Clauses 11 and 12, House of Lords, 7th December 2015

advertisement

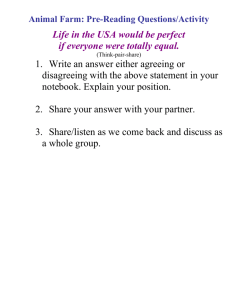

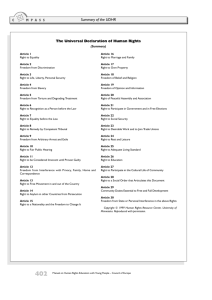

Welfare Reform and Work Bill Committee Stage: Clauses 11 and 12 House of Lords 7th December 2015 For more information please contact: Parliamentary lead: Rebecca Thomas 020 7832 7853 rebecca.thomas@equalityhumanrights.com Legal lead: Joanna Owen 020 7832 7811 joanna.owen@equalityhumanrights.com 1 1. Introduction The Equality and Human Rights Commission welcomes the aim of the Welfare Reform and Work Bill to encourage and help more people into work (where they can, and are able to), in the context of the Government's commitments to reduce the deficit and reform the welfare system. However, we have concerns that some of the measures in the Bill could exacerbate, rather than reduce, existing inequalities. In summary, we are concerned that Clauses 11 and 12 will have a detrimental effect on the living standards of low-income families with more than two children, and could raise concerns about the UK Government’s compliance with international human rights instruments. The proposed changes may have a disproportionate negative impact on people from particular ethnic or religious groups. The impact assessments and human rights memorandum which accompany the Bill do not assess the effect of the Bill on equality and human rights in sufficient detail to enable proper scrutiny of the legislation. Without proper consideration of the impact of the multiple welfare reform changes on people with particular protected characteristics - such as race or disability - the disadvantage currently experienced by people in some groups is likely to be compounded. 2. Clauses 11 and 12 Clauses 11 and 12 propose to limit entitlement to child tax credits (CTC) or the child element of universal credit (UC) to the first two children in a household. Parents will not be able to claim for any third (or subsequent) child born on or after 6 April 2017. If the child is disabled, parents will be able to claim the Disabled Child Element of CTC, but not the additional child element. Commission’s recommendation Support the motions that Clauses 11 and 12 should not stand part of the Bill. Clause 11 – Changes to child tax credit BARONESS SHERLOCK LORD McKENZIE OF LUTON 2 The above-named Lords give notice of their intention to oppose the Question that Clause 11 stand part of the Bill. Clause 12 – Changes to child element of universal credit BARONESS SHERLOCK LORD McKENZIE OF LUTON The above-named Lords give notice of their intention to oppose the Question that Clause 12 stand part of the Bill. Effect These motions would mean that the provisions changing child tax credits and the child element of universal credit would be removed from the Bill. Our analysis In our briefing for Second Reading we noted the Bill’s significant relevance to the UK's obligations under national and international human rights law. The Commission is concerned that Clauses 11 and 12 will have a detrimental effect on the living standards of low-income families with more than two children, and could raise concerns about the UK Government’s implementation of Articles 3, 26 and 27 of the Convention on the Rights of the Child, Articles 7 and 28 of the Convention on the Rights of Persons with Disabilities, and Articles 2, 3 and 9 of the International Covenant on Economic, Social and Cultural Rights (see Annex 1). While retention of the Disabled Child Element for third or subsequent children is welcome, introducing a two-child limit for CTC or UC is not, in our analysis, in the best interests of any child or low-income family. We are also concerned that the proposed changes may have a disproportionate negative impact on people from particular ethnic or religious groups. ONS data1 shows that some ethnic groups and families with a particular religion or belief2 have larger families than 1http://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=0ahU KEwi8sOTvusLJAhVBoRoKHavuCvkQFggdMAA&url=http%3A%2F%2Fwww.ons.gov.uk%2Fons%2F about-ons%2Fbusiness-transparency%2Ffreedom-of-information%2Fwhat-can-irequest%2Fpublished-ad-hoc-data%2Fpop%2Fmay-2014%2Ffamilies-with-dependent-children-byfamily-type--no-of-children--ethnic-group.xls&usg=AFQjCNHiXwoQ1bHGpEZYjM7j0vRL45EYMQ 2http://www.ons.gov.uk/ons/about-ons/business-transparency/freedom-of-information/what-can-irequest/published-ad-hoc-data/census/ethnicity/ct0546-2011-census.xls 3 others. This may put the Government at risk of breaching Articles 2 and 5(e)(iv) of the International Convention on the Elimination of All Forms of Racial Discrimination. The Commission is also concerned that the impact assessments and human rights memorandum which accompany the Bill do not assess the effect of the Bill on equality and human rights in sufficient