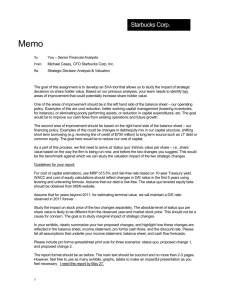

cash flow to the firm - هيئة الأوراق المالية والسلع

advertisement

أسباب االختالف في تقييمات الشركات أ.د .أسامة الخزعلي kazali@aus.edu الجامعة االمريكية فى الشارقة مقدمة الى هـيـئ ـة األوراق الـمال ـيـة والسـلع 1 Disclaimer • The information reported and discussed in this presentation do not represent the views or the opinions of the Securities and Commodities Authority (SCA) nor the American University of Sharjah (AUS. They represent my own views based on information that are publically available in books or newspapers. SCA or AUS are not responsible for the content of this seminar. 2 Seminar's Outline 1. Introduction: 2. What Purpose Does a Valuation Serve? 3. Main Valuation Methods 4. The Most Common Errors in Valuation 3 Introduction What is The Goal of the Financial Management? To Maximize the current value per share of the existing stock (maximizing the value of the firm) 4 Introduction How can we maximize the value of the firm? By 1. Finding the right investment 2. Finding the right source of Financing 3. Minimizing risk 5 Introduction Some important questions that need to be answered by you – What long-term investments should the firm take on? – Where will we get the long-term financing to pay for the investment? – How will we manage the everyday financial activities of the firm? 6 Introduction What is Valuation • Valuation is the process of estimating the potential market value of a financial asset or liability. Valuations can be done on assets (for example, investments in marketable securities such as stocks, options, business enterprises, or intangible assets such as patents and trademarks) or on liabilities (e.g., Bonds issued by a company). Valuations are required in many contexts including investment analysis, capital budgeting, merger and acquisition transactions, financial reporting, taxable events to determine the proper tax liability, and in litigation. 7 Introduction Steps of Valuation 1. Historic and strategic analysis of the company and the industry 2. Projections of future cash flows 3. Determination of the cost (required return) of capital 4. Net present value of future flows 5. Interpretation of the results 8 The Purpose of Valuation WHY? 9 1. In company buying and selling operations: For the buyer, the valuation will tell him the highest price he should pay. For the seller, the valuation will tell him the lowest price at which he should be prepared to sell. 10 2. Valuations for listed companies: The valuation is used to compare the value obtained with the share’s price on the stock market and to decide whether to sell, buy or hold shares. The valuation of several companies is used to decide the security that the portfolio should concentrate on: those that seem to it to be undervalues by the market. The valuation of several companies is also used to make comparisons between companies. 11 3. Public offerings: The valuation is used to justify the price at which the shares are offered to the public 4. Inheritances and wills: The valuation is used to compare the shares’ value with that of other assets. 12 5. Compensation schemes based on value creation: The valuation of a company or business unit is fundamental for quantifying the value creation attributable to the executives being assessed. 6. Identification of value drivers: The valuation of a company or business unit is fundamental for identifying and stratifying the main value drivers. 13 7. Strategic decisions on the company’s continued existence: The valuation of a company or a business unit is a prior step in the decision to continue in the business, sell, merge, milk, grow or buy other companies. 8. Strategic planning: The valuation of the company and the different business units is fundamental for deciding what products/business lines/countries/customers… to maintain, grow or abandon. The valuation provides a means for measuring the impact of the company’s possible policies and strategies on value creation and destruction. 14 Main Valuation Methods Discounted Cash Flow Income Statement Balance Sheet Mixed (Goodwill) Value Creation Options Free Cash flow PER Book value Classic EVA Black and Scholes Equity cash flow P/Sales Adjusted book value Indirect Method Economic profit Investment options Dividends P/EBIT Liquidation value Direct Method Expand the project Capital cash flow P/EBITDA Substantial value Annual Profit Purchase Method Delay the investment APV Other multiples 15 Discounted Cash flow Value of asset = CF1 CF2 CF3 CF4 CFn ..... (1 + r)1 (1 + r) 2 (1 + r) 3 (1 + r) 4 (1 + r) n where CFt is the expected cash flow in period t, r is the discount rate appropriate given the riskiness of the cash flow and n is the life of the asset. Proposition 1: For an asset to have value, the expected cash flows have to be positive some time over the life of the asset. Proposition 2: Assets that generate cash flows early in their life will be worth more than assets that generate cash flows later; the latter may however have greater growth and higher cash flows to compensate. 16 Discounted Cash flow • Inputs needed for DCF 1. Expected Cash flows 2. Discount Rate 3. Terminal Value 17 Generic DCF Valuation Model DISCOUNTED CASHFLOW VALUATION Expected Growth Firm: Growth in Operating Earnings Equity: Growth in Net Income/EPS Cash flows Firm: Pre-debt cash flow Equity: After debt cash flows Firm is in stable growth: Grows at constant rate forever Terminal Value Value Firm: Value of Firm CF1 CF2 CF3 CF4 CF5 CFn ......... Forever Equity: Value of Equity Length of Period of High Growth Discount Rate Firm:Cost of Capital Equity: Cost of Equity 18 VALUING A FIRM Cashflow to Firm EBIT (1-t) - (Cap Ex - Depr) - Change in WC = FCFF Value of Operating Assets + Cash & Non-op Assets = Value of Firm - Value of Debt = Value of Equity Firm is in stable growth: Grows at constant rate forever Terminal Value= FCFF n+1 /(r-gn) FCFF1 FCFF2 FCFF3 FCFF4 FCFF5 FCFFn ......... Forever Discount at WACC= Cost of Equity (Equity/(Debt + Equity)) + Cost of Debt (Debt/(Debt+ Equity)) Cost of Equity Riskfree Rate : - No default risk - No reinvestment risk - In same currency and in same terms (real or nominal as cash flows Expected Growth Reinvestment Rate * Return on Capital + Cost of Debt (Riskfree Rate + Default Spread) (1-t) Beta - Measures market risk Type of Business Operating Leverage X Weights Based on Market Value Risk Premium - Premium for average risk investment Financial Leverage Base Equity Premium Country Risk Premium 19 EQUITY VALUATION WITH FCFE Financing Weights Debt Ratio = DR Cashflow to Equity Net Income - (Cap Ex - Depr) (1- DR) - Change in WC (!