ARENS 23 2158 01 Audit of Cash Balance

advertisement

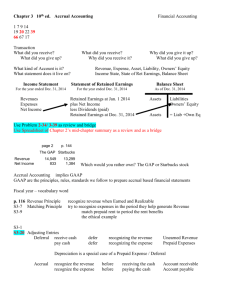

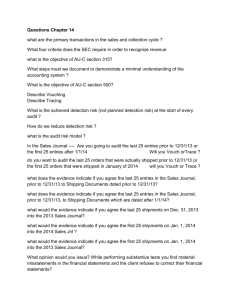

Chapter 23 Audit of Cash Balances Pages 315-330 1 Revenue & Collection Transaction cycle accounts receivable x.xx sales cash receipts cash x.xx accounts rec credit sales x.xx x.xx 2 significant classes of Transactions “credit sales” accounts “cash receipts” receivable sales x.xx cash accounts rec x.xx x.xx x.xx 3 Loren What is an imprest payroll account ? 4 cash equivalents an original maturity date of less than 90 days savings accounts – time deposits certificates of deposit money market funds 5 COSO components of internal controls • • • • • Control environment Risk assessment Control activities Information and communication Monitoring 6 Control Activities • Control Activities – Adequate separation of duties – – – – Proper authorization of transactions and activities Adequate documents and records Physical control over assets and records Independent checks on performance 7 Ricardo what responsibilities need to be separated to have adequate “segregation of duties” ? 8 Separation of Duties p 166 • authorization of transactions from the custody of related assets • custody of assets from accounting • operational responsibility from recordkeeping responsibility • IT duties from user departments 9 Separation of Duties authorization of transaction custody of assets involved in transaction Accounting (record-keeping) for the transaction reconciliation of assets to accounting records 10 Separation of Duties p 320 Bank reconciliation by someone who does not handle cash receipts record cash receipts custody of assets approve check requests Write checks record disbursements authorize transactions accounting / record-keeping custody of assets accounting / record-keeping 11 Adequate documents & records Pre numbered checks 12 Lauren What is the objective of AU-C section 500? 13 AU-C 500 Audit Evidence .04 The objective of the auditor is to design and perform audit procedures that enable the auditor to obtain sufficient appropriate audit evidence to be able to draw reasonable conclusions on which to base the auditor's opinion. 14 Nicole Describe a cutoff bank statement? 15 Romy Describe a Bank Confirmation What information is on a bank confirmation? 16 Marc Who must request the bank to send a bank confirmation to the auditor ? Who must sign the request for the bank confirmation? 17 18 Somer what distinguishes fraud from errors ? 19 fraud Intentional Knowingly making material misrepresentations with the intent of inducing someone to believe the falsehood and act upon it and, thus suffer a loss or damage. 20 significant classes of Transactions “credit sales” accounts “cash receipts” receivable sales x.xx cash accounts rec x.xx x.xx x.xx 21 auditing account balances cash 250 450 350 550 200 100 375 190 330 accounts receivable 800 300 200 275 100 450 300 190 320 550 200 100 375 190 480 365 845 450 350 550 200 100 375 190 sales 550 200 100 375 190 480 365 2,260 22 auditing transaction cycles cash 250 450 350 550 200 100 375 190 330 accounts receivable 800 300 200 275 100 450 300 190 320 550 200 100 375 190 480 365 845 450 350 550 200 100 375 190 sales 550 200 100 375 190 480 365 2,260 23 proof of cash (page 329) balance depositsw-drawals balance 12/31/LY CR checks 12/31/CY per bank statement 115,261 912,275 907,274 120,262 deposits in transit @ 12/31/LY @ 12/31/CY outstanding checks @ 12/31/LY @ 12/31/CY 21,321 (27,264) (21,321) 26,270 26,270 (27,264) 25,174 (25,174) adjusted balance 109,318 917,224 905,184 121,358 per Gen Ledger less NSF check 109,318 917,224 