SPED582_Performance_Based_Assessment__2_

advertisement

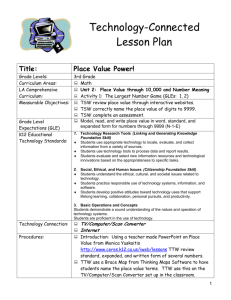

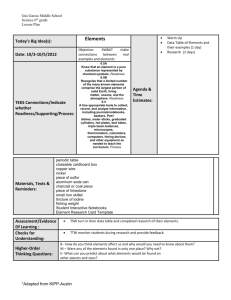

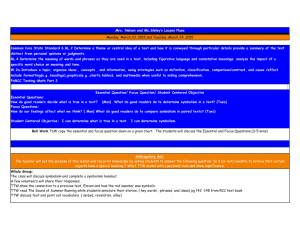

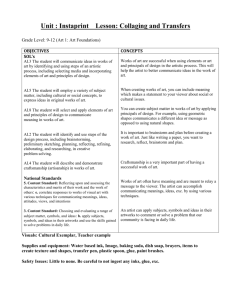

Name: Lisa Renee Payne Subject/Grade level: Budgeting/Economics School: Alabama School for the Deaf Group Size: 3 Intended Class: This performance-based assessment is intended for a 7th grade Civics/Economics class. Students will have completed instruction in basic economics, budgeting, and banking skills. Goals: 1. TSW be able to develop a personal budget listing 5 needs and 5 wants. 2. TSW be able to demonstrate an understanding of banking services by making deposits, making withdrawals, using automatic funds transfers, writing checks, and reconciling activities. 3. TSW determine which items to include on a shopping list through the use of comparison shopping. ALCOS: 7.8 Apply principles of money management to the preparation of a personal budget that addresses housing, transportation, food, clothing, medical expenses, and insurance as well as checking and savings accounts, loans, investments, credit, and comparison shopping. Objectives Assessment Following instruction in budgeting, needs, and wants, TSW develop a personal budget including 5 needs and 5 wants, given a salary and estimating the cost of their chosen needs and wants from newspaper and on-line advertisements with 100% accuracy. Following instruction in banking services (deposits, withdrawals, and checks), TSW make 2 deposits, make 3 withdrawals, write 5 checks, document 1 automatic funds transfer, and complete reconciliation of all activities with 70% accuracy given the information for each event from a word problem based on their personal budget. Following instruction in comparison shopping, TSW develop a shopping list of 20 grocery items either from a newspaper flyer or an online advertisement while staying within the amount from their personal budget with 100% accuracy. Submission of personal budget. Observation of independent work. Submission of deposit slips, checks, withdrawal slips, and reconciliation form. Observation of independent work. Submission of shopping list. Observation of independent work. Procedures TTW gather materials needed for the lesson. TTW prepare worksheets, forms, and documents needed for the lesson. TTW ensure access to technology as needed. TTW provide students a rubric with expectations and due dates listed. TTW provide students a folder to collect all work. TTW provide students with a rubric to explain the expectations of the project. TTW provide students with a calendar to help them set up a schedule of expected due dates of each stage of the project. Materials & Resources Blank personal budget sheet Career Card (1 per student) Newspaper advertisements and access to on-line advertisements for wants and needs: Websites for NEEDS (Classifieds) http://www.dailyhome.com http://www.al.com/birminghamnews/ http://www.al.com Websites for WANTS http://www.walmart.com http://www.target.com http://www.aeropostale.com http://www.gap.com http://www.petco.com http://www.sears.com http://www.jcp.com Calculator Deposit slips (2 per student) Checks (5 per student) Withdrawal slips (3 per student) Reconciliation form (1 per student) Word Problem with details for completing deposits, withdrawals, checks, and electronic funds transfers. On-line spreadsheet for creation of shopping list. Copies of grocery store advertisements or an iPad or computer with internet access to research grocery store advertisements Websites for Grocery Store Items http://www.publix.com http://www.walmart.com http://www.pigglywiggly.com http://www.winndixie.com Rubric of expected goals to be achieved. Calendar of anticipated due dates for each stage of the project. White board and markers PowerPoint and SmartBoard with rubric and project expectations Rubric Expectations Calendar Personal Budget Worksheet Career Card Folder for collecting work Calculator White board and markers Day 1 Engage: TTW open the lesson by asking TS why budgets are important. TTW wait for TS to respond. TTW write TS responses on the board and expound on responses as needed. TTW ask TS how they keep up with how much money they use every week. TTW wait for TS to respond. TTW write TS responses on the board and expound on responses as needed. TTW ask how students can be sure they stay “on budget”. TTW wait for TS to respond. TTW write TS responses on the board and expound on responses as needed. To conclude the review of information, TTW say, “we will work on a project to combine budgeting, checking, and comparison shopping.” Day 1 Explore: TTW provide TS with a rubric explaining the project. TTW provide TS with a calendar on which TS will fill in the expected due dates of each stage of the project. TTW review the expectations of the project. TTW answer any questions and clarify any misunderstandings from TS. TTW provide TS with a blank Personal Budget worksheet. TTW provide TS with a random Career Card which lists a career and salary. TTW remind the student that we have wants and needs. TTW tell TS to make a list of 5 wants and 5 needs for their Personal Budget sheet. TTW remind TS not to forget the