Presentation

advertisement

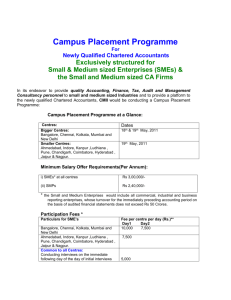

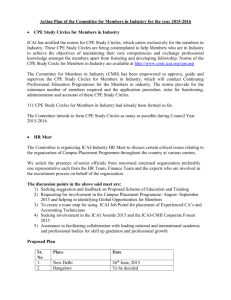

The Institute of Chartered Accountants of India Established by an Act of Indian Parliament “The Chartered Accountants Act, 1949” Our Mission The Indian Accountancy Profession will be the Valued Trustee of World Class Financial competencies,Good Governance and Competitiveness Profile of ICAI • Was set up in 1949 under the Chartered Accountants Act, 1949 even before adoption of Constitution of India in 1950 Since then Profession has grown leaps and bounds in terms of Membership and Student base Profession in India • 150K Members spread throughout the country and in different parts of the world • Sizeable studentship base • Increase in percentage of members joining industry • Chartered Accountants are rendering services in every walk of economic life - Politics, Judiciary, Government, Agriculture, Corporate, NGOs • Profession is dominated by small firms • Increasing trends towards consolidation • Government of India looks at ICAI as Partner in Nation Building • Technical Standards based on International Standards • Focus on Capacity Building in the emerging context Size of Firms • • • • Vast majority SMPs with SME clients Cost and time vis-a-vis detailed requirements of Standards We do not believe in separate auditing Standards for audit of SMEs alternative between “audit” and “review” likely to create confusion, not much value addition seen w.r.t clients as well as costs and risks involved vis-a-vis remuneration Size of Indian Accountancy Firms 27 sole proprietor 2-5 partners 6-10 partners 11-15 partners 16-20 partners 102 989 12635 31950 ICAI Profile Particulars No. ORGANIZATIONAL Regional Offices Branches Chapters Abroad 5 118 21 SPECIAL PURPOSE OUTFITS CPE Study Circle 131 CPE Chapters 43 Reference Libraries 33 Accredited Institutions MEMBERSHIP (‘000) % in Practice STUDENTS (‘000) 273 150 53% 520 Role of ICAI • • • • • • • • • • • • To regulate the profession of Accountancy Education & Examination of Chartered Accountancy Exercise Disciplinary Jurisdiction Input on Policy matters to Government Ensuring Standards of performance of Members Formulation of Accounting Standards Prescription of Engagement and Quality Control Standards Laying down Ethical Standards Continuing Professional Education Financial Report Review Monitoring Quality through Peer Review Conducting Post Qualification Courses ICAI Network New Delhi Kanpur Calcutta Mumbai Chennai Decentralized Offices Chapters Abroad • Abu Dhabi • Bahrain • Botswana • Doha • Dubai • Indonesia • Jeddah • Kuwait • London • Melbourne • Muscat • Nairobi (Kenya) • New York • Nigeria • Port Moresby (Papua New Guinea) • Riyadh • Saudi Arabia (Eastern province) • Singapore • Sydney • Toronto • Zambia Council Committees Standing Non-Standing The Central Council • Consisting of 40 Members – 32 Elected Members – 8 Nominated by Central Government • Term: Three years • Headed by President – Elected by the Council for one year term • Empowered to frame Regulations under the Act and to constitute necessary standing and non-standing Committees Standing Committees Executive Committee Finance Committee Examination Committee Disciplinary Committee (Section 21D) Key Non-Standing Committees Accounting Standards Board Auditing & Assurance Standards Board Committee on Insurance & Pension Committee on Accounting Standards for Local Bodies Committee on Economic and Commercial Laws Expert Advisory Committee Research Committee Board of Studies Editorial Board Corporate Laws Committee Committee on Information Technology Committee on Trade Laws & WTO Committee on Corporate Governance Ethical Standards Board Comm. On Fin. Markets & Investors’ Protection Key Non-Standing Committees - 2 Board of Discipline (Sec.21 A) Peer Review Board Capacity Building Committee Perspective Planning Committee Committee for Members in Industry Audit Committee Internal Audit Standards Board Vision Committee ICAI-ICWAIICSI Committee Committee on Government Accounting Management Accounting Committee Public Finance Committee Diamond Jubilee Committee Committee on International Taxation Financial Reporting Review Board Key Non-Standing Committees - 2 HR & Admin Direct Tax Committee Representation Committee Indirect tax Committee Infrastructure Committee Professional Development Committee Committee for Small & Medium Practitioners Continuing Professional Education Committee High Powered Committee International Affairs Committee Disciplinary Committee (Sec.21B) The Institute is responsive to the emerging challenges and constitutes new committees for effectively meeting these challenges Research Unit: ICAI-Accounting Research Foundation