-DR) = FCFE Value of Equity FCFE1 Expected Growth Retention Ratio * Return on Equity FCFE2 FCFE3 Firm is in stable growth: Grows at constant rate forever Terminal Value= FCFE n+1 /(ke-gn) FCFE5 FCFEn ......... Forever FCFE4 Discount at Cost of Equity Cost of Equity Riskfree Rate : - No default risk - No reinvestment risk - In same currency and in same terms (real or nominal as cash flows + Beta - Measures market risk Type of Business Operating Leverage X Risk Premium - Premium for average risk investment Financial Leverage Base Equity Premium Country Risk Premium 20 EQUITY VALUATION WITH DIVIDENDS Dividends Net Income * Payout Ratio = Dividends Value of Equity Dividend 1 Expected Growth Retention Ratio * Return on Equity Firm is in stable growth: Grows at constant rate forever Terminal Value= Dividend n+1 /(ke-gn) Dividend 5 Dividend n ......... Forever Dividend 2 Dividend 3 Dividend 4 Discount at Cost of Equity Cost of Equity Riskfree Rate : - No default risk - No reinvestment risk - In same currency and in same terms (real or nominal as cash flows + Beta - Measures market risk Type of Business Operating Leverage X Risk Premium - Premium for average risk investment Financial Leverage Base Equity Premium Country Risk Premium 21 First Principle of Valuation • Never mix and match cash flows and discount rates. • The key error to avoid is mismatching cashflows and discount rates, since discounting cashflows to equity at the weighted average cost of capital will lead to an upwardly biased estimate of the value of equity, while discounting cashflows to the firm at the cost of equity will yield a downward biased estimate of the value of the firm. 22 Cash Flows and Discount Rates • Assume that you are analyzing a company with the following cashflows for the next five years. Year CF to Equity Interest Exp (1-tax rate) CF to Firm 1 $ 50 $ 40 $ 90 2 $ 60 $ 40 $ 100 3 $ 68 $ 40 $ 108 4 $ 76.2 $ 40 $ 116.2 5 $ 83.49 $ 40 $ 123.49 Terminal Value$ 1603.0 $ 2363.008 • Assume also that the cost of equity is 13.625% and the firm can borrow long term at 10%. (The tax rate for the firm is 50%.) • The current market value of equity is $1,073 and the value of debt outstanding is $800. 23 Equity versus Firm Valuation Method 1: Discount CF to Equity at Cost of Equity to get value of equity – Cost of Equity = 13.625% – Value of Equity = 50/1.13625 + 60/1.136252 + 68/1.136253 + 76.2/1.136254 + (83.49+1603)/1.136255 = $1073 Method 2: Discount CF to Firm at Cost of Capital to get value of firm Cost of Debt = Pre-tax rate (1- tax rate) = 10% (1-.5) = 5% WACC = 13.625% (1073/1873) + 5% (800/1873) = 9.94% PV of Firm = 90/1.0994 + 100/1.09942 + 108/1.09943 + 116.2/1.09944 + (123.49+2363)/1.09945 = $1873 Value of Equity = Value of Firm - Market Value of Debt = $ 1873 - $ 800 = $1073 24 The Effects of Mismatching Cash Flows and Discount Rates Error 1: Discount CF to Equity at Cost of Capital to get equity value PV of Equity = 50/1.0994 + 60/1.09942 + 68/1.09943 + 76.2/1.09944 + (83.49+1603)/1.09945 = $1248 Value of equity is overstated by $175. Error 2: Discount CF to Firm at Cost of Equity to get firm value PV of Firm = 90/1.13625 + 100/1.136252 + 108/1.136253 + 116.2/1.136254 + (123.49+2363)/1.136255 = $1613 PV of Equity = $1612.86 - $800 = $813 Value of Equity is understated by $ 260. Error 3: Discount CF to Firm at Cost of Equity, forget to subtract out debt, and get too high a value for equity Value of Equity = $ 1613 Value of Equity is overstated by $ 540 25 Discounted Cash Flow Valuation: The Steps • Estimate the discount rate or rates to use in the valuation – Discount rate can be either a cost of equity (if doing equity valuation) or a cost of capital (if valuing the firm) – Discount rate can be in nominal terms or real terms, depending upon whether the cash flows are nominal or real – Discount rate can vary across time. • Estimate the current earnings and cash flows on the asset, to either equity investors (CF to Equity) or to all claimholders (CF to Firm) • Estimate the future earnings and cash flows on the firm being valued, generally by estimating an expected growth rate in earnings. • Estimate when the firm will reach “stable growth” and what characteristics (risk & cash flow) it will have when it does. • Choose the right DCF model for this asset and value it. 26 Discounted Cash Flow Valuation: The Inputs 27 Estimating Inputs: Discount Rates • Critical ingredient in discounted cashflow valuation. Errors in estimating the discount rate or mismatching cashflows and discount rates can lead to serious errors in valuation. • At an intuitive level, the discount rate used should be consistent with both the riskiness and the type of cashflow being discounted. – Equity versus Firm: If the cash flows being discounted are cash flows to equity, the appropriate discount rate is a cost of equity. If the cash flows are cash flows to the firm, the appropriate discount rate is the cost of capital. – Currency: The currency in which the cash flows are estimated should also be the currency in which the discount rate is estimated. – Nominal versus Real: If the