Revenue & Receipts Cycle - Introduction

advertisement

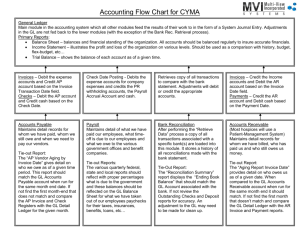

Revenue & Receipts Cycle –Internal Controls & Test of Controls REFERENCES • Internal control knowledge • International Standard on Auditing (ISA) 315 &330 “Identifying and assessing the risks of material misstatement through understanding the entity and its environment” and responding thereto – selected paragraphs LEARNING OUTCOMES Revenue & receipts system; controls readdressed (Revision) Mostly self study 1. Understand the internal control structure of the cycle including major classes of transactions and affected accounts 2. Understand and describe the cycles functional areas 3. Design a system of controls for the revenue and receipt cycle 4. Identify and explain weaknesses in the control systems and make recommendations for improvement Auditors application 1. Understand the decision tree for deciding on when to follow a “test of control” approach 2. Identify and describe the “key internal controls” on which to place reliance 3. Understand the direction of testing when performing tests on the key internal controls 4. Describe the test of control procedures 5. Understand the consequences of exceptions found during the testing of internal controls INTRODUCTION TO THE CYCLE •Classes of transactions affected: SALES and SALES RETURNS (revenue) RECEIPT transactions (movements in cash & bank balances) •Account balances affected: ACCOUNTS RECEIVABLE (Including trade debtors and allowances for doubtful debts) CASH and BANK Consider: 2.1 Variation amongst entities 2.2 Cash sales 2.3 Credit sales 2.4 Legislation BASIC FUNCTIONS IN THE CYCLE AN 10/2-10/3 Assumption: wholesale entity selling goods to customers on credit: Receiving customer orders Warehousing & Despatch of inventory Invoicing customers Credit management Receiving & recording of payments from debtors Recording sales and raising debtors Other: Sales returns & adjustments (credit notes); Granting of discounts; Write-offs of bad debt CONTROL ACTIVITIES IN THE CYCLE Categories of control activities Approval and authorisation What level of staff should approve/authorize? Segregation of duties Between execution, authorization, custody of asset, recording. Isolation of responsibility Employee acknowledges performing duty Access and custody controls (security) Protecting assets and information Comparisons and reconciliations Between what? Who performs it? INFORMATION FLOW IN THE CYCLE Functional area and Accounting entries documents/records prepared in general ledger Credit management •Credit application form None Order department •Customer order •Internal sales order None Warehouse/despatch •Picking slip •Delivery note [Inventory items removed from inventory register. G/L entries depend on periodic vs. perpetual]. INFORMATION FLOW IN THE CYCLE Functional area and Accounting entries documents/records prepared in general ledger Invoicing •Customer invoice None Recording of sales •Sales journal •Debtors ledger Debit Trade debtors Credit Sales Receiving cash •Receipt •Deposit slip •Remittance register None INFORMATION FLOW IN THE CYCLE Functional area and Accounting entries documents/records prepared in financial records \ Recording of receipts • Cash book •Debtors ledger Debit Bank Credit Trade debtors Sales returns and adjustments • Goods returned voucher (GRV) • Credit note Debit (Returns)/sales Credit Trade debtors BOOKKEEPING IN THE CYCLE •ISO •DN Sales journal General ledger INV •Remitt adv. •Bank stmt. •Dep. slip •Receipt Debtors ledger Cash book General ledger Debtors ledger Trial balance Reconciliations: Bank recon: Bank statement & GL (cash book) Debtors recon: Debtors ledger & GL debtors control a/c Financial statements OBJECTIVES OF INTERNAL CONTROLS (REVISION) Validity Completeness Accuracy A proper accounting system and related internal controls will achieve the “control objectives” of Validity, Accuracy and Completeness of financial information. •Why does management want V, A and C of financial information? •Why is an auditor interested in whether controls achieve V, A, C? AUDIT APPROACH (REVISION) Tests of Controls Performed to obtain audit evidence of: • The suitability of the design of the accounting and internal control system • The effective operation of the system throughout the period of reliance. Conclude on the Control Objectives Textbook 5/26-27 Substantive Procedures Performed to obtain evidence to detect material misstatements in the financial statements Consist of: • Tests of detail of transactions, balances and disclosures; •Analytical procedures Conclude on the Management Assertions TESTS OF CONTROLS - INTRODUCTION Tests of controls must be performed when (ISA 315, para. 08): • Risk assessment includes an expectation that controls are operating effectively • Risks identified for which substantive procedures alone do not provide sufficient appropriate evidence However, even if test of control approach followed, substantive procedures are compulsory for each material class of transactions, account balance and disclosure (ISA 330, para. 18) TESTS OF CONTROLS - NATURE Purpose of audit procedures (including tests of controls): Are the financial statements fairly presented? :: Focus is thus on the recorded financial information :: Are there controls in place that can achieve fair presentation through Validity, Accuracy and Completeness of recorded financial information? If so, perform test procedures on those controls to determine whether: there is evidence of the control having taken place; the control operated effectively as intended. TESTS OF CONTROLS - NATURE Perform tests of controls by applying the following procedures: Inquiry Observation Inspection Evidence control took place Reperformance Evidence control operated effectively Example: Manager’s signature on bank recon as evidence of review: Really reviewed? Reviewed it appropriately? Therefore, reperform