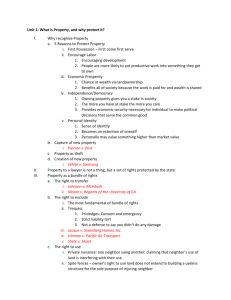

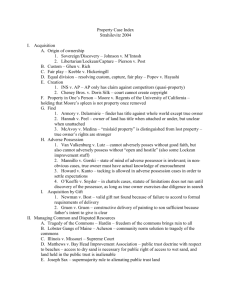

Chapter 1 – Justifications for Allocation of Property

advertisement