ishare

advertisement

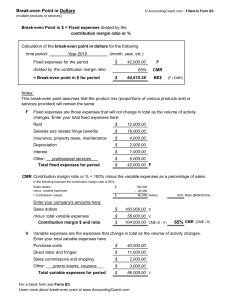

Chapter 1 Managerial Accounting and the Business Environment Managerial Accounting is concerned with providing information to managers who are inside an organization. 3 Major Responsibilities for Managers : 1. Planning : Identifying alternatives and select the best one to achieve the organization’s objective. Alternatives are expressed formally as budgets in quantitative terms. 2. Directing and Motivation : Oversee day-today activities and keep the organization functioning smoothly. 3. Controlling : to ensure that the plan is being followed. * Feedback show whether operations are on track , it is provided by detailed report. * Performance report compare budgets to actual result : Eg : Plan Actual NI = $ 4 million $ 5 million Favorable NI = $ 4 million $ 3 million Unfavorable why? Correct Action Financial Account Managerial Account Report to outside users Report to those inside organization for Planning , Directing and Motivating , Controlling , Performance evaluation Emphasis is on summaries of financial transactions of past activities Emphasis is on decisions affecting the future Objectivity and verifiability of data are emphasized Relevance and flexibility of data are emphasized Precision of information is required Timeliness of information is required Only summarized data for the entire organization are prepared Detailed segment reports about departments , products , customers and so on. Must follow International Financial Reporting Standards (IFRS) No need to follow IFRS Mandatory for external report Not mandatory 5 Major Programs of Managers : 1. Just In Time (JIT) Raw materials are purchased and units production are made only as need to meet actual demand. JIT is controlled by “Pull” approach Ex : Received orders from customers calculated the amount of raw material needed purchased 2. Total Quality Management (TQM) TQM has 2 characteristics - Focus on serving customers - Systematic problem solving using team made up of front line workers Problem solving can be done many ways Benchmarking – studying order organizations Plan – Do – Check – Act (PDCA) approach 3. Process Reengineering Focus on simplification A business process is diagrammed in details , questions , and then completely redesigned in order to eliminate the non-value-added-activities 4. Automation Replacing human with machines It’s expensive but can reduce set up time , greater flexibility , reduction in defects and get a higher rate of output 5. The theory of constraints Constraint is anything that prevents you from getting more of what you want. So effectively managing constraint is a key to success. Try to think how to utilize the constraint resources you have. Chapter 2 Manufacturing cost Direct materials: Raw materials that become an integral part of the product and that can be conveniently traced directly Direct labor: Those labor costs that can be easily traced to individual units of product. Manufacturing overhead: Manufacturing cost that cannot be traced directly to specific unit produced. Non-manufacturing cost is Selling and administrative costs Manufacturing costs are often classified as -Direct material and Direct labor is Prime cost -Direct labor and Manufacturing overhead is Conversion cost The income statement: Cost of goods sold for manufacturers differs only slightly from cost of goods sold for merchandisers. Schedule of cost of goods manufactured -Calculate the cost of raw material, direct labor and manufacturing overhead used in production. -Calculate the manufacturing costs associated with goods that were finished during the period. Overtime: The overtime premiums for all factory workers are usually considered to be part of manufacturing overhead. Idle time: The labor costs incurred during idle time are ordinarily treated as manufacturing overhead. Labor fringe benefits: Include employer paid costs for insurance programs, retirement plans, supplemental unemployment programs, social security, Medicare and unemployment taxes. Chapter 3 : Cost behavior Cost Behavior : to study the relationship between cost and activity 1. Variable Cost (VC) Total cost that changes in direct proportion to the activity but cost per unit (VCU) remains constant Variable Cost y TVC $ 0 units x 2. Fixed Cost (FC) - Committed Fixed Cost : cost that cannot be easily or quickly eliminated ex. maintaining operating facilities - Discretionary Fixed Cost : costs that can be discontinued at management's direction ex. advertising y Fixed Cost $200,000 0 TFC units x 3. Mixed Cost (MC) The sum of total variable cost plus total fixed cost. Methods to separate