to obtain evidence on operating effectiveness of the control. TESTS OF CONTROLS - NATURE Direction of testing NB When we select a sample for testing from where do we make the selection ? Validity & Accuracy: – the population is the transactions already recorded from recorded transaction to source document. i.e. journals/books of prime entry such as the sales journal to the invoice Completeness: – the population is the first record or source document of the transaction from source document to the recorded transaction i.e. delivery note to the recorded entry in the sales journal, thus Applying an incorrect direction of testing when answering a question will lead to an irrelevant/incorrect answer. TESTS OF CONTROLS - EXTENT “Extent” = “How much to test” The more reliance placed on controls, the more tests of controls to perform on those controls in order to JUSTIFY the reliance. • However, not test ALL controls (impractical and costly) • Test only KEY controls (those wish to place reliance on) • ISA 315, para. A60: “Not all … controls are relevant to the auditor’s risk assessment.” •Which controls are “KEY”? “Key” = measure of extent to which the control addresses the risk involved. TESTS OF CONTROLS - EXTENT Which controls are “KEY”? Example: consider RISK OF INCOMPLETE recording of sales transactions in sales journal: Control 1: “Invoices are pre-printed and sequentially numbered” vs. Control 2: “The senior bookkeeper reviews the sequential numbering of invoices recorded in the sales journal and follows up on missing entries”. Which is “KEY” control? Distinguish between key controls and mere supporting (indirect) controls! TESTS OF CONTROLS - TIMING “Timing” = “When to test” • Tests of control can be performed several months before year end (“interim audit”). • Advantages of this include: Time & opportunity to amend the substantive audit program (in case exceptions found and reliance not justified); Reduce time pressure during final audit. • However, the auditor needs evidence about the operation of controls throughout the year (ISA 330 para 12). • Thus also test intervening months between interim and year-end. TESTS OF CONTROLS - EXCEPTIONS Exceptions occur when a internal control procedure is: • not applied • not applied correctly and consistently • applied by an unauthorised person NOTE: An exception in a transaction of R 1 million carries the same weight as an exception in a transaction of R 1. Why? Accordingly, tests of controls are NOT value orientated! The control is tested, and not the underlying financial value. What if exceptions in internal controls are found by auditor? I.e. impact on audit approach? ANSWERING “TEST OF CONTROL” QUESTIONS IN THE CYCLE 1. Identify key control in scenario (i.e. controls you’d rely on for purpose of concluding on fair presentation of financial information) 2. Identify control objective applicable (V, A and/or C) 3. Determine direction of testing (recorded financial information to supporting doc or supporting doc to recorded financial information) 4. State selection and source of sample (e.g. sales journal / invoices) 5. Consider hierarchy of audit evidence reliability (source, nature) 6. Formulate and describe test of control procedure inquire, observe, inspect: evidence that control took place reperform: test operating effectiveness of control. [Audit verb] [Party/Process/Document] [Purpose] EXAMPLE YOU ARE REQUIRED TO: Identify internal control procedures present in the system that you would wish to place reliance on, and describe test of control procedures you would perform to obtain reliable evidence about the performance of each control identified. SYSTEM You are the senior in charge of the audit of Office Space (Pty) Ltd, a wholesale company which sells office furniture. During the planning phase of the current audit you established that the system for the processing of sales is as follows: Sales Orders Orders are received from retailers across the country. The majority of orders are faxed to the company, while some are received by phone. A sales order clerk writes out a sequentially numbered internal sales order (ISO) for both the fax and telephone orders. A second sales order clerk checks the calculations on the ISO back to the faxes received. Credit Control The sequentially numbered ISOs are, from time to time, passed to the credit controller during the day who confirms that the customer is still within his/her credit limit and authorizes the sale by signing the order. The ISOs are given back to the sales order clerk who transfers a copy of the ISO to the head of stores. Suggested solution: Office Space (Pty) Ltd Internal control procedure 1. Credit control: Credit controller assesses the credit-worthiness of each customer and authorizes each sale by signing the ISO. (Validity of sales : Authorization) Test of control 1.1. Select a sample of sales transactions recorded in sales journal, follow through to the supporting invoice and: 1.1.1 Inspect the corresponding ISO for the approval signature of the credit controller. (Note: direction of testing) 1.2. Enquire of management regarding the reliability of the credit control function. 