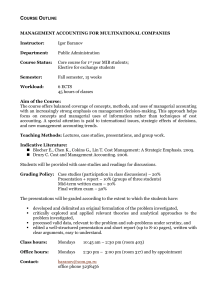

Costing in the Logistics Network

advertisement

Using Activity-Based Costing to Implement Supply Chain Improvements Terrance L. Pohlen Lt Col, USAF, PhD Overview • Why transportation and logistics managers require more accurate cost information • How activity-based costing can provide greater management insight • Using ABC to support transportation and logistics decision-makers • Applying ABC to supply chain management Transportation and logistics managers need more accurate cost information •Critical link exists between corporate profitability and logistics costs and performance •Many logistics costs and effects of logistics decisions buried in overhead costs •Logistics particularly requires accurate costing – Diversity in resource consumption – Products and resource consumption not correlated with unit based allocation measures •Identifying and costing activities may reveal opportunities to improve operating efficiencies Problems typically encountered in transportation and logistics accounting systems • Visibility frequently lost--included as part of SG&A • Allocated using cases shipped, miles, or sales • Costs not available by product, customer, or supply channel • Affect of logistics decisions/improvements not readily apparent • Output measures frequently not captured “The imaginary profits--and losses--that arise from flawed cost systems can lead to very expensive blunders. We may be giving away the best business (high volume, but supposedly low margin products) to foreign companies. Competitors don’t want your cats and dogs--they want the volume business. Once the high volume products are abandoned, those that remain must carry a greater share of overhead, and thus they too become less profitable.” Fortune Magazine 12 October 1997 Traditional Cost Accounting Overhead Direct Labor Direct Labor Direct Labor Direct Labor Activity Activity Activity Activity DIRECT MATERIALS DIRECT MATERIALS DIRECT MATERIALS DIRECT MATERIALS OUTPUT $$ Problems with Traditional Costing of Transportation & Logistics • Unit based allocation suggests costs will vary with volume-cannot accurately determine how changes in customer service effect total costs • No reward for reducing indirect cost categories--benefits diffused across all products • Costs “reduced” by eliminating direct labor • Overhead costs appear “fixed” and not affected by management action • Rewards based on cost center performance and not on total product/customer/channel profitability Are U.S. Manufacturers’ Accounting Systems a Major Tool Used in Management Decision-Making? No 18% Yes 82% Source: National Center for Manufacturing Sciences, Focus, 1993 Warning Signals: • • • • • • • Division managers want to drop seemingly profitable lines Product or customer profitability is hard to explain Departments develop internal costing systems The accounting department performs many special projects Competitors’ prices appear unrealistically low You have a high-margin niche all to yourself Customers don’t mind price increases Adapted from Cooper, Robin, “You Need a New Cost System When...,” Harvard Business Review, January-February 1989, pp 77-79. Activity-Based Costing Supervision Office Support Utilities Supplies Equipment Resources Receiving Put-Away Set-Ups Packing & Shipping Activities Product Division A Product Division B Product Division C Product Division D Cost Objects a technique to assign more accurately direct and indirect costs to the activities, customers or products which consume an organization’s resources Activity-Based Costing IS: An overhead allocation technique which generates the cost of activities IS NOT: A bookkeeping system A consolidation system ABC translates traditional costing into actionable information for decision-makers Cost data translated by ABC General Ledger Data (account balances) Activity-based information ABC Model Decision Makers How Does ABC Assign Costs? Supervision Office Support Utilities Supplies Equipment Resources Packing & Receiving Put-Away Set-Ups Shipping Activities Product Division A Product Division B Product Division C Product Division D Cost Objects ABC uses a two-stage process to assign costs – Resource costs are assigned to activities based on use – Activity costs are assigned to the products or customers consuming the activity Activity-based costing approach Overhead Overhead Overhead Overhead Direct Direct Direct Direct Labor Labor Labor Labor Activity Activity Activity Activity DIRECT MATERIALS DIRECT MATERIALS DIRECT MATERIALS DIRECT MATERIALS OUTPUT $$ Resources Terminal Insurance 13% 2% Supervision Office Labor 3% 9% Dock Labor 32% Depreciation 