904,984 200 adjusted balance 109,318 917,224 905,184 121,358 121,558 (200) 24 schedule of transfers handout 25 Bank transfer schedule handout bank accounts check no. amount from to 4100 4275 4280 B403 Parent Parent Parent Parent Sub B Sub B Sub B Sub B $50,000 $10,000 $20,000 $5,000 date disbursed receipt date PARENT per Parent's books bank SUBSIDIARY per SUB's books bank 12/31 12/31 1/2 1/2 12/31 1/2 12/31 1/3 1/3 1/4 1/2 1/3 1/2 1/2 12/31 12/31 26 transfer schedule (handout) st 1 Parent writes check check clears Parent’s bank nd 2 Sub receives check th 4 rd 3 check clears Sub’s bank 27 Jena handout Does check 4100 result in a $50,000 overstatement OK understatement 28 check 4100 st 1 nd 2 rd 3 th 4 date in CD Jnl date in Sub’s CR Jnl date check cleared Sub’s bank date check cleared Parent’s bank 1/2 1/3 Parent writes check 12/31 12/31 29 Parent's cash 250 450 350 550 200 100 375 190 12/31 1/1 280 Sub B's cash 800 300 200 275 100 450 300 190 320 50 550 200 100 375 190 480 365 50 895 450 350 550 200 100 375 190 30 consolidated cash is correct 31 Huyen How would these items show up on the bank reconciliation? outstanding check on the Parent’s bank reconciliation deposit in transit on the Sub’s bank reconciliation 32 Julissa handout Does check 4275 result in a $10,000 overstatement OK understatement 33 check 4275 st 1 nd 2 rd 3 th 4 date in CD Jnl date in Sub’s CR Jnl date check cleared Sub’s bank date check cleared Parent’s bank 1/2 1/4 Parent writes check 12/31 1/2 34 Parent's cash 250 450 350 550 200 100 375 190 12/31 1/1 Sub B's cash 800 300 200 275 100 450 300 190 320 10 550 200 100 375 190 480 365 450 350 550 200 100 375 190 10 35 consolidated cash understated by $10,000 36 Julia How would these items show up on the bank reconciliations? outstanding check on the Parent’s bank reconciliation it would not appear on the Sub’s bank reconciliation 37 Katina handout Does check 4280 result in a $20,000 overstatement OK understatement 38 check 4280 st 1 nd 2 rd 3 th 4 date in CD Jnl date in Sub’s CR Jnl date check cleared Sub’s bank date check cleared Parent’s bank Parent writes check 1/2 12/31 12/31 1/2 39 Parent's cash 250 450 350 550 200 100 375 190 12/31 1/1 Sub B's cash 800 300 200 275 100 450 300 190 320 550 200 100 375 190 480 365 20 450 350 550 200 100 375 190 20 40 consolidated cash overstated by $20,000 41 Xiaodan How would these items show up on the bank reconciliations? it would not appear on the Parent’s bank reconciliation it would not appear on the Sub’s bank reconciliation 42 5 points if you get it correct -2 points if you get it wrong handout Does check B403 result in a $5,000 overstatement OK understatement 43 check B403 st 1 nd 2 rd 3 th 4 date in CD Jnl date in Sub’s CR Jnl date check cleared Sub’s bank date check cleared Parent’s bank Parent writes check 1/2 1/3 12/31 1/3 44 Parent's cash 250 450 350 550 200 100 375 190 12/31 1/1 Sub B's cash 800 300 200 275 100 450 300 190 320 550 200 100 375 190 480 365 5 5 450 350 550 200 100 375 190 330 45 The subsidiary actually has $5,000 less in their checking account than they show in their G.L. B403 is an attempt to conceal the shortage. Depositing the $5,000 in the Sub’s bank account on 12/31/15 but not recording the deposit in the books until 1/2/16 would enable the Sub to reconcile their Bank Statement 46 Cash Receipts 47 Dillon If you are concerned about the occurrence assertion for cash receipts during the year would you Vouch from CR Jnl to supporting evidence OR Trace a sample of cash receipts from mailroom remittance list into CR Jnl 48 Christina For occurrence of cash receipts Vouch from CR Jnl to supporting