Organization Structure . PRESIDENT VICE-PRESIDENT SECRETARY TO THE COUNCIL (Secretary to the Institute) DEPARTMENTS COMMITTEES Administration Examination Disciplinary M&SS A/C. & Finance HRD, P & A Council International Affairs Technical Directorate Board of Studies CPE Directorate Institute Functions Professional Development Regulatory Advisory ICAI – A Key National Body Offers inputs to • Comptroller & Auditor General of India • Ministry of Company Affairs, Govt. of India • Reserve Bank of India • Securities and Exchange Board of India • Central Board of Direct Taxes • Insurance Regulatory and Development Authority • Departments of Central and State Governments • Departments of Public Enterprises Important Initiative Undertaken to Align with Changing Economic Order • Convergence with International Standards of Accounting and Auditing • Review and Revision of Education and training curriculum • Launch of Post Qualification Courses Capacity building of firms • Mandatory CPE Requirement • Peer Review Mechanism • Financial Report Review • Brand building – Nationally and Internationally • Focused approach on issues relating to Corp. Governance. • Facilitating changes in regulatory frames. • Vigorous pursuance of Mutual Recognition Agreements. • Arrangement with Universities for graduation qualification to CA students • Facilitating accounting reforms in various areas Examples of Involvement of ICAI in National Organizations • Drafting of Income Tax Laws • Drafting of Competition Law • Drafting of Company Law • Capital Market – Development and Regulation • Corporate Governance • Accounting & Utilization of Governmental resources • WTO & GATS • Import – Export Policy • Commercial and Economic Legislations • Non Banking Financial Companies Education and Training • Distant Mode of Education • Education Through Accredited Institutions and Branches • Meets the requirements of international educational pronouncements of IFAC • Comprehensive theoretical and practical curriculum • Continuous review of the curriculum Highlight of the New Scheme of Education & Training I Common Proficiency Test – Compulsory II 3½ years of Practical Training concurrent with components of Professional Competence Examination (PCE) and Final – Complete 100 hours of Compulsory Computer Training before appearing for PCE. – Undergo General Management & Communication Skills (GMCS) after 18 months of practical training and completion of PCE – Eligible to appear for Final Examination on completion of 3 ½ years and passing of PCE Highlights of the New Syllabus Financial Reporting – Corporate Financial Reporting – IFRS based Financial Reporting – US GAAP based Financial Reporting Strategic Management – Study of Business Environment – Understanding Strategic Planning and Analysis – Ability to understand and formulate Functional Strategies Financial Management Advanced Management Accounting Information Technology and Systems Control Business Ethics Examination • One of the largest Accounting examination networks • Administrative conduct of examination and exam related process largely computerized • Exams are held twice a year • Examination system considered to be of high standard & integrity worldwide • Has been lending expertise to accounting bodies in other countries Accounting Standards Convergence with IFRSs • ICAI has decided to converge with IFRSs from accounting periods commencing on or after 1st Aril 2011 for listed entities and other public interests entities such as banks, insurance companies and large-sized entities • For smooth transition to the IFRSs, ICAI will take up the matter of Convergence with NACAS, and various regulators such as the RBI, SEBI and IRDA. • ICAI would also formulate its work-plan to ensure that IFRSs are effectively adopted from 1st April 2011. • IFRSs-specific training programs will be organized for its members and others concerned to prepare them to implement IFRSs. • IASB has also offered to help the ICAI in its endeavors towards Convergence with IFRSs in India Convergence with IFRSs in India • Recognizing the need for convergence in India, Council of ICAI decided to converge with IFRSs from accounting periods starting from 1st April 2011 for: – for public interest entities including listed entities, banks, insurance entities and other large sized entities, – subject to its confirmation by government and other legal and regulatory authorities Strategy for Implementing Convergence with IFRSs in India For Implementing Convergence with IFRSs from 1st April 2011, ICAI has identified following issues to be resolved: • Cooperation from Legal and Regulatory Authorities • Level of preparedness of Industry • Education and Training of auditors and prepares