4% Maintenance 5% Fuel 7% License 1% Pickup & Delivery Drivers 18% Utilities Yard Labor 5% 1% • Resources are usually derived from the general ledger accounts • Represent the resources the organization has to perform its mission • Many ABC models use budget information to determine resources Assigning Resource Costs Terminal 13% Supervision 3% Office Labor 9% Insurance 2% Depreciation 4% Maintenance 5% Dock Labor 32% Fuel 7% License 1% Pickup & Delivery 18% Utilities 1% Yard Labor 5% Process Claims 4% Maintain vehicles 10% Marketing 5% Billing 4% Handling 10% Pickup 6% Unload 8% Deliver LTL 17% Load delivery 6% Load line haul 6% Scheduling 3% Line haul 8% Accessorial Services 5% Deliver TL 8% • Resource drivers used to assign costs to activities • Interviews frequently used for making the cost assignments • Activity costs are sum of all resources needed to perform the activity Activity Cost MHE 2% Supervision Maintenance 4% 1% Supplies 10% Labor 47% Facility 36% LTL Shipping Activity • An activity’s cost is the sum of the resources used in performing the activity • Consumption used to trace resource costs to the activities Identification and Number of Activities Pallet picks Pallet sent picks by RF sent by RF to Fork lifts to Fork lifts Pick lists Placed in Window Warehouse Signs for and Takes Pick List Property picked and Palletized Pallet moved to Shrink Wrap Area Warehouseman Orders Requiring Annotates CHEP Pallets Work Log Re-palletized Pallet Shrink-Wrapped Pallet moved to Staging Area • Activities identified by implementation team • Level of detail determined by: • Cost • Diversity • Management Focus • Most DCs using 20-40 activities for costing Receiving Product Storage Transp Planning Picking Customer Special Handling Shipping Administration Brand Cartage Unload and inspect Putaway Bulk storage Aerosol storage Pre-shipment scheduling Truckload planning Post-shipment support Transportation Administration Manual picking Mechanical picking Stage pallet for order Build pallet Adjust pallet height Clamp off/slip sheet Spec Hdling/Warehouse office Load pallet Check full pallet Check mixed pallet Ship international order Ship small package order Returns Rework Administration Assigning Activity Costs Process Claims 4% Maintain vehicles 10% Marketing 5% Billing 4% Handling 10% Pickup 6% Unload 8% Deliver LTL 17% Load delivery 6% Load line haul 6% Scheduling 3% Customer E 8% Line haul 8% Accessorial Services 5% Others 7% Customer A 32% Customer D 10% Customer C 17% Customer B 26% Deliver TL 8% • Activity costs assigned using cost drivers • Costs assigned on a per activity basis (per case, shipment, bill of lading) • Desired behavior should be considered when selecting a cost driver Assigning Distribution Center Costs We assign the cost of this activity to this cost object: using this activity driver Manual picking Rework Unload & inspect Truckload plng Bulk storage Administration customer brand product customer product brand cartons mech picked cartons reworked pallets unloaded pounds shipped avg pallet on hand no. of cartons shipped Cost Objects Customer E 8% Others 7% Customer A 32% Customer D 10% Customer C 17% Customer B 26% • The final output of the organization • Typically a customer, product, service, or distribution channel • Provides total cost of logistics support Cost Object: Bill of Activities Line Haul 55% Delivery 6% Billing 2% Pickup 15% Scheduling 3% Breakout of Customer A Costs Dockhandling-Origin 10% Processing Claims Dockhandling- 1% Destination 8% Product Division D 13% Product Division A 31% Product Division C 16% ABC Results Product Division B 40% Product Division D 21% Product Division A 29% Traditional Costing Results Product Division C 20% Product Division B 30% Comparison of ABC and Traditional Costing • Focus shifts from correlating unit level cost drivers (direct labor hours) to correlating cost drivers at the unit, batch, and process levels • Overhead assigned to activities based on consumption--costs assigned to products based on the consumption of the activities performed • “Fixed costs” viewed as long-term variable costs affected by short-term management decisions • Isolation of costs enables managers to trace cost reduction efforts to specific products, customers, or supply channels--benefits no longer diffused • Managers can trace the effect of decisions on product or customer profitability--ABC captures the effects of diversity • ABC provides significant amounts of non-financial information--useful for integrating cost management with performance management How ABC Can Assist Logistics Decision-makers • Can more accurately determine how changes