detail to enable proper scrutiny of the legislation. Section 149 of the Equality Act 2010 imposes a public sector equality duty (PSED) requiring Government Departments and Ministers to have due regard to the need to eliminate unlawful discrimination, advance equality of opportunity and foster good relations (the three aims of the PSED). This is an ongoing duty which applies throughout the policymaking process, from the development of options and draft proposals through to legislation and implementation. The Commission wrote to the Secretary of State for Work and Pensions asking him to set out his Department’s plans to improve the detail and analysis of the measures in the Bill, and offering our support to assist in this. In his response, the Secretary of State said that the Government had used ‘the most robust analysis available to give a good assessment of… the impact of the reforms contained in the Welfare Reform and Work Bill’.3 However, the analysis in the Welfare Reform and Work Bill: Impact Assessment of Tax Credits and Universal Credit, changes to Child Element and Family Element4 fails to demonstrate proper consideration of the effect of Clauses 11 and 12 on any of the three aims of the PSED. Nor is it clear how the impact of the proposals will be monitored and tackled if adverse impact is identified during implementation. The impact assessment suggests that the proposal should incentivise families to have only two children if they cannot afford to have more, but there is no evidence provided to support this assumption (e.g. research on previous similar policy initiatives in the UK or overseas). In the section of the impact assessment marked 'impact on protected groups' (page 6), the document notes that ethnic minorities may be adversely impacted by the policy. However, the Government has provided no further information about which ethnic minority communities are most likely to be affected; nor has it undertaken any analysis to examine the reasons why they are more likely to be affected, or 3 http://www.equalityhumanrights.com/sites/default/files/uploads/documents/Parli_Briefings/2015-1013%20SoS%20to%20R%20Hilsenrath%20-%20EHRC.PDF 4 http://www.parliament.uk/documents/impact-assessments/IA15-006E.pdf 4 explained how this disproportionate adverse impact is justified or could be mitigated. The impact assessment makes no reference at all to the protected characteristic of religion or belief, but in our analysis the policy could have an adverse impact on some religious groups, in particular those for whom family planning may be against their religious teachings. This may mean that children in some religious communities are more likely to be brought up in poverty. While the impact assessment seeks to quantify the savings that are likely to be made as a result of these and related measures, it does not attempt to assess the aggregate effect of these multiple changes on people with particular protected characteristics. This could mean that people in groups who are already disadvantaged will be further disadvantaged, running the risk of compounding entrenched disadvantage, opening up wider inequalities and undermining cohesive communities. In our report Is Britain Fairer?5 we noted evidence from a variety of sources6 suggesting that the Government’s welfare reforms were having a disproportionately negative impact on certain groups, such as disabled people, women and ethnic minorities. Until the Government shows that it has properly considered the potential impact of these proposals on equality, and how any adverse effects can be mitigated, as required by section 149 of the Equality Act 2010, we recommend that Parliamentarians vote to oppose the Question that Clauses 11 and 12 stand part of the Bill. About the Equality and Human Right Commission The Equality and Human Rights Commission is a statutory body established under the Equality Act 2006. It operates independently to encourage equality and diversity, eliminate unlawful discrimination, and protect and promote human rights. It contributes to making and keeping Britain a fair society in which everyone, regardless of background, has an equal opportunity to fulfil their potential. The Commission enforces equality legislation on age, disability, gender reassignment, marriage and civil partnership, pregnancy and maternity, race, religion or belief, sex and sexual orientation. It encourages compliance with the Human Rights Act 1998 and is accredited by the UN as an ‘A status’ National Human Rights Institution. 5http://www.equalityhumanrights.com/about-us/our-work/key-projects/britain-fairer/supporting- evidence/standard-living-domain 6 http://www.equalityhumanrights.com/publication/research-report-94-cumulative-impact-assessment 5 Find out more about the Commission’s work at: www.equalityhumanrights.com 6