of Financial Statements • Work Plan of ASB for smooth transition to IFRSs • Conceptual Issues with IFRSs Constitution of the Group on Implementation of Convergence For resolving various issues, ASB of ICAI has Constituted Group on Implementation of Convergence with IFRSs, which constituted following subgroups: • Sub-Group for preparing the Work Plan of ASB and liaising with the IASB • Sub-Group for approaching the Government and Regulatory Authorities • Sub-Group for liaising with the Industry Associations • Sub-Group on Education and Training on IFRSs Engagement & Quality Control Standards On the Road to Convergence • AASB founder member of IFAC • Auditing standards based to the extent possible on corresponding International Standards (IS) of International Auditing and Assurance Standards Board (IAASB) - 35 Auditing Standards till 2006 • Chalked out timeline for bridging gap in convergence with IS under IAASB Clarity Project • Hopes to achieve full convergence by December 2010. Engagement & Quality Control Standards • AASB’s response to IAASB Clarity Project (2006 till date): – Revised & more rigorous Due Process – Revised Framework & Preface – AASs renamed & renumbered in line with IAASB terminology – ENGAGEMENT STANDARDS: • Standards on Auditing • Standards on Review Engagements • Standards on Assurance Engagements • Standards on Related Services – Mother Standard on Quality Control – Revised/ new Standards on Fraud, Audit Planning & Risk-based Audits – Many new/ revised Standards in pipeline Engagement & Quality Control Standards • 32 Guidance Notes on Auditing issues • 04 Industry specific Guidance Notes: * Banking * General Insurance * Stockbrokers * Life Insurance • Milestones – AAS 12, Responsibility of Joint Auditors – Statement on the Companies (Auditor’s Report) Order, 2003 – Study on Money Laundering – Implementation Guide to Quality Control Standard – Guide to Audit of SMEs – Backgrounder on Auditing Standards – Implementation Guide on Risk-based Audit (in the pipeline) – Study on Basel II – Technical Guide on E-commerce – Implications for Auditors Research and CPE • Commitment to advancement of knowledge in accountancy, auditing, taxation and allied areas • Published about 150 Publications • Expert Opinions on Applicability of Standards • 20 Compendiums over 1000 opinions • More than 50 CPE materials published • 3000 CPE programs held annually • ICAI-ARF to promote research on contemporary issues • Publishes a monthly journal with more than 175,000 circulation Professional Ethics • Cardinal Principles – Service before self – Extends beyond the legal requirements • Some major highlights • Prohibition on other occupations • Prohibition on solicitation • Prohibition on advertisement and Canvassing • Prohibition on financial interest in auditee company • Restriction on number of audits • Limit on fees for non-audit assignments • Prohibition on writing Books of Accounts of Auditee company • Demarcation between External and Internal Auditors • Professional fees for audit and other services received by a firm not to exceed 40% of the gross annual fees of the firm Professional Development • Identifying Role of Profession in emerging areas • Developing Practice Areas • Upgrading and updating the knowledge and skill sets • Developing technical material to facilitate practice in new areas • Considered as critical in the changed Scenario Quality Control Initiative – Peer Review • Peer Review Board of established in March 2002 • Focus on: – Technical Standards compliance – Quality of Reporting – Office Systems and Procedures (attestation services only) – Staff training Programmes (attestation services only) • 3378 Strong panel of Reviewers maintained • 2430 Reviewers have undergone training • 1231 Practice units have been issue Peer Review Certificates • The Council of the Institute accepted the request of SEBI that audit of listed companies shall be carried out by the auditors who have undergone Peer Review Process Quality Review Board • Central Government has constituted Quality Review Board consisting of 11 persons. • Council of ICAI has nominated 5 members on QRB • Chairman and other 5 members have been appointed by Central Government • All services provided by members (Both attestation and non attestation will be subject to Quality Review) • Disciplinary action if there is a deficiency in service Peer Review • Peer Review Board established in March 2002 • Reviews by Board to ensure – compliance with technical standards; and – existence, compliance and adherence to quality control – policies and procedures • Findings would not have any relationship with the disciplinary proceedings Financial Reporting Review • Financial Reporting