Identifying financial corporations

advertisement

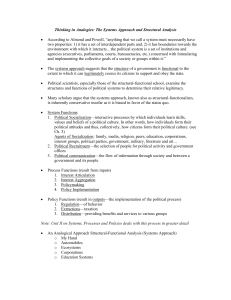

Measuring the production of financial corporations Progress Report by the OECD Task Force on Financial services (Banking Services) in National Accounts OECD Meeting of National Accounts Experts Paris, 10th of October 2002 Labour Productivity Index, 1990 - 2000 (Basis 1990 = 100) 160 150 National Economy Services (excl. Financial Intermediaries) 140 Financial Intermediaries 130 120 110 100 90 80 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 Evolution of revenues of Swiss banks, 1985-2001 Basis 1985 = 100 800 Revenues from t rading in securit ies 700 600 500 400 300 200 T ot al revenues 100 01 20 99 19 97 19 95 19 93 19 91 19 89 19 87 19 19 85 0 Recent changes on financial markets • Enhanced role of the equity and bond markets for financial corporations • New channels and institutional forms for financial services • Increasing importance of intra-sectoral transactions • Increased liquidity of assets and liabilities Identifying financial corporations Current treatment in the SNA93 Financial corporations: “… all resident corporations or quasi-corporations principally engaged in financial intermediation or in auxiliary financial activities which are closely related to financial intermediation” Identifying financial corporations Current treatment in the SNA93 Financial corporations: “… all resident corporations or quasi-corporations principally engaged in financial intermediation or in auxiliary financial activities which are closely related to financial intermediation” Identifying financial corporations Current treatment in the SNA93 Financial Intermediation: • “… productive activity in which an institutional unit incurs liabilities on its own account for the purpose of acquiring financial assets by engaging in financial transactions on the market (….)”. Identifying financial corporations Current treatment in the SNA93 Financial Intermediation: • “… productive activity in which an institutional unit incurs liabilities on its own account for the purpose of acquiring financial assets by engaging in financial transactions on the market (….)”. • Financial corporations “…. collect funds from lenders and transform, or repackage, them in ways that suit the requirement of borrowers”. Identifying financial corporations Current treatment in the SNA93 Financial Intermediation: • “… productive activity in which an institutional unit incurs liabilities on its own account for the purpose of acquiring financial assets by engaging in financial transactions on the market (….)”. • Financial corporations “…. collect funds from lenders and transform, or repackage, them in ways that suit the requirement of borrowers”. • “…. A financial intermediary does not simply act as an agent for other institutional units but places itself at risk by incurring liabilities on its own account”. Identifying financial corporations Points of analysis: • Particular emphasis is put on financial intermediation Identifying financial corporations Points of analysis: • Particular emphasis is put on financial intermediation activity. Identifying financial corporations Points of analysis: • Particular emphasis is put on financial intermediation activity. • Activity is characterised by features of “Risk-taking” and “Repackaging”. Identifying financial corporations Points of analysis: • Particular emphasis is put on financial intermediation activity. • Activity is characterised by features of “Risk-taking” and “Repackaging”. • General definition of financial intermediation - beyond the deposit and loan case characteristic of traditional banks. Identifying financial corporations Points of analysis: • Particular emphasis is put on financial intermediation activity. • Activity is characterised by features of “Risk-taking” and “Repackaging”. • General definition of financial intermediation - beyond the deposit and loan case characteristic of traditional banks. • Yet, at the same time, ambiguity about the role of “Own funds”. These do not provide any financial service. The changing nature of financial activities Risk management Risks involved in “traditional” risk management: • Extension of credit lines acceptance of counterpart risk • Taking of deposits acceptance of withdrawal risk • Mismatch of terms acceptance of interest rate risk spread over time of risks that cannot be diversified by other means The changing nature of financial activities Risk management Risks involved in “traditional” risk management: • Extension of credit lines acceptance of counterpart risk • Taking of deposits acceptance of withdrawal risk • Mismatch of terms acceptance of interest rate risk spread over time of risks that cannot be diversified by other means The changing nature of financial activities Risk management Features of “new” risk management: • Strive for financial innovations Bundling and unbundling of assets and liabilities • Risk trading and shifting risk-adverse units bear less risk than risk-friendly units spread of risks at a given point in time among units according to their risk profile The changing nature of financial activities Risk management Features of “new” risk management: • Strive for financial innovations Bundling and unbundling of assets and liabilities • Risk trading and shifting risk-adverse units bear less risk than risk-friendly units spread of risks at a given point in time among units according to their risk profile • Financial corporations are nevertheless the ultimate bearers of certain types of risks The changing nature of financial activities Liquidity transformation “Traditional” liquidity transformation: • Investors: uncertainty about time when holdings of given financial asset are modified (mainly deposits) • Borrowers: uncertainty about ability to raise funding in future (mainly credits) Deposits/loans case - Typically Balance sheets “Demand driven” The changing nature of financial activities Liquidity transformation “New” liquidity transformation: • Arbitrage and counterpart activities, underwriting facilities • Multiple interactions, short term perspective On- and off-balance sheets “Market oriented” Identifying financial corporations A working definition ... “ Financial corporations are all resident corporations or quasicorporations principally engaged in providing financial services. The production of financial services is the result of risk management, liquidity transformation and/or auxiliary financial activities”. Identifying financial corporations A working definition ... “ Financial corporations are all resident corporations or quasicorporations principally engaged in providing financial services. The production of financial services is the result of risk management, liquidity transformation and/or auxiliary financial activities”. Identifying financial corporations A working definition ... “ Financial corporations are all resident corporations or quasicorporations principally engaged in providing financial services. The production of financial services is the result of risk management, liquidity transformation and/or auxiliary financial activities”. Identifying financial corporations A working definition (continued): “ Risk management and liquidity transformation are productive activities in which an institutional unit incurs financial liabilities for the purpose of acquiring mainly financial assets. Corporations engaged in these activities obtain funds, not only by taking deposits but also by issuing bills, bonds or other securities. They use these as well as own funds to acquire mainly financial assets by making advances or loans to others but also by purchasing bills, bonds or other securities”. Identifying financial corporations A working definition (continued): “ Risk management and liquidity transformation are productive activities in which an institutional unit incurs financial liabilities for the purpose of acquiring mainly financial assets. Corporations engaged in these activities obtain funds, not only by taking deposits but also by issuing bills, bonds or other securities. They use these as well as own funds to acquire mainly financial assets by making advances or loans to others but also by purchasing bills, bonds or other securities”. Identifying financial corporations A working definition (continued): “ Risk management and liquidity transformation are productive activities in which an institutional unit incurs financial liabilities for the purpose of acquiring mainly financial assets. Corporations engaged in these activities obtain funds, not only by taking deposits but also by issuing bills, bonds or other securities. They use these as well as own funds to acquire mainly financial assets by making advances or loans to others but also by purchasing bills, bonds or other securities”. Identifying financial corporations Issues for discussion • Should financial corporations be identified via the services they provide, as suggested in the working definition? • Do “Risk management”, “Liquidity transformation” and “Auxiliary financial activities” properly capture core activities of financial corporations? • Does the group support the proposal of the task force to include own funds as a source for the provision of financial services?