mixed cost - Least square - Regression - Linear programming - High - low method High - Low Method - VCU = 𝐻𝑖𝑔ℎ𝑒𝑠𝑡 𝑐𝑜𝑠𝑡 − 𝐿𝑜𝑤𝑒𝑠𝑡 𝑐𝑜𝑠𝑡 Highest activity−Lowest activity - TFC = Total cost - total variable cost Mixed Cost y TVC MC $200,000 TFC 0 x units 4. Step Fixed Cost Use when there is an intermittent jump in the fixed cost ex. depreciation - building Step Fixed Cost y c b a 0 units x 5. Step Variable Cost Step variable cost is when variable cost per unit is constant only at a particular point. Step Variable Cost y 5 $ 5 5 0 units Cost Flow Ledger T account 1. Permanent account which consist of - Raw materials inventory control account - Work-in-process inventory control account - Finished goods inventory control account x 2. Temporary account which consist of - Factory payroll control account - Factory overhead control account - cost of goods sold account FOMULAR 1. NI = NET SALES - CGS - OPERATING EXPENSES TAXES 2. CGS = FG. INV. BB + CGM - FG. INV. BB 3. CGM = DM USED + DL + FOH + WIP INV. BB - WIP INV. EB 4. DM USED = RAW MATERAILS USED - IDM 5. RM USED = RM INV. BB + NET PURCHASES - RM INV. EB 6. NET PURCHASES = PURCHASE PRICE + FREIGHT-IN - PRA - PD 7. PURCHASE PRICE = LIST PRICE - TRADE DISCOUNT Income Statement ex. Schedule of Cost of Goods Manufactured ex. Chapter 4 Cost volume profit Relationships Cost volume profit (CVP) analysis is a powerful tool that helps managers understand the relationships among cost , volume , and profit.CVP analysis focuses on how profits are affected by the following five factors: 1. Selling price 2. Sales volume 3.Unit variable costs 4. Total fixed costs 5.Mix of products sold Because CVP analysis helps managers understanding how profits are affected by these key factors, it is a vital tool in many business decisions. These decisions include what products and service to offer, what prices to charge, what marketing strategy to use, and what cost structure to implement. Contribution Margin As explained in the previous chapter, contribution margin is the amount remaining from sales revenue after variable expenses have been deducted. Thus, it is the amount available to cover fixed expenses and then to provide profits for the period. Notice the sequence here-contribution margin is used first to cover the fixed expenses, and then whatever remains goes toward profit. If the contribution margin is not sufficient to cover the fixed expenses, then a loss occurs for the period. Computation of the break-even point is discussed in detail later in the chapter; for the moment, note that the break-even point is the level of sales at which profit is zero Once break-even point has been reached, net operating income will increase by the amount of unit contribution margin for each addition unit sold. CVP Relationship in Equation Form The contribution format income statement can be expressed in equation form as follows: Profit = (Sales – Variable expenses) – Fixed expenses For brevity, we use the term profit to stand for net operating income in equations. When a company has only a single product, as at Acoustic Concepts, we can further refine the equation as follows: Sales = Selling price per unit X Quantity sold = P X Q Variable expenses = Variable expenses per unit X Quantity sold = VXQ Profit = (P X Q – V X Q) – Fixed expenses It is often use full to express the simple profit equation in terms of the unit contribution margin (Unit CM) as follows: Unit CM = Selling price per unot – Variable expenses per unit = P - V Profit = (P X Q – V X Q) – Fixed expenses Profit = (P - V) X Q – Fixed expenses Profit = Unit CM X Q – Fixed expenses Contribution Margin Ratio (CM Ratio) In the previous section, we explored how cost-volume-profit relationships can be visualized. In this section, we show how the contribution margin ratio can be used in cost-volume-profit calculation. As the first step, we have added a column to Acoustic Concepts’ contribution format income statement in which sales revenue, variable expenses, and contribution margin are expressed as a percentage of sales The contribution margin as a percentage of sales is referred to as the contribution margin ratio (CM ratio). This ratio is computed as follows: CM ration = Contribution margin / Sales The relation between profit and the CM ratio can also be expressed using the following equation: Profit = CM ratio X Sales – Fixed expenses Break-Even Analysis Earlier in the chapter we defined the break-even point as the level of sales at which the company’s profit is zero. What we call break-even analysis is really just a special cause of target profit analysis in which the target profit is zero. We can use