Review Board constituted in 2002 to review general purpose financial statements of certain enterprises • Board’s findings would form basis for : – initiating action against auditor concerned; and – informing irregularity to relevant regulatory authority • Board seeks general purpose financial statements of top 500 companies in India on yearly basis Code of Ethics PARTICULARS ICAI CODE IFAC CODE (a) Approach Rule based. Principle based (b) Framework Based on legal framework as per CA Act, 1949. Conceptual framework based on general principles. (c) Authority Authority founded in specific Statute. It suggests basic principles in modular form along with examples without any statutory authority. (d ) Enforceability Inbuilt mechanism for its enforcement is in place. Professional Accountants to see enforceability themselves. New Initiatives- Education & Training • Launch of new course for Accounting Technicians & IPCC • Introduction of concept E-Learning • Launch of Virtual Institute Project providing e-services to members and students • Recast of professional curriculum • Lectures through Gyan Darshan Channel for CPT & PCC Students • Three Months Residential Course for improving General Management & Communication Skills • Establishment of more than 100 computer labs to impart ITT Training all over India • Grant of status of approved research supervisors by the Guru Govind Singh Indraprastha University • Establishment of CA Student Benevolent Fund • Setting of Centre of Excellence for CA Students • MOU with Bharathiar University & Guru Jambheshwar University Of Science And Technology (GJUS&T) New Initiatives- Profession and Standards • Convergence to IFRS- By April 2011 • Convergence to Clarity Project • Cap on fee for rendering services other than audit • Disciplinary mechanism framework • Focus on bridging the expectation gap International Presence • ICAI is founder member of IFAC, CAPA, SAFA and IIN • ICAI represented in : – IFAC - Board, Education Standards Board, SMP Committee, Developing Nations Committee, International Public Sector Accounting Standards Board, Professional Accountants in Business Committee – CAPA – President & Board member – ICAI holds Permanent Secretariat, SAFA – SAFA - Chairmen and member of various Committees and Working Groups International Initiatives • Opening up of new Chapters abroad- Oman, New York & Singapore. • MRAs with Foreign Accountancy Bodies like ICAEW & CPA Australia. • MOU with College of Banking and Financial Studies, Oman – For institutionalization of accounting profession in Oman. • MOU with Center of Excellence for Applied Research and Training (CERT), Dubai- To conceptualize and devise an international curriculum in accountancy integrating local needs keeping in mind various requirements of different levels of accountancy and audit professionals. • Technical assistance programme to CPA Mongolia and University of Djibouti ongoing. • Implementation of Guidelines for Article Training Abroad. International Initiatives Contd. • ICAI being consulted by IAASB in Audit Standards Setting and by IASB in IFRS setting • Playing a lead role in the area of Developing Nations, SMPs and SMEs, International Public Sector Accounting Standards, International Education Standards • SAFA adopted ICAI curriculum as model • Student exchange programs held with ICAB, ICAP, ICAN and ICASL • Opened an Office in Dubai • Initiatives for recognition of ICAI qualification by accounting bodies in other countries ICAI - Virtual Institute • ‘Virtual Institute’ integrates all the regions and offices to present a unified view of the operations of the entire Institute through a single integrated enterprise system • It FULFILLS the members and students right to convenience, comfort and make the benefits of Information Technology (IT) available to the members and students for rendering the Institute services online anywhere-anytime • With this all operational functions of the institute have been brought onto a common intranet with seamless flow and availability of information • Towards Tomorrow Today – ICAI started IT initiative towards a bright future and is in it today • ICAI Portal is effectively used to make a repository of information and knowledge accessible to the members, students and employees at the click of a button. • The portal brings dynamic features to the content. It functions as a Global Gateway to ICAI. The portal’ provides a single interface to users for accessing Institute’s services taking into consideration security requirements. The Institute of Chartered Accountants of India [Set up by an Act of Parliament] “ICAI Bhawan”, Indraprastha Marg, New Delhi – 110 002. Phone: 91-11-39893989, 30110210 Website: www.icai.org