H1 2014/15 - Tricorn Group plc

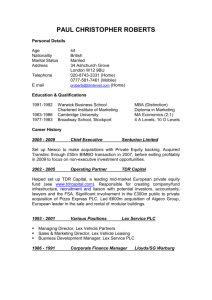

advertisement

Tricorn Group Plc Interim Results Presentation 2 December 2014 Introduction • • • • Bespoke tubular solutions to major global blue chip OEMs Operating in niche markets with low batch sizes and high variety High proportion of recurring revenue Focus on creating value Transportation Energy Key markets: On and off highway, including construction, trucks and agriculture Key markets: Power generation, marine, oil & gas, mining 2 Meeting our customers’ needs wherever they operate MTC, UK JV Minguang-Tricorn Tubular Products, Nanjing, China Maxpower, UK Maxpower Wuxi, China FTP Franklin, USA Highlights-Interim Results • • • • • • • Uniquely positioned with global manufacturing platform Revenue up 7.9% on six months ended 31 March 2014 Further growth in China Disposal of aerospace business for £1.064m in cash enabling Group to focus on its core markets Net debt reduced by 12.5% from year end position Cash and cash equivalents at £1.028m After period end, appointment of Non-Exec Chairman with over 30 years experience in international engineering groups 4 Financial review H1 2015 £’000 Restated H1 2014 £’000 H1 2015 v H1 2014 Restated H2 2014 £’000 H1 2015 v H1 2014 10,630 11,366 (736) 9,856 774 11 367 (356) (426) 437 (70) 335 (405) (528) (458) (0.21)p 0.61p (0.82)p (1.36)p 1.15p Capex/Dep’n ratio 0.42 1.31 n/a 0.54 n/a Cash and equiv 1,028 862 166 1,284 (256) (2,963) (3,641) 678 (3,386) 423 Revenue Operating profit/(loss) (Loss)/Profit before tax Adjusted (LPS)/EPSbasic Net (debt) All references to operating loss/profit, operating margin, loss/profit before tax and EPS are before China start up costs, restructuring costs, intangible asset amortisation, share based payment charges and foreign exchange derivative valuation. Comparative results for continuing operations have been restated to exclude the RMDG Aerospace and the Redman Fittings businesses as these were discontinued during the periods ended 30 September 2014 and 30 September 2013 respectively. 5 Financial review-change in net funds £000’s March 2014 Net Debt Operating profit (Excl JV) Dep’n Sale of business Finance charges China investment Capital expenditure Working Capital (90) Sept 2014 Net Debt (2,963) (230) (3,386) 934 (127) (405) 304 Gearing 45.4% 37 Gearing 49.5% 6 Financial review-net debt • Group net debt is £2.963m down from £3.641m at 30 September 2013 and £3.386m at 31 March 2014 • Resultant gearing is at 45.4% (H1 2014: 48.3%, FY 2014: 49.5%) • Following the final injection of registered capital into China in September 2014, Group investments in existing businesses in H1 are significantly lower than in previous years • The Group continues to use short term borrowing facilities and lease finance arrangements for its cashflow needs • The Group does not have any long term debt in place 7 Business Performance-Energy £’000 • • • • • Benefitting from Revenue restructuring implemented last year PBT Delivering an improved operational performance Responding well to increases in demand Revenue up 11.2% on previous period Significant improvement in segmental profit 8 H1 2014/15 H2 2013/14 H1 2013/14 3,730 3,355 3,578 281 (221) 194 Business Performance-Transportation UK • Business benefitting from improved demand through the period £’000 H1 2014/15 H2 H1 2013/14 2013/14 Sales 6,900 6,501 7,788 PBT (310) (178) 199 China USA • • Revenues broadly flat on previous period • Operational performance fell short of expected levels • New management team has made an encouraging start • • WOFE continues to see revenue grow Busy with managing in load of new work Joint venture integrating well into the Group 9 Outlook • Strategic investments in the USA and China position the Group uniquely in its target sectors • Provides the platform for accelerated growth – New business with existing customers – As market conditions improve • Business in China continues to expand • The new management team in the USA has made an encouraging start in creating a solid platform from which the business can develop • Market conditions expected to remain challenging for the balance of the current year • Revenue expected to be slightly lower in H2 compared to H1 • Adjusted LBT in H2 is expected to be slightly higher than the first half 10 Appendix Tricorn shareholders Major shareholders:% R Allsop 33.5% Hargreave Hale 18.4% W B Nominees 4.1% Rock Nominees 4.1% Quilter Nominees 3.1% 12 Shareholder Analysis 35% 23% 42% Institutions Private shareholders Directors Board of Directors Andrew Moss Non-Executive Chairman Appointed as Non-Executive Director in November 2014 and Non-Executive Chairman from December 2014. Member of the Audit, Remuneration and Nomination Committee. He has over 30 years' experience in international engineering Groups specialising in aviation, automotive and power electronics products, and advanced composite materials. He spent 13 years with Umeco Plc, five years of which was spent as a main board Director, resulting in his appointment as Chief Executive in 2011. Prior to this he was with BTR/Invensys Plc managing a number of international manufacturing businesses. Mike Welburn - Chief Executive Joined Tricorn in April 2003,appointed to the Board in March 2004 and as Chief Executive in November 2007. He had previously been with IMI plc for 18 years where he had held a number of senior roles within the Fluid Power Division. This included responsibility for European Operations and Global OEM Strategy. Phil Lee - Group Finance Director Joined Tricorn in January 2009 and appointed to the Board in February 2009. He had previously been at Rolls-Royce for 9 years working in a number of roles including Finance Director of Distributed Generation Systems (part of the Rolls-Royce Energy Business). Prior to Rolls-Royce he had been with National Grid Plc. David Leakey - Group Sales Director Joined Tricorn and appointed to the Board in June 2011. He had previously spent 27 years working at Norgren Ltd, the Motion and Fluid Controls division of IMI Plc. He has most recently held the role of Global Sales Director in the Energy Sector, with responsibility for the global business development of the company’s products into the oil and gas markets. David has also held the position of Sales Director in Norgren’s Life Sciences and Automotive Sectors. Roger Allsop - Non Executive Director Purchased MTC in 1984 and Chief Executive of Tricorn up to 2002 after which he became a non-executive Director. Chairman of the Audit and Remuneration Committees and a member of the Nomination Committee. He was previously managing Director of Westwood Dawes plc and non-executive Director of Netcall plc. Nick Paul CBE - Non Executive Director Appointed to the Board as non-executive Chairman in October 2001 and has held that position until the end of November 2014 following his decision to step down as Chairman. He has announced his intention to retire from the Board at the end of March 2015. Member of the Remuneration and Audit Committees, and Chairman of the Nomination Committee. He is currently Chairman of Severn Valley Railway (Holdings) plc. 13