Z. STUDY GUIDE--FISCAL & MONETARY POLICY

advertisement

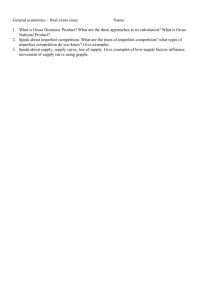

Name __________________________________________________ Government and the Economy: Budget, Fiscal & Monetary Policy Unit Test Review Multiple Choice & Free Response/Graphing –__________________________________ FORMAT: Test will cover all lectures, handouts, current events. This test will have many graphs on both sections of the test Free Response Format: You will have 2 economic problems to solve using either fiscal or monetary policy You will have to draw 1 or 2 graphs to solve the economic problem depending on the nature of your policy. -Monetary Policy- requires 2 graphs to solve a policy (money market & Aggregate demand/supply) -Fiscal Policy- requires only 1 graph to solve policy (aggregate demand/supply) You will need to analyze the affect of your policy over the short and long run and state the opportunity costs/benefits of your approach! See practice test on website to check your understanding! 1) Identify and define the 4-types of unemployment _______________---_______________________________ _____________---_____________________________________ _______________---_______________________________ _____________---_____________________________________ Which 2 can the U.S. Gov’t influence most? Why?_________________________________________________________________________ __________________________________________________________________________________________________________________ 2) List & Define the 3-types of inflation. Explain what causes each one? _________________________ --- ______________________________________________________________________ _________________________ --- ______________________________________________________________________ _________________________ --- ______________________________________________________________________ 3) Explain what full employment means to an economist. What economic problem can occur when the unemployment rate falls below this level? Where on the AS curve symbolizes full employment? ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ 4) Identify & define the 3 general categories of taxes (i.e. progressive, etc.): progressive --- ______________________________________________________________________ _________________________ --- ______________________________________________________________________ _________________________ --- ______________________________________________________________________ 5) How would a Classical Economist respond different to a recession than a Keynesian Economist? Why? ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ 6) What was the total amount that the U.S. government spent in the most recent year we have figures for? $______________________ How much tax revenue did the U.S. government collect in the most recent year we have figures for? $______________________ What was the budget deficit in the most recent year we have figures for? $______________________ 7) What is meant by an “entitlement” program? ______________________________________________________________________ ___________________________________________________________________________________________________________ 8) Identify/define the 3 main entitlement programs, and the dollar amount and the percentage of the overall budget each one makes up. Entitlement Program 9) Description of Program $ Amount Spent in the most recent year we have figures for % of Overall Federal Budget Explain why entitlement spending will be increasing so rapidly in the future. 10) Identify/define the two largest single non-entitlement components of the federal budget, and the dollar amount and the percentage of the overall budget each one makes up. % of Overall Federal Budget Program $ Amount Spent in the most recent year we have figures for 11) How is the federal debt related to federal deficits? What is the dollar amount of the current federal debt? ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ 12) Explain very precisely how the Federal Government raises money to cover deficit spending when it chooses not to raise taxes or cut government spending: _____________________________________________________________________________________________________________ _____________________________________________________________________________________________________________ 13) What is the theory of “crowding out”? Why is crowding out a potential risk of excessive expansionary fiscal policy? _______________________________________________________________________________________________ _______________________________________________________________________________________________ _______________________________________________________________________________________________ _______________________________________________________________________________________________ 14) What are the 2-Types of FISCAL Policy and the goal of each? Type 1: _________________________________________ Goal: _________________________________________ Type 2: _________________________________________ Goal: _________________________________________ 15) What are the 2 Tools of FISCAL Policy? Tool 1: ______________________________________ Tool 2: ___________________________________________ 16) AD/AS MODEL: a. Draw an aggregate demand (AD) curve and an aggregate supply (AS) curve illustrating an economy that has strong (but not too strong) GDP growth and moderate inflation. b. Label the axes 17) List the 2-Types of MONETARY Policy and the goal of each. Type 1: _________________________________________ Goal: _________________________________________ Type 2: _________________________________________ Goal: _________________________________________ 18) Identify and describe the 2-Tools of MONETARY Policy (one main tool and one minor tool)? Minor Tool: ______________________---_________________________________________________________________ Major Tool: __________________________---________________________________________________________________________ By what specific means/mechanism does the Fed wield the above major tool? ___________________________________________ 19) Explain precisely why lower interest rates will normally cause Aggregate Demand to shift to the right? For what reason would the Federal Reserve lower interest rates (that is, the Federal Funds Rate)? _______________________________________________________________________________________________________ _______________________________________________________________________________________________________ _______________________________________________________________________________________________________ 20) First, draw the MONEY MARKET GRAPH: Demand for Money and Supply of Money. Label the axes. Second, draw an aggregate demand (AD) curve and an aggregate supply (AS) curve illustrating an economy with high demandpull inflation where the circular flow is moving too fast. Again, label the axes. Explain why the Money Supply curve is a vertical line._______________________________________________________ What specifically would the Fed do (buy or sell Treasury bonds) to address this situation? __________________________ Would the above policy be an example of loose or tight monetary policy? _____________________________________ Which way would Money Supply shift during monetary policy? ___________________________ On the graphs below, show graphically what effect such policy would have on the federal funds rate and what effect it would have on Aggregate Demand: MONEY MARKET GRAPH AD/AS GRAPH 21) Explain the economic logic of a progressive income tax system a. Explain one potential problem if an income tax system becomes too progressive. (think about GDP growth!) ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ 22) Identify five specific taxes that some level of government collects to raise money for its various functions, then identify what level of government imposes those taxes (national, state, local) , and identify if each tax is progressive, proportional, or regressive. Specific tax Example: Social Security tax 1. Level of Gov’t that collects the tax (national, state, and/or local government National government Type of tax: progressive, proportional, or regressive Proportional/flat 2. 3. 4. 5. 23) Describe the structure of the Federal Reserve System How many Governors are there on the Federal Reserve Board of Governors? _________ How long are their terms of office? __________________ How is the Federal Open Market Committee (FOMC) related to the Board of Governors and what is its main power? ________________________________________________________________________________________________________ How many Federal Reserve District Banks are there? _________________ 24) What are the two primary goals/responsibilities of the Federal Reserve/monetary policy? ________________________________________________ and __________________________________________________ 25) Explain exactly what the Federal Funds rate is. ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ 26) For an economy that has an 11% unemployment rate and a -6.5% GDP growth rate Draw an aggregate demand (AD) curve and an aggregate supply (AS) curve illustrating this economy (label your axes) Demonstrate how the AD curve would shift if you used “expansionary” fiscal policy? What two specific fiscal policy actions would Congress take in this situation? __________________________ and _________________________________ 27.GDP growth has been +5.5% & +6.0% the last 2 quarters. Unemployment is at 2%, consumer confidence is at a 10-year high. The inflation rate is 5.8% As a member of CONGRESS, formulate a policy that will address this problem. A. Draw the Aggregate Demand Curve and the Aggregate Supply Curve that reflects the state of this economy. B. Label each axis of your graph. C. Explain in words what specific policy tools you will use. Be sure to explain the specific effects you expect from the actions you propose. D. Illustrate the change Graphically [Label any new curves AD2 or AS2] 28. GDP growth has been -1.5% & -2.0% the last 2 quarters. Unemployment is at 8%, consumer confidence is at a 10-year low, Auto and home sales are declining. The inflation rate is -0.4%. As a MEMBER OF THE FEDERAL RESERVE, what policy would you implement in this economy? A. Draw the Aggregate Demand Curve/Aggregate Supply Curve that reflects the state of this economy. Label each axis of your graph. B. Use Monetary Policy ONLY to solve this economic problem. Explain your Monetary Policy plan in writing Explain in writing the specific actions the Fed needs to take to implement this policy C. Illustrate the change graphically with 2-graphs (Money Market Graph + AD/AD Graph) MONEY MARKET GRAPH AD/AS GRAPH __________________________________________________________________________________________________________________ __________________________________________________________________________________________________________________ __________________________________________________________________________________________________________________ __________________________________________________________________________________________________________________ __________________________________________________________________________________________________________________ 29. What is a country’s debt-to-GDP ratio? _________________________________________________________________________________ 30. For context, what is the European Union’s debt-to-GDP limit? ______________________________ What is the U.S.’s debt-to-GDP ratio? ______________ France’s ____________ Greece’s _____________ Japan’s _____________ 31. What exactly is meant by “austerity measures?” ________________________________________________________________________ __________________________________________________________________________________________________________________ __________________________________________________________________________________________________________________ 32. Why has Greece been forced to impose austerity measures? _______________________________________________________________ __________________________________________________________________________________________________________________ __________________________________________________________________________________________________________________ 33. How are short-term interest rates (the Federal Funds Rate) different from long-term interest rates? What factor most strongly affects short term rates and what factor most strongly affects long term rates? ______________________________________________________________ __________________________________________________________________________________________________________________ __________________________________________________________________________________________________________________ 34. To avoid eventual bankruptcy, what are five specific austerity measures to which the U.S. could/may have to resort? a. _________________________________ b. __________________________________ c. __________________________________ d. ___________________________________ e. ___________________________________ 35. Why should one expect a time lag when the government uses fiscal or monetary policy? __________________________________________________________________________________________________________________ __________________________________________________________________________________________________________________ 36. What is the difference between “discretionary spending” and “mandatory spending?” __________________________________________________________________________________________________________________ __________________________________________________________________________________________________________________ __________________________________________________________________________________________________________________ 37. What is the difference between a “structural” deficit and a “cyclical” deficit? Which of these is the U.S. confronting currently? __________________________________________________________________________________________________________________ __________________________________________________________________________________________________________________ __________________________________________________________________________________________________________________