important NEEDS we have. TTW remind TS to stay within their salary as they develop their budgets. TSW use newspaper and on-line advertisements to calculate and estimate costs of their Needs and Wants to develop their Personal Budgets. TSW use a calculator to verify that they are not over budget. TSW place their completed budget, calendar, and rubric in their folder at the end of the day. Extension as time or ability levels allow: TSW include photos of homes, cars, and other purchases they choose on their budget sheet. TSW develop a budget which includes pet expenses, child expenses, or other “life” expenses. Days 2-3 Engage: TTW distribute TS folders from Day1. TTW remind TS that budgets are an important part of daily lives, but they are only a small part. TTW ask TS “What do we do after we have a budget?” TTW wait for TS to respond. (Make purchases, spend money, use the money, etc.) TTW ask “What are some ways we use the money from our budget?” TTW wait for TS to respond. (cash, checks, debit, credit, etc.) Days 2-3 Explore: TTW say, “We have practiced making deposits and withdrawals, writing checks, using automatic payments, and reconciling checking accounts. Now, using your personal budget from yesterday, you will make 2 deposits, write 5 checks, make 3 withdrawals, document 1 automatic funds transfer, and complete reconciliation of all these Day 1 folders o Calendar o Rubric o Personal Budget form 2 Deposit Slips 5 Checks 3 Withdrawal Forms Reconciliation Form activities. I will give you all the documents you need to do this work, you just need to use your Personal Budget from yesterday.” TTW remind students to refer back to the rubric to make sure they complete all the steps, and to follow along with their calendar to make sure they stay on track. TTW walk around the room to ensure TS are on task and to assist with any technical problems which may be encountered. Extension as time or ability levels allow: TSW include justification for expensive purchases and optional purchases for expenses they would like to reconsider. TSW set up an Option A and Option B set of purchases. Option A would be their “dream” purchases and Option B would be their purchases given a minimum wage job. TSW write a paragraph explaining how they can achieve their goals regardless of their job type. (Setting up and staying on a budget). Day 4 Engage: TTW explain that TS have set up a budget and used a checking account. TTW ask TS “How do you make sure you stay within your budget?” TTW wait for TS to respond, write answers on the board and expound as needed (comparison shopping). TTW remind TS that they have practiced comparison shopping techniques. TTW say “Now, you will use your comparison shopping skills to write a grocery list. Be sure to follow the specifics in your rubric. You will key your grocery list in on an Excel spreadsheet, which, as you remember, will allow you to do your calculations easier.” Day 1 Folder o Personal Budget o Calendar Day 4 Explore: TSW use a spreadsheet to key in a list of 20 grocery items. The items must meet the specifications from the list on the student rubric. TSW use comparison shopping to ensure they stay within the personal budget they set on Day 1. TSW have access to newspaper advertisements, iPads, and computers with internet access to review costs for various items from local vendors. o Rubric Excel spreadsheet with calculations Newspapers with grocery store advertisements iPads and computers with internet access Extension as time or ability levels allow: TSW purchase items required for a planned meal instead of a general list. TSW write a paragraph explaining how local vendors impact the community through sales tax. Accommodations: TTW communicate via voice and manual communication to ensure D/HOH students receive adequate instruction. TTW provide additional vocabulary assistance through modeling, scaffolding, worksheets, flashcards, and other activities to D/HOH and ADD/ADHD students as needed to clarify any misunderstandings that may occur. TTW use visual aids to help reinforce concepts for the D/HOH, ADD/ADHD, and VI students. TTW incorporate technology to provide the D/HOH, ADD/ADHD, and VI students with opportunities for hands on learning to keep them actively engaged. TTW provide extension activities for students who are Gifted or who need additional challenges to help provide more detailed learning opportunities. Grade 7 - Budgeting/Economics Personal Budget Worksheet Name:_____________________________________Date:_________________ SALARY: $_____________________ Want/Need Description Need Groceries Purchased From Piggly Wiggly Cost BALANCE $200.00 $800.00 For a house payment given the cost of a house, use 5% of the total cost of the house as your monthly payment (i.e., a $150,000.00 house would be a $750.00 payment). For a car payment given the cost of a car, use 2% of the total cost of the car as your monthly payment (i.e., a $15,000.00 car would be a $300.00 payment). For your insurance payment, use 1% of the total cost of your house and/or car divided by 12 for your monthly payment (i.e. a $150,000.00 house would be ($150,000.00 x 1%)/12=$125) Career Card: Career Card: High School Teacher and Coach Bus Driver Married, No