVESTMENT IN U.S. REAL PROPERTY TAX ACT (“FIRPTA”) RULES Foreign persons are not generally subject to U.S. tax on gains from dispositions of capital assets. However, under the FIRPTA rules, a nonresident alien individual or foreign corporation disposing of a U.S. real property interest (“USRPI”), will be taxed on the net gains from such a disposition as if such gains or losses were effectively connected with the conduct of the U.S. business. Special withholding regime under FIRPTA: - 10% of amount realized; or - 35% of gain. Complex interplay with corporate reorganization rules. Page 19 US REAL PROPERTY INTEREST (USRPI) USRPI includes: Any interest in real property located in the U.S. or the U.S. Virgin Islands; and Any interest (other than solely creditor) in a domestic corporation that is a U.S. real property holding company (USRPHC) at any time during the 5 year period ending on date of disposition of the interest. For this purpose, a corporation is considered to own a proportionate share of assets held through a partnership, trust or estate, as well as a domestic or foreign corporation in which it holds a controlling interest. Generally, a corporation is a USRPHC if the FMV of its USRPI is at least 50% of the FMV of all its real property interests and any other property used in its business. Taxpayer must prove that corporation is NOT a USRPHC. Page 20 FIRPTA WITHHOLDING The nonresident individual or foreign corporation will be subject to U.S. income tax at the regular rates on the net gains derived from the disposition of U.S. real property interests. The transferee is generally required to withhold 10 % of the amount realized when a foreign person disposes of a U.S. real property interest. Sellers can obtain a certificate from the IRS to certify the actual U.S. tax liability due on the disposition of the U.S. real estate, in which case, the transferee should withhold the actual tax liability due from the amount realized upon disposition. Certification can be obtained by filing a Form 8288-B (Application for Withholding Certificate for Dispositions by Foreign Persons of U.S. Real Property Interests). Page 21 SALT ISSUES IMPACTING FOREIGN ENTITIES Impact of US Tax Treaty is Complex - Even if the company does not have PE under the Treaty it still needs to evaluate if it is “doing business” within the states. - P.L. 86-272 only applies to “interstate” commerce so the immunities available within this law are not available to foreign organized entities - Some states have extended the immunities to foreign organized entities but a state is not obligated to provide these same immunities to foreign entities - The taxable income starting point can be difficult to determine because a treaty protected foreign entity definitionally has zero FTI - Need to be careful because some states (e.g., NY and NJ) have worldwide income modifications in spite of the fact that the “starting” point is FTI Critical to consider state elections - Foreign entities must consider making “waters edge” elections in states (e.g., California) that require worldwide combined reporting because the failure to make these elections may require the foreign entity to file on a combined basis with all of its foreign affiliates. 22 SALT ISSUES IMPACTING FOREIGN ENTITIES (CONT.) Taxes that are based on something other than net income create the most significant exposures for foreign entities - Sales/Use Taxes - If the foreign entity has any employees or independent contractors visit a state then it will be required to collect sales/use tax on transactions that are classified as being taxable transactions. - It is critical to remember that sales/use taxes are the customer’s tax but the vendor is put into a position to administer/collect the taxes. If the vendor (i.e., foreign entity) fails to collect the tax then the vendor is held responsible for the taxes. - Non-Income based taxes - The type of non-income based tax that may produce the largest exposure for foreign entities are state taxes based on gross receipts (e.g., Washington B&O, Ohio Commercial Activity Tax) 23 MICHAEL R. WHITACRE Atlanta Office PARTNER- TAX SERVICES EXPERIENCE Mike has more than 25 years of experience in auditing and taxation in public accounting with BDO. Mike has worked proactively with a variety of businesses including clients in the technology, service and distribution sectors. He has assisted clients with federal, state and international tax issues including mergers and acquisitions, controversy and tax minimization. Phone: 404-979-7116 Email: mwhitacre@bdo.com Mike’s areas of specialization include: corporate taxation, mergers and acquisitions, and taxation of pass-through entities. PROFESSIONAL AFFILIATIONS American Institute of Certified Public Accountants connex (America Israel Business Connector) Board of Directors Business Forums International Financial Executives Institute (FEI) Georgia Society of Certified Public Accountants EDUCATION B.S., Accounting, Indiana University – Kelley School of Business Page 24