cash flows being discounted are nominal cash flows (i.e., reflect expected inflation), the discount rate should be nominal 28 The Cost of Equity: Competing Models Model CAPM Expected Return E(R) = Rf + (Rm- Rf) Inputs Needed Riskfree Rate Beta relative to market portfolio Market Risk Premium APM E(R) = Rf + j=1j (Rj- Rf) Riskfree Rate; # of Factors; Betas relative to each factor Factor risk premiums Multi factor E(R) = Rf + j=1,,Nj (Rj- Rf) Riskfree Rate; Macro factors Betas relative to macro factors Macro economic risk premiums 29 The CAPM: Cost of Equity • Consider the standard approach to estimating cost of equity: Cost of Equity = Rf + Equity Beta * (E(Rm) - Rf) where, Rf = Riskfree rate E(Rm) = Expected Return on the Market Index (Diversified Portfolio) • In practice, – Short term government security rates are used as risk free rates – Historical risk premiums are used for the risk premium – Betas are estimated by regressing stock returns against market returns 30 Short term Governments are not riskfree in valuation…. • On a riskfree asset, the actual return is equal to the expected return. Therefore, there is no variance around the expected return. • For an investment to be riskfree, then, it has to have – No default risk – No reinvestment risk • In valuation, the time horizon is generally infinite, leading to the conclusion that a long-term riskfree rate will always be preferable to a short term rate, if you have to pick one. 31 Everyone uses historical premiums, but.. • The historical premium is the premium that stocks have historically earned over riskless securities. • Practitioners never seem to agree on the premium; it is sensitive to – How far back you go in history… – Whether you use T.bill rates or T.Bond rates – Whether you use geometric or arithmetic averages. 32 If you choose to use historical premiums…. • Go back as far as you can. A risk premium comes with a standard error. • Be consistent in your use of the riskfree rate. Since we argued for long term bond rates, the premium should be the one over T.Bonds • Use the geometric risk premium. It is closer to how investors think about risk premiums over long periods. 33 Two Ways of Estimating Country Equity Risk Premiums for other markets • Default spread on Country Bond: In this approach, the country equity risk premium is set equal to the default spread of the bond issued by the country • Relative Equity Market approach: The country equity risk premium is based upon the volatility of the market in question relative to U.S market. Total equity risk premium = Risk PremiumUS* Country Equity / US Equity • Country ratings measure default risk. Country Equity risk premium = Default spread on country bond* 34 Country Equity / Country Bond Implied Equity Premiums • If we assume that stocks are correctly priced in the aggregate and we can estimate the expected cashflows from buying stocks, we can estimate the expected rate of return on stocks by computing an internal rate of return. Subtracting out the riskfree rate should yield an implied equity risk premium. • This implied equity premium is a forward looking number and can be updated as often as you want (every minute of every day, if you are so inclined). 35 Implied Equity Premiums • We can use the information in stock prices to back out how risk averse the market is and how much of a risk premium it is demanding. In 2004, dividends & stock buybacks were 2.90% of the index, generating 35.15 in cashflows Analysts expect earnings to grow 8.5% a year for the next 5 years . 38.13 41.37 44.89 48.71 After year 5, we will assume that earnings on the index will grow at 4.22%, the same rate as the entire economy 52.85 January 1, 2005 S&P 500 is at 1211.92 • If you pay the current level of the index, you can expect to make a return of 7.87% on stocks (which is obtained by solving for r in the following equation) 38.13 41.37 44.89 48.71 52.85 52.85(1.0422 ) 1211 .92 (1 r) (1 r) 2 (1 r) 3 (1 r) 4 (1 r) 5 (r .0422 )(1 r) 5 • Implied Equity risk premium = Expected return on stocks - Treasury bond rate = 7.87% 4.22% = 3.65% 36 Estimating Beta • The standard procedure for estimating betas is to regress stock returns (Rj) against market returns (Rm) – Rj = a + R m – where a is the intercept and is the slope of the regression. • The slope of the regression corresponds to the beta of the stock, and measures the riskiness of the stock. Beta is sensitive to: • Data interval (monthly, weekly, daily) • Study period • Index 37 Beta Estimation: The Noise Problem 38 Beta Estimation: The Index Effect 39 Solutions to the Regression Beta Problem • Modify the regression beta by – changing the index used to estimate the beta – adjusting the regression beta estimate, by bringing in information about the fundamentals of the company • Estimate the beta for the firm using – the standard deviation in stock prices instead of a regression against an index – accounting earnings or revenues, which are less noisy than market prices. • Estimate the beta for the firm from the bottom up without employing the regression technique. This will require – understanding the business mix of the firm – estimating the financial leverage of the firm • Use an alternative measure of market risk not based upon a regression. 