in service requirements will affect logistics costs • Provides ability to trace indirect resources to logistics activities and outputs • Focus on high cost activities or processes • Translate logistics performance into corporate profitability • Greater visibility over logistics costs--better trade-offs within the firm • Simulate changes and impact on logistics costs Benefits Obtained From ABC 65% Identify cost driver 59% Improved cost info 47% Better pricing Performance measures 41% Elim redundant work 41% Cost control 23% LaLonde and Pohlen, Journal of Business Logistics, 1994 Terminal Insurance 13% 2% Supervision Office Labor 3% 9% ABC demonstrates how logistics resources and activities are consumed Depreciation 4% Maintenance 5% Dock Labor 32% Fuel 7% License 1% Pickup & Delivery Drivers 18% Marketing Billing Process Claims 5% 4% 4% Maintain vehicles 10% Utilities Yard Labor 5% 1% Handling 10% Pickup 6% Unload 8% Load delivery Deliver LTL 17% 6% Customer E 8% Others 7% Load line haul 6% Customer D 10% Customer A 32% Customer C 17% Customer B 26% Scheduling Line haul 3% 8% Accessorial Services 5% Deliver TL 8% Problems frequently encountered during ABC implementation • • • • • • • • Management and employee buy-in A new “system” and stand alone initiative Accuracy versus precision Delay in immediate pay-off Multiple views on cost allocations and costs Putting controller in charge Too much detail--costing vs reengineering Cost and effort required during implementation Where ABC best practices are being implemented General Analysis: Nabisco, Roundy’s, Food Lion, Tops, Coca-Cola, Pepsi-Cola, Dial Corp, Bozzotos, Kroger, Shaw’s Category Analysis: Procter & Gamble, Super Valu, Fleming, H.E. Butt Menu Pricing: Spartan, Fleming, Super Valu Application of activity-based costing to supply chain management • ABC can evaluate alternative supply chains • Activity analysis can achieve a sustainable competitive advantage by lowering costs or differentiating services • Supply chain analysis enables firms to exploit linkages and perform trade-offs across the entire supply chain • ABC/ABM provides means for assessing individual firm as well as supply chain performance Supply Chain Costing Vendor (Upstream) Total Cost of Ownership Perspective of the Firm DPP, ABC Customer (Downstream) DPP, ABC Marketplace Landed Cost Operations Physical Distribution Inventory Carrying Costs Materiels Management Physical flow costs Supplier Information costs • Determine overall effectiveness of the supply chain • Identify opportunities for improvement • Measure performance • Evaluate alternative supply chain structures • Select supply chain partners • Support “make versus buy” decisions • Negotiate prices • Evaluate effects of technology improvements • Reengineer the supply chain Transaction costs Why supply chain costing? Customer Supply Chain Costs Why use supply chain costing?: customer and channel profitability • Type of customer and distribution channel generally have greater affect on costs than product type • ABC can determine how customers/ channels drive indirect costs • Customer/channel costing provides technique for assessing profitability • Joint action between supply chain members can reduce costs Using ABC to simulate cost changes within the supply chain Process redesign Target Setting Performance measurement & benchmarking Activity Analysis Problem solving Activitybased costing Time Quality Cost Flexibility The Continuous Improvement Cycle, Paul Sharman, CMA Magazine, Vol 66, No. 4 Distribution Center Application: Activity Volume Change • Determine how anticipated shifts in activity volumes will affect distribution center costs. • Use cost per activity and activity volume to assess effect • Example: Customers order more frequently but in smaller quantities Activity volume example Activity Cost per Activity Load Whse Transfer $150/truck Load Pool Shipment 210/truck Load LTL/UPS Storage 16/shipment 18/order Process Returns 75/return $40/shipment Ship Routine $25/shipment 36/order Receive Whse Transfer -10 +300 -2,100 +300 +5,400 +300 $10,800 4,800 4/pallet Ship Priority Pick/Build Orders Change 125/pallet/year Process Orders Pull/Put Full Pallets Activity Volume 95/WT Net change to the DC: +$18,900 Using ECR scorecards to determine supply chain capabilities and costs INDICATOR LEVEL 0 LEVEL 1 LEVEL 2 LEVEL 3 LEVEL 4 Receiving Optimization Non-staged or unitized shipments manually received with drivers often expected to unload; information processed at time of delivery with no advanced preparation and poor document and load integrity Pallets staged to reduce hand unloading and improve unloading