Budget Overview and Financial Statements

advertisement

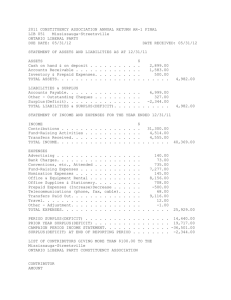

Summary of Recommendations BUDGET OVERVIEW Summary of Recommendations For the year ending 30 June 2015 2013-14 Anticipated $000 2014-15 Proposed $000 2015-16 Proposed $000 2016-17 Proposed $000 1,997,777 1,936,989 2,440,030 1,919,038 1,995,760 1,888,370 2,140,094 1,891,101 INCREASE IN OPERATING CAPABILITY 60,787 520,991 107,390 248,993 Appropriations from Operations Accumulated Surplus at beginning of year -80,120 547 -313,133 528 -316,454 463 -49,474 447 ACCUMULATED SURPLUS AVAILABLE FOR TRANSFER Transfers (to) / from Reserves ACCUMULATED SURPLUS AT PERIOD END -18,786 208,386 -208,601 199,966 19,314 528 -207,923 463 209,048 447 -199,592 374 OPERATIONS Revenue Expenses Note: (i) Figures in the Budgeted Financial Statements have been rounded to the nearest thousand with the figures midway between rounding points rounded up -7- Budgeted Statement of Comprehensive Income BUDGETED FINANCIAL STATEMENTS Budgeted Statement of Comprehensive Income For the year ending 30 June 2015 2013-14 Anticipated $000 2014-15 Proposed $000 2015-16 Proposed $000 2016-17 Proposed $000 911,686 -50,115 861,571 958,615 -47,450 911,165 1,011,972 -49,175 962,796 1,067,870 -50,978 1,016,892 312,093 214,130 305,856 68,888 235,239 728,938 212,443 313,230 62,082 212,172 208,939 220,248 321,061 34,599 248,117 209,716 227,183 335,083 20,321 330,898 1,136,205 1,528,865 1,032,964 1,123,201 Total Income 1,997,777 2,440,030 1,995,760 2,140,094 Expenses Employee costs Materials and services costs Depreciation and amortisation expenses Finance costs Loss on disposal of property, plant and equipment 660,130 1,745,733 322,549 133,344 136,634 682,500 1,651,283 337,043 138,075 22,824 688,495 1,180,521 368,739 118,906 23,014 706,293 1,244,875 372,963 99,644 23,014 73,092 85,313 91,681 89,296 3,071,483 2,917,039 2,471,356 2,536,086 -1,134,493 -998,000 -582,986 -644,985 1,936,989 1,919,038 1,888,370 1,891,101 60,787 520,991 107,390 248,993 Income Revenue Rates and utility charges Less discount and pensioner remissions Donations, contributions, subsidies and grants Fees and charges Public transport Interest Other revenue Other expenses Less capitalised expenses Total Expenses INCREASE IN OPERATING CAPABILITY -8- Budgeted Statement of Financial Position BUDGETED FINANCIAL STATEMENTS Budgeted Statement of Financial Position For the year ending 30 June 2015 2013-14 Anticipated $000 2014-15 Proposed $000 2015-16 Proposed $000 2016-17 Proposed $000 151,945 78,682 13,014 72,324 322 316,287 420,652 76,038 11,679 74,058 322 582,749 97,072 78,731 8,349 68,055 322 252,529 306,792 86,316 8,805 68,175 322 470,410 1,241,282 172,629 2,158,143 16,849,861 115,285 20,537,200 561,282 173,431 2,158,143 16,661,583 157,321 19,711,760 261,282 174,253 2,158,143 16,783,302 145,416 19,522,395 0 175,096 2,158,143 17,006,249 120,439 19,459,927 20,853,487 20,294,509 19,774,924 19,903,337 418,112 46,801 1,702 108,786 23,620 599,021 473,506 506,730 1,702 111,303 23,653 1,116,894 350,314 112,786 1,707 112,374 24,349 601,530 368,535 30,955 1,704 112,783 23,964 537,940 16,154 2,520,573 26,951 2,485 4,061 2,570,224 16,154 1,552,400 27,606 2,487 4,064 1,602,710 16,154 1,439,702 27,885 2,483 4,058 1,490,282 16,154 1,408,749 27,991 2,487 4,065 1,459,446 3,169,245 2,719,604 2,091,812 1,997,386 17,684,242 17,574,905 17,683,112 17,932,951 9,073,470 8,367,672 242,572 528 9,386,603 7,737,343 450,496 463 9,703,057 7,738,160 241,447 447 9,752,531 7,739,006 