40 In a perfect world… we would estimate the beta of a firm by doing the following Start with the beta of the business that the firm is in Adjust the business beta for the operating leverage of the firm to arrive at the unlevered beta for the firm. Use the financial leverage of the firm to estimate the equity beta for the firm Levered Beta = Unlevered Beta ( 1 + (1- tax rate) (Debt/Equity)) 41 Adjusting for operating leverage… Unlevered beta = Pure business beta * (1 + (Fixed costs/ Variable costs)) 42 Equity Betas and Leverage • Conventional approach: If we assume that debt carries no market risk (has a beta of zero), the beta of equity alone can be written as a function of the unlevered beta and the debt-equity ratio L = u (1+ ((1-t)D/E)) In some versions, the tax effect is ignored and there is no (1t) in the equation. • Debt Adjusted Approach: If beta carries market risk and you can estimate the beta of debt, you can estimate the levered beta as follows: L = u (1+ ((1-t)D/E)) - debt (1-t) (D/E) • While the latter is more realistic, estimating betas for debt can be difficult to do. 43 Bottom-up Betas Step 1: Find the business or businesses that your firm operates in. Possible Refinements Step 2: Find publicly traded firms in each of these businesses and obtain their regression betas. Compute the simple average across these regression betas to arrive at an average beta for these publicly traded firms. Unlever this average beta using the average debt to equity ratio across the publicly traded firms in the sample. Unlevered beta for business = Average beta across publicly traded firms/ (1 + (1- t) (Average D/E ratio across firms)) Step 3: Estimate how much value your firm derives from each of the different businesses it is in. Step 4: Compute a weighted average of the unlevered betas of the different businesses (from step 2) using the weights from step 3. Bottom-up Unlevered beta for your firm = Weighted average of the unlevered betas of the individual business Step 5: Compute a levered beta (equity beta) for your firm, using the market debt to equity ratio for your firm. Levered bottom-up beta = Unlevered beta (1+ (1-t) (Debt/Equity)) If you can, adjust this beta for differences between your firm and the comparable firms on operating leverage and product characteristics. While revenues or operating income are often used as weights, it is better to try to estimate the value of each business. If you expect the business mix of your firm to change over time, you can change the weights on a year-to-year basis. If you expect your debt to equity ratio to change over time, the levered beta will change over time. 44 Why bottom-up betas? • The standard error in a bottom-up beta will be significantly lower than the standard error in a single regression beta. Roughly speaking, the standard error of a bottom-up beta estimate can be written as follows: Std error of bottom-up beta =Average Std Error across Betas Number of firms in sample • The bottom-up beta can be adjusted to reflect changes in the firm’s business mix and financial leverage. Regression betas reflect the past. • You can estimate bottom-up betas even when you do not have historical stock prices. This is the case with initial 45 public offerings, private businesses or divisions of The Cost of Equity: A Recap Preferably, a bottom-up beta, based upon other firms in the business, and firm’s own financial leverage Cost of Equity = Riskfree Rate Has to be in the same currency as cash flows, and defined in same terms (real or nominal) as the cash flows + Beta * (Risk Premium) Historical Premium 1. Mature Equity Market Premium: Average premium earned by stocks over T.Bonds in U.S. 2. Country risk premium = Country Default Spread* ( Equity /Country bond ) or Implied Premium Based on how equity market is priced today and a simple valuation model 46 Estimating the Cost of Debt • The cost of debt is the rate at which you can borrow at currently, It will reflect not only your default risk but also the level of interest rates in the market. • The two most widely used approaches to estimating cost of debt are: – Looking up the yield to maturity on a straight bond outstanding from the firm. The limitation of this approach is that very few firms have long term straight bonds that are liquid and widely traded – Looking up the rating for the firm and estimating a default spread based upon the rating. While this approach is more robust, different bonds from the same firm can have different ratings. You have to use a median rating for the firm 47 Weights for the Cost of Capital Computation • The weights used to compute the cost of capital should be the market value weights for debt and equity. • As a general rule, the debt that you should subtract from firm value to arrive at the value of equity should be the same debt that you used to compute the cost of capital. 48 Recapping the Cost of Capital Cost of borrowing should be based upon (1) synthetic or actual bond rating (2) default spread Cost of Borrowing = Riskfree rate + Default spread Cost of Capital = Cost of Equity (Equity/(Debt + Equity)) Cost of equity based upon bottom-up beta + Cost of Borrowing (1-t) Marginal tax rate, reflecting tax benefits of debt (Debt/(Debt + Equity)) Weights should be market value weights 49 The Cost of Capital (WACC) The Weighted Average Cost of Capital is given by: rWACC = Equity Debt × rEquity + × rDebt ×(1 – TC) Equity + Debt Equity + Debt E B rWACC = × re + × rB ×(1 – TC) E+ B E+B • Because interest expense is tax-deductible, we multiply the last term by (1 – TC). 50 II. Estimating Cash Flows DCF Valuation 51 Measuring Cash Flow to the Firm EBIT ( 1 - tax rate) - (Capital Expenditures - Depreciation) - Change in Working Capital = Cash flow to the firm 52 II. Correcting Accounting Earnings • Make sure that there are no financial expenses mixed in with operating expenses – Example: Operating Leases: they are really financial expenses and need to be reclassified as such. This has no effect on equity earnings but does change the operating earnings • Make sure that there are no capital expenses mixed in with the operating expenses – R & D Adjustment: Since R&D is a capital expenditure (rather than an operating expense), the operating income has to be adjusted to reflect its treatment. 53 Dealing with Operating Lease Expenses Adjusted Operating Earnings = Operating Earnings + Operating Lease Expenses - Depreciation on Leased Asset As an approximation, this works: Adjusted Operating Earnings = Operating Earnings + Pre-tax cost of Debt * PV of Operating Leases. 