Children Married, No Children Monthly Salary: $3,000 Spouse’s Weekly Salary: $600 Weekly Salary: $700 Spouse’s Weekly Salary: $600 You are a married teacher. You and your spouse work full time. This week you will deposit your monthly salary and your spouse’s weekly salary. You will pay your car payment and house payment and you will write a check for both of them. You will also buy groceries and clothes. You will write a check for both of them. Then you had to go to the doctor, you wrote a check to the doctor too. You set up an automatic funds transfer for your car insurance. It comes out this week. You went to the ATM this week and made 3 withdrawals for 3 wants on your list. Reconcile your sheet using this information, your Personal Budget sheet from Day 1, and a calculator. You are a married bus driver. You and your spouse work full time. This week you will deposit your weekly salary and your spouse’s weekly salary. You will pay your car payment, groceries, and water bill and you will write a check for all 3 of them. You will also buy gas and medicine. You will write a check for both of them. You set up an automatic funds transfer for your credit card bill. It comes out this week for $25. You went to the ATM this week and made 3 withdrawals for 3 wants on your list. Reconcile your sheet using this information, your Personal Budget sheet from Day 1, and a calculator. Career Card: Secretary Part-time Sales Clerk Not Married, No Children Career Card: Machine Operator Not Married, No Children Weekly Salary: $700 Sales Clerk Weekly Salary: $100 Weekly Salary: $700 You are a secretary and a part-time sales clerk. This week you will deposit your weekly salary for both jobs. You will pay your car payment and rent and you will write a check for both of them. You will also buy groceries and clothes. You will write a check for both of them. Then you write a check for your utility bill of $75. You set up an automatic funds transfer for your phone bill. It comes out this week for $85. You went to the ATM this week and made 3 withdrawals for 3 wants on your list. Reconcile your sheet using this information, your Personal Budget sheet from Day 1, and a calculator. You are a machine operator. This week you will deposit your weekly salary. You will pay your rent and groceries. You will write a check for both of them. You will also pay 2 credit card payments. You will write a check for both of them at $25 each. Then you write a check for your rent. You set up an automatic funds transfer for your car payment. It comes out this week. You went to the ATM this week and made 3 withdrawals for 3 wants on your list. Reconcile your sheet using this information, your Personal Budget sheet from Day 1, and a calculator. Checking Account Reconciliation Form Name:_______________________________________Date:________________ Number Date Item Description Payment, Deposit Fee, , Credit Withdrawal Balance 101 1/2/12 Wal-Mart groceries $150.00 $500 Shopping List Name:_____________________________Date:____________ This is a shopping list for a week. Your shopping list should include 20 items. The total cost of the 20 items should remain within the budget you set on your Personal Budget sheet on Day 1. Be sure to include items from the following groups, but the exact items from each group are your decision. CATEGORIES Breakfast items (enough for 5 days) Lunch items (enough for 5 days) Dinner items (enough for 5 days) Snacks Drinks Fruits and/or vegetables (2 servings) Other…. After you have made your selections, enter your choices on an excel spreadsheet using the following format: Category Breakfast Fruits/Vegetables Lunch Breakfast Item Purchased Description from Cost Pop Tarts Apples Salad Kit (2) Eggs Progresso Soup Lunch (4 cans) Michelina’s Microwave Lunch Meals Dinner Pizza Dinner Chicken Alfredo Drinks Bottled Water REMAINING BALANCE Wal-Mart Piggly Wiggly Winn Dixie Wal-Mart $2.50 $4.95 $3.95 $2.50 Publix $5.00 Publix Publix Wal-Mart K-Mart $2.50 $5.00 $5.00 $3.50 $65.10 Budgeting Performance Assessment Rubric Name:______________________________________Date:_______________ Objective 10 Points 8 Points 6 Points 4 Points 2 Points Personal Budget Worksheet – Develop a budget given a salary The student will develop a complete budget including 5 needs (housing, transportation, food, clothing, medical expenses, savings, and insurance) and 5 wants (entertainment, credit cards, grooming, cell phones) given a salary. The cost of needs and wants is estimated from newspaper and on-line advertisements without going over budget based on the given salary with 100% accuracy. The student makes 2 deposits, makes 3 withdrawals, writes 5 checks, and documents 1 automatic funds transfer, completing all 11 activities with 100% The student will develop a budget including 3-4 needs (housing, transportation, food, clothing, medical expenses, savings, and insurance) and 5 wants (entertainment, credit cards, grooming, cell phones) given a salary. The student will develop a budget including 5 needs (housing, transportation, food, clothing, medical expenses, savings, and insurance) and 3-4 wants (entertainment, credit cards, grooming, cell phones) given a salary. The student will develop a budget