441,039 374 17,684,242 17,574,905 17,683,112 17,932,951 Assets Current assets Cash and cash equivalents Trade and other receivables Inventories Other assets Financial assets Non-current assets Receivables Other financial assets Investments in associates Property, plant and equipment Intangible assets Total Assets Liabilities Current liabilities Trade and other payables Other financial liabilities Derivative financial instruments Provisions Others Non-current liabilities Payables Other financial liabilities Provisions Defined benefit plan Other Total Liabilities NET COMMUNITY ASSETS Community Equity Capital Asset revaluation surplus Other reserves Accumulated surplus TOTAL COMMUNITY EQUITY -9- Budgeted Statement of Cash Flows BUDGETED FINANCIAL STATEMENTS Budgeted Statement of Cash Flows For the year ending 30 June 2015 2013-14 Anticipated $000 2014-15 Proposed $000 2015-16 Proposed $000 2016-17 Proposed $000 860,581 520,688 208,053 72,949 68,888 165,246 1,896,404 918,062 521,420 622,606 76,243 62,082 142,674 2,343,087 961,960 539,452 98,304 81,135 34,599 154,910 1,870,361 1,011,250 560,323 97,389 82,827 20,321 250,600 2,022,710 642,532 1,749,302 92,325 73,092 671,145 1,602,735 92,370 85,313 686,321 1,301,212 115,128 91,681 700,458 1,232,426 95,862 89,296 2,557,252 -1,134,493 2,451,563 -998,000 2,194,341 -582,986 2,118,042 -644,985 1,422,758 1,453,563 1,611,355 1,473,057 473,646 889,524 259,005 549,653 163,464 200,716 81,419 51,038 -1,103,402 -967,911 -553,486 -615,485 72,653 67,800 99,900 79,800 -867,285 -699,395 -372,166 -484,647 437,508 -46,801 0 -601,421 0 -510,419 0 -116,567 0 680,000 300,000 261,282 390,707 78,579 -210,419 144,714 NET INCREASE/(DECREASE) IN CASH HELD -2,932 268,707 -323,580 209,720 Cash and cash equivalents at beginning of year 154,877 151,945 420,652 97,072 CASH AND CASH EQUIVALENTS AT YEAR END 151,945 420,652 97,072 306,792 Cash Flows from Operating Activities Receipts Net rates and utility charges Public transport, fees and charges Subsidies and grants Contributions Interest Other Payments Employee costs Materials and services costs Finance costs Other Less capitalised expenses Net cash generated by Operating Activities Cash Flows from Investing Activities Proceeds from disposal of property, plant and equipment Payments for property, plant and equipment and capital work in progress Dividends received Net cash used in Investing Activities Cash Flows from Financing Activities Proceeds from borrowings Repayment of borrowings Proceeds on settlement of loan receivables Net cash provided by Financing activities - 10 - BUDGETED FINANCIAL STATEMENTS Budgeted Statement of Changes in Equity For the year ending 30 June 2015 Total 2014 Anticipated $000 Balance at beginning of year 2013-14 Anticipated Accumulated City Capital Surplus and Capital Accounts $000 $000 Asset Revaluation Surplus $000 Fair Value / Other Reserves $000 Total 2015 Proposed $000 Accumulated Surplus $000 2014-15 Proposed Capital $000 Asset Revaluation Surplus Fair Value / Other Reserves $000 $000 Total 2016 Proposed $000 Accumulated Surplus $000 2015-16 Proposed City Capital and Capital Accounts $000 Asset Revaluation Surplus $000 Other Reserves $000 Total 2017 Proposed $000 Accumulated Surplus $000 2016-17 Proposed City Capital and Capital Accounts $000 Asset Revaluation Surplus $000 Other Reserves $000 18,224,137 547 8,993,349 8,968,354 261,886 17,684,242 528 9,073,470 8,367,672 242,572 17,574,905 463 9,386,603 7,737,343 450,496 17,683,112 447 9,703,057 7,738,160 241,447 60,787 60,787 