either the equation method or the formula method or the formula method to solve for the break-even point, but for brevity we will illustrate. The only difference is that the target profit is zero in break-even analysis. Breakeven in Unit Sales In a single-product situation, recall that the formula for the unit sales to attain a specific target profit is: Unit sales to attain the target profit = (Target profit + Fixed expenses) / Unit CM To compute the unit sales to break even, all we have to do is to set the target profit to zero in the above equation as follows: Unit sales to break even = (0+Fixed expenses) / Unit CM Unit sales to break even = Fixed expenses / Unit CM Linking Margin Margin of safety Percentage with Break-Even Percentage Break-even percentage (percentage of sales) through its relationship with the margin of safety percentage is handy and useful, especially when we apply it in multiproduct breakeven analysis in a later section. To prove the relationship, we can define margin of safety percentage in the following: Margin of safety percentage (MoS%) = Margin of safety in dollars / Total sales in dollar = (Total sales in dollar – Breakeven in dollars) / Total sales in dollars = 1 – (Breakeven in dollar/Total sales in dollars) = 1 – Break-even percentage = 1 – BE% Operating Leverage A level is a tool for multiplying force. Using a lever, a massive object can be moved with only a modest amount of force. In business, operating leverage serves a similar purpose. Operating leverage is a measure of how sensitive net operating income is to a given percentage change in dollar sales. Operating leverage acts as a multiplier. If operating leverage is high, a small percentage increase in sales can produce a much larger percentage increase in net operating income The degree of operating leverage at a given level of sales is computed by the following formular: Degree of operating leverage = Contribution margin / Net operating income Chapter 11 Flexible budgets and performance analysis Flexible budget and variance analysis are generic approaches used by many organizations regardless of the costing systems they employ. Many companies will compare their actual results directly with the master and/or rolling budgets. Characteristics of a flexible budget 1. Planning budget is prepared before the period begins and is valid for only the planned level of activity. 2. Flexible budget is an estimate of what revenues and costs should have been, given the actual level of activity for the period. Deficiencies of the static planning budget Rick has identified eight major categories of costs – wages and salaries, hairstyling, supplies, client gratuities, electricity, rent, liability insurance, employee health insurance, and miscellaneous. Client gratuities consist of flowers, candies, and glasses of champagne that Rick gives to his customers while they are in the salon. Rick’s Hairstyle Planning Budget For the month ended March 31 Budgeted client-visits (q) 1000 Revenue ($180.00q) $180000 Expenses: Wages and salaries ($65000+$37.00q) 102000 Hairstyling supplies ($1.50q) Client gratuities ($4.10q) Electricity ($1500+$0.10q) Rent ($28500) Liability insurance ($2800) Employee health insurance ($21300) Miscellaneous ($1200+$0.20q) Total expense Net operating income 1500 4100 1600 28500 2800 21300 1400 163200 $16800 Rick’s Hairstyle Income Statement For the month ended March 31 Actual client-visits Revenue Expenses: Wages and salaries Hairstyling supplies Client gratuities Electricity Rent Liability insurance Employee health insurance Miscellaneous Total expense Net operating income 1100 $194200 106900 1620 6870 1550 28500 2800 22600 2130 172970 $21230 We have considered so far A flexible budget approach recognizes that a budget can be adjusted to show what costs should be for the actual level of activity. Preparing the report is straightforward. The cost formula for each cost is used to estimate what the cost should have been for 1100 client-visits—the actual level of activity for March. Activity Variances Part of the discrepancy between the budgeted profit and the actual profit is due to the fact that the actual level of activity in March was higher than expected. Therefore, the differences between the planning budget and the flexible budget show what should have happened solely because the actual level of activity differed from what had been expected. Revenue and spending variances In the last section we answered the question “What impact did the change in activity have on our revenues, costs, and profit?” In this section we will answer the question “How well did we control our revenues, our