Document

advertisement

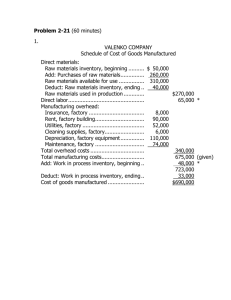

Managerial Accounting Dr. Baldwin University of Arkansas – Fort Smith Fall 2010 CHAPTER 14 Managerial Accounting Concepts & Principles C1 Managerial & Financial Accounting ___________ accounting provides financial and non-financial information for managers of an organization and other internal decision makers _________ accounting provides general purpose financial information to those who are outside the organization. Activities of a Managerial Accountant • Determining costs of products – – – – Predicting Future Costs Product Pricing Profitability Analysis Make or Buy Decisions • Planning – Strategic Plans – long term – Budgeting - Short Terms Plans • Controlling costs • Applying Cost-Volume-Profit techniques • Standard costing and variance analysis C1 Nature of Managerial Accounting Financial Accounting Managerial Accounting Investors, creditors and other external users Managers, employees and other internal users 2. Purpose of information Making investment, credit Planning and and other decisions control decisions 3. Flexibility of practice Structured and often Relatively flexible controlled by GAAP (no GAAP) 4. Timeliness of information Often available only Available quickly without after audit is complete need to wait for audit Historical information with some predictions Many projections and estimates Emphasis on Projects, processes and whole organization segments of an organization Monetary Monetary and information nonmonetary information 1. Users and decision makers 5. Time dimension 6. Focus of information 7. Nature of information Internal Reporting • Management functions include the following: – – – – Planning – set goals, budgets Executing – carrying out plans Reviewing – monitoring progress towards goals. Reporting – to outside parties • Management accountants provide information to facilitate these processes. Goal of Lean Business? Provide high product at low . Implementing a lean business model allows companies to focus on their core competencies (what they do best) which will help them achieve these two goals. C2 Lean Business Model Customer Orientation Global Economy Lean Business Model Quality while eliminating Waste Satisfy the Customer Positive Return Continuous Improvement • The following ideas have emerged to deal with increasing competition and the need to continually improve business practices. – Just-in-time Operations – Total Quality Management – Activity-based Management (and costing) Just-in-Time… • JIT involves the reduction of inventories and the purchase and production of merchandise only when needed. (Demand – pull system) • Operations become much more _________ and waste is virtually eliminated. • Quality of the products typically improves as well. Total Quality Management • In an effort to drive down the cost of poor quality, firms have decided to build quality into their products. – They have been able to reduce total costs and improve their products at the same time. • This same approach can be applied to all business functions and settings. Activity Based Management • This approach requires that management identify value-added and non-value-added activities. • The goal is to reduce or eliminate non-valueadded costs and activities. • In doing so, the company becomes more efficient and can devote more time and energy to value-added activities. Understanding Costs • Common Questions to consider: – – – – What costs are incurred in making our product? How do these costs behave? What factors affect these costs? How can we control costs, without our quality suffering? What Next? • Once we understand our costs, we can use that information to determine – – – – – Budgets Setting prices Value of inventory Performance evaluation What products to make C3 Classification of Costs Many ways to classify costs in order to understand them… • Direct versus ______ costs • Variable versus _____ costs • Product versus _____ costs • Controllable versus ___________ costs. • ______ versus out-of-pocket costs versus ___________ costs. Classification by Behavior In planning, we must understand how costs behave. For example, do costs change as production activity changes or do they stay the same? • Variable cost – costs that ______ as production activity increases (direct materials, direct labor) • Fixed cost – costs that ____________ over a range of activity levels (depreciation, rent) • Mixed cost – costs that have ____ a fixed and variable component Classification by Traceability • We need to be able to associate costs with particular cost objects (units of product or department). • Costs can either be considered: – ____ costs can be easily traced to an object (some materials or labor). – ______ costs are allocated to objects because they cannot be easily traced (plant depreciation, rent of equipment). Classification by Relevance • ______Costs – already incurred and can not be avoided or changed – always irrelevant to short term decision analysis • Out-of-pocket costs – require future outlay of cash – possibly relevant to short term decision making • ____________costs – benefit or revenue lost when choosing one alternative over another – relevant to short term decision analysis C4 Classification by Function Product costs • include all costs associated with making or buying a product for resale (COGS) – Direct Materials (DM) – Direct Labor (DL) – Manufacturing or Factory Overhead (FOH) • Costs attach to _________ and are expensed only when items are _____. Classification by Function Period Costs • Selling Costs – Costs incurred to obtain customer orders and to deliver finished goods to customers • General & Administrative Expenses – Non-manufacturing costs of staff support and administrative functions – accounting, data processing, personnel, research and development. • These costs _____attach to inventory. • They are expensed in the ________ in which they are incurred or used up. – Advertising, insurance, interest etc. Manufacturing Costs Three categories of product costs for manufacturing companies: • Direct ________ – the cost of specific parts or materials that can be directly traced to a product (raw materials) • Direct ________ – the labor costs that can be directly traced to individual units or batches of products • _________ Manufacturing Costs… Manufacturing overhead costs: all other costs of production which cannot be directly traced to individual units or batches of products • Indirect _______ – supervisory salaries • Indirect _______ – grease, nails, etc. • Other – depreciation, insurance, maintenance Other Cost Terminology prime costs versus conversion costs • ________ costs include the direct costs of production. – Material and Labor • ________ costs include – Labor and Overhead. • Obviously these categories are not mutually exclusive. Mfg. Cost Flow & Classifications Costs Product Costs Materials Purchases Direct Labor Factory Overhead Period Costs Selling and Administrative Balance Sheet Raw Materials Inventory Work in Process Inventory C5 P1 Period costs flow directly to the income statement Income Statement Finished Goods Inventory Cost of Goods Sold Selling and Administrative P2 Cost of Materials Used… • Some of the key relationships need to be defined. • Cost of Materials Used = – Beg RM inventory + Materials purchased during the period – End RM inventory • Manufacturing Costs Incurred = – Direct materials used + direct labor for the period + Overhead Applied to products • NOTE: all three types of product costs here! Cost of Goods Manufactured • Cost of Goods ____________ = – Beg WIP inventory + Manufacturing Costs Incurred – End WIP inventory • Cost of Goods ____________ = – beg FG inventory – + cost of goods manufactured – - ending FG inventory Flow of Costs in Perpetual Inventory Accounts Materials Materials Purchased Work in Process DM DM IM DL COGM Finished Goods COGM SOLD FOHA Cost of Goods Sold Wages Payable Total Wages Factory Overhead DL IM IL IL SOLD FOHA Based on predetermined overhead rate OFOH Summary of cost flows FOHA = Factory Overhead Applied COGM = Cost of Goods Manf. P2 Manufacturing Statement Let’s take a look at Rocky Mountain Bikes’ Manufacturing Statement. P2 Manufacturing Statement Exh. 18-16 ROCKY MOUNTAIN BIKES Manufacturing Statement For Year Ended December 31, 2008 Direct materials used in production $ Direct labor Total factory overhead costs 85,500 60,000 30,000 Total manufacturing costs for the period Add: Beginning goods in process inventory $ 175,500 2,500 Total cost of goods in process Deduct: Ending goods in process inventory $ 178,000 7,500 Cost of goods manufactured $ 170,500 P2 Computation of Cost of Direct Material Used Beginning raw materials inventory Add: Purchases of raw materials $ 8,000 86,500 Cost of raw materials available for use Deduct: Ending raw materials inventory $ 94,500 9,000 ROCKY MOUNTAIN BIKES Cost of direct materials used in production $ 85,500 Exh. 18-16 Manufacturing Statement For Year Ended December 31, 2008 Direct materials used in production $ Direct labor Total factory overhead costs 85,500 60,000 30,000 Total manufacturing costs for the period Add: Beginning goods in process inventory $ 175,500 2,500 Total cost of goods in process Deduct: Ending goods in process inventory $ 178,000 7,500 Cost of goods manufactured $ 170,500 P2 Manufacturing Statement Exh. 18-16 Include all direct labor costs incurred during the ROCKY MOUNTAIN BIKES current period. Manufacturing Statement For Year Ended December 31, 2008 Direct materials used in production $ Direct labor Total factory overhead costs 85,500 60,000 30,000 Total manufacturing costs for the period Add: Beginning goods in process inventory $ 175,500 2,500 Total cost of goods in process Deduct: Ending goods in process inventory $ 178,000 7,500 Cost of goods manufactured $ 170,500 P2 Computation of Total Manufacturing Overhead Manufacturing Statement Indirect labor $ 9,000 Factory supervision 6,000 Factory utilities 2,600 Property taxes, factory building 1,900 Exh. 18-16 Factory supplies usedROCKY MOUNTAIN BIKES 600 Factory insurance expired 1,100 Manufacturing Statement Depreciation, building and equipment 5,300 For Year Ended December 31, 2008 Other factory overhead 3,500 Total factory overhead Direct materials usedcosts in production $ 30,000 $ Direct labor Total factory overhead costs 85,500 60,000 30,000 Total manufacturing costs for the period Add: Beginning goods in process inventory $ 175,500 2,500 Total cost of goods in process Deduct: Ending goods in process inventory $ 178,000 7,500 Cost of goods manufactured $ 170,500 P2 Manufacturing Statement Exh. 18-16 Beginning work in process inventory is ROCKY MOUNTAIN BIKES carried over from the Manufacturing Statement prior period. For Year Ended December 31, 2008 Direct materials used in production $ Direct labor Total factory overhead costs 85,500 60,000 30,000 Total manufacturing costs for the period Add: Beginning goods in process inventory $ 175,500 2,500 Total cost of goods in process Deduct: Ending goods in process inventory $ 178,000 7,500 Cost of goods manufactured $ 170,500 P2 Manufacturing Statement Exh. 18-16 Ending work in process inventory contains the cost ofBIKES unfinished goods, ROCKY MOUNTAIN and is reportedStatement in the current assets Manufacturing section of the balance sheet. For Year Ended December 31, 2008 Direct materials used in production $ Direct labor Total factory overhead costs 85,500 60,000 30,000 Total manufacturing costs for the period Add: Beginning goods in process inventory $ 175,500 2,500 Total cost of goods in process Deduct: Ending goods in process inventory $ 178,000 7,500 Cost of goods manufactured $ 170,500