efficiency; information processed at time of delivery with no advanced preparation and limited document and load integrity Pallets staged and loaded to minimize in-transit damage; manufacturer electronically transmits information (ASNs and EDI) prior to delivery to update files, increase document integrity and allow retailer receipt preparation; some delivery exceptions Cross Dock— Custom Cubes Cross docking at retailer DC not supported by manufacturer Cross docking supported only for promotional items for largest stores and with extended order lead time Cross docking done for promotional items for most stores and with above normal lead times; beginning to support turn items Joint assessment for each order and shipment to reduce receiving time and space, using freight configuration, “tie and high” capability, and DC receiving area utilization (drop and hook used where applicable) supported by EDI and ASN transmissions that support pre-delivery activities; rare delivery exceptions Manufacturer supports cross docking of storeready pallets; minimal lead times; deliveries accompanied by ASNs Pallet and Case Labels (Barcoding) No labels supplied or supported Testing UCC/EAN-128 pallet labeling with retailer; UPC (SCC-14) bar codes available on most outgoing cases Supports UPC (SCC-14) and UCC/EAN-128 (SSC18) on outgoing cases and pallets; included on ASNs, but not used to receive via scanning; considering compliance issues Manufacturer has established cost effective freight configuration guidelines to optimize space and unload time for different load types, supports drop and hook, uses EDI and ASN transmissions; allows retailer receipt preparation (matching, label printing, etc); minimal delivery exceptions Manufacturer supports systemic cross docking for both promotional and turn items, primarily for single SKU pallets; normal lead times; deliveries accompanied by ASNs/Pallet UCC 128 Pallet and case labeling is integrated fully with ASNs to automate receiving via scanning; consistent compliance with industry standards Joint implementation of pallet and case labeling with retailer based on a complete analysis of all costs including the cost of applying labels; consistent compliance with industry standards Activity-Based Management • Use non-financial data provided by ABC to drive continuous improvement and reengineering • Link performance measurement system to changes in process costs or profitability • ABC can trace effect of management decisions to changes in total process cost or profitability The Two-Dimensional ABC Model Cost Assignment View Resources Process View Cost Drivers Activities Performance Measures Cost Objects Peter B. B. Turney, Common Cents Cost Assignment View Cost Assignment View Resources Focus of early ABC efforts Activities Cost Objects Objective - more accurate product costs for product mix, sourcing and product design decisions Process View Focus of newer ABC implementations Objective - improving operational processes by identifying (and eliminating) non-value-added activities Process View Cost Drivers Activities Performance Measures Balanced scorecard approach Financial Perspective Goals Measures How do customers see us? What must we excel at? Internal Business Perspective Goals Measures Customer Perspective Goals How do we look to shareholders? Measures Innovation and Learning Perspective Goals Measures Can we continue to improve and create value? Kaplan, Robert S., and David P. Norton, “The Balanced Scorecard - Measures That Drive Performance,” Harvard Business Review, January-February 1992, pp. 71-79. Vendor/Carrier Evaluation Use ABC to assess current carriers and vendors: • Vendor selection affects the costs of ordering, expediting, receiving, inspection, production, and distribution • ABC provides a means of more accurately tracing how vendor decisions affect total costs • Purchasing managers can use “total cost of ownership” in vendor selection and evaluation • Activity analysis opens potential for exploiting vendor-buyer linkages to reduce costs and differentiate service Key References • Turney, Peter B. B., Common Cents: The ABC Performance Breakthrough, Portland, OR: Cost Technology, 1993. • Player, Steve and David Keys, Activity-Based Management: Arthur Andersen’s Lessons from the ABM Battlefield, New York: Mastermedia Ltd., 1995 • Journal of Cost Management published by Warren, Gorham & Lamont • Brinker, Barry, editor, Emerging Practices in Cost Management: 1996 Edition, Warren, Gorham & Lamont, 31 St. James Avenue, Boston, MA 02116, (800) 950-1213 • Cokins, Gary, Activity-Based Cost Management: Making It Work, Chicago, IL: Irwing Professional Publishing, 1996