costs, and our profit?” Performance reports in nonprofit organization The performance reports in nonprofit organizations are basically the same as the performance reports we have considered so far – with one prominent difference. Nonprofit organizations usually receive a significant amount of funding from sources other than sales. Performance reports in cost centers Performance reports are often prepared for organizations that do not have any source of outside revenue. In particular, in large organization a performance report may be prepared for each department- including departments that do not sell anything to outsides. Because the managers in these departments are responsible for costs, but not revenues, they are often called cost centers. Flexible budgets with multiple cost drivers Rick’s Hairstyle Flexible budget For the month ended March 31 Actual client-visits (q1) Actual hours of operation (q2) Revenue (180.00q1) Expenses: Wages and salaries ($65000+$220q2) Hairstyling supplies ($1.50q1) Client gratuities ($4.10q1) Electricity($390+$0.10q1+$6.00q2) Rent ($28500) Liability insurance ($2800) Employee health insurance ($21300) Miscellaneous ($1200+0.20q1) Total expense Net operating income 1100 185 $198000 105700 1650 4510 1610 28500 2800 21300 1420 167490 $30510 Chapter 11 Standard costs and operating performance measures Performance measurement can be helpful in an organization. It can provide feedback concerning what works and what does not work, and it can help motivate people to sustain their efforts. Standard costs – Management by exception Standard are widely used in managerial accounting where they relate to the quantity and cost of inputs used in manufacturing goods or providing services. Quantity and price standards are set for each major input such as raw materials and labor time. Quantity standards specify how much of an input should be used to make a product or provide a service. Price standards specify how much should be paid for each unit of the input. Actual quantities and actual costs of inputs are compared to these standards. This process is called management by exception. Setting Standard costs Setting price and quantity standards ideally combined the expertise of everyone who has responsibility for purchasing and using inputs. However, the standards should be designed to encourage efficient future operation, not just a repetition of past operation that may or may not have been efficient. Setting direct materials standards The standard price per unit for direct materials should reflect the final, delivered cost of the materials, net of any discounts taken. Purchase price, top-grade pewter ingots, in 40-pound ingots $3.85 Freight, by truck, from the supplier’s warehouse 0.24 Less purchase discount (0.09) Standard price per pound $4.00 Setting direct labor standards Direct labor price and quantity standards are usually expressed in terms of a labor rate and labor-hours. Basic wage rate per hour Employment taxes at 10% of the basic rate Fringe benefits at 30% of the basic rate Standard rate per direct labor-hour $10.00 1.00 3.00 $14.00 Price and quantity variances A price variance is the difference between the actual price of an input and its standard price, multiplied by the actual amount of the input purchased. A quantity variance is the difference between how much of an input was actually used and how much should have been used and is stated in dollar terms using the standard price of the input. Materials price variance—A closer look A material price variance measures the difference between what is paid for a given quantity of materials and what should have been paid according to the standard. Materials price variance = (AQ x AP) – (AQ x SP) Advantages of standard costs 1. Standard costs are a key element in a management by exception approach. If costs conform to standards, managers can focus on other issues. When costs are significantly outside the standards, managers are alerted that problems may exist that require attention. This approach helps managers focus on important issues. 2. Standards that are viewed as reasonable by employees can promote economy and efficiency. They provide benchmarks that individuals can use to judge their own performance. 3. Standard costs can greatly simplify bookkeeping. Instead of recording actual costs for each job, the standard costs for direct materials, direct labor, and overhead can be charged to jobs. 4. Standard costs fit naturally in an integrated system of “responsibility accounting.” The standard establish what costs should be, who should be responsible for them, and whether actual costs are under control.