54 Net Capital Expenditures • Net capital expenditures represent the difference between capital expenditures and depreciation. Depreciation is a cash inflow that pays for some or a lot (or sometimes all of) the capital expenditures. • In general, the net capital expenditures will be a function of how fast a firm is growing or expecting to grow. High growth firms will have much higher net capital expenditures than low growth firms. • Assumptions about net capital expenditures can therefore never be made independently of assumptions about growth in the future. 55 Capital expenditures should include • Research and development expenses, once they have been re-categorized as capital expenses. The adjusted net cap ex will be Adjusted Net Capital Expenditures = Net Capital Expenditures + Current year’s R&D expenses Amortization of Research Asset • Acquisitions of other firms, since these are like capital expenditures. The adjusted net cap ex will be Adjusted Net Cap Ex = Net Capital Expenditures + Acquisitions of other firms - Amortization of such acquisitions 56 Working Capital Investments • In accounting terms, the working capital is the difference between current assets (inventory, cash and accounts receivable) and current liabilities (accounts payables, short term debt and debt due within the next year) • A cleaner definition of working capital from a cash flow perspective is the difference between non-cash current assets (inventory and accounts receivable) and non-debt current liabilities (accounts payable) • Any investment in this measure of working capital ties up cash. Therefore, any increases (decreases) in working capital will reduce (increase) cash flows in that period. • When forecasting future growth, it is important to forecast the effects of such growth on working capital needs, and building these effects into the cash flows. 57 Estimating FCFE • Cash flows to Equity for a Levered Firm Net Income - (Capital Expenditures - Depreciation) - Changes in non-cash Working Capital - (Principal Repayments - New Debt Issues) = Free Cash flow to Equity – I have ignored preferred dividends. If preferred stock exist, preferred dividends will also need to be netted out 58 Estimating FCFE when Leverage is Stable Net Income - (1- ) (Capital Expenditures - Depreciation) - (1- ) Working Capital Needs = Free Cash flow to Equity = Debt/Capital Ratio For this firm, – Proceeds from new debt issues = Principal Repayments + (Capital Expenditures - Depreciation + Working Capital Needs) • In computing FCFE, the book value debt to capital ratio should be used when looking back in time but can be replaced with the market value debt to capital ratio, looking forward. 59 Estimating FCFE • • • • • • Net Income= $ 1533 Million Capital spending = $ 1,746 Million Depreciation per Share = $ 1,134 Million Increase in non-cash working capital = $ 477 Million Debt to Capital Ratio = 23.83% Estimating FCFE Net Income $1,533 Mil - (Cap. Exp - Depr)*(1-DR) $465.90 [(1746-1134)(1-.2383)] Chg. Working Capital*(1-DR) $363.33 [477(1-.2383)] = Free CF to Equity $ 704 Million Dividends Paid $ 345 Million 60 III. Estimating Growth DCF Valuation 61 Ways of Estimating Growth in Earnings • Look at the past – The historical growth in earnings per share is usually a good starting point for growth estimation • Look at what others are estimating – Analysts estimate growth in earnings per share for many firms. It is useful to know what their estimates are. • Look at fundamentals – Ultimately, all growth in earnings can be traced to two fundamentals - how much the firm is investing in new projects, and what returns these projects are making for the firm. 62 I. Historical Growth in EPS • Historical growth rates can be estimated in a number of different ways – Arithmetic versus Geometric Averages – Simple versus Regression Models • Historical growth rates can be sensitive to – the period used in the estimation 63 I. Expected Long Term Growth in EPS • When looking at growth in earnings per share, these inputs can be cast as follows: Reinvestment Rate = Retained Earnings/ Current Earnings = Retention Ratio Return on Investment = ROE = Net Income/Book Value of Equity • In the special case where the current ROE is expected to remain unchanged gEPS = Retained Earningst-1/ NIt-1 * ROE = Retention Ratio * ROE = b * ROE • Proposition 1: The expected growth rate in earnings for a company cannot exceed its return on equity in the long term. 64 Changes in ROE and Expected Growth • When the ROE is expected to change, gEPS= b *ROEt+1 +(ROEt+1– ROEt)/ ROEt • Proposition 2: Small changes in ROE translate into large changes in the expected growth rate. • Proposition 3: No firm can, in the long term, sustain growth in earnings per share from improvement in ROE. 65 ROE and Leverage • ROE = ROC + D/E (ROC - i (1-t)) where, ROC = EBITt (1 - tax rate) / Book value of Capitalt-1 D/E = BV of Debt/ BV of Equity i = After-tax Cost of Debt / BV of Debt t = Tax rate on ordinary income • Note that Book value of capital = Book Value of Debt + Book value of Equity. 66 67 Getting Closure in Valuation • A publicly traded firm potentially has an infinite life. The value is therefore the present value of cash flows t = CF t forever. Value = t t = 1 (1 + r) t = N CFt Terminal Value Value = t (1 + r)N t = 1 (1 + r) • Since we cannot estimate cash flows forever, we estimate cash flows for a “growth period” and then estimate a terminal value, to capture the value at the end of the period: 68 Ways of Estimating Terminal Value 69 Stable Growth and Terminal Value • When a firm’s cash flows grow at a “constant” rate forever, the present value of those cash flows can be written as: Value = Expected Cash Flow Next Period / (r - g) where, r = Discount rate (Cost of Equity or Cost of Capital) g = Expected growth rate • This “constant” growth rate is called a stable growth rate and cannot be higher than the growth rate of the economy in which the firm operates. • While companies can maintain high growth rates for extended periods, they will all approach “stable growth” at some point in time. • When they do approach stable growth, the valuation formula above can be used to estimate the “terminal value” of all cash flows beyond. 