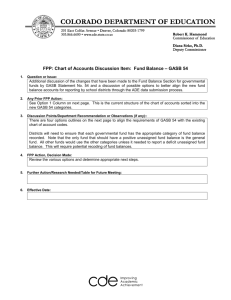

GASB Statement No. 54 and Iowa School Districts

advertisement

GASB STATEMENT NO. 54 AND IOWA SCHOOL DISTRICTS 2 Agenda • Provide a brief overview of GASB Statement No. 54 “Fund Balance Reporting and Governmental Fund Type Definitions” • Governmental Fund Types • Fund Balance Categories • Discuss Implementation in Iowa School Districts 3 GASB Statement No. 54 • Why? • Two overall changes to financial reporting: • Revised/Clarified definitions of governmental funds • Changed fund balance reporting • Effective for June 30, 2011 • No effect to the proprietary funds (enterprise funds or internal service funds) or fiduciary funds • No effect to government-wide statements 4 GASB Statement No. 54 • General Fund: to account for and report all financial resources not accounted for and reported in another fund • Special revenue funds: specific revenue sources that are restricted or committed to expenditure for specified purposes other than debt service or capital projects • Student Activity Fund • Management Levy Fund • Capital projects funds: financial resources that are restricted, committed, or assigned to expenditure for capital outlays, including the acquisition or construction of capital facilities and other capital assets • Physical Plant and Equipment Levy Fund-previously reported as a special revenue fund is now a Capital Projects Fund, Fund 36. • Capital Projects Fund 5 GASB Statement No. 54 • Debt service funds: financial resources that are restricted, committed, or assigned to expenditure for principal and interest • Permanent funds: financial resources that are restricted to the extent that only earnings, and not principal, may be used for the District’s programs 6 GASB Statement No. 54 • Nonspendable • Restricted • Committed • Assigned • Unassigned 7 GASB Statement No. 54 • Nonspendable: Not in a spendable form • Cannot ever be spent: inventories or prepaid items • Cannot currently be spent: Long-term portion of loans receivable or assets held for sale • If the proceeds must be used for a specific purpose, classify based on the constraint • Other long-term receivables are usually offset by the deferred revenue liability and there is no fund balance as a result • Legally or contractually required to be maintained intact-permanent fund principal 8 GASB Statement No. 54 • Restricted-externally imposed • External: Creditors, grantors, contributors or laws or regulations of other governments, such as the State • Difference between restricted fund balance and restricted net assets on the government-wide • Committed • Highest level of decision-making authority (Board) • MUST be committed by the Board prior to year-end, must be documented • Assigned • May be established by the governing body itself or the governing body may delegate this to an official (Superintendent or Business Manager) or another body within the organization (Finance Committee) • Cannot be negative 9 GASB Statement No. 54 • Unassigned • Only allowed a positive unassigned fund balance in the General Fund • Other governmental funds may report deficit balances as unassigned • Remember, cannot report an assignment for an amount to a specific purpose if the assignment results in a deficit unassigned fund balance • Classification • Determine nonspendable amounts first. • Apply the District’s policy for whether restricted or unrestricted amounts have been spent when an expenditure is incurred and both types of resources are available. • Next, apply the District’s policy for use of committed, assigned or unassigned. • Deficit position: Eliminate any amounts assigned and if residual is still negative, then report a deficit unassigned amount 10 Stabilization Arrangements • Formally setting aside amounts for use only in certain specific circumstances • Reported as restricted or committed • The formal action taken for setting aside the amounts specifies the circumstances for use and organization must prove non-routine nature • If the formal action is not sufficient, the fund balance is reported as unassigned 11 Implementation • Establish District policies • Committed fund balances-need Board approval prior to June • Assigned fund balances-need to determine the body or official authorized to make assignments and the policy that delegated entity is to follow • Flows: In what order will the resources be used? • Start now with the prior year audit report and determine the fund balance reporting • Draft the footnote disclosures based on the policies that have been adopted 12 Implementation • Student Activity Special Revenue Fund • Reported as restricted net assets on government wide statements • Fund balance is restricted • Management Levy Special Revenue Fund • Reported as restricted net assets on government wide statements • Source of revenue is the levy annually certified by the District • Fund balance is restricted • PPEL Capital Projects Fund • Reported as restricted net assets on government wide statements • Source of revenue is the levy annually certified by the District • Fund balance is restricted • Capital Projects Fund • Reported as restricted net assets on government wide statements • Statewide sales and service tax • Fund balance is restricted 13 Implementation • Debt Service Fund • Reported as restricted net assets on government wide statements • Source of revenue is the levy specifically approved by voters • Fund balance is restricted • General Fund • Categorical funding-restricted • May have Committed and/or Assigned 14 15 16 General Fund example FY 2010 Fund Balance=$7,935,158 a. Any Nonspendable? Prepaid items b. Any Restricted? Federal and state programs c. Any Committed? None d. Any Assigned? Federal and state programs What is the Unassigned Balance? 17 Sarah Bohnsack, Partner 563.343.9595 Mia Frommelt, Partner 913.660.3931 Sarah@governmentalservice.com Mia@governmentalservice.com