0 0 0 520,991 520,991 0 0 0 107,390 107,390 0 0 0 248,993 248,993 0 0 0 -600,682 0 0 -600,682 0 -630,329 0 0 -630,329 0 817 0 0 817 0 846 0 0 846 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 17,684,242 61,335 8,993,349 8,367,672 261,886 17,574,905 521,519 9,073,470 7,737,343 242,572 17,683,112 107,853 9,386,603 7,738,160 450,496 17,932,951 249,440 9,703,057 7,739,006 241,447 Debt Funding 0 -46,801 46,801 0 0 0 129,801 -129,801 0 0 0 -206,641 206,641 0 0 0 148,497 -148,497 0 0 Asset Acquisition 0 -33,320 33,320 0 0 0 -442,935 442,935 0 0 0 -109,813 109,813 0 0 0 -197,970 197,970 0 0 0 -80,120 80,120 0 0 0 -313,133 313,133 0 0 0 -316,454 316,454 0 0 0 -49,474 49,474 0 0 Insurance 0 5,000 0 0 -5,000 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Valley Mall General 0 -27 0 0 27 0 -138 0 0 138 0 13 0 0 -13 0 4 0 0 -4 Valley Mall Asset Replacement 0 -535 0 0 535 0 -647 0 0 647 0 -723 0 0 723 0 -723 0 0 723 Queen Street Mall General 0 -294 0 0 294 0 94 0 0 -94 0 -395 0 0 395 0 -1,106 0 0 1,106 Queen Street Mall Asset Replacement 0 -846 0 0 846 0 -816 0 0 816 0 -886 0 0 886 0 -886 0 0 886 Emergent Expenditure and Inflation Provision 0 29,630 0 0 -29,630 0 -198,699 0 0 198,699 0 250,339 0 0 -250,339 0 -196,882 0 0 196,882 Infrastructure 0 -15,414 0 0 15,414 0 -7,717 0 0 7,717 0 -39,300 0 0 39,300 0 0 0 0 0 TransApex 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 City Reach Boardwalk 0 1,800 0 0 -1,800 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Transfer to reserve (from) accumulated surplus 0 19,314 0 0 -19,314 0 -207,923 0 0 207,923 0 209,048 0 0 -209,048 0 -199,592 0 0 199,592 17,684,242 528 9,073,470 8,367,672 242,572 17,574,905 463 9,386,603 7,737,343 450,496 17,683,112 447 9,703,057 7,738,160 241,447 17,932,951 374 9,752,531 7,739,006 441,039 Increase in Operating Capability Increase/(Decrease) in asset revaluation surplus Transfer to foreign exchange reserve for adjustments to cash flow hedges Total recognised income and expense for the year Appropriations to / (from) accounts: Transfers to capital (from) accumulated surplus Reserves Transfers Balance at Year End - 11 - BUDGET OVERVIEW Summary of Recommendations - Long Term Financial Forecast For the year ending 30 June 2015 2014-15 Proposed $000 2015-16 Proposed $000 2016-17 Proposed $000 2017-18 Proposed $000 2018-19 Proposed $000 2019-20 Proposed $000 2020-21 Proposed $000 2021-22 Proposed $000 2022-23 Proposed $000 2023-24 Proposed $000 2,440,030 1,919,038 1,995,760 1,888,370 2,140,094 1,891,101 2,116,003 1,973,561 2,220,863 2,031,885 2,284,738 2,090,102 2,310,948 2,168,391 2,381,800 2,218,916 2,456,305 2,274,389 2,535,714 2,301,833 INCREASE IN OPERATING CAPABILITY 520,991 107,390 248,993 142,442 188,977 194,636 142,557 162,884 181,916 233,881 Appropriations from Operations Accumulated Surplus at beginning of year -313,133 528 -316,454 463 -49,474 447 -148,245 374 -188,968 371 -194,629 381 -142,567 388 -154,039 378 -128,651 374 -132,683 389 208,386 -208,601 199,966 -5,429 381 388 378 9,224 53,639 101,587 -207,923 209,048 -199,592 5,800 0 0 0 -8,850 -53,250 -101,182 463 447 374 371 381 388 378 374 389 405 20,294,509 2,719,604 17,574,905 19,774,924 2,091,812 17,683,112 19,930,337 1,997,386 17,932,951 20,154,420 2,079,027 18,075,392 20,558,107 2,332,851 18,225,256 20,795,436 2,368,531 18,426,905 20,983,213 2,369,733 18,613,480 21,104,450 2,326,373 18,778,077 21,243,977 2,282,700 18,961,277 21,433,925 2,237,842 19,196,083 OPERATIONS Revenue Expenses ACCUMULATED SURPLUS AVAILABLE FOR TRANSFER