including 2-4 needs (housing, transportation, food, clothing, medical expenses, savings, and insurance) or 2-4 wants (entertainment, credit cards, grooming, cell phones) given a salary. The cost of needs and wants is estimated from newspaper and on-line advertisements going over budget based on the given salary by $20$40. The cost of needs and wants is estimated from newspaper and on-line advertisements going over budget based on the given salary by $41$60. The cost of needs and wants is estimated from newspaper and on-line advertisements going over budget based on the given salary by $61$80. The student will develop a budget including less than 2 needs (housing, transportation, food, clothing, medical expenses, savings, and insurance) or less than 2 wants (entertainment, credit cards, grooming, cell phones) given a salary. The cost of needs and wants is estimated from newspaper and on-line advertisements going over budget based on the given salary by more than $80. The student makes 2 deposits, makes 3 withdrawals, writes 5 checks, and documents 1 automatic funds transfer, completing 910 activities with 80%-90% The student makes 1 deposit, makes 2 withdrawals, writes 4 checks, and documents 1 automatic funds transfer, completing 8-9 activities with 70-80% accuracy. The student makes 1 deposit, makes 1 withdrawal, writes 2 checks, and documents 1 automatic funds transfer, completing 7-8 activities with 60-70% accuracy. The student makes 1 deposit, makes 1 withdrawal, writes 1 check, and documents 1 automatic funds transfer, completing less than 7 activities with less than 60% accuracy. Banking Services – Deposits, Withdraw als, Checks, EFT, and Reconcilia tion completed TOTAL / NOTES Shopping List in Excel formatted with Calculatio ns accuracy. The student completes reconciliation of all activities with 100% accuracy. accuracy. The student completes reconciliation of activities with 80-90% accuracy. The student completes reconciliation of activities with 70-80% accuracy. The student completes reconciliation of activities with 60-70% accuracy. The student completes reconciliation of activities with less than 60% accuracy. The student will develop a shopping list of 20 grocery items. The student will develop a shopping list of 16-19 grocery items. The student will develop a shopping list of 12-16 grocery items. The student will develop a shopping list of 8-11 grocery items. The student will develop a shopping list of less than 8 grocery items. The student will develop a shopping list of items from at least 7 categories including: breakfast, lunch, dinner, snacks, drinks, fruits/vegetab les, and other items with 100-90% accuracy. The student will develop a shopping list of items from at least 6 categories including: breakfast, lunch, dinner, snacks, drinks, fruits/vegetab les, and other items with 90-80% accuracy. The student will develop a shopping list of items from at least 5 categories including: breakfast, lunch, dinner, snacks, drinks, fruits/vegetab les, and other items with 80-70% accuracy. The student will develop a shopping list of items from at least 4 categories including: breakfast, lunch, dinner, snacks, drinks, fruits/vegetab les, and other items with 70-60% accuracy. The student will develop a shopping list which stays within their Personal Budget with 100% accuracy. The student will develop an Excel spreadsheet listing their shopping list The student will develop a shopping list which exceeds their Personal Budget by $21-30. The student will develop a shopping list which exceeds their Personal Budget by 9+$31-40. The student will develop a shopping list which exceeds their Personal Budget by $41-50. The student will develop an Excel spreadsheet listing their shopping list The student will develop an Excel spreadsheet listing their shopping list The student will develop an Excel spreadsheet listing their shopping list The student will develop a shopping list of items from at least less than 4 categories including: breakfast, lunch, dinner, snacks, drinks, fruits/vegetab les, and other items with less than 60% accuracy. The student will develop a shopping list which exceeds their Personal Budget by more than $50. The student will develop an Excel spreadsheet listing their shopping list items which is formatted with 4 headings (Category, Item Description, Purchased From, Cost), all 20 selected items are listed, costs of each item are included, and a remaining balance is totaled. items which is formatted with 4 headings (Category, Item Description, Purchased From, Cost), 16 selected items are listed, costs of each item are included, and a remaining balance is totaled. items which is formatted with 4 headings (Category, Item Description, Purchased From, Cost), 12 selected items are listed, costs of each item are included, and a remaining balance is totaled. items which is formatted with 4 headings (Category, Item Description, Purchased From, Cost), 8 selected items are listed, costs, of each item are included, and a remaining balance is totaled. items which is formatted with 4 headings (Category, Item Description, Purchased From, Cost), less than 8 selected items are listed, costs of each item are included, and a remaining balance is totaled.