70 Summarizing the Inputs • In summary, at this stage in the process, we should have an estimate of the – the current cash flows on the investment, either to equity investors (dividends or free cash flows to equity) or to the firm (cash flow to the firm) – the current cost of equity and/or capital on the investment – the expected growth rate in earnings, based upon historical growth, analysts forecasts and/or fundamentals • The next step in the process is deciding – which cash flow to discount, which should indicate – which discount rate needs to be estimated and – what pattern we will assume growth to follow 71 Which cash flow should I discount? • Use Equity Valuation (a) for firms which have stable leverage, whether high or not, and (b) if equity (stock) is being valued • Use Firm Valuation (a) for firms which have leverage which is too high or too low, and expect to change the leverage over time, because debt payments and issues do not have to be factored in the cash flows and the discount rate (cost of capital) does not change dramatically over time. (b) for firms for which you have partial information on leverage (eg: interest expenses are missing..) (c) in all other cases, where you are more interested in valuing the firm than the equity. (Value Consulting?) 72 Given cash flows to equity, should I discount dividends or FCFE? • Use the Dividend Discount Model – (a) For firms which pay dividends (and repurchase stock) which are close to the Free Cash Flow to Equity (over a extended period) – (b)For firms where FCFE are difficult to estimate (Example: Banks and Financial Service companies) • Use the FCFE Model – (a) For firms which pay dividends which are significantly higher or lower than the Free Cash Flow to Equity. (What is significant? ... As a rule of thumb, if dividends are less than 80% of FCFE or dividends are greater than 110% of FCFE over a 5-year period, use the FCFE model) – (b) For firms where dividends are not available (Example: Private Companies, IPOs) 73 What discount rate should I use? • Cost of Equity versus Cost of Capital – If discounting cash flows to equity -> Cost of Equity – If discounting cash flows to the firm -> Cost of Capital • What currency should the discount rate (risk free rate) be in? – Match the currency in which you estimate the risk free rate to the currency of your cash flows • Should I use real or nominal cash flows? – If discounting real cash flows -> real cost of capital – If nominal cash flows -> nominal cost of capital – If inflation is low (<10%), stick with nominal cash flows since taxes are based upon nominal income – If inflation is high (>10%) switch to real cash flows 74 Which Growth Pattern Should I use? • If your firm is – large and growing at a rate close to or less than growth rate of the economy, or – constrained by regulation from growing at rate faster than the economy – has the characteristics of a stable firm (average risk & reinvestment rates) Use a Stable Growth Model • If your firm – is large & growing at a moderate rate (≤ Overall growth rate + 10%) or – has a single product & barriers to entry with a finite life (e.g. patents) Use a 2-Stage Growth Model • If your firm – is small and growing at a very high rate (> Overall growth rate + 10%) or – has significant barriers to entry into the business – has firm characteristics that are very different from the norm 75 Use a 3-Stage or n-stage Model The Building Blocks of Valuation Choose a Cash Flow Dividends Expected Dividends to Stockholders Cashflows to Equity Cashflows to Firm Net Income EBIT (1- tax rate) - (Capital Exp. - Deprec’n) - (1- ) (Capital Exp. - Deprec’n) - Change in Work. Capital - (1- ) Change in Work. Capital = Free Cash flow to Equity (FCFE) = Free Cash flow to Firm (FCFF) [ = Debt Ratio] & A Discount Rate Cost of Equity Cost of Capital WACC = ke ( E/ (D+E)) Basis: The riskier the investment, the greater is the cost of equity. Models: + kd ( D/(D+E)) CAPM: Riskfree Rate + Beta (Risk Premium) kd = Current Borrowing Rate (1-t) E,D: Mkt Val of Equity and Debt APM: Riskfree Rate + Betaj (Risk Premiumj): n factors & a growth pattern Stable Growth Two-Stage Growth g g Three-Stage Growth g | t High Growth | Stable High Growth Transition Stable 76 Income Statement-Based Method 1. Value of Earnings: PER Equity Value = PER X earnings 2. Value of the Dividends: Equity value = DPS/Ke Equity value = DPS1/(Ke- g) 77 Income Statement-Based Method 3. Sales Multiples: Price/Sale = (Price/earnings)x(earnings/sales) 78 Income Statement-Based Method • Other Multiples: Value of the company/EBIT Value of the company/EBITDA Value of the company/book value Value of the company/operating cash flow 79 Balance Sheet-Based Methods 1. Book Value (the value of the shareholders’ equity stated in the balance sheet, TA-TL) 2. Adjusted Book Value 3. Liquidation Value (the value of the company if it is liquidated, that is, its assets are sold and its debts are paid off) 80 Balance Sheet-Based Methods 4. Substantial Value (the investment that must be made to form a company having identical conditions as those of the company being valued); assets replacement value. a) Gross substantial value (the assets’ value at market price) b) Net substantial value or corrected net assets (the gross substantial value less liabilities or adjusted net worth) c) Reduce gross substantial value (gross substantial value reduced only by the value of the cost-free debt) 81 Goodwill-Based Methods Goodwill is the value that a company has above its book value or above the adjusted book value. Goodwill seeks to represent the value of the company’s intangible assets, which often do not appear on the balance sheet but which, contribute an advantage with respect to other companies operating in the industry (quality of the customer portfolio, industry leadership, brands, strategic alliances, etc.). 