1.3. Enquire of the credit controller regarding his function and the likelihood of fictitious/invalid orders getting past him/her. 1.4. Reperform the creditworthiness check to confirm the check was properly performed by the credit controller (operating effectiveness). Warehousing and Dispatch The head of stores, on the authority of the signed ISO, requests a store man to pick the goods from the store and authorizes the store man to transfer the goods to the dispatch clerk. The head of stores agrees the ISO to the goods actually picked, then stamps the order "filled" and signs it. The dispatch clerk prepare a sequentially pre-numbered delivery note for each order. The delivery note and the ISO are cross-referenced. The fast copy remains in the delivery note book and the two top copies are torn out and packed, with the boxed goods, into the delivery truck. Gate control personnel conduct checks on the trucks leaving the premises by checking that all goods in the truck appears on the delivery note accompanying the goods. The top copy of the delivery note is left with the customer and the second copy is signed by the customer to be returned to the invoicing section. Internal control procedure 2. Gate control Gate personnel conduct checks on goods leaving the premises. (Completeness of sales) 3. Customers are required to sign delivery notes as acknowledgement of receipt of goods. (Validity of sales : Authenticity) Test of control 2.1 Observe the checking of trucks and goods by gate control personnel. 2.2 By reperformance, select trucks leaving the premises and compare the content with the accompanying delivery note. 2.3 Enquire of management as to the reliability of the gate control and any problems which may have occurred. 2.4 Enquire of the gate control personnel regarding their function to ensure they understand what is expected of them. 3.1 For the sample of sales invoices selected in 1.1 above: agree by inspection of the invoice the corresponding customer signed delivery note to confirm evidence of the customer ‘s acknowledgement of receipt. (Note: direction of testing) Invoicing On the basis of the information on the delivery note and an authorized price list, an invoicing clerk prepares a sequentially pre-numbered invoice. The invoice and the delivery note are cross referenced. The details and casts and extensions on the invoice are checked by the invoicing supervisor who signs the fast copy as evidence of this check. The top copy is then mailed to the customer. Recording of Sales The fast copy of the invoice is recorded, in number order, in the sales journal by the accounts receivable clerk. On a daily basis, the senior bookkeeper checks each sales entry in the sales journal by comparing the recorded amount to the invoiced amount. He ticks the entry as evidence of performing the check. The delivery note is then filed with a copy of the invoice in number order and the sequence thereof is checked by the invoicing supervisor to ensure all delivery notes have been invoiced. He signs completed batches as evidence of the check. 4. Internal control procedure Test of control Invoicing 4 For the sample of sales invoices selected in 1.1 The senior bookkeeper above: agrees the amounts 4.1 Inspect the entry in the sales journal for recorded in the sales evidence of the senior bookkeeper’s tick journal with the amounts evidencing his check on the recorded amount. on the invoices and ticks each entry in the sales 4.2 Follow the entry through to the invoice and journal as evidence of inspect the invoice for the signature of the performing the check. invoice supervisor indicating her check on mathematical accuracy. The details and casts and extensions on the invoice By reperformance, test the operating effectiveness are checked by the of the controls as follows: invoicing supervisor who signs the fast copy as 4.3 the quantity from the delivery notes have been evidence of this check. correctly carried across to the invoice; 4.4 the prices on the invoices are in accordance with (Accuracy of revenue) the authorized price list; 4.5 each invoiced amount has been correctly recorded in the sales journal; 4.6 casts and extensions are correct on invoice and in the sales journal. Internal control procedure 5. Invoicing: The delivery note is filed in number order with the invoice and the sequence thereof is checked by the invoicing supervisor, who signs completed batches as evidence of the check. (Completeness of revenue) Test of control 5.1 Inspect the batches of the delivery notes in the invoicing section for signature of the invoicing supervisor indicating the sequence check for completeness of invoiced delivery notes. 5.2 Reperform the sequence check on delivery notes. Select a sample of delivery notes and, using the cross-referencing, inspect the corresponding fast copy invoice, and trace the invoice to the sales journal. (Note: direction of testing) END Thank you! Dankie! Enkosi Kakhulu!! ANSWER TECHNIQUE When answering “weakness” questions, remember the following: Read the scenario and the ‘required’ very carefully! Know the difference between ‘identify’, ‘explain’ and ‘recommend’. ‘Weakness’ should be in detail and must be relevant to the scenario and required. ‘Explanation’ should explain “what can go wrong/what are the risks involved”. Recommendation must be in detail : specify the actual control procedure and not simply the control objective: e.g. “All sales should be recorded” (control objective) vs. “Sequential numbering of recorded invoices in the sales journal should be reviewed by Mr A Countant on a regular basis for missing numbers (control procedure) ANSWER TECHNIQUE (CONTINUED) The following is not acceptable when answering weakness questions: Stating the control activity category as a weakness (e.g. “No division of duties”) rather than the control weakness in the activity itself (e.g. “Person receiving orders from customers also ships inventory items to customers”). Making vague references to responsibility levels, e.g. stating a control procedure should be performed by a “second clerk” or “a senior staff member” if the scenario clearly indicates the titles of the positions in the entity and the staff members’ names. (e.g. “financial accountant”/Mr A Countant). Making assumptions that are not relevant to the scenario or the type of business. Allocating tasks to incorrect levels of authority, e.g. “financial manager should perform the bank reconciliation” while there clearly is a bookkeeping clerk available to do so. Clerks are the staff performing most functions and executing most controls! Senior staff and management approve, authorize and review etc.