evidence IF you find an entry in the CR Jnl for which there is no supporting evidence Would Cash Receipts be over or under stated 49 Gordon If you are concerned about the completeness assertion for cash receipts during the year would you Vouch from CR Jnl to supporting evidence OR Trace a sample of cash receipts from the mailroom remittance list into the CR Jnl 50 Jake M For completeness Trace a sample of cash receipts from the mailroom remittance list into the CR Jnl If you find evidence of a CR in the mailroom for which there was no entry in the CR Jnl Would Cash Receipts be over or under stated 51 Cash Disbursements 52 Ian With regard to the occurrence of cash disbursements at Year End Would you Vouch from the 2015 CD Jnl to the bank statement or Trace a sample of checks on the 12/31/15 bank statement into the CD Jnl 53 Tim With regard to the occurrence of cash disbursements Vouch from 2015 CD Jnl to the bank statement If you find an entry in the 2015 CD Jnl for which there is no evidence of an underlying check Would Cash Disburse be over or under stated? 54 Ashley With regard to the occurrence of cash disbursements Vouch from 2015 CD Jnl to the bank statement If you find an entry in the 2015 CD Jnl for which there is no evidence of an underlying check Would ”Cash” be over or under stated 55 Aleksandr With regard to the completeness of cash disbursements Would you Vouch from the 2015 CD Jnl to cancelled checks on the bank statement or Trace a sample of checks from the 12/31/15 bank statement into the CD Jnl 56 Vivian For completeness of cash disbursements Trace a sample of checks from the 12/31/15 bank statement into the 2015 CD Jnl If you are unable to trace a check that appears on the 12/31/15 bank statement into the 2015 CD Jnl Would Cash Disburse be over or under stated 57 Janet For completeness of cash disbursements Trace a sample of checks into the CD Jnl If you are unable to trace a check that appears on the bank statement into the CD Jnl Would “Cash” be over or under stated 58 cut-off at 12/31/2015 59 Fiona cash receipts are you going to audit the last 25 entries in the Cash Receipts Jnl prior to 12/31/15 or the first 25 entries in the Cash Receipts Jnl after 1/1/16 60 Bryce cash receipts - will you Vouch or Trace ? 61 Sam cash receipts with which financial statement assertion are you concerned if we are auditing cash receipts at 12/31/15? 62 cash 250 12/31 1/1 450 350 550 200 300 200 275 100 450 100 375 190 300 190 320 63 Jake S cash receipts what evidence is provided if we audit the last 25 entries in the Cash Receipts Journal prior to 12/31/15? 64 Alyssa cash disbursements audit the last 25 checks in the Cash Disbursements Jnl prior to 12/31/15 or the first 25 checks in the Cash Disbursements Jnl after 1/1/16 65 Stephanie cash disbursements with which financial statement assertion are we concerned if we are auditing cash disbursements at 12/31/15 ? 66 cash 250 450 350 550 200 12/31 1/1 100 375 190 300 200 275 100 450 300 190 320 67 Katie You are concerned about cash being overstated With regard to cash disbursements You are auditing the first 25 entries in the January 2016 Cash Disbursements Journal will you Vouch or Trace 68 Vouch from the CD Jnl to cancelled checks on the bank statement 69 Loren If you vouch a check that appears in the 2016 CD Jnl into the 12/31/15 bank statement Would Cash Disburse be over or under stated 70 Ricardo If you vouch a check that appears in the 2016 CD Jnl into the 12/31/15 bank statement Would “Cash” be over or under stated 71 Lauren what evidence is provided if we audit the first 25 checks dated after 1/1/2016 ? 72 73 74 75 76 77