16-1

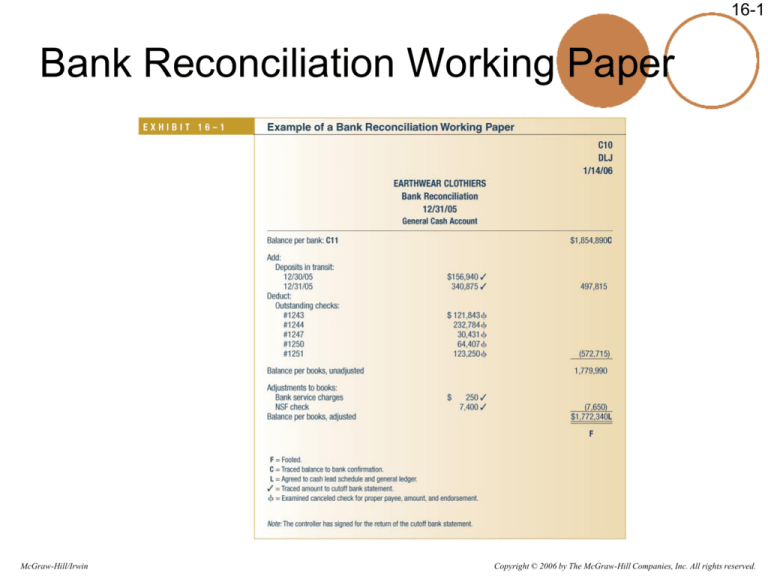

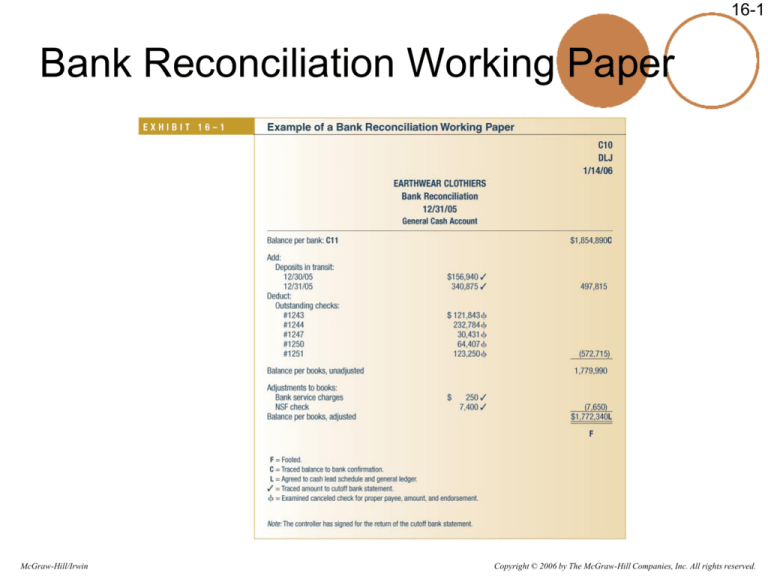

Bank Reconciliation Working Paper

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-2

Standard Bank Confirmation Form

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-3

Cutoff Bank Statement

Date of Last

Bank

Reconciliation

7 to 10

Days

A cutoff bank statement normally covers the 7- to 10-day

period after the date on which the bank account is

reconciled.

Any reconciling item should have cleared the client’s

bank account during the 7- to 10-day period.

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-4

Tests of the Bank Reconciliation

The auditor uses the following audit procedures to

test the bank reconciliation:

1. Test the mathematical accuracy and agree the balance per the books to

the general ledger.

2. Agree the bank balance on the reconciliation with the balance shown

on the standard bank confirmation.

3. Trace the deposits in transit on the bank reconciliation to the cutoff

bank statement.

4. Compare the outstanding checks on the bank reconciliation with the

canceled checks in the cutoff bank statement for proper payee, amount

and endorsement.

5. Agree any charges included on the bank statement to the bank

reconciliation.

6.McGraw-Hill/Irwin

Agree the adjusted book balance to the cash Copyright

account

© 2006 by The lead

McGraw-Hill schedule.

Companies, Inc. All rights reserved.

16-5

Fraud-Related Audit Procedures

Extended Bank

Reconciliation

Procedures

Proof of Cash

Tests for Kiting

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-6

Proof of Cash

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-7

Tests for Kiting

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-8

Auditing a Payroll or Branch Imprest

Account

The audit of any imprest cash account

such as payroll or a branch account

follows the same basic audit steps

discussed under the audit of the general

cash account.

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-9

Obtain an Understanding of Internal

Control

The auditor should obtain an understanding of each of

the five components of internal control in order to plan

the audit. This knowledge is used to:

McGraw-Hill/Irwin

Identify types of

potential

misstatements

Consider factors

that affect the risk

of material

misstatement

Design tests of

controls

Design substantive

procedures

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-10

Auditing Petty Cash

Usually not

material.

Potential for

defalcation.

Seldom perform

substantive

tests.

Document

controls.

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-11

Disclosure Issues for Cash

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-12

Disclosure Issues for Cash

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-13

Disclosure Issues for Cash

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-14

Investments

McGraw-Hill/Irwin

Common Stock

Preferred Stock

Debt Securities

Hybrid Securities

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-15

Control Risk Assessment—Investments

Occurrence

and

Authorization

Here are some of the

more important

assertions for

investments.

Completeness

Accuracy and

Classification

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-16

Segregation of Duties

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-17

Substantive Procedures for Testing

Investments

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

16-18

End of Chapter 16

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.