82 Goodwill-Based Methods 1. The “Classic” Valuation Method: Value = value of net assets + value goodwill Goodwill is valued as n times the company’s net income, or as a certain percentage of the turnover. V = A + (n x B), or V = A + (z x F) A = net asset value, n = coefficients between 1.5 and 3; B = net income; z = % of sales revenue; and F = turnover. 83 Goodwill-Based Methods 2. Abbreviated Goodwill income V = A + PVA (B- iA) A = corrected net assets or net substantial value PVA = present value of annuities factor with n between 5 and 8 years. B = net income I = rate on long term government bond 84 Goodwill-Based Methods 3. Indirect Method V = (A + B/i)/2, or V = A + (B – iA)/2i) 85 Goodwill-Based Methods 4. Anglo-Saxon or Direct Method: V = A + (B + iA)/K where, K is rate on fixed income securities multiply by a coefficient between 1.25 and 1.5 to adjust for the risk 86 Goodwill-Based Methods 5. Annual Profit Purchase Method: V = A + m(B-iA) m: number of years for super profits period, ranges between 3 and 5. 87 Value Creation Method 1. Economic Value Added (EVA) EVA = NOPAT- (WACC)(Capital) NOPAT = EBIT (1-t) WACC is weighted average cost of capital 88 Value Creation Method 2. Market Value Added (MVA) • MVA = Market Value of the Firm - Book Value of the Firm • Market Value = (# shares of stock)(price per share) + Value of debt • Book Value = Total common equity + Value of debt (More…) 89 Value Creation Method • If the market value of debt is close to the book value of debt, then MVA is: • MVA = Market value of equity – book value of equity 90 MVA for a Constant Growth Firm MVAt = ┌ │ └ ┐ ┐┌ CR Sales (1 + g) OP – WACC ( │ │ │ ) (1+g) WACC - g ┘ ┘└ t 91 MVA and the Four Value Drivers • MVA is determined by four drivers: – Sales growth – Operating profitability (OP=NOPAT/Sales) – Capital requirements (CR=Operating capital / Sales) – Weighted average cost of capital 92 MVA in Terms of Expected ROIC MVAt = Capitalt (EROICt – WACC) WACC - g If the spread between the expected return, EROICt, and the required return, WACC, is positive, then MVA is positive and growth makes MVA larger. The opposite is true if the spread is negative. 93 Expected Return on Invested Capital (EROIC) • The expected return on invested capital is the NOPAT expected next period divided by the amount of capital that is currently invested: EROICt = NOPATt + 1 Capitalt 94 Options Method 95 What are some types of real options? • Investment timing options • Growth options – Expansion of existing product line – New products – New geographic markets 96 Types of real options (Continued) • Abandonment options – Contraction – Temporary suspension • Flexibility options 97 Five Procedures for Valuing Real Options 1.DCF analysis of expected cash flows, ignoring the option. 2.Qualitative assessment of the real option’s value. 3.Decision tree analysis. 4.Standard model for a corresponding financial option. 5.Financial engineering techniques. 98 The Most Common Errors in Valuation 99 1. Errors in the discount rate calculation and concerning the company’s riskiness 100 A. Wrong risk-free rate used for the valuation 1. Using the historical average of the risk-free rate. 2. Using the short-term Government rate. 3. Wrong calculation of the real risk-free rate. 101 B. Wrong beta used for the valuation 1. Using the historical industry beta, or the average of the betas of similar companies, when the result goes against common sense. 2. Using the historical beta of the company when the result goes against common sense. 3. Assuming that the beta calculated from historical data captures the country risk. 4. Using the wrong formula for levering and unlevering the beta. 5. Arguing that the best estimation of the beta of a company from an emerging market is the beta of the company with respect to the S&P 500. 6. When valuing an acquisition, use the beta of the acquiring company. 102 B. Wrong market risk premium used for the valuation 1. The required market risk premium is equal to the historical equity premium. 2. The required market risk premium is equal to zero. 3. Assume that the required market risk premium is the expected risk premium. 103 D. Wrong calculation of WACC 1. Wrong definition of WACC. 2. The debt to equity ratio used to calculate the WACC is different from the debt to equity ratio resulting from the valuation. 3. Using discount rates lower than the risk-free rate. 4. Using the statutory tax rate, instead of the effective tax rate of the levered company. 5. Valuing all the different businesses of a diversified company using the same WACC (same leverage and same Ke). 104 D. Wrong calculation of WACC 6. Considering that WACC/(1-T) is a reasonable return for the company’s stakeholders. 7. Using the wrong formula for the WACC when the value of debt is not equal to its book value. 8. Calculating the WACC assuming a certain capital structure and deducting the outstanding debt from the enterprise value. 9. Calculating the WACC using book values of debt and equity. 10. Calculating the WACC using strange formula. 105 E. Wrong calculation of the value of tax shields 1. Discounting the tax shield using the cost of debt or the required return to unlevered equity. 2. Odd or ad-hoc formula. 106 F. Wrong treatment of country risk 1. Not considering the country risk, arguing that it is diversifiable. 2. Assuming that a disaster in an emerging market will increase the beta of the country’s companies calculated with respect to the S&P 500. 