acc_310f_exam_2_studyguid

Ch. 10 Budgetary Control and Responsibility Accounting &

Ch. 11

(p. 254-256)

Standard Costs and Balanced Scorecard

A grade report helps illustrate how successful you are as a student. In this section, you’ll learn how to organize and interpret various reports that a company can use to help determine how successful it has been at meeting specific objectives. In many respects, this is a conclusion to the budgeting concepts addressed earlier in the semester. The budget is the plan; the performance report is the actual result as well as a tool to help improve future performance.

One of management’s major functions is to control company operations; control consists of the steps taken by management to see that planned objectives are met.

Budgetary control: the use of budgets in controlling operations; such control takes

Place by means of budget reports that compare actual results

With planned objectives

Budgetary Control Activities

1.

Develop budget

2.

Analyze differences between actual and budget and determine their causes

3.

Take corrective action

4.

Modify future plans

Static budget: a projection of the budget data at one level of activity

-these budgets do not consider data for different levels of activity; as a result, companies always compare actual results w/ budget data at the activity level that was used in developing the master budget

-data are not modified or adjusted, regardless of changes in activity

-appropriate for fixed manufacturing costs and for fixed selling and

administrative expenses

- *A static budget is not useful for performance evaluation if a company has substantial variable costs

Static Budget Report

June

Sales (in units)

Budget Actual Variance

30,000 32,000 2,000 F

(favorable)

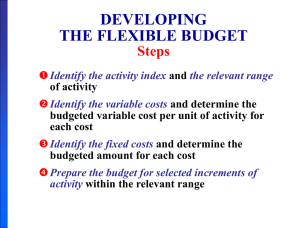

Flexible budget: projects budget data for various levels of activity; the flexible

budget is a series of static budgets at different levels of activity.

-recognizes that the budgetary process is more useful if it is adaptable to

changed operating conditions; can be prepared for each of the types of

budgets included in the master budget

-ex. Marriott Hotels – can budget revenues and net income based on

60%, 80%, and 100% room occupancy

American Van Lines – can budget its operating expenses based on

various levels of truck miles driven

-EX. Barton Steel Company plans a manufacturing overhead budget for 2010 (static) budget based on a production volume of 10,000 units of steel; BUT, the company ends up selling 12,000 units instead (would mean higher profit = good). HOWEVER, a comparison of the actual and budgeted costs shows an unfavorable difference. This is because the comparison uses budget data based on the original activity level of

10,000 units of steel. The budget data are not relevant because at the time the budget was developed, the company only planned on 10,000 units being produced

not 12,000.

**comparing actual with budgeted variable costs is meaningless; As product-

ion increases, the budget allowances for variable costs should increase pro-

portionately

-variable costs for Steel Company: indirect materials, indirect labor, utilities

So, use the budget data for the costs at 10,000 to create Variable Costs per Unit at

10,000 units and then use the per unit costs to calculate the Budgeted Variable Costs at 12,000 units (will give you the budgeted costs at 12,000 units for the flex. Budget report). Then use that to create a Flexible Budget Report between the actual costs at

12,000 units and the budgeted costs at 12,000 units. –See pg. 208-209

Flexible Budget Reports

1) production data for a selected activity index, such as direct labor hours or units or production

2) cost data for viable and fixed costs

The report provides a basis for evaluating a manager’s performance in production

control and cost control

See next page for the example of making a flexible budget report from the notes

Original Budget - here the original (master budget) is given and shows expected unit volume to be 30,000. The budget column is used to calculate Variable Costs per Unit. The actual column shows actual unit volume of 32,000 units and the costs with it (given info. not calculated). *We must create a flexible budget for 32,000 units to compare and not 30,000.

Per unit

June

Budget Actual (Given) Variance

Unit Volume

Variable costs

Spice Mix (DM)

Bags (DM)

Russet Potatoes (DM)

Boyd, Stanton (DL)

Dolan, Joseph (DL)

Karlin, Jerry (DL)

Corn Oil (OH)

Utilities (OH)

Fixed costs

Rent on Factory (OH)

Rent on Equipment

(OH)

30,000

600/30,000= 0.02 600

0.04 1,200

0.42 12,600

0.06

0.06

1,800

1,800

0.07

0.05

0.10 n/a

2,100

1,500

3,000

5,400 n/a 900

32,000

645

1,280

15,440

1,800

2,160

2,240

1,450

3,225

5,400

1,100

Total costs 30,900 34,740

Flex Budget – We used the per unit calculated in the original budget to make a new flex budget for 32,000 units instead of 30,000 units. We then compared the actual and budgeted costs to find the variance.