Transfers (to)/from Reserves ACCUMULATED SURPLUS AT PERIOD END Total Assets Total Liabilities TOTAL COMMUNITY EQUITY Note: (i) Figures in the Budgeted Financial Statements have been rounded to the nearest thousand and the figures midway between rounding points are rounded up - 12 - Index of Outcomes Financial Ratios BUDGETED FINANCIAL STATEMENTS Financial Ratios For the year ending 30 June 2015 2014-15 Proposed 2015-16 Proposed 2016-17 Proposed 2017-18 Proposed 2018-19 Proposed 2019-20 Proposed 2020-21 Proposed 2021-22 Proposed 2022-23 Proposed 2023-24 Proposed Revenue Ratio Net Rates and Utility Charges Revenue / Total Revenue (Council's dependence on rate income) 37.3% 48.2% 47.5% 50.8% 50.1% 50.4% 51.6% 51.8% 52.0% 52.2% Debt Servicing Cover (Operating Capability Increase + Debt Servicing Costs) / Debt Servicing Costs (Extent to which debt servicing cost requirements are covered by the increase in Operating Capability) 4.8 times 1.9 times 3.5 times 2.5 times 2.8 times 2.8 times 2.3 times 2.5 times 2.8 times 3.3 times Debt Servicing Ratio Debt Servicing and Redemption Cost / Total Revenue (The capacity of the Council to service its outstanding debt) 30.3% 31.5% 10.1% 6.2% 6.8% 7.2% 7.2% 6.9% 6.6% 6.3% Net Debt/Revenue Ratio Net Debt / Total Revenue (Council's borrowing ability) 67.1% 72.9% 52.9% 55.3% 64.5% 63.1% 59.3% 53.9% 47.2% 38.8% 7.5 to 1 9.5 to 1 10.0 to 1 9.7 to 1 8.8 to 1 8.8 to 1 8.9 to 1 9.1 to 1 9.3 to 1 9.6 to 1 81.2% 65.4% 21.3% 12.3% 13.6% 14.2% 14.0% 13.4% 12.7% 12.1% $ 1,411 $ 1,237 $ 952 $ 972 $ 1,175 $ 1,170 $ 1,099 $ 1,019 $ 912 $ 766 0.4 0.9 0.9 0.8 0.9 0.9 1.0 1.1 0.4% 7.4% 2.0% 4.0% 1.5% 2.2% 2.8% 4.8% Debt Exposure Ratio Total Assets / Total Liabilities (Council's exposure to debt) Debt Commitment Ratio Debt Servicing and Redemption Costs / Net Rate and Utility Charges Revenue (Identifies Council debt redemption strategy) Net Debt Per Capita Working Capital Ratio Current Assets / Current Liabilities (Extent to which Council has liquid assets available to meet short term financial obligations) Operating Surplus Ratio Net Operating Surplus / Total Operating Revenue (Extent to which revenues raised cover operational 0.5 -0.4% - 13 - 0.8 4.0% Index of Outcomes For the year ending 30 June 2015 2014-15 Proposed 2015-16 Proposed 2016-17 Proposed 2017-18 Proposed 2018-19 Proposed 2019-20 Proposed 2020-21 Proposed 2021-22 Proposed 2022-23 Proposed 2023-24 Proposed 113.2% 97.6% 74.9% 79.1% 88.8 % 87.2% 83.7% 78.2% 70.9% 61.9% Interest Coverage Ratio Net Interest Expense on Debt Service / Total Operating Revenue (Extent to which Council’s operating revenues are committed to interest expenses) 4.0% 4.5% 3.9% 4.1% 4.3% 4.5% 4.4% 4.1% 3.7% 3.2% Asset Sustainability Ratio Capital Expenditure on the Replacement of Assets (renewals) / Depreciation Expense (Approximation of the extent to which the infrastructure assets managed by Council are being replaced as these reach the end of their useful lives) 84.0% 68.7% 66.6% 74.4% 75.8% 75.1% 76.4% 78.0% 79.5% 78.0% Asset Consumption Ratio Written Down Value of Infrastructure Assets / Gross Current Replacement Cost of Infrastructure Assets (The aged condition of a Council’s stock of physical assets) 73.8% 73.8% 73.8% 73.6% 73.4% 73.2% 73.1% 72.9% 73.1% 73.1% expenses only or are available for capital funding ) Net Financial Liabilities Ratio Total Liabilities less Current Assets / Total Operating Revenue (Extent to which the net financial liabilities of Council can be serviced by its operating revenues) - 14 -