3. Assuming that an agreement with a government agency eliminates country risk. 4. Assuming that the beta provided by Market Guide with the Bloomberg adjustment incorporates the illiquidity risk and the small cap premium. 5. Odd calculations of the country risk premium. 107 G. Including an illiquidity, small-cap, or specific premium when it is not appropriate 1. Including an odd small-cap premium. 2. Including an odd illiquidity premium. 3. Including a small-cap premium equal for all companies. 108 2. Errors while calculating or forecasting the expected cash flows 109 A. Wrong definition of the cash flows 1. Forgetting the increase in Working Capital Requirements when calculating cash flows. 2. Considering the increase in the company’s cash position or financial investments as an equity cash flow. 3. Errors in the calculation of the taxes that affect the FCF. 4. Expected Equity Cash Flows are not equal to expected dividends plus other payments to shareholders (share repurchases…). 5. Considering net income as a cash flow. 6. Considering net income plus depreciation as a cash flow. 110 B. Errors when valuing seasonal companies 1. Wrong treatment of seasonal working capital requirements. 2. Wrong treatment of stocks that are cash equivalent. 3. Wrong treatment of seasonal debt. 111 C. Errors due to not projecting the balance sheets 1. Forgetting balance sheet accounts that affect the cash flows. 2. Considering an asset revaluation as a cash flow. 3. Interest expenses not equal to D Kd. 112 D. Exaggerated optimism when forecasting cash flows 113 3. Errors in the calculation of the residual value A. Inconsistent cash flow used to calculate perpetuity. B. The debt to equity ratio used to calculate the WACC to discount the perpetuity is different from the debt to equity ratio resulting from the valuation. C. Using ad hoc formulas that have no economic meaning. D. Using arithmetic averages instead of geometric averages to assess growth. E. Calculating the residual value using the wrong formula. F. Assume that a perpetuity starts a year before it really starts. 114 4. Inconsistencies and conceptual errors 115 A. Conceptual errors about the free cash flow and the equity cash flow 1. Considering the cash in the company as an equity cash flow when the company has no plans to distribute it. 2. Using real cash flows and nominal discount rates, or vice-versa. 3. The free cash flow and the equity cash flow do not satisfy: ECF=FCF + D – Int(1- T) 116 B. Errors when using multiples 1. Using the average of multiples extracted from transactions executed over a very long period of time. 2. Using the average of transactions multiples that have a wide scatter. 3. Using multiples in a way that is different to their definition. 4. Using a multiple from an extraordinary transaction. 5. Using ad hoc valuation multiples that conflict with common sense. 6. Using multiples without using common sense. 117 C. Time Inconsistencies 1. Assuming that the equity value will be constant for the next five years. 2. The equity value or the enterprise value does not satisfy the time consistency formula. 118 D. Other conceptual errors 1. Not considering cash flows resulting from future investments. 2. Considering that a change in economic conditions invalidates signed contracts. 3. Considering that the value of debt is equal to its book value when they are different. 4. Not using the correct formula when the value of debt is not equal to its book value. 5. Including the value of real options that have no economic meaning. 6. Forgetting to include the value of non-operating assets. 7. Inconsistencies between discount rates and expected inflation. 119 D. Other conceptual errors 8. Valuing a holding company assuming permanent losses (without tax savings) in some companies and permanent profits in others. 9. Wrong concept of the optimal capital structure. 10. In mature companies, assuming projected cash flows that are much higher than historical cash flows without any good reason. 11. Assumptions about future sales, margins, etc. that are inconsistent with the economic environment, the industry outlook, or competitive analysis. 12. Considering that the ROE is the return to the shareholders. 13. Considering that the ROA is the return of the debt and equity holders. 120 D. Other conceptual errors 14. Using different and inconsistent discount rates for cash flows of different years or for different components of the free cash flow. 15. Using past market returns as a proxy for required return to equity. 16. Adding the liquidation value and the present value of cash flows. 17. Using ad hoc formulas to value intangibles. 18. Arguing that different discounted cash flow methods provide different valuations. 19. Wrong notion of the meaning of the efficient markets. 20. Applying a discount when valuing diversified companies. 21. Wrong arbitrage arguments. 22. Adding a control premium when it is not appropriate. 121 5. Errors when interpreting the valuation A. B. C. D. E. F. Confusing value with price. Asserting that “the valuation is a scientific fact, not an opinion”. A valuation is valid for everybody. A company has the same value for all buyers. Confusing strategic value for a buyer with fair market value. Considering that the goodwill includes the brand value and the intellectual capital. G. Forgetting that a valuation is contingent on a set of expectation about cash flows that will generated and about their riskiness. H. Affirming that “a valuation is the starting point of a negotiation”. I. Affirming that “a valuation is 50% art and 50% science”. 122 6. Organizational errors A. Making a valuation without checking the forecasts made by the client. B. Commissioning a valuation from an investment bank without having any involvement in it. C. Involving only the finance department in valuing a target company. 123