June

Per unit Budget Actual (given) Variance

Unit Volume

Variable costs

Spice Mix (DM)

Bags (DM)

Russet Potatoes (DM)

Boyd, Stanton (DL)

Dolan, Joseph (DL)

Karlin, Jerry (DL)

Corn Oil (OH)

Utilities (OH)

Fixed costs

Rent on Factory (OH)

Rent on Equipment (OH)

Total costs

0.02

32,000

(32,000)(x)

640

0.04

0.42

0.06

1,280

13,440

1,920

0.06

0.07

0.05

0.10 n/a n/a

1,920

2,240

1,600

3,200

5,400

900

32,540

32,000

645 5 U

1,280

15,440 2,000 U

1,800 120 F

2,160 240 U

2,240

1,450 150 F

3,225 25 U

5,400

1,100 200 U

34,740 2,200 U

0

0

0

Responsibility Accounting: involves accumulating and reporting costs (and revenues, where relevant) on the basis of the manager who has the authority to make the day-to-day decisions about the items; under responsibility accounting, a manager’s performance is evaluated on matters directly under that manager’s control

-gives managers responsibility for controllable costs at each level of authority

controllable: a cost over which a manager has control; costs incurred directly by a level of responsibility are controllable costs at that level

1) all costs are controllable by top management b/c of the broad range of its authority

2) Few costs are controllable as one moves down to each lower level of man- gerial responsibility because of the manager’s decreasing authority

noncontrollable: costs incurred indirectly and allocated to a responsibility level

are noncontrollable costs at that level

Responsibility Centers: (cost, profit, investment) these classifications indicate the degree of responsibility the manger has for the performance of the center

1)Cost center: incurs costs (and expenses) but does not directly generate revenues (usually either production or service departments)

- Ex. Ford Motor Company; welding, painting, and assembling depart. are production departments; Ford’s maintenance, cafeteria, and human resources depart. are service departments (all are cost centers)

Managers of cost centers have the authority to incur costs; they are evaluated on their ability to control costs

2) Profit center: incurs costs (and expenses) and also generates revenues

(usually include the individual departments of a retail store, such as clothing, furniture, and automotive products, and branch offices of banks)

Mangers of profit centers are evaluated on the profitability of their centers

3) Investment center: incurs costs (and expenses) and generates revenues ; and has control over decisions regarding the assets available for use

- Mangers of investment centers are evaluated on both the profitability of the center and the rate of return earned on the funds invested

- often associated w/ subsidiary companies

-return on investment (ROI): a useful performance measurement because

it shows the effectiveness of the manager in

utilizing the assets at his or her disposal

-the primary basis for evaluating performance of a manager of an investment center

ROI = Controllable Margin

Avg. Operating Assets

-Both factors in the formula are controllable by the investment center manager

1)operating assets: consists of current assets and plant assets used in opera-

tions by the center and controlled by the manager;

Average operating assets: usually based on the cost or book

value of the assets at the beginning

and end of the year

2)controllable margin: fixed costs controllable by the manager; all fixed

costs are controllable by its manager

Behavioral Principles: the human factor is critical in evaluating performance

1.

Managers of responsibility centers should have direct input into the process of establishing budget goals of their area of responsibility

2.

The evaluation or performance should be based entirely on matters that are controllable by the manager being evaluated

3.

Top management should support the evaluation process

4.

The evaluation process must allow managers to respond to their evaluations

5.

The evaluation should identify both good and poor performance

Reporting Principles: pertain primarily to the internal reports that provide the basis for evaluating performance; performance reports should:

1.

contain only data that are controllable by the manager of the responsibility center

2.

provide accurate and reliable budget data to measure performance

3.

highlight significant differences b/w actual results and budget goals

4.

Be tailor-made for the intended evaluation

5.

Be prepared at reasonable intervals

Balanced Scorecard

Most companies recognize that both financial (dollars) and nonfinancial measures can provide useful insights into what is happening in the company; use broad-based approach, called a balanced scorecard to evaluate performance

-incorporates financial and nonfinancial measures in an integrated system that links performance measurement and a company’s strategic goals; evaluates company performance from a series of “perspectives”

1.

Financial Perspective: net income; financial measures of performance

2.

Customer Perspective: customer satisfaction; from viewpoint of the consumers; shows how well company compares to competitors in price, quality, product innovation, customer service, etc.

3.

Internal Process Perspective: stock outs; internal operating processes critical to success; ensure company is operating effectively and efficiently

4.

Learning and Growth Perspective: training hours; how well company develops and retains its employees; employee skills, employee satisfaction, training programs